Many of the “Magnificent Seven” corporations have constructed and scaled respectable synthetic intelligence (AI) platforms, however two outliers in huge tech stay.

Certainly one of Silicon Valley’s most well-known “what-if” tales facilities on a rumored deal that by no means occurred. Based on experiences, Apple (AAPL 1.21%) had the possibility to accumulate Tesla (TSLA 6.18%) roughly a decade in the past — however the deal by no means materialized.

Within the years since, Tesla has cemented itself as a worldwide chief in electrical autos (EV), whereas Apple has remained a dominant pressure in shopper electronics. But regardless of their respective clout, each corporations share a stunning weak point: Not like Microsoft, Alphabet, Amazon, and Meta Platforms, neither Apple nor Tesla has constructed a really scaled synthetic intelligence (AI) enterprise.

Apple’s foray into the AI enviornment has been comparatively muted, counting on incremental iPhone upgrades fairly than a daring, stand-alone AI platform — a departure from its embellished historical past of innovation. Tesla, then again, has bold plans for its humanoid robotic, dubbed Optimus, and its robotaxi community, however these initiatives stay unproven at scale.

That is what makes the prospects of a strategic partnership between Apple and Tesla so intriguing proper now. Every might assist cowl the opposite’s blind spots, and in doing so, construct the inspiration of scaled AI platforms that their rivals already get pleasure from.

Why Apple wants Tesla

Apple’s legacy has at all times been rooted in shopper units, pioneering category-defining merchandise such because the iPod, iPhone, and iPad. For years, the corporate was seen because the undisputed grasp of uncovering latent wants and turning them into must-have improvements.

Lately, nevertheless, Apple’s push into superior {hardware} has struggled to stay as much as the corporate’s historic observe file.

Final 12 months, the corporate scrapped its automobile initiative, Venture Titan, after years of analysis and growth. The bold undertaking ended and not using a formal product launch — leaving Apple with no presence within the automotive market regardless of years of hypothesis.

Extra not too long ago, Apple unveiled its Imaginative and prescient Professional headset, a foray into augmented and digital actuality. The system has broadly been considered as a disappointment — a high-end luxurious gadget fairly than a mass-market breakthrough, limiting its adoption amongst on a regular basis customers.

Now, as rumors swirl round a Siri-powered robotic in Apple’s pipeline, administration faces a vital determination: pursue one more {hardware} moonshot from scratch and threat billions in capital expenditures (capex), or align with a associate that is already in manufacturing.

For my part, Apple does not have to reinvent the wheel by sinking extra money and time into creating merchandise that will by no means launch. As a substitute, Apple might thrive by positioning itself because the software program and providers layer powering clever {hardware} that already exists out there.

By becoming a member of forces with Tesla, Apple might leverage the corporate’s experience in autonomous driving techniques and robotics whereas integrating its personal AI-powered software program ecosystem and shopper advertising prowess.

Such a collaboration might enable Apple to leapfrog into each shopper and enterprise adoption of sensible units — staking a declare within the robotics and autonomous period of AI, with out repeating expensive errors of the previous.

Picture supply: Getty Photographs.

Why Tesla wants Apple

Tesla’s robotaxi and Optimus each carry transformative potential. However bringing these tasks to life requires large investments in compute energy and AI infrastructure.

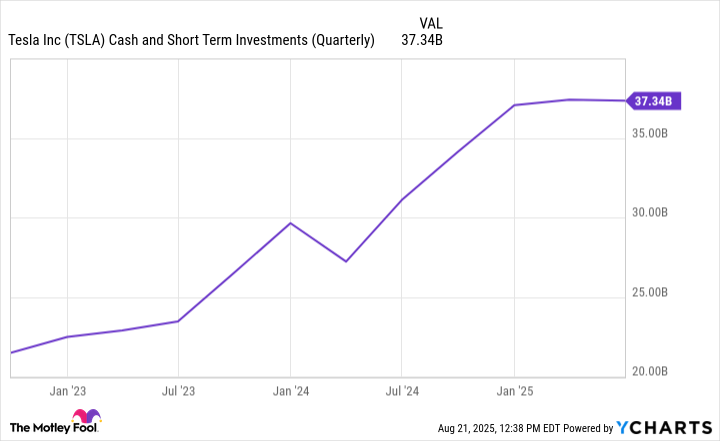

Whereas Tesla’s steadiness sheet boasts a wholesome money cushion, it is price noting that, like Apple, the corporate has additionally made some controversial capital allocation selections lately.

TSLA Money and Brief Time period Investments (Quarterly) information by YCharts

Living proof: Tesla not too long ago scaled again its in-house Dojo AI supercomputer undertaking, opting as a substitute to revert to confirmed infrastructure from Nvidia and Superior Micro Units. Much like Apple’s Venture Titan, the current strikes round Dojo underscore how expensive and unsure it may be to construct proprietary techniques at scale.

That is the place a three way partnership with Apple might reshape Tesla’s monetary trajectory. Apple sits on greater than $132 billion in money, equivalents, and marketable securities, and it instructions unmatched world distribution channels. By partnering with Apple, Tesla might speed up the commercialization of Optimus and robotaxi with out overplaying its hand financially.

Furthermore, Apple’s unparalleled model fairness might assist remodel Tesla’s AI-driven machines from prototype ideas into mainstream merchandise — bridging the hole between Musk’s futuristic imaginative and prescient and tangible family and enterprise adoption.

A second probability that nobody sees coming

Apple’s determination to not purchase Tesla is commonly portrayed as a missed alternative. However having spent a decade working in mergers and acquisitions as an funding banking analyst, I can say with confidence that offers hardly ever unfold as neatly because the monetary fashions counsel. In lots of circumstances, strategic partnerships can unlock far higher, extra accretive alternatives than an outright acquisition.

Because the final of massive tech to scale an AI enterprise, each Apple and Tesla now sit at a pivotal crossroad. A collaboration between the 2 would signify a uncommon second probability for trillion-dollar innovators to hitch forces and reshape the way forward for the know-how panorama.

By combining Apple’s ecosystem with Tesla’s progress in robotics and autonomous techniques, the businesses might fast-track the commercialization of next-generation AI functions — transferring them from analysis labs and into the fingers of customers worldwide.

Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.