The Pound Sterling (GBP) flattens round 1.3230 towards the US Greenback (USD), weakens towards different foreign money pairs, through the European buying and selling session on Monday. The GBP/USD pair consolidates whereas the US Greenback falls additional amid agency expectations that the Federal Reserve (Fed) will lower rates of interest in its financial coverage announcement subsequent week.

Throughout European buying and selling hours, the US Greenback Index (DXY), which tracks the Dollar’s worth towards six main currencies, posts a recent two-week low close to 99.30.

The CME FedWatch instrument reveals that the chance of the Fed slicing rates of interest by 25 foundation factors (bps) to three.50%-3.75% in December is 87.5%.

Fed dovish hypothesis has remained intensified on account of weak spot within the US labour market, and expectations that the affect of tariffs on inflation stays restricted.

Each day digest market movers: Traders await ISM PMI, ADP Employment Change information

- The Pound Sterling trades decrease towards its main foreign money friends in the beginning of the week. The British foreign money has come beneath strain as merchants are more and more assured that the Financial institution of England (BoE) will lower rates of interest in its final financial coverage announcement of this yr on December 18.

- Traders anticipate the BoE to chop curiosity charges by 25 foundation factors (bps) to three.75% as the newest United Kingdom (UK) information confirmed indicators of additional weak spot in job progress and slowing inflation progress.

- Along with dovish BoE expectations, cooling gilt yields, following the announcement of recent tax hikes by Chancellor of the Exchequer Rachel Reeves within the Autumn finances report, launched final Wednesday, are additionally anticipated to cap the Pound Sterling’s upside. 10-year UK gilt yields are down nearly 4% to close 4.44% from the November excessive of 4.62%.

- Within the finances report, Reeves introduced that the federal government will increase taxes by 26 billion kilos by 2029-30 to fill the fiscal hole. Moody’s score company has acknowledged the Labour Occasion’s efforts to scale back the debt, whereas warning that “execution dangers” stay intact. “Whereas the federal government’s willingness to carry public funds again according to its targets is constructive, execution dangers stay excessive,” Moody’s stated.

- This week, the GBP/USD pair will probably be influenced by a slew of United States (US) information, notably the ADP Employment Change for November, which will probably be launched on Wednesday.

- The ADP Employment Change information will point out the present standing of labour demand within the personal sector. Economists anticipate the personal sector to have added recent 20K staff in November, decrease than the 42K employed in October.

- In Monday’s session, buyers will take note of the US ISM Manufacturing Buying Managers’ Index (PMI) determine for November, which will probably be revealed at 15:00 GMT. The company is anticipated to report that the Manufacturing PMI contracted at a sooner tempo to 48.6 from 48.7 in October.

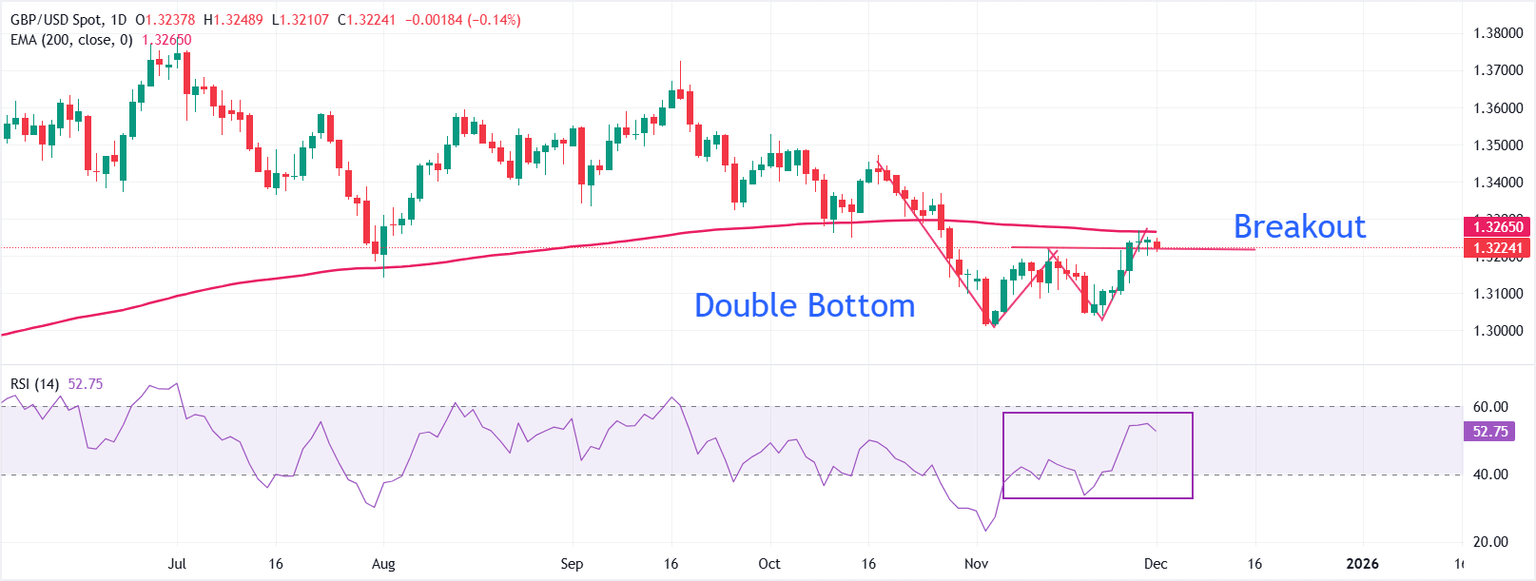

Technical Evaluation: GBP/USD turns bullish after Doubble Backside formation

On the each day chart, GBP/USD trades flat at 1.3224 and is anticipated to draw important bids as a breakout of a Double Backside formation has set a bullish reversal. Nevertheless, the 200-day Exponential Transferring Common (EMA) close to 1.3265 continues to behave as a key barrier for the Pound Sterling bulls.

The Relative Power Index (RSI) at 52.75 is neutral-to-bullish, reflecting a gradual restoration in momentum.

Wanting up, the Cable may strengthen if it decisively breaks above the 200-day EMA. Such a state of affairs could lead on the pair in direction of the October 28 excessive round 1.3370. On the draw back, the November 21 low round 1.3040 will stay a key help stage for the pair.

(The technical evaluation of this story was written with the assistance of an AI instrument.)