Holding onto the highest inventory in Inventory Advisor’s storied historical past required extra braveness than you assume. A inventory that appears at this time to be taking a protracted victory lap as soon as gave the impression to be slowly circling the drain.

Since David Gardner’s preliminary Nvidia (NVDA 3.56%) suggestion on April 15, 2005, a passive S&P 500 index investor may have loved a 726% return just by reinvesting dividends.

However that 2005 rec, now Inventory Advisor‘s all-time high performer, leaves the market within the mud with a return of 107,479% as of this writing.

That’s not a typo. Nvidia is the primary Inventory Advisor choose to develop greater than 1,000 occasions in worth!

Whereas it is easy to spotlight a winner, the true problem was having the persistence to carry Nvidia shares by each bout of uncertainty over time.

What classes may we study from essentially the most profitable outlier in our flagship service? Fairly just a few. Regardless of its spectacular returns, holding onto Nvidia wasn’t a stroll within the park.

Let’s discover what it really takes to attain a 1,000x return.

At a Look

The Good

A Inventory That Has Doubled 10 Instances

The Rule of 72 is an easy method to estimate how lengthy it takes for an funding to double. If a inventory grows 9% a 12 months, roughly the historic return of the inventory market, it could take eight years (72 / 9) to double an funding.

Now, think about your favourite shares are horses operating a race round a monitor. Every time they full a lap, they double in worth. Figuring out that the inventory market as a complete would possibly take almost a decade to double, which horses would you guess on?

On this race, the horses do not cease operating, and you’ll select to again these clearly main the pack — together with Nvidia, which has now completed 10 laps of doubling since 2005, with 9 of these laps taking 2.5 years or much less.

| Lap | A number of Achieved | Month Began | Months to Full |

|---|---|---|---|

| 1 | 2x | April 2005 | 9 |

| 2 | 4x | Jan. 2006 | 17 |

| 3 | 8x | June 2007 | 109 |

| 4 | 16x | July 2016 | 5 |

| 5 | 32x | Dec. 2016 | 13 |

| 6 | 64x | Jan. 2018 | 30 |

| 7 | 128x | July 2020 | 13 |

| 8 | 256x | Aug. 2021 | 22 |

| 9 | 512x | June 2023 | 9 |

| 10 | 1,024x | March 2024 | 16 |

Many traders might need hesitated to purchase Nvidia, ready for a pullback after seeing it double again and again. Nevertheless, those that waited usually discovered themselves nonetheless sidelined, lacking out on its phenomenal development.

Anchoring to previous costs is widespread, however on this limitless race, would not you like to again the horse constantly lapping the sector? As David Gardner correctly notes, 5 dangerous phrases for traders are, “I assume I missed it.”

The subsequent doubling for Nvidia would require one other $4 trillion in worth, a feat that may not appear as far-fetched sooner or later.

Excluding PetroChina‘s transient brush with a trillion-dollar valuation in 2007, Apple (AAPL 0.45%) based the trillion-dollar membership in August 2018 earlier than reaching the $2 trillion and $3 trillion thresholds in 2020 and 2023, respectively. Nvidia broke the $4 trillion barrier earlier in July, with Microsoft (MSFT 2.18%) becoming a member of on Wednesday.

There is not any assure that Nvidia will ever get to $8 trillion or $16 trillion — not to mention get there first — however it does have the within lane.

Extra Years of Doubling Than Down Years

One enjoyable stat I’ve stumbled upon whereas following Nvidia comes courtesy of 1stock1.com, a web site itemizing calendar-year returns in addition to pre-split pricing (which I will point out once more later). Together with the partial 12 months of its 1999 IPO, Nvidia has loved 10 calendar years with positive aspects of 100% or extra, whereas the inventory fell by any quantity in solely 7 years to this point.

| Years NVDA Rose 100% or Extra | Years NVDA Fell |

|---|---|

| 1999, 2001, 2003, 2006, 2009, 2016, 2020, 2021, 2023, 2024 | 2002, 2008, 2010, 2011, 2012, 2018, 2022 |

Nvidia is not distinctive on this class — Shopify (SHOP 5.56%) and The Commerce Desk (TTD 4.31%) share the identical distinction of getting extra years of 100% positive aspects than of losses for now — however it’s noteworthy.

The Winner Outweighing All of the Losers

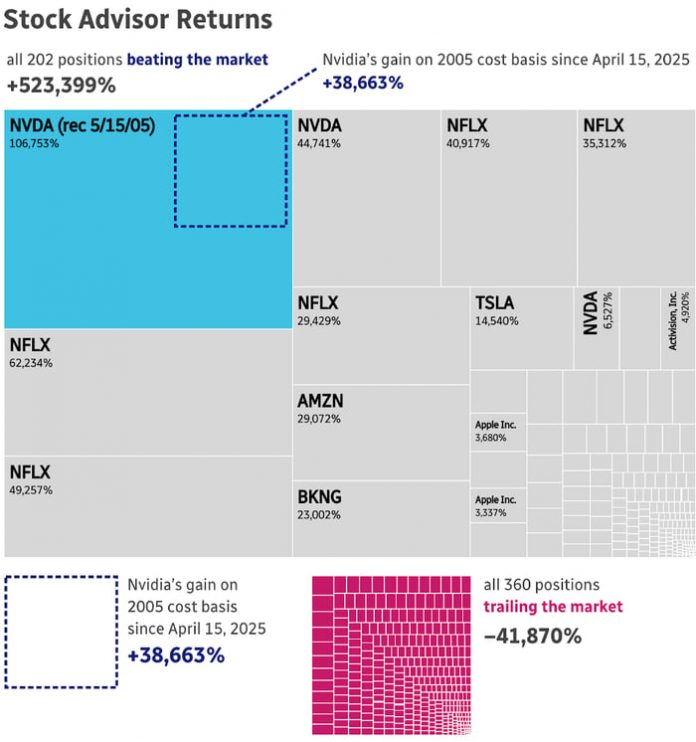

Inventory Advisor members have entry to our full scorecard, the place every suggestion is tracked in opposition to the S&P 500 from the time it is chosen till it is offered (or held by at this time). With two inventory picks every month since 2002, we have seen a whole bunch of winners and losers alongside the way in which.

Knowledge Supply: The Motley Idiot. Returns as of July 29, 2025. Graphic: Rik Silverman.

This graphic illustrates the returns of all 562 Inventory Advisor suggestions relative to their S&P 500 benchmark. David’s April 2005 Nvidia choice leads with greater than 106,000 proportion factors of outperformance above the market’s 726% return in the identical interval.

Not all underperformers misplaced worth; some, like FedEx‘s (FDX 0.15%) 403% acquire since 2003, underwhelmed in comparison with the S&P’s 959% over the identical time-frame.

One standout like Nvidia can outweigh all of the underperformers in Inventory Advisor‘s storied historical past. David’s 2009 Nvidia rerecommendation, together with two long-standing Netflix (NFLX 1.05%) suggestions, additional highlights this level. However it will get higher: The acquire on the preliminary rec since April 15, 2025 — the compounding simply after the twentieth anniversary — almost makes up for the a whole bunch of dropping inventory picks over time.

Nvidia exemplifies the Silly precept of holding winners and never promoting too early. But its journey wasn’t at all times clean. A inventory that appears at this time to be taking a protracted victory lap as soon as gave the impression to be slowly circling the drain.

The Dangerous

The Inventory That Plummeted 85%

Think about a inventory falling 80%. It would invoke ideas of high-growth investments dealing with challenges or an unfavorable rate of interest local weather, maybe echoing unhealthy recollections of 2021 or 2022.

In the event you keep in mind the 2000s, you would possibly recall that one thing huge occurred available in the market earlier than the tip of the last decade. The primary Nvidia rec quintupled by 2007 solely to lose all these positive aspects in mere months.

Knowledge Supply: Yahoo Finance. Returns as of July 29, 2025. Graphic: Rik Silverman.

If it must be repeated, this can be a chapter within the biggest inventory story of the final 20 years.

The 85% plummet was the steepest for Nvidia shares since 2005, however seeing it commerce considerably beneath earlier highs was widespread for shareholders over the past 20-odd years. On common, Nvidia spent its time on our scorecard 34% beneath its then-highs. If we depend days on which the inventory closed greater than 20% beneath its historic excessive worth, Nvidia was in its personal bear market greater than 59% of the time!

Let that marinate for a second. All of us want for a time machine so we may return and purchase Nvidia inventory many years previously. However if you happen to had owned shares at the moment, would you actually have held by to at this time? In any case, the discomfort wasn’t restricted to the sharp pangs of those low factors. There was additionally a uninteresting ache that lasted for years.

The Misplaced Decade

On October 17, 2007, Nvidia closed at an all-time excessive. The subsequent day, shares declined, and the file excessive was not reset till Might 15, 2016.

There is a cause the Idiot encourages traders to carry shares for 5 years or extra. Durations of volatility or obvious mispricing can persist for much longer than most traders (and all merchants) are keen to attend. Might you sit in your arms whereas a inventory was 85% underwater after six months or 50% within the purple after the higher a part of a decade, ready like Silly investor ought to?

And in any case of these years ready to interrupt even, would you narrow ties as quickly as shares rose in spring 2016 again to costs of greater than eight years earlier? If that seems like one thing you might need executed, I’ve some unhealthy information.

Guess which Idiot rec was the best-performing inventory in your entire S&P 500 in 2016? That might be Nvidia, after all, the canine many traders offered alongside the way in which. It gained 227% that 12 months, earlier than David really useful it for a 3rd time in January 2017.

The Ugly

Holding Results in Portfolio Focus

Nothing is sort of as disagreeable as a number of years of dismal returns, however what differentiates Silly investing outcomes is commonly a willingness to take a seat in your individual discomfort and construct the long-term-investor mindset when the brief run appears to be like bleak. That entails difficult typical knowledge.

I believe most traders would not imagine the next:

- A big cap value $40 billion in 2016 may develop 100x within the subsequent 9 years.

- A mega cap value $400 billion in 2022 may develop 10x in simply three years.

- An investor who offered on the 2007 peak and who efficiently prevented the 85% drop would have missed out on 17,660% positive aspects in the event that they stayed on the sidelines.

- An investor who locked in positive aspects by promoting half their place when Nvidia first doubled and stayed in with “home cash” has now given up 54,689% of the positive aspects they may have earned.

The best mistake we make as traders is promoting our winners too early. The chance price of these errors compounds over time as nicely, however that does not imply you must by no means promote. Whereas the pullback in Nvidia’s inventory worth throughout the nice monetary disaster was a lot deeper from prior highs than any drop since, comparatively smaller latest drawdowns had a lot bigger greenback impacts for anybody who has held a few years.

The 37% pullback between January and April meant that the earliest Nvidia rec dropped from being a 910-bagger to a 574-bagger, briefly dropping 336 occasions an unique funding. We all know now that Nvidia went on to higher heights inside months, however a concentrated place with none allocation guardrails would have turn out to be a significant threat.

You’ve gotten extra flexibility to set your individual sleep quantity and trim chubby positions than the Inventory Advisor workforce has on our scorecard. It is doable that we may sometime maintain Nvidia as a high-conviction purchase suggestion whereas on the similar time closing one or two of the lively recs as a reminder of prudent portfolio administration relatively than as a press release of near-term outlooks or overvaluation.

The Thesis Needed to Evolve

Within the Nineteen Nineties, our Chief Rule Breaker really rooted in opposition to Nvidia, seeing it as a rival to his most well-liked online game graphics card firm, 3Dfx. By 2005, Nvidia had acquired 3Dfx, and David’s funding thesis centered on Nvidia’s development potential with Microsoft’s Xbox and Motorola (MSI 0.77%) cellphones.

Cloud computing and information facilities, now Nvidia’s largest enterprise phase, have been nonexistent. Cryptocurrency mining hadn’t been invented but, and synthetic intelligence was absent from the unique imaginative and prescient. Even CEO Jensen Huang’s enduring management wasn’t a part of David’s preliminary evaluation.

Whereas some funding theses stay easy — maybe promoting extra sneakers or opening extra espresso retailers — the largest winners have a high quality we name optionality. You would possibly foresee that a web-based bookseller like Amazon (AMZN -1.42%) may turn out to be “the every thing retailer” or that Netflix may pivot from mailed DVDs to video streaming. It is essential to look forward, acknowledging that profitable investments would possibly differ drastically from their unique enterprise fashions. However reevaluating your understanding of your investments is less complicated mentioned than executed, and it’d take some additional homework to remain comfy holding onto growing winners.

The Penny Inventory That Wasn’t

Nvidia’s 2005 price foundation on our scorecard is simply $0.16, a minimum of till it is adjusted additional decrease because of dividends or future inventory splits. One of many largest errors new traders usually make is to see information like this and presume the one place to hunt for multibaggers is amongst penny shares.

The explanation for that misdirection is inventory splits. Nvidia has by no means traded in penny-stock territory since 2005 because of 4 splits:

- April 2006: 2-for-1 cut up

- September 2007: 3-for-2 cut up

- July 2021: 4-for-1 cut up

- June 2024: 10-for-1 cut up

In the event you adopted the April 2005 suggestion, an funding of lower than $20 per share would now translate to 120 shares for each 1 held since then. With out these splits, that single share would at this time be value above $21,000. Nvidia would have the identical market cap however far fewer shares excellent.

Whereas fractional shares weren’t accessible again then, at this time’s traders can purchase partial shares of many firms by their dealer for as little as $5. For a similar greenback quantity invested, I would relatively personal a fraction of a powerful enterprise like Nvidia than hundreds of shares of a failing one buying and selling over-the-counter for pennies.

The Silly Backside Line

Nvidia has been a mainstay on Inventory Advisor‘s Foundational Shares record since 2022 and is more likely to stay a Idiot favourite for years to return. In the event you do not personal shares immediately, know that nearly $8 out of each $100 invested in an S&P index fund is tied to Nvidia, its largest weight at this time. And those that have adopted our suggestion for years would possibly personal greater than sufficient already, which shifts the query of whether or not to purchase to when to pare down an oversize place within the years forward. (That is how I am considering by the 70x positive aspects on the primary block of shares I purchased in 2017.)

As I wrote above, there isn’t any assure Nvidia will proceed to be the market darling it has been for thus lengthy. But when there’s one concept I’d take to the financial institution — one premise I am almost sure about — it is that Nvidia is not executed educating Fools classes about long-term considering that may pay dividends throughout all the opposite investments we take into account on our investing journeys.

If you have not held Nvidia since 2005, it is not too late to gather a small slice of one of many highest-quality companies on the planet. And you probably have… take that victory lap. You’ve got earned it.

Additional Studying

*Accessible to Motley Idiot Inventory Advisor members.