My Journey

I’ve all the time been passionate concerning the world of finance and buying and selling. After I first began exploring the world of foreign exchange, I used to be struck by how tough it may be for the typical particular person to navigate. There’s a lot data on the market, and it may be overwhelming to try to make sense of all of it. I noticed a chance to make a distinction and assist folks obtain their monetary targets. I knew that if I may develop buying and selling specialists that may be straightforward for folks to make use of, it may assist them make higher buying and selling selections and finally, earn extra money as an alternative of dropping. I’m pushed by the concept that expertise can be utilized to degree the enjoying area and provides folks the instruments they should be profitable. I actually consider that my buying and selling specialists could make an actual distinction in folks’s lives and I’m motivated by the chance to have a constructive impression on the world. I’m always studying and researching new methods to enhance my abilities, and I’m devoted to offering the absolute best resolution to assist folks obtain their monetary targets. My final purpose is to create buying and selling specialists that may change the best way folks strategy the foreign exchange market, making it extra accessible and fewer intimidating, whereas serving to them to be worthwhile. I really feel assured that the buying and selling specialists I develop will assist folks earn and never lose, and that is a rewarding factor for me.

Knowledgeable Creation

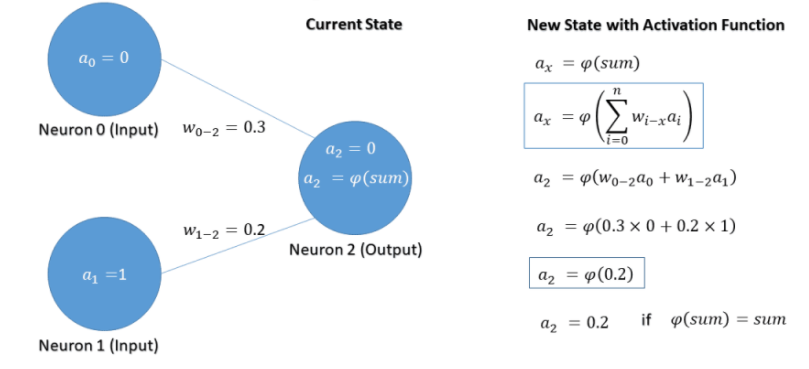

I developed T-Rocket AI primarily based EA on deep studying as a result of I consider it might help merchants within the international alternate market, significantly these new to buying and selling, by offering beneficial insights and enhancing their decision-making. Deep studying methods allow the EA to acknowledge intricate market patterns, providing merchants a bonus in predicting future value actions. Deep studying is a subset of machine studying that employs synthetic neural networks, that includes a number of hidden layers for dealing with complicated information. It makes use of backpropagation for coaching, employs activation features, contains Convolutional Neural Networks (CNNs) for photos, and Recurrent Neural Networks (RNNs) for sequences. Switch studying is frequent, and deep studying finds functions in laptop imaginative and prescient, pure language processing, healthcare, and extra, usually leveraging {hardware} acceleration.

Learn how to keep away from over-optimization and over becoming in Neural Community (NN) Knowledgeable Advisor (EA) creation:

Avoiding over-optimization and overfitting in Neural Community (NN) Knowledgeable Advisor (EA) creation is essential to make sure your buying and selling mannequin generalizes nicely to unseen information and performs successfully in the actual foreign exchange market. Listed below are some methods that can assist you obtain that:

-

Use Enough Information: Guarantee you’ve gotten a big and various dataset for coaching and testing your NN. The extra information you’ve gotten, the higher your mannequin can study from numerous market circumstances.

-

Cut up Information Correctly: Divide your dataset into three components: coaching, validation, and testing units. The coaching set is used for mannequin coaching, the validation set helps you tune hyperparameters and detect overfitting, and the testing set evaluates the mannequin’s efficiency on unseen information.

-

Regularization: Apply regularization methods like L1 and L2 regularization to penalize giant weights within the neural community. This helps forestall the mannequin from becoming the noise within the information.

-

Dropout: Implement dropout layers in your NN structure throughout coaching. Dropout randomly deactivates a fraction of neurons, which prevents co-adaptation of neurons and reduces overfitting.

-

Early Stopping: Monitor the validation loss throughout coaching. If it begins to extend whereas the coaching loss decreases, it is a signal of overfitting. Cease coaching early to forestall additional overfitting.

-

Cross-Validation: Use k-fold cross-validation to evaluate your mannequin’s efficiency from a number of splits of your information. This supplies a extra strong estimate of how nicely your mannequin will carry out on unseen information.

-

Easy Fashions: Begin with less complicated NN architectures and steadily improve complexity provided that vital. Easy fashions are much less vulnerable to overfitting.

-

Function Engineering: Rigorously choose related options and keep away from utilizing noise or redundant variables in your enter information.

-

Hyperparameter Tuning: Systematically seek for optimum hyperparameters (studying price, batch measurement, variety of layers, neurons per layer, and so on.) utilizing methods like grid search or random search.

-

Ensemble Studying: Mix predictions from a number of NN fashions, every educated in a different way, to cut back overfitting and enhance generalization.

-

Common Monitoring: Repeatedly monitor the efficiency of your EA in a demo or paper buying and selling atmosphere. If it begins to underperform, re-evaluate and presumably retrain the mannequin.

-

Use Correct Analysis Metrics: Concentrate on related analysis metrics like Sharpe ratio, Most Drawdown, and Revenue Issue relatively than simply accuracy or loss.

-

Reasonable Simulations: When backtesting, take into account transaction prices, slippage, and different real-world components to make the simulations extra reasonable.

-

Stroll-Ahead Testing: Periodically replace and retrain your EA with new information to adapt to altering market circumstances.

-

Diversification: Keep away from relying solely on a single NN EA. Diversify your buying and selling methods to cut back threat.

-

Steady Studying: Keep up to date with the most recent analysis and buying and selling methods within the foreign exchange market and adapt your NN EAs accordingly.

Keep in mind that overfitting is a standard problem in EA creation, and it is important to strike a stability between mannequin complexity and generalization. Common monitoring and adaptation are key to long-term success in algorithmic buying and selling.

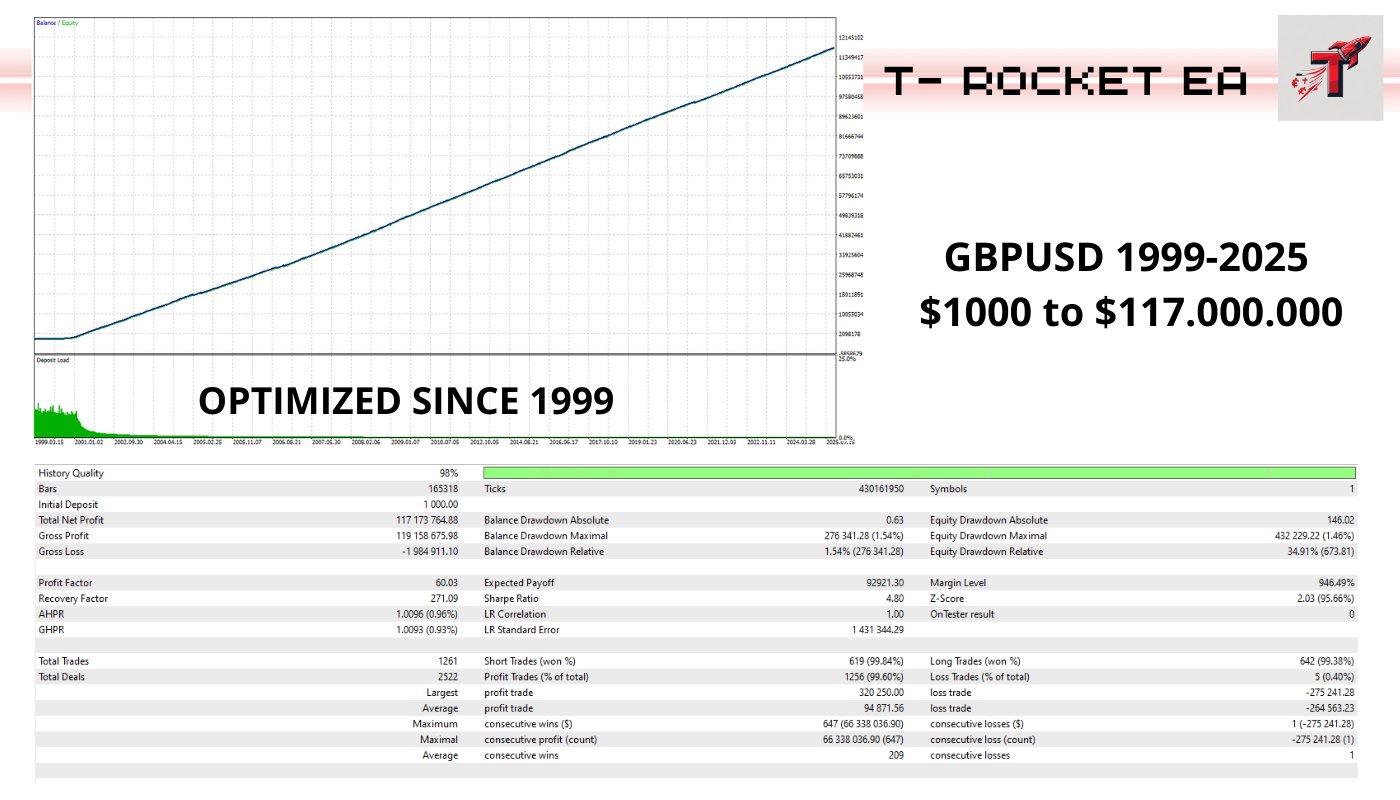

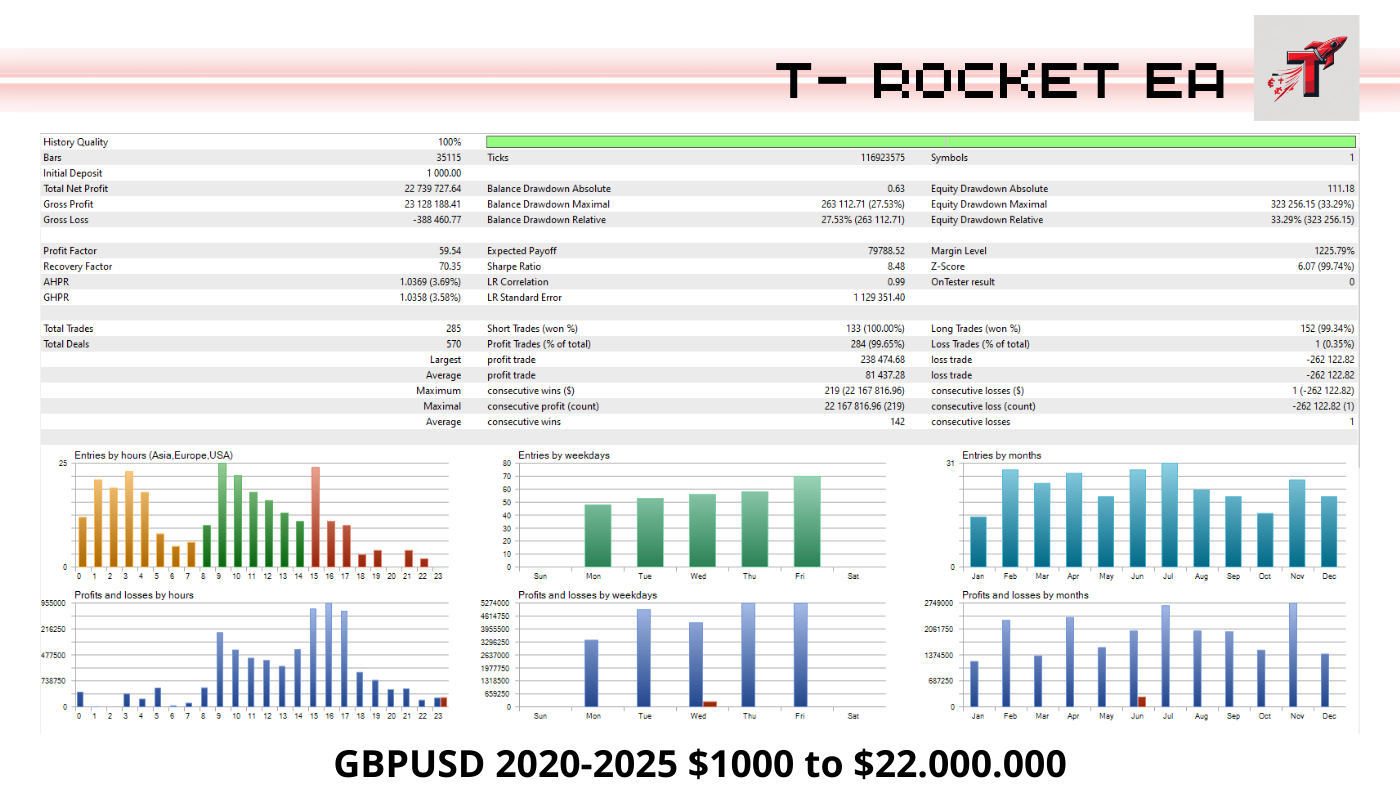

Outcome

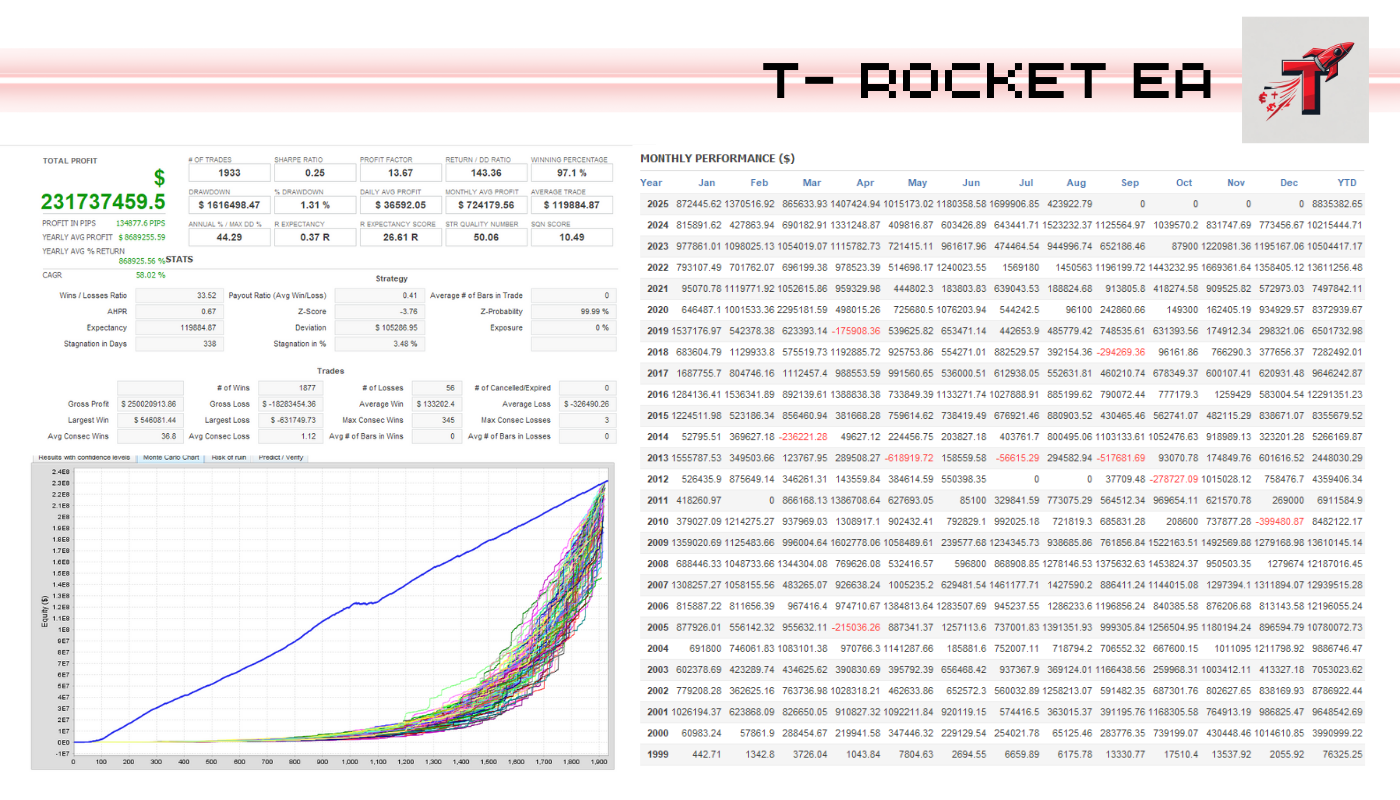

In abstract, I created T Rocket EA as a result of I consider it might assist merchants make extra knowledgeable selections and achieve success within the international alternate market. Utilizing machine studying expertise permits the EA to research huge quantities of knowledge and make predictions with excessive accuracy, offering merchants with a strong instrument that may assist them obtain their monetary targets.

I’ve devoted vital effort to again testing, ahead testing and tuning of my algorithm to make it performs optimally. With its capability to adapt to altering market circumstances, it has confirmed to be a strong instrument for producing constant returns. I’m honored to have obtained recognition for my work and excited to proceed to refine and enhance my algorithm sooner or later.

When you have any questions for me, write right here https://www.mql5.com/en/customers/darksidefx