The Reserve Financial institution of Australia (RBA) shocked the markets with a choice to maintain rates of interest on maintain at 3.85% as an alternative of reducing to three.60%. How did our watchlist setups for this top-tier catalyst fare?

Watchlists are value outlook & technique discussions supported by each elementary & technical evaluation, an important step in the direction of making a prime quality discretionary commerce concept earlier than engaged on a threat & commerce administration plan.

In case you’d prefer to comply with our “Watchlist” picks proper when they’re printed all through the week, try our BabyPips Premium subscribe web page to study extra!

The Setup

- What We Have been Watching: RBA Financial Coverage Assertion (July 2025)

- The Expectation: Rate of interest reduce from 3.85% to three.60%

- Information consequence: Charges maintained at 3.85% whereas RBA Governor Bullock reiterated “cautious, gradual stance” on easing

- Market atmosphere surrounding the occasion: Impartial to risk-on; Easing geopolitical issues and cautious risk-taking as merchants began shrugging off tariff issues

Occasion End result:

The RBA delivered a shock determination to maintain charges on maintain at 3.85% regardless of the market consensus of a 0.25% rate of interest reduce. The choice was made in a break up 6-3 vote, which additionally marked the primary time the central financial institution printed its voting breakdown.

Key factors from the RBA assertion:

- Current month-to-month CPI information got here in “barely stronger than anticipated”

- Board desires extra affirmation that inflation stays on monitor for two.5%

- Cited heightened uncertainty about world commerce insurance policies and home demand

Throughout the press convention, RBA Governor Bullock instructed additional cuts stay possible as soon as they achieve extra confidence within the inflation trajectory. The central financial institution famous that with charges already 50 foundation factors decrease than 5 months in the past, they may afford to attend for extra information.

Basic Bias Triggered: Bullish AUD Setups

Market sentiment swung between warning and optimism all through the week as merchants navigated tariff uncertainties forward of the July 9 deadline.

The week opened with threat aversion after Trump threatened 10% tariffs on BRICS nations and introduced 25% levies on Japan and South Korea by August 1. This sparked safe-haven flows into gold and the greenback whereas pressuring threat belongings.

A transient bump in risk-taking was seen main as much as the RBA determination when Trump talked about in a press briefing that the August 1 deadline is agency however “topic to negotiations” and that he’s “open to different concepts,” whilst extra tariff letters had been being despatched out.

A turning level got here with the FOMC minutes launch on Wednesday, revealing a rising divide amongst policymakers on the dimensions and timing of future rate of interest cuts. This dovish shock triggered a pointy drop in Treasury yields and broad greenback weak spot whereas lifting equities and bitcoin to new highs above $116,000.

Vitality markets noticed important volatility, with WTI crude initially surging on Houthi assaults within the Pink Sea and OPEC+ manufacturing will increase, earlier than reversing on weak Chinese language demand forecasts. The Australian greenback emerged as a star performer after the RBA shocked markets by holding charges at 3.85%, whereas Fed officers’ feedback about potential charge cuts regardless of tariff-induced inflation stored threat urge for food supported, not less than till Trump hit Canada with a 35% risk on Friday!

AUD/CHF: Web Bullish AUD Occasion consequence + Danger-On Situation = Arguably greatest odds of a web optimistic consequence

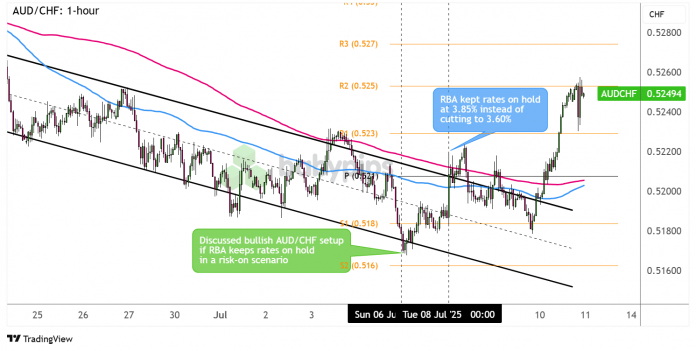

AUD/CHF 1-hour Foreign exchange Chart by TradingView

In our watchlist, we anticipated that AUD/CHF would discover help on the backside of its descending channel in case the RBA shocked with a choice to carry as an alternative of reducing by 0.25%. Our thesis was primarily based on a mix of potential risk-on flows from easing world commerce tensions and dovish expectations for the SNB.

Though the pair already bounced off the channel backside forward of the occasion attributable to cautious optimism amid the U.S. tariff deadline extension, the precise occasion nonetheless triggered a bullish AUD response and a sustained rally to the channel resistance and past.

AUD/CHF hovered close to the highest of its channel as risk-off flows picked up following affirmation that the tariff deal deadline was pushed to August 1. That extension stored uncertainty in play and inspired some merchants to lock in positive factors.

The following day, the FOMC minutes confirmed that “a few” members had been in favor of a July charge reduce. That weighed on U.S. 10-year yields and the greenback, giving the Swiss franc a raise as safe-haven demand returned. AUD/CHF pulled again towards pre-event ranges close to the S1 help.

Nonetheless, the pair discovered its footing and staged a stronger breakout from the channel later within the week, supported by dovish Fed commentary that stored the door open for decrease U.S. borrowing prices. Merchants additionally shrugged off recent tariff threats and as an alternative priced in stronger demand for equities and renewed hopes for U.S. commerce offers.

Not Eligible to maneuver past Watchlist – Bearish AUD Setups and GBP/AUD brief technique

GBP/AUD: Bullish AUD Occasion consequence + Danger-Off Situation

GBP/AUD 4-hour Foreign exchange Chart by TradingView

Whereas the occasion consequence supported a bearish setup on GBP/AUD, the broader threat temper heading into the RBA determination didn’t fairly match. Markets had been leaning optimistic, possible hoping for an additional “TACO” state of affairs or progress on commerce offers after the tariff deadline was pushed again.

Nonetheless, the RBA shock would have performed out properly for the pair, which had already bounced off the vary resistance zone close to R1 and the two.1000 main psychological degree we had our eyes on.

GBP/AUD stored the bearish momentum going under the pivot level, paused for a fast pullback, then resumed its slide right down to the vary help at S1 and past.

Urge for food for European currencies pale as U.S.-EU commerce talks stay unsure and the U.S. rolled out extra tariff warnings. In the meantime, threat sentiment turned extra optimistic, and merchants dismissed the unimplemented threats, giving commodity currencies just like the Aussie a recent enhance. Lastly, GBP was knocked decrease on Friday due to weaker-than-expected UK GDP updates, sending GBP/AUD to recent intraweek lows a number of hours forward of the shut.

AUD/NZD Quick: Web Bearish AUD Occasion consequence + Danger-Off Situation

AUD/NZD 1-hour Foreign exchange Chart by TradingView

AUD/NZD dipped towards the Pivot Level degree forward of the RBA determination, however that transfer wasn’t actually in regards to the RBA’s stance. The drop possible mirrored broader threat jitters tied to tariff uncertainty, particularly after the U.S. slapped a 50 % tariff on copper imports, a transfer that weighed on the Aussie earlier than the occasion even kicked off.

As soon as the RBA shocked markets by holding charges regular, AUD/NZD rapidly popped larger, leaping from round 1.0825 to above 1.0870. The choice marked a transparent coverage divergence from the RBNZ, which had stored its dovish tone intact this week.

From there, the pair prolonged its positive factors because the Aussie drew extra help from the pickup in threat urge for food than the New Zealand greenback did. Optimism over commerce offers, recent Fed charge reduce speculations, and broad USD weak spot gave the foreign money a strong tailwind.

AUD/JPY Lengthy: Bearish AUD Occasion consequence + Danger-On Situation

AUD/JPY 1-hour Foreign exchange Chart by TradingView

Our authentic dialogue on AUD/JPY was invalidated straight away with the RBA shock, however for many who adjusted to the brand new info and tailored to it, probably might have seen favorable outcomes.

In contrast to in our technique setup, AUD/JPY didn’t drop nearer to the channel help earlier than the RBA determination. The 94.40 degree held agency, and as an alternative of dipping, the pair turned larger forward of the occasion because the yen took successful following the U.S. announcement of a 25% tariff on Japanese items.

That anti-yen sentiment spilled into Tuesday and sure helped gas AUD/JPY’s sharp transfer larger after the RBA shocked with a charge maintain. The pair broke above its earlier July highs, then paused for a quick pullback on Wednesday because the FOMC minutes boosted Fed charge reduce expectations and gave the yen a short-lived raise.

By the top of the week, AUD/JPY was again on the transfer, breaking by way of the R2 Pivot Level resistance as merchants possible leaned on that RBA maintain shock, and falling odds of BOJ charge hikes after weaker-than-expected Japanese PPI information on Friday.

The Verdict

Our elementary evaluation and watch state of affairs primarily based on bettering threat urge for food and a web optimistic AUD consequence leaned in favor of a possible lengthy AUD/CHF setup.

Our technical evaluation nailed the channel backside help zone as a possible space of curiosity for lengthy entries forward of the occasion, plus the potential of the pair sustaining its bounce momentum again above S1 and the pivot level degree if sentiment continued to lean in favor of threat currencies after the RBA determination.

And due to extra risk-on flows from the FOMC minutes and Fed rhetoric within the latter a part of the week, AUD/CHF was poised to increase its upside previous the channel resistance onto R1 then R2.

Total, we assess this as possible supportive of a web optimistic consequence since AUD was already having fun with a little bit of a risk-on enhance pre-event and managed to carry its floor earlier than one other push larger on Thursday.

The alignment of elementary and technical elements made for a simple play: Tariffs deadline delay supported risk-taking, coverage divergence between RBA and SNB highlighted in shock maintain determination, and Fed easing narrative led to a different wave larger.

Nonetheless, commerce administration and execution would have performed a minor function, as short-term pullbacks throughout the RBA press convention and tariffs bulletins in a while might have supplied higher entry alternatives with larger return-on-risk in comparison with breakout performs.

Key Takeaways:

Function of Exterior Components

With all of the market deal with tariff developments, it’s no shock that precise bulletins and even threats of countermeasures have brought about big swings in sentiment, taking part in a key function within the consequence of the AUD setups.

Commerce headlines and Trump’s Reality Social posts might have gone both method, so the significance of being fast in your toes by way of actively managing open positions can’t be overstated, particularly for the reason that RBA determination befell early within the week earlier than a complete host of different market occasions unfolded.

Making Entry and Danger Changes

Whereas the watchlist setups pinpointed key inflection factors for commerce entry targets, a number of market developments main as much as the precise RBA occasion already allowed the degrees to carry and a few momentum to return into play.

Changes to entry ranges to account for these value actions also needs to include applicable modifications to cease losses and/or place sizes to make sure correct threat administration whereas staying versatile with targets. On this case, sustaining a bullish AUD bias regardless of midweek dips would have stored AUD/CHF in a strong place to reap the benefits of the post-FOMC threat rally previous preliminary conservative targets.

The foreign exchange evaluation content material supplied in Babypips.com is meant solely for informational functions solely. The technical and elementary eventualities mentioned are offered to focus on and educate on the way to spot potential market alternatives that will warrant additional impartial analysis and due diligence. This content material exhibits how we cowl a portion of the total buying and selling course of, and doesn’t represent that we ever give particular funding or buying and selling recommendation. The setups and analyses offered on Babypips.com are very possible not appropriate for all portfolios or buying and selling kinds.

Commerce and threat administration are the only duty of every particular person dealer. All buying and selling selections and their subsequent outcomes are the unique duty of the person making them. Please commerce responsibly.

Buying and selling responsibly means figuring out as a lot as you possibly can a couple of market earlier than you consider taking over threat, and when you suppose this type of content material might help you with that, try our BabyPips Premium subscribe web page to study extra!