Thailand is on the record of crypto-friendly nations. For instance, it has a regulated cryptocurrency change market. It additionally lately carried out adjustments in tax exemptions for people holding crypto property. Nonetheless, earnings from these property remains to be taxable. Now it has added the chance to purchase tokenized authorities bonds. They go for as little as $3.

So, what are these tokenized bonds in Thailand all about?

Tokenized Bonds in Thailand

The Ministry of Finance in Thailand plans to launch $150M value of digital “G-tokens”. It goals for each institutional and retail buyers. This makes tokenized authorities bonds accessible to Thai residents.

Thailand is ready to problem B5 billion in funding tokens, marking a major step within the nation’s monetary innovation. The tokens might be obtainable to each institutional and retail buyers, aiming to spice up financial progress and appeal to world funding. The initiative is… pic.twitter.com/4IUuqpgsCn

— Bangkok Publish (@BangkokPostNews) Might 13, 2025

Listed below are some extra particulars relating to these tokenized bonds,

- G-tokens begin at solely $3. They’re obtainable to Thai residents.

- The tokenized bonds are regulated however aren’t crypto. Extra on this in a second.

- They’re tradable on licensed digital asset platforms.

- Geared toward larger yields than commonplace financial institution deposits. Business banks in Thailand at present provide 1.25% for a 12-month deposit.

This displays an enormous change for Thai retail about tokenized bonds. They’d restricted or no entry to giant funding product choices. In Thailand, these are on the whole for institutional or rich buyers.

The Distinction Between G-Tokens and Crypto

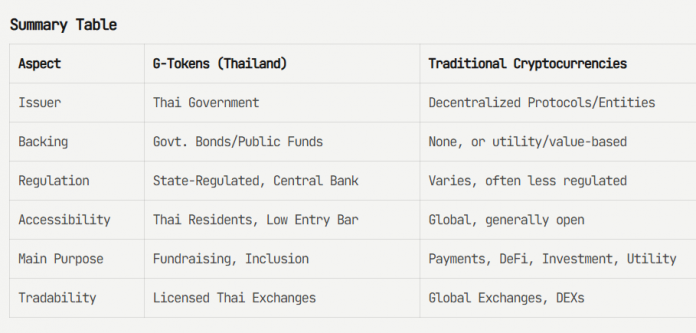

Nonetheless, the ‘G-tokens’ aren’t thought-about to be a cryptocurrency. Let’s check out the distinction between the 2.

G-tokens — The Thai authorities points them by the Ministry of Finance. They’re digital funding tokens tied to authorities bonds. They aren’t labeled as crypto. Moreover, they’re additionally not thought-about to be debt devices in authorized phrases.

Cryptocurrency — A decentralized digital asset that tasks or protocols can mint. These aren’t backed by governments or some other property.

Supply: Alva

Moreover, G-tokens are designed to lift authorities funds. They provide larger yield in comparison with financial institution deposits. The pleasant entry value of solely $3 is another excuse for retail to become involved. Thailand additionally diversifies its fund-raising choices by including tokenized bonds. By including blockchain know-how, it additionally modernizes its public fundraising.

Nonetheless, G-tokens are compliant with the Financial institution of Thailand’s digital asset guidelines. It’s additionally essential to note that they’re explicitly talked about as not being crypto. So, G-tokens fluctuate in some ways from crypto property. They are usually way more decentralized but in addition have much less regulation. You’ll be able to solely commerce them on Thai exchanges and aren’t obtainable to non-Thai residents. Crypto is on the market on exchanges world wide and obtainable to nearly anybody.

Disclaimer

The knowledge mentioned by Altcoin Buzz will not be monetary recommendation. That is for instructional, leisure and informational functions solely. Any info or methods are ideas and opinions related to accepted ranges of threat tolerance of the author/reviewers, and their threat tolerance could also be completely different from yours.

We aren’t accountable for any losses that you could be incur because of any investments immediately or not directly associated to the knowledge supplied. Bitcoin and different cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The publish Thailand to Supply $3 Tokenized Bonds to Retail Buyers appeared first on Altcoin Buzz.