Flying automobiles? Vacationing in house? There is not any doubt that issues will look completely different a number of many years from now. In any case, we had been nonetheless going to Blockbuster Video 30 years in the past.

However some issues will definitely keep the identical. The choice to reward shareholders with dividends is hardly prone to change anytime quickly, and buyers trying to fortify their private funds with dividend-paying shares are definitely making a wise transfer. For these dedicated to producing constant passive earnings for a few years to come back, choosing up shares of tried and true dividend shares Coca-Cola (KO 0.48%), ExxonMobil (XOM 1.07%), and York Water (YORW -0.16%) can be an incredible transfer proper now.

Have Coke inventory — and a smile

With a historical past stretching again to the pouring of the primary glass of Coca-Cola almost 140 years go, it is clear that urge for food for the long-lasting beverage has appreciable endurance. Granted, shopper tastes have expanded past sugary sodas lately, however Coca-Cola is delicate to this variation and has taken steps to develop its product portfolio. This willingness to evolve its household of manufacturers to slake shoppers’ thirst for more healthy drink choices serves the corporate properly, and it means that administration will most likely exhibit flexibility within the coming years if shopper appetites change once more.

There is not any certainty that any firm can pay dividends for the following few many years, however the truth that Coca-Cola is a Dividend King that has a historical past of elevating its dividend larger for greater than six many years is definitely noteworthy. Representing a large place within the Berkshire Hathaway portfolio, Coca-Cola inventory, together with its 2.9% ahead dividend yield, is a worthy consideration for these with prolonged investing horizons.

Play within the oil patch with ExxonMobil

Photo voltaic panels might pop up in your neighbors’ roofs, and electrical automobiles might zip previous you on the freeway, however a easy reality stays: Fossil fuels aren’t disappearing from the vitality panorama anytime quickly. Buyers concerned with pumping passive earnings into their portfolios, due to this fact, can be properly served to think about oil supermajor ExxonMobil inventory together with its juicy 3.6% ahead yield.

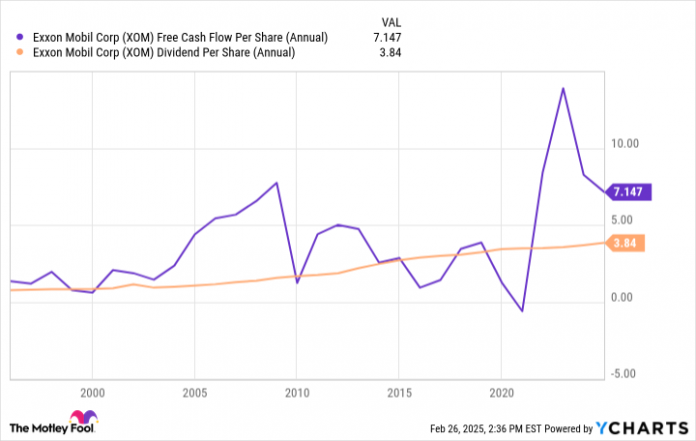

Transcending its historical past of 42 consecutive years of dividend raises, ExxonMobil has rewarded shareholders with a dividend for greater than a century — an encouraging signal that paying dividends is embedded within the company’s identification. With ample operations that reach all through the vitality worth chain, ExxonMobil generates sturdy free money stream, even amid volatility in vitality costs, from which the corporate has oftentimes been capable of supply its dividend funds over the previous 30 years.

XOM Free Money Circulate Per Share (Annual) knowledge by YCharts.

In truth, ExxonMobil initiatives that it’ll have $165 billion in extra money after dividend funds from 2025 by means of 2030. With this money, ExxonMobil can pursue further development alternatives to bolster the likelihood that it’ll have the assets to take care of dividend funds within the coming many years.

Quench your thirst for passive earnings with York Water

There is not any denying the enchantment of high-yield dividend shares. However there’s additionally one thing engaging about firms which have dependable enterprise fashions that assist them to distribute regular dividends by means of thick and skinny — firms like water utility York Water. Since 1816, this investor-owned utility has helped present water service to residents of Pennsylvania, and all of the whereas, it has been offering buyers with dividends.

Threat-averse buyers will typically flip to utility shares like York Water, with its 2.6% forward-yielding dividend, for passive earnings as a result of these firms largely function in regulated markets which assist present predictable money flows. As is the case with York Water, the corporate cannot arbitrarily elevate buyer charges when it needs. Nonetheless, the Pennsylvania Public Utility Fee does be sure that the corporate receives sure charges of return. This helps administration plan accordingly for capital expenditures resembling acquisitions, infrastructure upgrades, and dividends.

YORW EPS Diluted (Annual) knowledge by YCharts.

To additional illustrate the enchantment of York Water for these trying to mitigate threat with a protected dividend inventory, York Water has taken an more and more circumspect strategy to its distribution since 2010 as its diluted earnings per share have grown at a higher clip than its dividend. Furthermore, the corporate has averaged a conservative 58.3% payout ratio from 2015 to 2023.

Which dividend inventory is the precise alternative?

For buyers on the prowl for an effervescent dividend alternative, Coca-Cola is a consumer-staples stalwart that is properly value additional investigation. Equally, these interested in the vitality sector to energy their passive earnings can be smart to drill down into ExxonMobil inventory. However, these searching for minimal threat will wish to dip their toes into an funding with York Water.

No matter which alternative one pursues, Coca-Cola, ExxonMobil, and York Water are three names that ought to proceed rewarding shareholders for many years to come back.

Scott Levine has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway. The Motley Idiot has a disclosure coverage.