The Invesco QQQ Belief tracks the Nasdaq 100 Index, which is straightforward in development however advanced to contemplate inside a portfolio.

The Invesco QQQ Belief (QQQ 0.14%) is extremely profitable at what it goals to attain. However that is additionally a possible downside for buyers.

This comparatively easy exchange-traded fund (ETF) must be rigorously thought of earlier than you make it a core holding in your portfolio. Listed here are the small print that may probably be most necessary so that you can contemplate.

What does the Invesco QQQ Belief do?

The Invesco QQQ Belief is an index-tracking ETF. So, technically, it simply buys no matter its index buys. The true concern is what the index does.

On this case, the index is the Nasdaq 100 index. It’s a pretty easy index that buys the 100 largest nonfinancial shares that commerce on the Nasdaq trade. The shares are market-cap weighted, so the most important firms have the largest affect on efficiency.

Picture supply: Getty Photos.

One fascinating reality right here is that the Invesco QQQ Belief’s expense ratio is on the excessive aspect for an index ETF, at 0.20%. By comparability, among the hottest S&P 500 index-tracking ETFs include a lot decrease expense ratios.

To place some numbers on that, the expense ratio is 0.09% for the SPDR S&P 500 ETF and 0.03% for the Vanguard S&P 500 ETF. Even a technology-focused ETF like The Know-how Choose Sector SPDR Fund has an expense ratio of simply 0.08%.

That final comparability, nonetheless, highlights the complexity of the Nasdaq 100. As a result of that index tracks the 100 largest nonfinancial firms on the Nasdaq trade, that is not instantly focusing the ETF on know-how shares. However the Nasdaq trade occurs to be house to lots of a very powerful know-how firms.

The Invesco fund’s portfolio combine is biased

Whereas the S&P 500 index will offer you a reasonably well-diversified portfolio, the Nasdaq 100 leaves you closely weighted towards tech. For comparability, the S&P 500’s know-how weighting is round 34%, whereas tech makes up almost 61% of the Invesco QQQ Belief’s portfolio. That is a really massive distinction.

Worse, the highest 10 holdings within the Invesco QQQ Belief account for almost 53% of the portfolio’s property. And all 10 are both know-how shares or are very intently tied to the tech sector. The highest 10 of the S&P 500 are additionally tech heavy, however the checklist is barely about 38% of the portfolio. Once more, that is a giant distinction.

The Invesco QQQ Belief will not be a foul ETF. The truth is, it does precisely what it units out to do. However that aim results in a scarcity of diversification within the portfolio. And, in flip, that may end up in increased volatility, since tech shares have a historical past of swinging between being in favor and out of favor with buyers.

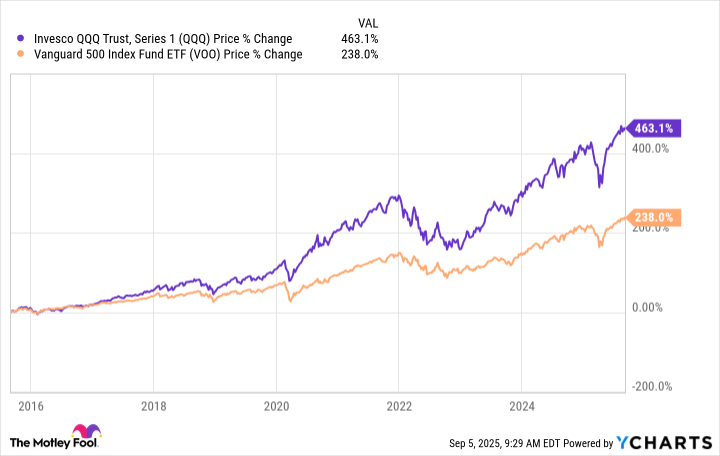

Nonetheless, being concentrated in know-how has been a efficiency profit lately. Because the chart above highlights, the Invesco QQQ Belief has simply outdistanced the Vanguard S&P 500 ETF over the previous decade. But it surely has completed that with extra volatility alongside the way in which, which is necessary to remember when contemplating it as a portfolio holding.

Ought to the Invesco QQQ Belief be a core holding?

For many buyers, the Invesco fund most likely will not make an amazing core holding. It merely does not have sufficient diversification to be the inspiration of your portfolio.

That mentioned, in case you are trying so as to add a technology-heavy ETF to the combo, it may very well be an excellent complement to a extra diversified ETF. And it may even be a long-term holding, so long as you go in with an understanding that the Invesco QQQ Belief has a reasonably concentrated and technology-heavy portfolio.