Ethereum has reclaimed the $3,150 stage after a risky stretch, providing a uncommon signal of energy in an in any other case unsure market. The broader crypto panorama stays sharply divided: some analysts argue that ETH and the remainder of the market nonetheless face downward continuation, doubtlessly setting new native lows, whereas others consider this correction is solely a reset earlier than a a lot bigger bull cycle—presumably extending into 2026.

Associated Studying

But one sign stands out clearly amid the noise: sensible whales are unanimously going lengthy on ETH. On-chain information exhibits that a number of of probably the most worthwhile and constant whale merchants—every with tens of hundreds of thousands in realized good points—have opened substantial lengthy positions, collectively exceeding tons of of hundreds of thousands of {dollars}. Their coordinated habits signifies confidence that Ethereum’s current lows characterize alternative relatively than hazard.

This alignment amongst top-performing whales introduces a compelling counterpoint to bearish narratives. Whereas retail sentiment stays fragile, probably the most refined market individuals look like positioning for a bigger transfer forward. As Ethereum stabilizes above $3,150, the query now turns into whether or not whale conviction will show to be early—or appropriate.

Prime Performers Load Up on Ethereum

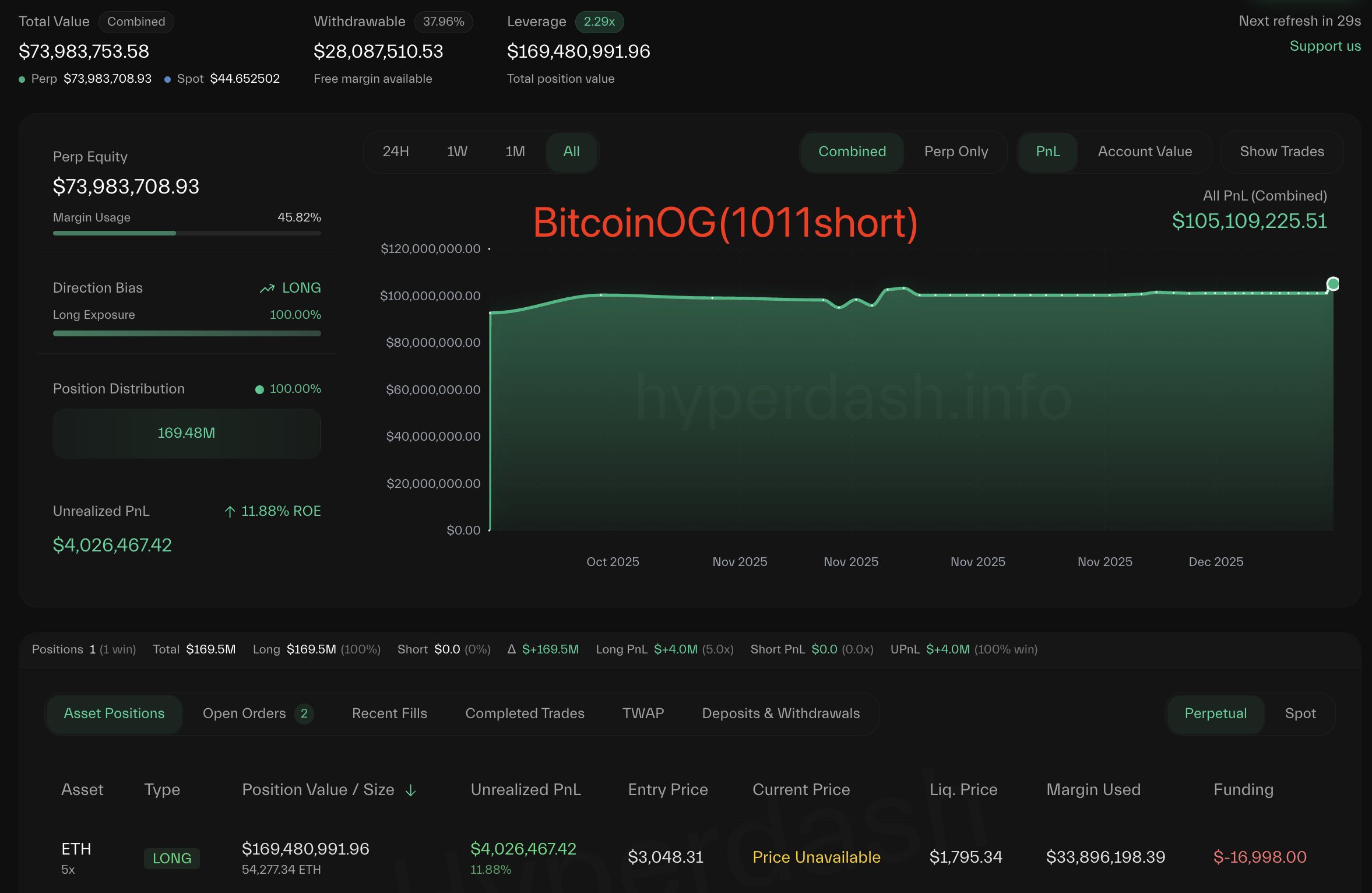

Based on Hyperdash information shared by Lookonchain, a few of the most profitable and influential whales available in the market are aggressively accumulating Ethereum—sending a robust sign that high-conviction gamers anticipate upside forward.

Probably the most notable is BitcoinOG, the dealer well known for shorting the market throughout the violent 10/10 crash, a transfer that earned him important credibility. With a complete realized PNL of $105 million, BitcoinOG is now positioned firmly on the bullish facet, holding 54,277 ETH price roughly $169.48 million.

One other main participant is the well-known Anti-CZ whale, named for his historic sample of taking the other facet of positions favored by Binance founder Changpeng Zhao. With a powerful $58.8 million in whole PNL, this whale is at present lengthy 62,156 ETH—a large $194 million place. His trades have usually been early indicators of broad market route, including weight to this shift towards bullish publicity.

Lastly, pension-usdt.eth, a persistently worthwhile whale handle with $16.3 million in realized good points, is lengthy 20,000 ETH valued at $62.5 million.

Taken collectively, these positions replicate a unified stance amongst top-performing whales: regardless of market uncertainty, they’re positioning for Ethereum energy.

Associated Studying

Weekly Construction Exhibits Early Indicators of Stabilization

Ethereum’s weekly chart reveals a market trying to regain its footing after a pointy multi-week decline from the $4,500 area. The current reclaim of $3,150 is a significant growth, as this stage aligns carefully with prior weekly help from mid-2024 and sits simply above the 50-week transferring common—an space that usually acts as a trend-defining zone. ETH briefly dipped under this area throughout the November selloff, however patrons stepped in aggressively, producing a robust weekly wick that alerts demand at decrease ranges.

Regardless of this restoration try, ETH stays under key resistance ranges. The 20-week and 100-week transferring averages are positioned above the present value and converging, making a zone of potential rejection except momentum strengthens. For now, ETH is buying and selling in a transitional construction: not trending downward aggressively, however not but displaying a confirmed bullish reversal on excessive timeframes.

Associated Studying

Quantity patterns additionally help this interpretation. Promoting quantity has diminished in comparison with the capitulation section, whereas current inexperienced candles present average however regular shopping for curiosity—suggesting accumulation relatively than full risk-on habits.

If ETH can set up consecutive weekly closes above $3,200–$3,300, the chart opens the door for a retest of the $3,600–$3,800 vary. Failure to carry $3,150, nonetheless, dangers one other transfer towards $2,800 help.

Featured picture from ChatGPT, chart from TradingView.com