The Depository Belief & Clearing Company (DTCC) has formally listed the primary Solana futures ETFs (exchange-traded funds) from Volatility Shares.

The event signifies that these ETFs are actually eligible for clearing and settlement by DTCC’s central infrastructure, making certain a streamlined and safe buying and selling course of.

Solana Futures ETFs Cleared by DTCC

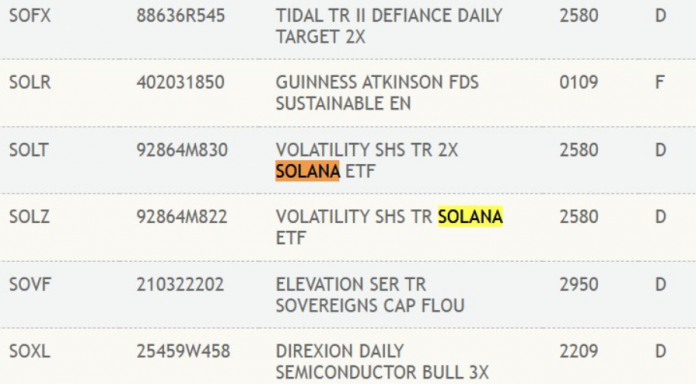

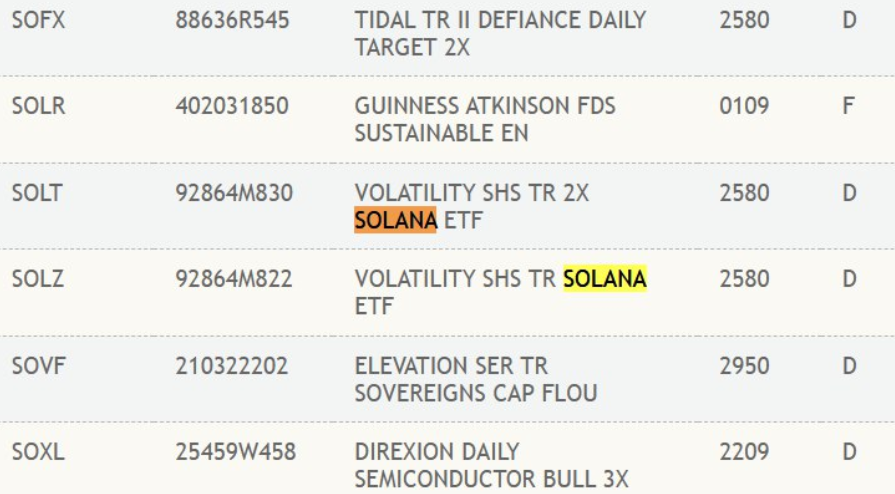

The newly listed merchandise embody the Volatility Shares 2x Solana ETF (SOLT) and the Volatility Shares Solana ETF (SOLZ).

Volatility Shares had initially filed with the SEC (Securities and Change Fee) in December 2024, in search of approval for 3 Solana-focused ETFs. Amongst them was the -1x Solana ETF, which goals to offer inverse publicity to Solana futures contracts.

On the time of the preliminary submitting, nevertheless, no Solana futures contracts have been accessible on any Commodity Futures Buying and selling Fee (CFTC) regulated exchanges. This raised questions concerning the feasibility of launching these ETFs with out an underlying futures market.

Subsequently, itemizing Solana’s future ETFs on DTCC highlights the rising institutional curiosity in cryptocurrency funding merchandise. However, whereas DTCC’s itemizing is a vital step in making these ETFs accessible to buyers, it doesn’t equate to formal approval by the US SEC.

Coinbase’s Position within the Solana Futures Market

In hindsight, the scales shifted earlier this month when Coinbase Derivatives LLC launched CFTC-regulated Solana futures contracts. This transfer addressed issues concerning the absence of a regulated Solana futures market and bolstered the case for future regulatory approval of Solana ETFs.

Coinbase’s announcement adopted hypothesis that Solana and XRP futures could possibly be launched on the Chicago Mercantile Change (CME). This was in mild of a leaked staging web site hinting at a possible February 10 begin date.

“Assuming “beta.cmegroup” is a beta/check model of the particular CMEGroup web site — seems like CME is anticipating to launch SOL & XRP futures on Feb 10. However this isn’t accessible on the precise web site but,” ETF analyst James Seyffart noticed.

Nonetheless, the area was taken down shortly after it was found. Thereafter, the CME Group clarified that the leak was an error and that no last resolution had been made.

Regardless of these uncertainties, the supply of regulated Solana futures contracts is a constructive step for institutional buyers. It supplies a structured and safe avenue for buying and selling Solana, bridging the hole between conventional finance (TradFi) and the crypto market.

In the meantime, the launch of Solana futures ETFs and the emergence of regulated futures contracts might set the stage for the eventual approval of a spot Solana ETF. A number of asset administration corporations, together with VanEck and 21Shares, Bitwise, and Canary Capital, have submitted filings for spot Solana ETFs.

The SEC’s dealing with of those functions can be attention-grabbing to observe because the race to create extra altcoin ETFs continues.

Regardless of the constructive developments, the SOL worth has declined practically 5% to $137.68 on the time of writing. Market volatility stays a persistent consider crypto, with regulatory uncertainty and macroeconomic traits influencing worth actions.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.