Bitcoin is struggling to reclaim the $80,000 degree after a pointy and extended decline that has erased over 30% from its all-time excessive. Promoting stress continues to mount as commerce struggle fears and macroeconomic instability rattle international monetary markets. The uncertainty fueled by aggressive tariff insurance policies and geopolitical pressure has accelerated the downturn, with altcoins bleeding even more durable as buyers rush to scale back danger publicity.

Many analysts at the moment are calling for the official begin of a bear market, pointing to damaged technical buildings and weakened sentiment throughout the board. Regardless of the grim outlook, on-chain information from CryptoQuant reveals a notable absence of panic promoting. In accordance with their insights, HODLers — long-term holders of Bitcoin — seem like responding with resilience, not worry.

The shortage of “orange” bars, which generally point out waves of capitulation, means that skilled market members usually are not dashing to exit their positions regardless of the drawdown. This habits might function a stabilizing power amid the chaos, signaling that foundational confidence in Bitcoin stays intact.

Nonetheless, with BTC hovering just under key resistance, bulls should step in quickly or danger deeper losses as broader market weak point continues to use stress.

Bitcoin Bears Tighten The Grip — However HODLers Keep Calm

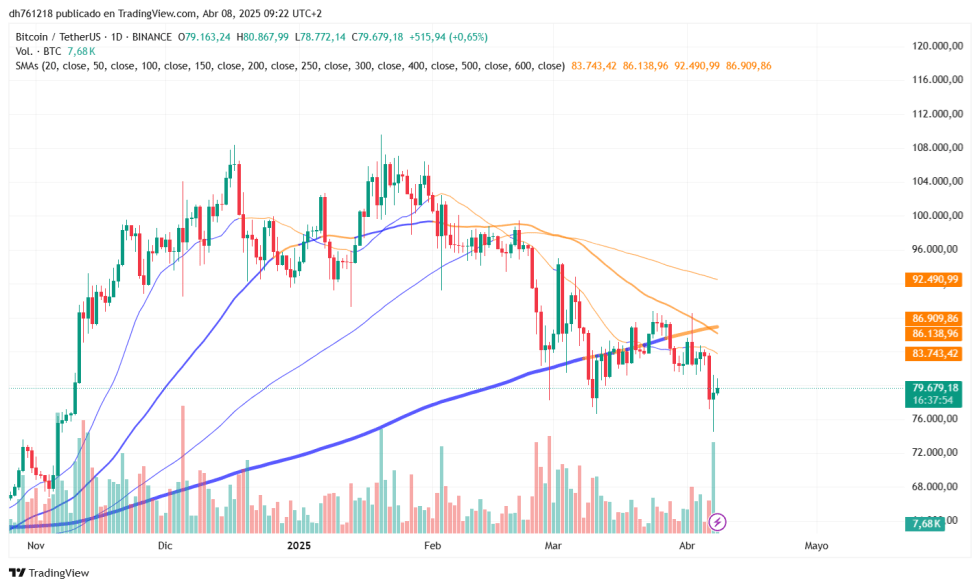

Bitcoin is buying and selling at crucial ranges as bearish momentum continues to dominate market sentiment. Since late March, BTC has shed over 15% of its worth, breaking down from key help zones and struggling to keep up footing across the $80K mark. The broader market outlook stays grim, with escalating macroeconomic tensions and the onset of a full-scale commerce struggle triggered by U.S. President Donald Trump’s aggressive tariff insurance policies. As international monetary markets reel from uncertainty, many analysts anticipate the downtrend to persist — with few indicators of a powerful restoration on the horizon.

Whereas most headlines level to additional declines, not all information is flashing purple. Prime crypto analyst Axel Adler shared a extra nuanced view, highlighting an on-chain metric that would sign resilience beneath the floor. In accordance with Adler, Bitcoin’s Every day Realized Revenue Loss Ratio reveals a hanging absence of “orange” bars — a visible indicator for panic promoting.

This lack of panic-driven exits means that HODLers — long-term holders recognized for his or her conviction — usually are not capitulating underneath stress. Actually, their regular habits might act as a buffer in opposition to deeper losses, signaling that regardless of the sharp correction, confidence in Bitcoin’s long-term outlook stays.

If bulls can reclaim momentum quickly, this robust base of holders might assist gasoline a reversal. For now, although, Bitcoin stays trapped underneath bearish management, and the following few days will probably decide whether or not the $80K area turns into a launching pad — or the following flooring to fall by means of.

BTC Value Struggles Beneath $80K As Bulls Combat To Keep away from Additional Losses

Bitcoin is at present buying and selling at $79,600 after narrowly avoiding a deeper breakdown beneath the $75,000 degree. Over the weekend, BTC confirmed indicators of panic-driven weak point, however bulls stepped in simply in time to defend the decrease boundary of help. Now, the $80K degree stands as the following crucial threshold that should be reclaimed swiftly to shift momentum and spark a restoration part.

A decisive transfer above $80,000 would sign renewed purchaser curiosity and will assist BTC start focusing on greater resistance round $85,000 — a key zone that bulls should take again to reestablish any form of bullish construction. Failure to reclaim $80K within the coming periods, nevertheless, might set off one other leg down. A drop again beneath $75,000 would open the door to testing deeper demand ranges, doubtlessly within the $70K vary or decrease, relying on market response.

The stress is mounting as macroeconomic headwinds and commerce struggle tensions proceed to weigh closely on investor sentiment. Bulls should act rapidly, or the broader market narrative might flip much more bearish. For now, Bitcoin teeters on a tightrope — and the following few days can be essential in figuring out whether or not restoration or additional decline comes subsequent.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.