The Reserve Financial institution of New Zealand (RBNZ) lower its Official Money Price (OCR) by 25 foundation factors to three.50%, marking its fifth consecutive price discount since starting the easing cycle in August 2024.

This resolution adopted three massive 50bp cuts earlier within the cycle, together with the substantial February 2025 discount that introduced charges to three.75%.

The central financial institution’s Financial Coverage Committee, now chaired by interim Governor Christian Hawkesby following Adrian Orr’s shock resignation in March, cited a number of components behind their resolution:

- Inflation stays close to the midpoint of the 1-3% goal band at 2.2%

- The financial system is slowly recovering from recession with important spare capability

- World commerce tensions are creating draw back dangers, notably Trump’s tariffs

- New Zealand’s vulnerability to international financial developments as an export-driven financial system

Notably, the RBNZ left the door huge open for additional financial easing, stating:

“Because the extent and impact of tariff insurance policies develop into clearer, the Committee has scope to decrease the OCR additional as acceptable.“

Hyperlink to RBNZ’s April 2025 coverage assertion

Buyers are actually pricing in roughly a 90% probability of one other quarter-point lower in Might, with expectations for charges to probably attain 3.00% or decrease by year-end.

The RBNZ’s pivot to specializing in international dangers, notably Trump’s tariffs together with the 104% efficient tariff price on Chinese language imports, alerts a shift in priorities from the sooner part of the easing cycle which was extra domestically targeted. With U.S.-China tensions escalating and JPMorgan now predicting a 60% chance of recession within the U.S. financial system this yr, the exterior atmosphere will possible proceed to affect RBNZ coverage by means of 2025.

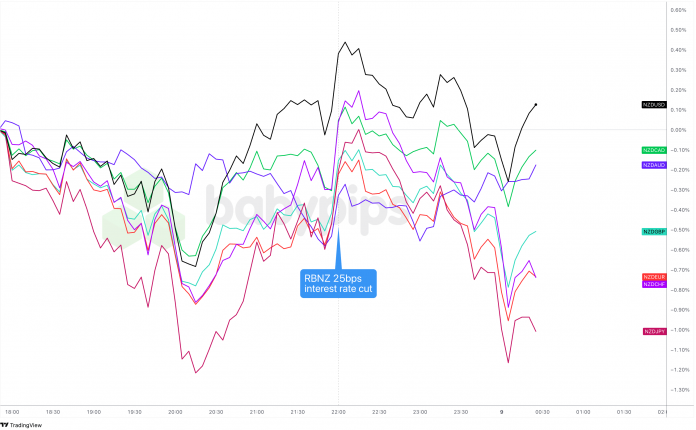

New Zealand greenback vs. Main Currencies: 5-min

Overlay of NZD vs. Main Currencies Chart by TradingView

The New Zealand greenback, which had been recovering from its U.S. session and early Asian session losses, initially popped increased when the RBNZ delivered the anticipated 25bps price lower.

However the tides shortly turned because the central financial institution’s give attention to U.S. tariff dangers and its openness to extra easing got here off extra dovish than anticipated. A Might lower was already on everybody’s radar, however now markets are considering the RBNZ may go full throttle with extra price cuts after that.

Kiwi bought off throughout the board, taking the largest hits towards secure havens just like the yen and Swiss franc, in addition to European currencies just like the euro and pound. Losses had been extra restricted towards the softer U.S. greenback and different commodity currencies.