Ethereum is below strain as volatility spikes, with the value lately slipping under the $4,300 mark. After weeks of sturdy momentum and multi-year highs, bulls at the moment are struggling to defend help zones. The lack of this degree raises issues a couple of potential deeper correction, although fundamentals stay firmly bullish.

Associated Studying

Institutional adoption continues to supply sturdy tailwinds, with main corporations growing publicity to Ethereum by ETFs, treasury methods, and on-chain accumulation. This regular demand displays rising confidence in ETH’s long-term position inside the digital asset ecosystem. On the similar time, Open Curiosity has been rising sharply, highlighting a surge in hypothesis and leveraged positioning throughout derivatives markets. Whereas this may amplify strikes in each instructions, it underscores the extreme battle between bulls and bears at present ranges.

Market members now see the approaching days as important for Ethereum’s short-term trajectory. Holding above close by help may pave the best way for a rebound and renewed makes an attempt to problem the $4,500–$4,800 resistance zone.

Ethereum Faces Document Brief Place Strain

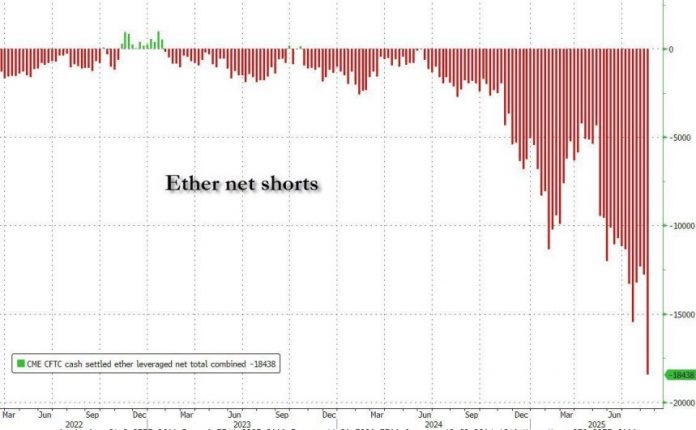

Ethereum is coming into certainly one of its most decisive moments but, with unprecedented quick positioning increase available in the market. In keeping with high analyst Ted Pillows, we’re witnessing the largest leveraged quick place on ETH ever recorded. Web leveraged shorts have climbed to 18,438 contracts, marking the largest bearish wager in Ethereum’s historical past. This surge in positioning displays a market bracing for volatility, as merchants place aggressive draw back bets following Ethereum’s retrace from the $4,790 degree.

Nevertheless, Pillows emphasizes that this dynamic may create the right storm for a brief squeeze. If Ethereum manages to rally from present ranges, these bearish positions may rapidly unwind, forcing shorts to cowl at larger costs and accelerating the rally. Traditionally, such imbalances have led to explosive upside strikes in a brief timeframe, catching bears off guard and rewarding bulls with speedy beneficial properties.

Whereas short-term volatility stays elevated, sturdy fundamentals — together with declining trade provide, institutional accumulation, and broader adoption traits — proceed to help the long-term bullish thesis. For now, all eyes stay on whether or not the record-short positioning turns into the catalyst for Ethereum’s subsequent breakout.

Associated Studying

ETH Technical Particulars: Testing Demand Degree

Ethereum is at present buying and selling at $4,284, displaying indicators of volatility after its current decline from the $4,800 area. The 4-hour chart highlights how ETH has struggled to reclaim momentum, with worth now testing a key help zone across the $4,200–$4,250 vary. This degree is essential as a result of it aligns with the 100-day shifting common (inexperienced line), which has acted as dynamic help throughout earlier pullbacks on this rally.

The worth construction reveals that bulls stay energetic however are below strain. After weeks of constant beneficial properties, Ethereum is now experiencing heavier promoting quantity, as seen within the current crimson bars on the chart. Nevertheless, the broader development stays bullish so long as ETH holds above the 200-day shifting common (crimson line), at present sitting under $3,920.

Associated Studying

A breakdown of $4,200 may expose ETH to additional draw back towards $4,000 and even $3,900 within the quick time period. Then again, if patrons defend this zone, Ethereum may try one other rally to retest resistance ranges round $4,500–$4,600.

Featured picture from Dall-E, chart from TradingView