Counter to standard discourse, we argue that upgrades to Bitcoin — such because the BitVM, OP_CAT or OP_CTV — will stabilize Bitcoin consensus. By opening up new miner charges and lowering reliance on extractive pooling schemes, additions to Bitcoin will create community sustainability, push miners away from extra harmful types of expressivity and assist Bitcoin preserve its lead in stability with out injecting rivalrous or centralizing types of income.

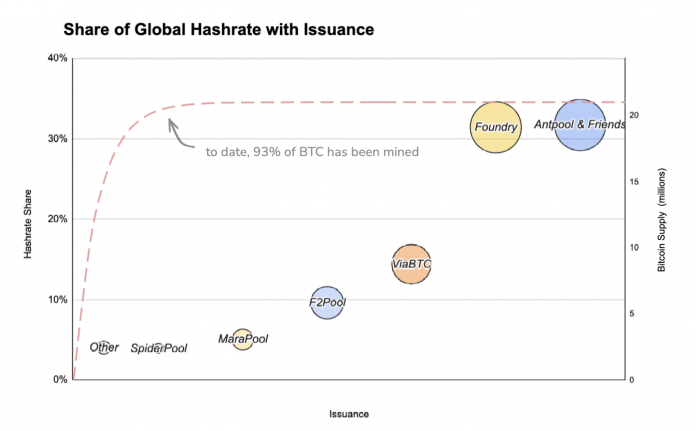

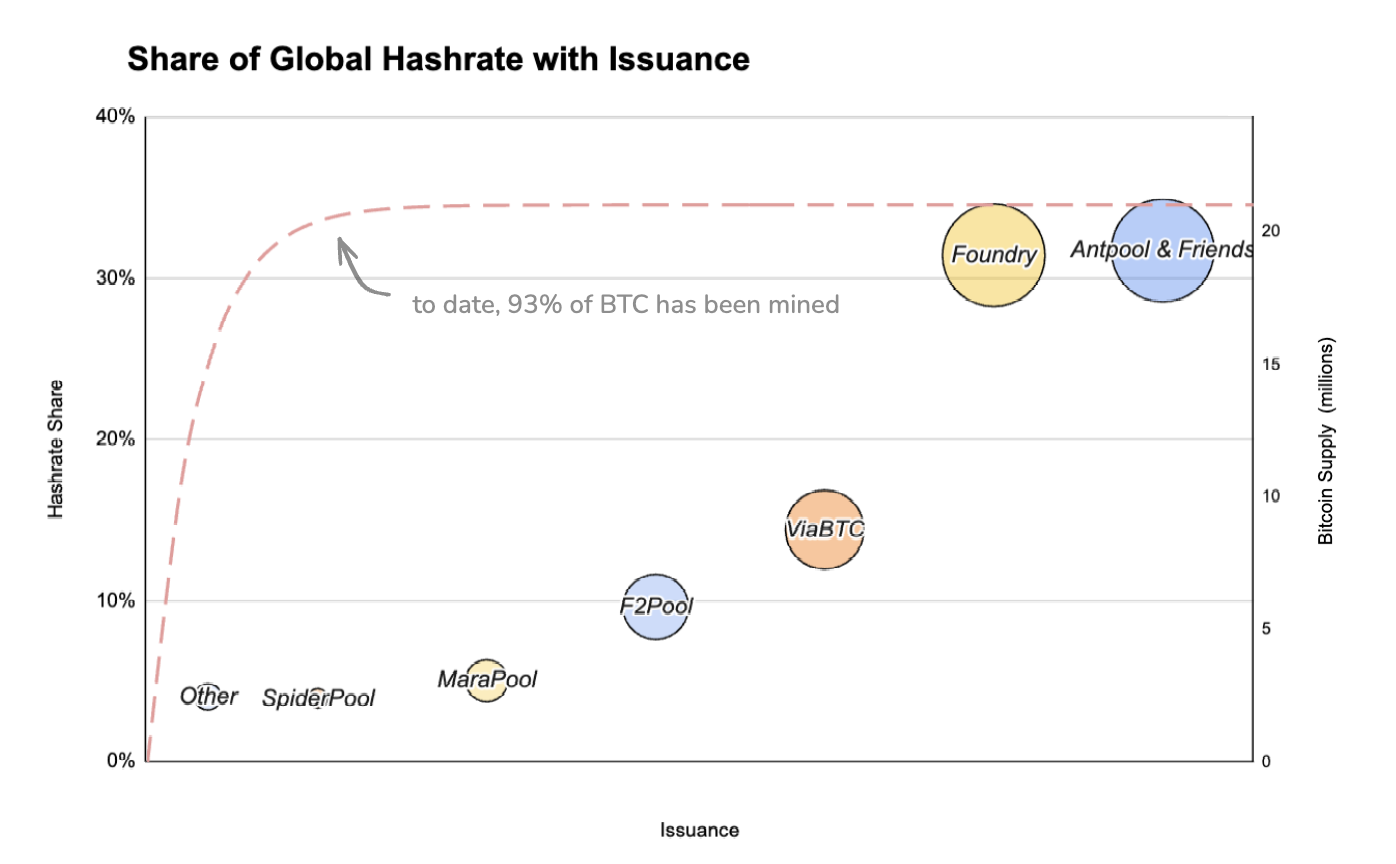

A wholesome mining market is important to the longevity of Bitcoin. Final 12 months, amid low blockspace demand, Bitcoin’s greatest miners started to merge mine for further charges. Whereas exploration has its place, this hints that with out issuance, miners in want of income will destabilize Bitcoin by embracing worse types of expressivity. Given this, we discovered ourselves asking: How would totally different types of expressivity alter Bitcoin’s prospects for stability? Particularly, how would expressivity and costs change its mining market, which is dominated by simply 5 swimming pools?

Maybe the strongest argument to not add expressivity to Bitcoin is the irreducible dangers related to extra opcodes: in different phrases, that covenants may “Ethereum-ize” Bitcoin. Nonetheless, when rightly grasped, we consider nonlinear and ephemeral charges, Bitcoin consensus and proof of labor’s (PoW) race circumstances will protect it from the worst types of entrenchment.

Going ahead, we consider sure opcodes can really degree the miner enjoying subject, stewarding Bitcoin’s core properties and shutting the door to the unhealthy expressivity being adopted.

Within the following, we overview and set up fundamental miner and person wants. We rapidly overview classes from Ethereum’s historical past with expressivity, then study miner pool economics and, lastly, utilizing OP_CAT as a proxy, we discover the way forward for mining when Bitcoin is expressive.

What Do Bitcoin Miners and Bitcoin Customers Want?

Miners Want feeeeeees

All miners want charges to remain hashing. Whereas low charges and undifferentiated {hardware} suggest that mining is a commodity enterprise, large miners wield actual energy over small ones. Large miners subsidize mining by way of market cycles through distinct enterprise traces. Alternate Matrixport and miner Bitdeer are examples of this, as are ASIC maker Bitmain and mining pool Antpool.

This dynamic is pushed by smaller miners leaning on massive ones to clean their sometimes variable income. Small miners have little management over bigger miners and pool operators and can’t survive with out them at present.

Customers Want a Respectable UX

Whereas miners are steered by income, customers want a dependable expertise. This implies each the standard of transacting, in addition to censorship resistance and settlement assurances of bitcoin.

Customers embrace DLC-powered lenders, stakechains, Metaprotocols and, after all, merge-mined chains (drivechains). All customers want robust inclusion and settlement assurances from miners. Designs intently tied to hashrate — together with drivechains — create economies of scale in mining.

Hash-based expressivity creates a reciprocal recreation the place customers wanting inclusion ship transactions solely to the miners operating the expressive (however unreliable and sometimes unverifiable) infrastructure. On this hash-based but programmatic world, different miners can compete with their very own expressivity, however feather forks, reorgs and assaults drive consolidation to the most important miners.

Merely put, hash-based expressivity severely degrades Bitcoin’s defining property of sovereignty by severely centralizing Bitcoin mining.

What’s the Different?

With out embracing safe, egalitarian avenues for miners to earn income, Bitcoin slow-walks towards PoW-based expressivity. At finest, this implies merge mining and Metaprotocols; at worst, it means the collapse of stability and censorship resistance as re-orgs drive centralization.

Clearly, some fixes (equivalent to tail issuance) are out of the query. Our view — constructed on Ethereum’s historical past — is that opcodes can strengthen Bitcoin by injecting secure price variance and new pool-level accountability. The remainder of this piece appears to be like at classes from Ethereum earlier than utilizing mining at present to color an image the place Bitcoin is steady on account of its expressiveness.

Vectors for Censorship on Ethereum

PBS: How and Why We Received Right here

Whereas Ethereum goals to be “moderately egalitarian,” extra charges can be found through Maximal Extractive Worth (MEV). Higher movement, capital, information and infrastructure let savvy actors develop, gaining energy at all layers. Considerations over this energy led to Proposer Builder Separation (PBS).

Below this design, resource-heavy constructing (transaction harvesting and ordering) is sandboxed into its personal aggressive market, enabling easy and complex nodes alike to mine the most worthwhile block. PBS goals to make block constructing as aggressive as doable.

Ethereum MEV Immediately

Atomic MEV (e.g., liquidations, sandwiching, and so on.) is completed solely on-chain, making it extra aggressive. Atomic MEV entails a closed loop, all-or-nothing transaction, with capital sourced on-chain. This lowers dangers and obstacles to entry, making it moderately open.

In distinction, asynchronous MEV is extremely rivalrous. As outlined in Flash Boys 2.0 — a well known 2019 analysis paper by a workforce of researchers, principally from Cornell College — asynchronous MEV is primarily realized in decentralized exchanges, which “in truth current a severe safety threat to the blockchain techniques on which they function.” MEV launched through DEXs is outlined by its exclusivity (and entrenchment).

Immediately’s Ethereum block constructing is owned by two teams: arbitrageurs (who compete with capital, latency, proprietary fashions and decrease charges) and people with tit-for-tat Unique Order Stream (EOFs). Fixes proceed to be sought, together with inducing native constructing by altering default staker settings. In addition to PBS-adjacent analysis and work on buildernet, designs that dampen centralization from arbitrage or EOF are restricted.

What’s the Large Deal?

Centralization at any level undermines censorship resistance of complete networks and opens up verticalization. On Solana, the coupling of liquid staking to a MEV consumer lets Jito dominate MEV.

Very like built-in searcher-builders (who internalize prices, and so on), integration of an LST into the MEV market lowers dangers, enhances profitability and creates a constructive loop of unique order movement. With out staking, ASICs and swimming pools stay the looming menace for verticalization in Bitcoin.

Classes from Proof-of-Work Ethereum

Previous to the merge, Ethereum was outlined by PoW. As soon as community charges eclipsed block rewards, front-running of transactions and personal mining swimming pools (with precedence entry) turned frequent.

The priority for PoW Ethereum then is similar for Bitcoin at present: App incentives threaten decentralized consensus. Early researchers evened PoW Ethereum through mevgeth, a consumer letting any miner public sale off blockspace to classy events for egalitarian income.

Given Bitcoin’s restricted expressivity, most points frequent to PoW Ethereum don’t map. Nonetheless, attributable to ongoing expressivity debates round new opcodes, Ethereum’s main perception of maintaining mining open and limiting rivalrous financial exercise is pertinent for Bitcoin.

Relevance for Bitcoin Swimming pools: Zooming in

Bitcoin’s pooling market stays understudied. Over the following Halvings, safety will shift from issued cash to charges; to maintain Bitcoin steady, mining should keep aggressive and open.

What Retains Bitcoin Steady?

Ethereum consensus selects proposers every epoch, delegating leaders mounted slots. This absolute monopoly over blockspace allows excessive extraction. In distinction, whereas Bitcoin miners nonetheless management blocks, the slot shouldn’t be mounted and as a substitute ends randomly. Race circumstances from hashing nonces immediate fast transaction inclusion and quick propagation of blocks to mining friends. Stated in a different way, with many members, the community all the time races ahead, staying steady and open.

Therefore, solely with a considerable quantity of hashrate consolidation or with centralizing types of expressivity (talked about above), will Bitcoin’s censorship resistance (and worth) degrade.

In different phrases, whereas miners nonetheless have a type of monopoly on inclusion, PoW’s race circumstances be certain that so long as mining is aggressive, inclusion pressures are robust. In our view, this implies the terminal concern for Bitcoin is mining sustainability. All different points, together with worth accrual, reorgs or different assaults, and community stability, are downstream of miner stability and miner economics.

Fundamentals of Mining Pool Abuse

Immediately, massive miners and swimming pools skim income, preserve templating opaque, and even conduct assaults to maintain smaller miners subservient. Once more, small miners solely use swimming pools to scale back luck inherent in PoW. Inside a pool, a centralized server templates blocks and pushes them to miners. ASICs hash the template for a golden nonce (a sound block).

Most swimming pools have closed supply mining firmware and pay out rewards primarily based on issuance, not charges inside a given block. A couple of totally different pool schemes are used, together with:

- Pay-Per-Share (PPS): Miners get much less variance by incomes their share of the anticipated worth of the pool’s issuance rewards. Swimming pools can lose cash beneath PPS however may also develop bigger by having adjoining companies (ASIC manufacturing, and so on.).

- Full-Pay-Per-Share (FPPS): Miners earn the PPS rewards in addition to their share of transaction charges upfront (e.g., no matter whether or not the pool discovered a block). Charge income shouldn’t be auditable — charges are taken as a median and primarily based on belief within the pool operator.

- Pay Per Final N Shares (PPLNS): Miners earn charges primarily based on the quantity of hash they contribute over a given variety of rounds. PPLNS swimming pools pay solely after profitable a block.

There are a couple of deviations from vanilla mining, with Marathon operating Slipstream, a notable non-public channel for bypassing mempool requirements, and Ocean providing open templating to customers.

Exterior of Slipstream and Ocean, swimming pools primarily use FPPS. Makes an attempt to make use of others have failed, as decrease per-hash income harms miner economics and centralizes Bitcoin. Wanting forward, miners will want visibility into templating as charges turn out to be extra important to their companies. To maintain Bitcoin steady and decentralized, smaller miners will want a aggressive but auditable pool.

What’s the Form of Bitcoin Charges?

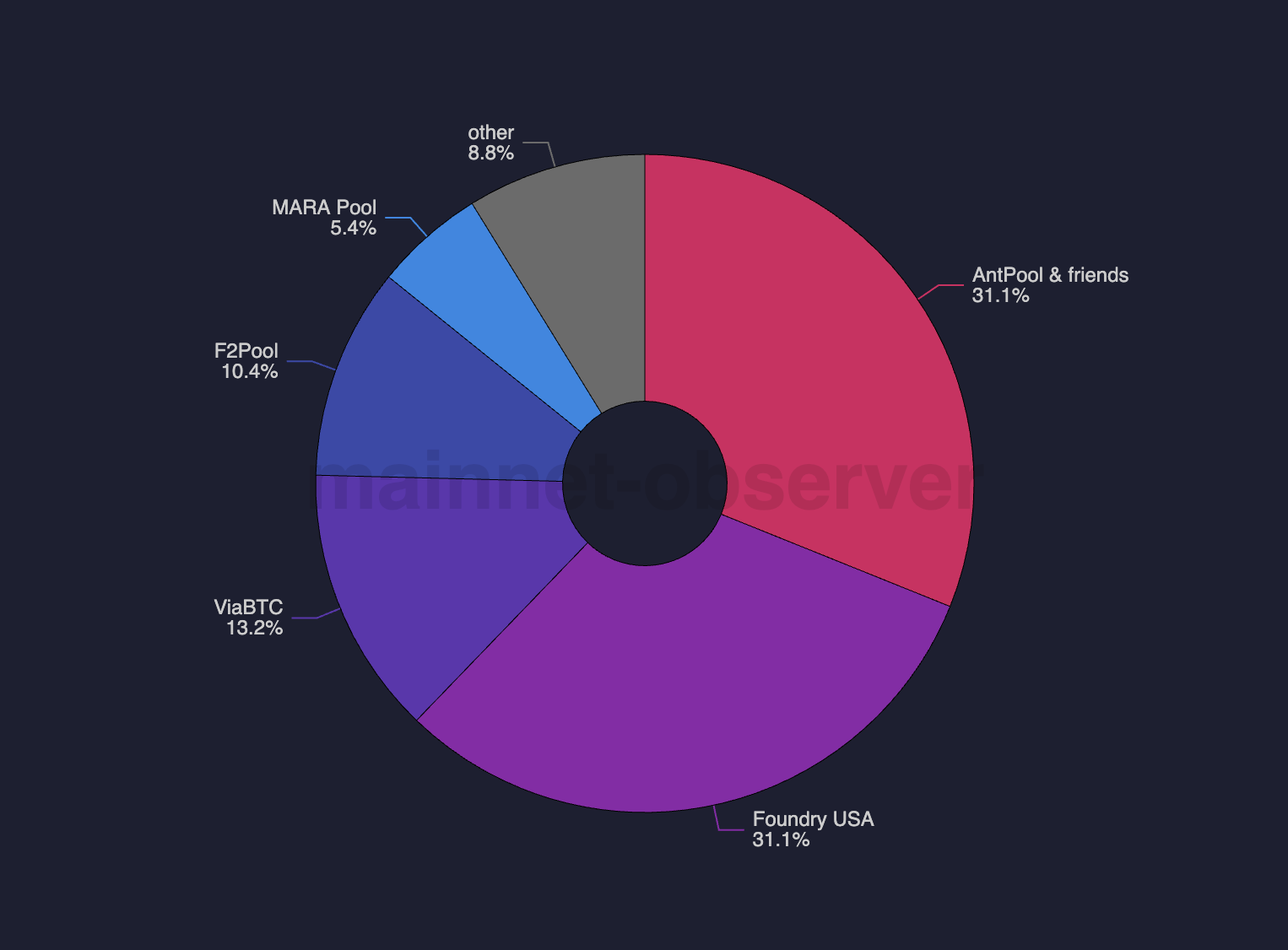

At the moment, Bitcoin has low charges. Most blocks are empty or just comprise vanilla UXTO spends or inscriptions. When charges do exist, they’re “spikey.”

In an setting with common demand (charges), there are scant incentives to reorg because the subsequent block additionally has charges. Nonetheless, deployments of latest contracts, ordinal mints or common volatility (e.g., an change collapse) may cause big price spikes, incentivizing reorgs.

Whereas Nakamoto consensus will finally finalize, it’s doubtless miners privately mine massive charges and try and reorg Bitcoin to steal high-fee blocks from different miners.

In both case (e.g., common charges or low common charges), these spikes in demand will result in hashrate consolidation as customers will more and more rely on bigger miners and swimming pools, pushing small miner to work for bigger ones.

Nonetheless, in our view, spikey charges may in the future be captured by smaller miners, lessening entrenchment. Particularly, beneath the best payout and accountability scheme, small miners can band collectively to offer customers higher settlement assurances than bigger solo miners. Within the subsequent sections, we lay out this thesis and argue why we consider Bitcoin ought to due to this fact embrace spikey charges.

Can and Will Mining Swimming pools Share Spikey Charges?

As talked about above, small miners at present depend on large miners and/or swimming pools for charges. Designing an open or egalitarian pool that ensures charges are cut up pretty is tough within the absence of auditability. Whereas Bitcoin has and can keep away from most types of unauditable charges (e.g., arbitrage, non-public order movement), out-of-band transactions stay unauditable.

In idea, stress from rivals may induce price sharing — however in apply, dangerous information, switching prices and verticalization push small miners to belief massive ones.

It’s price noting reordering of blocks is heightened by charges. Whereas Nakamoto consensus will finally finalize (uncling feather-forks), it’s doubtless miners privately mine massive charges and try and reorg Bitcoin to steal high-fee blocks from different miners. Customers might face delays as miners maintain transactions, whereas smaller miners can have a good tougher time getting auditability.

What Can Stabilize Bitcoin Consensus With out Charges?

One potential repair is tacking accountability onto a federated pool. Accountability brings financial finality, decreasing reorg threat and bettering affirmation ensures. Critically, miners can nonetheless mine outdoors this pool with Bitcoin Core, making certain liveness is preserved and letting the community progress and be validated by as many members as doable.

On this mannequin, miners cut up charges and supply joint, accelerated but accountable entry to Bitcoin. Customers would undergo this pool over a personal one like SlipStream attributable to its reorg resistance and entry to extra miners, yielding larger inclusion and affirmation ensures. Whereas solo channels for nonstandard or weak transactions can persist, preserving race circumstances through accountability would give customers a aggressive but decentralized different.

Since finality is a helpful property for monetary apps and requires collaboration between miners, this pool will see a significant chunk of transactions. Accountability between its brokers will create fairer economics, driving rival swimming pools to share charges as effectively. In a phrase, we consider expressivity rightly formed will stabilize Bitcoin through financial finality, quelling considerations over community stability and making mining extra egalitarian.

Having checked out mining, we now flip to how expressivity may affect community stability.

Poolin’ in OP_CAT’s World

There are numerous proposed Bitcoin tender forks; utilizing OP_CAT as a proxy and starting with an AMM, we analyze how new opcodes might alter mining and the community extra broadly.

Notice to reader: Within the following, we theorize about the way forward for Bitcoin wherein Bitcoin has a local automated market maker (AMM) — a mathematical perform encoded on blockchains which allows decentralized buying and selling. AMMs are the primary supply of MEV (or MEVil) on blockchains, enabling each rivalrous arbitrage and recurring EOFs agreements.

A lot of the writing on this part attracts from “Unity is Power” and “Balrogs and OP_CATs.”

Situation 1 (no AMM unlocked from tender fork)

On this state of affairs, the community wouldn’t face the perils of arbitrage or EOF; with out an AMM, most MEV could be atomic or one-off (e.g., posting rollup information, Ordinals). Whereas miners might verticalize, transactors will principally maximally broadcast transactions to get higher inclusion charges.

Once more, decrease issuance would break up bigger swimming pools, whereas new ones would want to offer higher auditability for use by small miners. Whereas untenable, mining may very well be an operational price for verticalized companies. As Matt Corallo factors out in “Cease Calling it MEV,” with out an AMM, MEV will likely be sandboxed into larger layers.

Situation 2 (tender fork additionally powers an AMM; leakage is minimal)

On this state of affairs, an AMM is native to Bitcoin’s base layer. Because of the Bitcoin block time variance, dangerous costs are intrinsic, and orders are reorged and stale usually. Furthermore, different complicated assaults and extra performant options will make the AMM principally unused.

Merchants should still commerce on the L1 for ideological or memantic causes, however with out substantial adjustments to Bitcoin, it’s unlikely a Bitcoin AMM will likely be durably used and therefore create MEVil.

Situation 3 (AMM on L1; excessive leakage)

Whereas the world the place Bitcoin hosts its personal standard DEX appears unlikely, it’s price contemplating.

On this world, arbitrage and EOF agreements produce verticalization and aggregation of hashpower right into a superpool. The reliability of a bigger pool and the unique nature of each kinds of extraction will create a tit-for-tat relationship between miner and extractor, making them primarily one actor. Most miners would be a part of this pool, however have little management over its economics.

Nonetheless, this miner will face some limits on its dimension; Bitcoin’s worth relies on decentralization, so at a sure dimension, the actor would hurt itself. Moreover, PoW can let different miners outrace the pool, whereas geographic frictions recommend a number of exchanges or a number of EOF can thrive. Nonetheless, an AMM with any utilization would markedly worsen community well being.

We discover this unlikely:

Even when a DEX turns into possible, it might be extraordinarily restricted and reorg threat, variability in block instances, and poor costs would preserve utilization low (for extra, see “The Spectre of MEV on Bitcoin”).

Bridge MEVil and Different Assaults

Past an AMM, some potential opcode-driven assaults are price highlighting. These embrace:

- 51% assault on optimistic rollup: 51% of hashrate can induce assaults from optimistic rollups and BitVM bridges. A well-capitalized attacker may hire hash and quick bitcoin futures to revenue from censorship and bridge assaults. Any attacker would want to build up a excessive variety of ASICs, forgo future income and brick their machines. Notably, a zk-verification opcode (or probably simply OP_CAT) makes this assault infeasible.

- Oracle assault: Immediately’s Bitcoin lenders self-host their very own oracles. Whereas presigned transactions make sure the oracle can not steal funds, if {the marketplace} additionally was the lender, they may liquidate collateral unfairly. Censorship of liquidations can be doable.

In fact, different assaults (equivalent to mass exit or loot assaults) exist and mapping all a priori is not possible. Few appear to worsen the quite a fewmethods Bitcoin could be poisoned at present, however different opcodes (like an opcode for zk-verification) can really restrict assaults.

What Ought to We Suppose About Different Opcodes?

Past OP_CAT, there are a number of paths for upgrading Bitcoin. Whether or not for Lighting, Ark, covenants, discrete log contracts or one thing else, opcodes like OP_CTV, OP_VAULT, unlock expressivity. Bitcoin can embrace opcodes so long as it grows charges with out creating economies of scale or exclusivity, and thereby preserve out the worst varieties of expressivity.

It’s our view that almost all expressivity — equivalent to a BitVM attestation chain or a Bitcoin rollup — will profit safety long-term with out true entrenchment. No fork is ideal, however by limiting extra rivalrous types of price variance and creating new methods for the community to pay for its personal safety (with open types of MEV or with a type of income smoothing), Bitcoin can guard towards a decline in safety over the following few halvings whereas sustaining and even enhancing sovereignty.

There are a couple of designs that may open income to miners:

- Decentralized Alternate: With a SNARK verification opcode, miners may collectively function a fast-finality, BTC-denominated change, incomes settlement and buying and selling charges.

- Rollup: A general-purpose, trustless, and verifiable sidechain, a Bitcoin-based rollup would pay for information availability, in addition to finality. Miners can construct their very own rollups or work collectively. Whereas one miner may verticalize and dominate, geographic frictions recommend a number of miners can compete. Furthermore, with higher opcodes the rollup could be absolutely noncustodial, making the sidechain a greater different to centralized platforms (e.g., Celsius, FTX). Miners may even offset PoW prices with rollup charges.

- Funds Chains: statechains or designs like Ark can have on-chain prices paid to miners and might also be a candidate for precedence finality through an accountable pool.

Notably, any of those designs tied to Bitcoin will want higher finality as issuance declines. By opening the door to accountable pooling, the door to egalitarian miner income widens. Once more, we consider the choice to embracing verifiable and democratic miner income is bigger miners adopting hash-based types of expressivity (or clunkery, abominable work-arounds). As such, it appears prudent to prioritize designs that push miners away from dangerous types of expressivity.

The Mining World of Tomorrow

The siloed nature of personal channels and the incapability of miners to behave independently of or confirm massive swimming pools suggests pooling will fracture as issuance zeros. In tandem, with out inflation (no, tail issuance shouldn’t be a repair) and with out democratic price sharing, hashrate will drop and consolidate.

In our view, this makes restricted, secure expressivity and egalitarian charges a key pursuit. Ought to expressivity develop, verticalized miners throughout distinct geographies will likely be finest geared up to outlive as issuance dwindles. And with developments in accountable pooling, apps, rollups and others can bid for quick finality, giving miners income and stabilizing Bitcoin in return for different events getting safe, precedence entry to at present’s most pristine asset.

Going ahead, we count on to see a market considerably much like mevgeth to evolve. Below this market, bundles of transactions which symbolize “spikey income” (e.g., Ordinals mints, information from rollups, and so on) could be submitted to miners through a pool. The diploma of openness of this pool to strange miners, together with its accountability, will, in lots of respects, decide Bitcoin’s sturdiness.

Neither rejecting nonstandard transactions (charges) nor non-public channels (which produce huge hashrate focus) is a solution to Bitcoin’s dwindling safety funds.

If Bitcoin needs to cross the chasm from digital retailer of worth or gold equal to digital peer-to-peer money, opening the door to utility that unlocks even-handed satsflow to miners is important. As long as charges unlocked by a tender fork end in atomic transactions, one-shot off-chain agreements, and self-referential MEV from miner-supported apps (and, extra critically, not unique or entrenching), income will likely be moderately open and clean for miners, permitting bitcoin’s distinctive shortage to compound right into a digital medium of change through its personal purposes and trust-minimized sidechains.

Maybe most significantly, failure to evolve secure expressivity implicitly embraces much less worthy varieties. With out dependable miner charges, much less safe, much less sustainable and fewer democratic types of expressivity will proliferate among the many greatest miners, whereas smaller ones merely shut store.

BM Large Reads are weekly, in-depth articles on some present subject related to Bitcoin and Bitcoiners. If you’ve gotten a submission you assume suits the mannequin, be happy to succeed in out at editor[at]bitcoinmagazine.com.

Walt Smith is a visitor creator and associate at Customary Crypto. Lively in Bitcoin since 2019, Walt beforehand led U.S. ventures at Cyberfund and labored at Galaxy in New York Metropolis. A Colorado native, he studied Austrian Economics at Grove Metropolis School in Pennsylvania.

Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.