In a landmark resolution, the U.S. Securities and Change Fee (SEC) has formally rescinded Workers Accounting Bulletin (SAB) No. 121, a controversial rule that had lengthy hindered banks from providing bitcoin and crypto custody companies. This transfer, introduced on Thursday, alerts a big shift within the SEC’s strategy to regulating bitcoin and crypto and paves the way in which for higher monetary integration.

BREAKING: 🇺🇸 SEC OFFICIALLY RESCINDS SAB 121, WHICH PREVENTED BANKS FROM CUSTODYING #BITCOIN pic.twitter.com/VCnggkCGmL

— Bitcoin Journal (@BitcoinMagazine) January 23, 2025

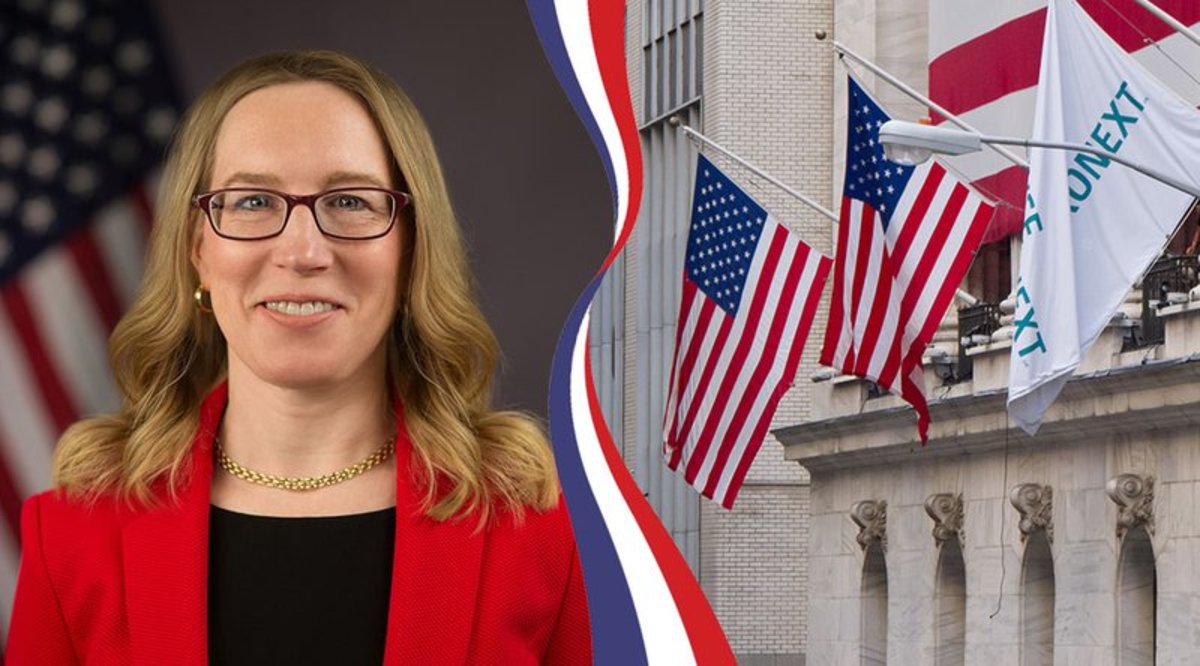

Launched in March 2022 underneath former SEC Chair Gary Gensler, SAB 121 required establishments holding bitcoin and crypto property for purchasers to file these holdings as liabilities on their steadiness sheets. This accounting customary created important operational and monetary burdens for banks and custodians, successfully discouraging them from offering bitcoin-related companies. The rule was broadly criticized by the crypto business and lawmakers, with SEC Commissioner Hester Peirce famously calling it a “pernicious weed” in April 2023.

“Bye, bye SAB 121! It is not been enjoyable,” Peirce wrote in a put up on X (previously Twitter) on Thursday, following the SEC’s issuance of Workers Accounting Bulletin No. 122, which formally rescinds the steering.

The SEC’s transfer to rescind SAB 121 comes simply days after Gensler’s resignation and marks the beginning of a brand new period underneath Republican management. Performing SEC Chair Mark Uyeda, who assumed the position on Monday, rapidly introduced the formation of a crypto job drive led by Peirce to craft clearer and extra sensible regulatory frameworks for the business.

“Thus far, the SEC has relied totally on enforcement actions to control crypto retroactively and reactively, usually adopting novel and untested authorized interpretations alongside the way in which,” the company acknowledged in an announcement on Tuesday.

With the elimination of SAB 121, main banks at the moment are anticipated to maneuver swiftly to combine bitcoin and crypto custody companies into their choices. This can be a important milestone within the financialization of bitcoin, bringing it nearer to mainstream adoption.