Bitget CEO Gracy Chen has warned that the long-anticipated altcoin season is unlikely to reach in 2025 and even 2026, signaling a dramatic shift in general crypto market sentiment.

Liquidity, momentum, and institutional focus have more and more shifted from these different cryptocurrencies, leaving them with restricted investor consideration and weaker value motion. The message is evident: the golden period of altcoin hypothesis seems to be on pause—if not over totally.

Sponsored

Sponsored

Is the Altcoin Season Over for Good?

In a current publish on X (previously Twitter), Chen said that altcoins are “fading.” She defined that the “Black Swan” occasion on October 11 inflicted extreme injury on the altcoin market. It worsened an already fragile setting the place VC funding in early-stage Web3 initiatives had been drying up for over a yr.

“Retail buyers buying and selling altcoins face a horrible risk-reward ratio. Let’s be actual—the alt season is not going to are available in 2025 or 26,” Chen wrote.

Chen added that giant capital has change into more and more risk-averse, reflecting the broader warning out there. She identified that weekly buying and selling quantity throughout centralized exchanges (CEXs) has fallen by 20–40%, whereas a number of main market makers suffered liquidations after overleveraging.

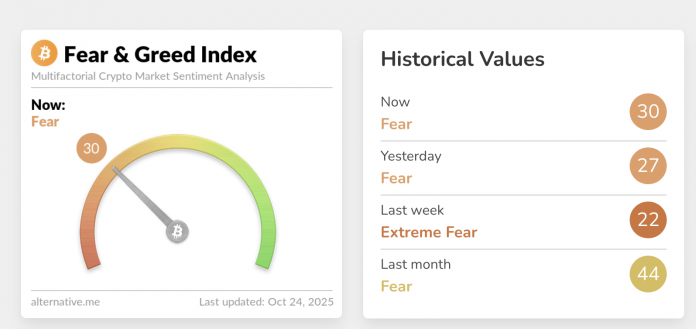

The Bitget CEO described the present stage because the “doubt” section of the market cycle. This sentiment is mirrored within the Crypto Worry and Greed Index, which stands at 30 throughout press time.

She emphasised that the market now wants time to recuperate and that merchants ought to proceed with self-discipline. In accordance with her, solely a handful of initiatives tied to real-world use circumstances, resembling stablecoins, real-world property (RWA), and fee infrastructure, should stand out.

Sponsored

Sponsored

Nevertheless, Chen famous that many of those initiatives are unlikely to difficulty tokens, additional lowering alternatives within the altcoin area.

Bitcoin Season Is Again — and Altcoins Might Not Get well Anytime Quickly

The shift Chen described isn’t simply sentiment—it’s displaying up within the numbers. 10x Analysis not too long ago reported that momentum has firmly moved towards Bitcoin, whereas altcoins face declining liquidity.

“Altcoins have underperformed Bitcoin by an astonishing $800 billion this cycle — and retail buyers are those left behind. Whereas social media continues to vow the subsequent ‘alt season,’ the information tells a special story,” the publish learn.

The market intelligence agency added that even Korean retail merchants, as soon as recognized for driving altcoin hypothesis, are redirecting their focus towards crypto-related equities. Beforehand, BeInCrypto additionally identified that crypto-related shares have gained considerably this yr, even outpacing BTC.

“Liquidity, momentum, and conviction have all migrated elsewhere, leaving the altcoin market eerily quiet. In the meantime, establishments are shaping this cycle in methods few anticipated — and retail might not but notice what meaning,” 10x Analysis added.

Market indicators corroborate this downturn. The Altcoin Season Index, which measures whether or not 75% of the highest 50 non-stablecoins outperform Bitcoin over 90 days, has plummeted to 37. This marked its lowest level since mid-July, firmly entrenching a “Bitcoin Season.”

As well as, the sudden decline in altcoin narrative discussions in October mirrored a rising sense of fatigue. Taken collectively, these alerts paint a bleak image for a possible altcoin rally.