By the third week of August, a number of altcoins skilled a pointy drop in trade reserves. This pattern displays rising demand for accumulation and off-exchange holding. The shift is very notable because the so-called altcoin season has grow to be more and more selective.

Which tokens are seeing this surge in accumulation, and what elements drive investor optimism?

1. Ethena (ENA)

Knowledge from Santiment exhibits that Ethena (ENA) trade reserves fell from 1.3 billion to 1.15 billion throughout the third week of August. In different phrases, 150 million ENA left centralized exchanges.

This occurred whereas ENA’s value surged 30% in August, climbing from $0.51 to $0.65.

The reserve drop coincided with the Ethena Basis asserting a $260 million buyback program. The plan allocates round $5 million every day to repurchase ENA from the market.

Tokenomist estimates the buyback might take away 3.48% of the circulating provide. This absorption of promote stress boosts long-term investor confidence.

As well as, Ethena crossed main milestones in August. Income surpassed $500 million, whereas USDe provide reached a file excessive of $11.7 billion.

Collectively, these drivers fueled ENA accumulation and trade reserve declines.

2. BIO Protocol (BIO)

BIO Protocol, a number one mission within the DeSci sector, delivered an distinctive efficiency in August with positive factors of over 265%.

Alongside the value rally, trade reserves fell sharply. From early August to now, reserves dropped from 380 million to 294 million BIO — a greater than 22% decline.

The third week of August noticed essentially the most dramatic motion. Traders withdrew 42 million BIO in only one week, pushing trade reserves to their lowest stage this yr.

A number of catalysts clarify this accumulation wave. BIO launched a staking program early in August that attracted over 25 million tokens. Moreover, Arthur Hayes invested $1 million into BIO this week, reigniting market consideration.

Bio Protocol additionally rolled out a brand new option to attain new buyers. Customers are requested to debate the mission on social media to earn BioXP, which provides them entry to the primary BioAgent gross sales.

These elements mixed to spice up visibility, entice new buyers, and speed up accumulation.

3. API3

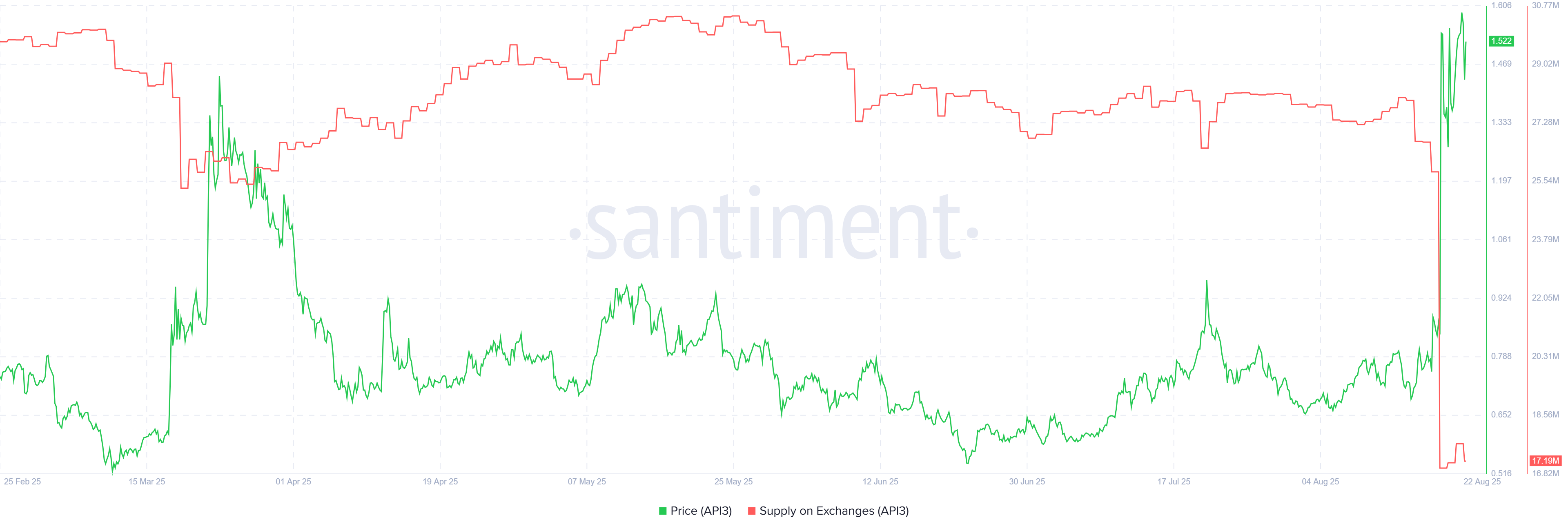

API3, an oracle-focused mission, regained investor curiosity in August, sending its value up greater than 130%. On the similar time, trade reserves fell to their lowest level this yr.

The third week of August marked a turning level. Over 9 million API3 had been withdrawn from exchanges, decreasing trade provide to simply 17.19 million.

The catalyst was Upbit’s itemizing of API3. In line with the BeInCrypto report, the token’s value jumped over 120% instantly after the itemizing.

Investor give attention to the Oracle sector additionally elevated on account of Chainlink’s (LINK) rally. LINK’s robust efficiency prior to now month spilled over into associated initiatives. Knowledge from Artemis confirmed Oracle was the market’s best-performing sector in August.

The surge in API3 accumulation has saved its value buying and selling regular at above $1.50.

These three altcoins spotlight completely different drivers behind August’s selective altcoin rally. Whereas a broad-based altcoin season has but to emerge, initiatives with distinctive catalysts — whether or not buyback applications, staking incentives, or an trade itemizing — are attracting investor consideration and capital.

The put up Prime 3 Altcoins Collected Off Exchanges in Mid-August appeared first on BeInCrypto.