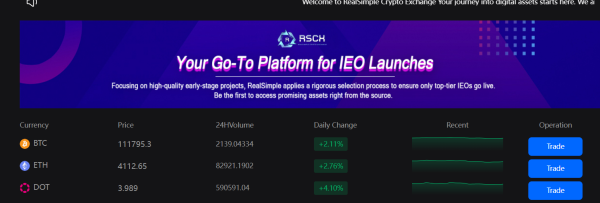

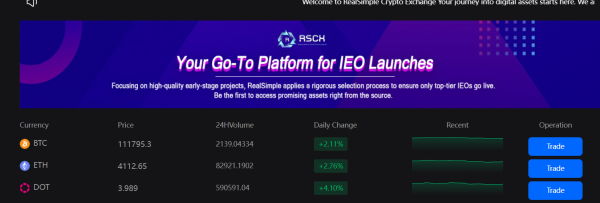

RealSimple Crypto Change Redefining Funding Methods with AI and Actual-World Belongings

Within the evolving panorama of world finance, the connection between know-how and funding methods is present process a profound shift. The age when digital belongings had been seen as speculative instruments for short-term merchants is ending, changed by a extra sustainable, institutional, and innovation-driven method. On the forefront of this transformation is RealSimple Crypto Change (RSCX), a platform that has positioned synthetic intelligence (AI) and real-world asset (RWA) tokenization on the core of its mission.

By merging the analytical energy of AI with the steadiness and tangibility of RWAs, RSCX isn’t solely constructing a brand new mannequin for buying and selling but additionally empowering buyers—retail and institutional alike—with refined methods as soon as reserved for elite hedge funds. The result’s a extra inclusive monetary ecosystem the place entry, effectivity, and adaptableness coexist.

A New Period of Digital Finance

The final decade demonstrated the explosive rise of cryptocurrency exchanges, but additionally their shortcomings. Many platforms provided little greater than speculative markets with restricted safety, opaque governance, and nearly no connection to conventional finance. This hole created volatility and distrust, proscribing crypto’s mainstream adoption.

Nonetheless, the brand new period of digital finance is being formed by two megatrends:

The tokenization of real-world belongings (RWA)—bringing tangible worth, resembling actual property, commodities, treasury bonds, or company fairness, onto blockchain rails.

The infusion of AI into monetary infrastructure—delivering predictive insights, automated compliance, and dynamic funding methods.

RSCX has acknowledged that the longer term lies on the intersection of those two forces. The place others see fragmentation, RSCX has constructed a unified mannequin.

The Imaginative and prescient Behind RSCX

The management at RSCX has articulated a easy however bold imaginative and prescient: make digital buying and selling as dependable, clever, and globally accessible as conventional finance—whereas leveraging some great benefits of decentralization.

To realize this, the alternate focuses on three pillars:

Integration with real-world belongings to stabilize portfolios and broaden past speculative tokens.

AI-powered technique technology and danger administration to present buyers sharper instruments.

Cross-border monetary accessibility, guaranteeing that international customers can take part with out being restricted by geography or legacy infrastructure.

This imaginative and prescient acknowledges a actuality usually ignored by rivals: buyers need each innovation and belief, each development alternatives and draw back safety.

Actual-World Belongings: Anchoring Digital Portfolios

Tokenizing real-world belongings isn’t a novelty anymore, however RSCX treats it as a cornerstone relatively than a aspect product. The platform gives buyers entry to digital representations of belongings resembling:

Authorities Bonds and Treasuries: permitting buyers to seize secure yields in tokenized kind.

Industrial Actual Property: enabling fractional possession of high-value properties, lowering obstacles to entry.

Commodities like gold, silver, and power sources, providing hedges towards market volatility.

Company Debt and Fairness: bridging capital markets with blockchain liquidity.

By itemizing RWAs alongside cryptocurrencies, RSCX creates hybrid portfolios. Buyers can steadiness risky belongings like BTC or ETH with the steadiness of U.S. Treasuries or actual property, all inside the similar alternate account.

This steadiness modifications the notion of crypto buying and selling—from hypothesis to holistic wealth administration.

AI because the Strategic Engine

Whereas RWAs present stability, synthetic intelligence is the mind of RSCX’s ecosystem. The platform has embedded AI into a number of layers of its infrastructure:

Predictive Market Analytics: AI fashions analyze international macroeconomic information, on-chain metrics, and market sentiment to supply forward-looking indicators. Buyers obtain actionable insights—whether or not to regulate publicity to commodities, or rebalance into safer bonds.

Portfolio Optimization: As a substitute of handbook guesswork, buyers can depend on AI instruments to construct diversified portfolios throughout RWAs and digital belongings. The system constantly adjusts allocations in response to new information.

Danger Administration & Compliance: AI algorithms scan transactions in actual time to detect anomalies, fraud, or non-compliant actions. This protects each the alternate and its members, whereas lowering regulatory danger.

Personalised Funding Methods: The platform’s AI engines can create individualized methods based mostly on every investor’s objectives, whether or not they search aggressive development, revenue technology, or capital preservation.

This AI layer transforms RSCX into greater than a buying and selling platform—it turns into a co-pilot for buyers, guiding them via an more and more advanced monetary panorama.

Bridging Institutional and Retail Wants

One of many persistent challenges in finance has been the divide between institutional buyers with entry to elite methods and retail buyers left with simplified instruments. RSCX’s mannequin narrows this hole.

Establishments profit from compliance-first infrastructure, RWA listings that align with conventional finance, and scalable AI danger frameworks.

Retail buyers acquire democratized entry to superior analytics, AI-driven technique builders, and publicity to beforehand inaccessible RWAs like industrial property or non-public fairness.

By serving each audiences, RSCX positions itself as a multi-layered market, very like conventional exchanges that cater to each retail merchants and institutional desks.

RSCX and the Evolution of Funding Methods

The true transformation lies not within the know-how alone however in the way it redefines methods. Contemplate the next examples of how RSCX is reshaping investor habits:

AI-Pushed Hedging with RWAs

Buyers can instruct AI to robotically hedge cryptocurrency publicity by shifting capital into tokenized U.S. Treasuries when volatility exceeds an outlined threshold.

Macro-Adaptive Portfolios

Throughout inflationary cycles, AI reallocates portfolios towards commodities like tokenized gold or power belongings, offering safety towards forex devaluation.

Actual-Property Backed Yield Technology

By pooling fractionalized actual property tokens, buyers can generate revenue streams similar to conventional REITs, however with better liquidity.

International Diversification

RSCX permits publicity to worldwide company debt or infrastructure tasks via tokenization, whereas AI manages forex and geopolitical danger.

These methods symbolize a elementary shift from static, one-dimensional crypto portfolios to dynamic, adaptive, and globally diversified allocations.

Safety and Belief as a Basis

Innovation is barely as priceless because the belief it conjures up. Recognizing this, RSCX prioritizes:

Clear governance with common audits of RWA reserves.

On-chain verification of asset possession to forestall over-issuance or manipulation.

AI-monitored cybersecurity protocols, which evolve in actual time towards rising threats.

Compliance partnerships throughout a number of jurisdictions to make sure long-term sustainability.

Belief turns into not only a regulatory requirement however a aggressive benefit.

The International Affect of RSCX

RSCX’s twin method of AI and RWA integration has broader implications for international finance:

Monetary Inclusion

Customers in rising markets acquire entry to safe, RWA-backed belongings with out conventional intermediaries. This democratizes wealth constructing.

Institutional Adoption

By providing tokenized bonds and commodities with AI-driven compliance instruments, RSCX lowers entry obstacles for institutional gamers that beforehand prevented digital exchanges.

Cross-Border Capital Flows

Tokenized RWAs on blockchain rails facilitate sooner, cheaper worldwide transfers, lowering dependency on gradual and expensive banking techniques.

Market Stabilization

The presence of RWAs alongside risky tokens brings pure steadiness to the ecosystem, lowering systemic danger.

Trying Forward: The Subsequent Chapter

RSCX isn’t content material with the current. Its roadmap consists of:

Growth of RWA choices into new sectors like carbon credit, infrastructure tasks, and mental property rights.

Deeper AI integration, the place predictive fashions evolve into autonomous asset managers.

Partnerships with international monetary establishments to bridge on-chain and off-chain liquidity swimming pools.

Sustainability initiatives, guaranteeing tokenized belongings additionally align with ESG ideas.

These steps level to a future the place RSCX acts much less like a standard alternate and extra like a international monetary working system.

Conclusion

The mixing of AI and RWAs isn’t just a technical improve—it’s a paradigm shift. By positioning itself on the nexus of those forces, RealSimple Crypto Change is crafting a platform the place methods are adaptive, entry is common, and belief is non-negotiable.

For buyers, this implies the power to maneuver past speculative buying and selling towards refined, AI-enhanced portfolio administration that includes the steadiness of real-world belongings. For the trade, it means the daybreak of a brand new mannequin the place exchanges aren’t merely marketplaces however strategic companions in wealth creation.

RealSimple Crypto Change isn’t solely remodeling how folks commerce—it’s remodeling how they take into consideration investing itself.

Media Contact

Group: RealSimple Crypto Change

Contact Individual: Lukas Hash

Web site: https://realsimplesocial.com

E-mail: Ship E-mail

Nation:United States

Launch id:34583

The put up RealSimple Crypto Change Redefining Funding Methods with AI and Actual-World Belongings appeared first on King Newswire. This content material is supplied by a third-party supply.. King Newswire makes no warranties or representations in reference to it. King Newswire is a press launch distribution company and doesn’t endorse or confirm the claims made on this launch. When you have any complaints or copyright considerations associated to this text, please contact the corporate listed within the ‘Media Contact’ part