Have you ever seen how some merchants appear to develop their accounts unbelievably shortly?

By some means, they flip modest beginnings into spectacular sums…

Are they utilizing a hidden components, maybe?

Nicely, whereas it may appear unimaginable – the reality is way less complicated and really achievable.

The key lies in mastering the facility of compounding.

It’s a fundamental however highly effective technique that reinvests earnings to develop your account extra shortly.

By understanding and making use of compounding, you’ll be able to rework regular returns into extraordinary outcomes.

The catch?

It requires endurance, self-discipline, and a transparent technique to make it work.

Now, if you happen to’ve ever felt daunted by compounding or prevented it as too technical, don’t fear.

On this article, I’ll break it down for you step-by-step.

By the tip, you’ll uncover:

- What compounding in buying and selling really means and why it’s so highly effective.

- The maths behind compounding and easy methods to calculate your potential development.

- Methods to maximise compounding whereas managing dangers.

- Frequent errors to keep away from that may derail your progress.

Able to take your buying and selling to the following stage?

Nice – Let’s get began!

What does it imply to compound your buying and selling returns, and why must you care about it?

Compounding your buying and selling returns is a strong course of whereby earnings earned on trades are reinvested to generate even higher returns.

It’s possible you’ll assume, “However I wish to take earnings and use that cash!”

However, bear with me for a second.

When used accurately, compounding creates a wealth-generating suggestions loop the place a interval’s earnings are added to beginning capital, growing the bottom for future development.

Not like normal returns, which develop steadily, compounding accelerates your wealth over time.

Think about a dealer beginning with $10,000 and attaining constant 10% month-to-month returns, taking their earnings alongside the best way…

…in a single yr, they may develop their account to $22,000. Not unhealthy.

Now, evaluate this to a dealer utilizing compounding, growing their investments as their account grows…

…in the identical timeframe, they’d see their account develop to $31,000!

Are you excited now?!

Let’s dig deeper into this…

Key Ideas

The core of compounding lies in reinvestment.

Two features drive the method: the speed of return and the way usually you compound.

They’re completely key!

However compounding additionally rewards self-discipline and endurance.

The longer you retain earnings in your account, the extra pronounced the compounding impact turns into.

Consider it like a snowball rolling downhill: because it gathers velocity, it accumulates extra snow, and will get greater, and so forth…

Really, the fitting idea to compound your returns in buying and selling.

It’s the reinvestment that basically amplifies development over time.

Actually, I wish to share one in every of my favorite quotes with you.

Einstein’s eighth Marvel of The World

Albert Einstein famously referred to compound curiosity as “the eighth marvel of the world,” saying, “He who understands it, earns it; he who doesn’t, pays it.”

This quote highlights the huge potential of compounding for wealth creation.

For merchants, it’s a instrument to exponentially develop their capital by way of consistency and time.

It additionally reveals the significance of beginning early, staying disciplined, and reinvesting positive factors.

Those that grasp the artwork of compounding can unlock further wealth, whereas those that overlook it threat lacking out.

Let’s dig into its technicals!

The maths to compound your buying and selling returns

So, compounding is all in regards to the lengthy sport.

The straightforward equation to work out the long run worth of your buying and selling account is the next:

Future Worth = Principal × (1 + Fee/100)^Time

To know it higher, let’s break it into its parts:

- Principal: That is your beginning capital or the preliminary quantity in your buying and selling account.

- Fee: The share return per compounding interval (e.g., month-to-month or yearly), expressed as a decimal or fraction of 100.

- Time: The variety of compounding intervals, reminiscent of months or years, over which earnings are reinvested.

Let’s check out an instance to image this higher.

Instance

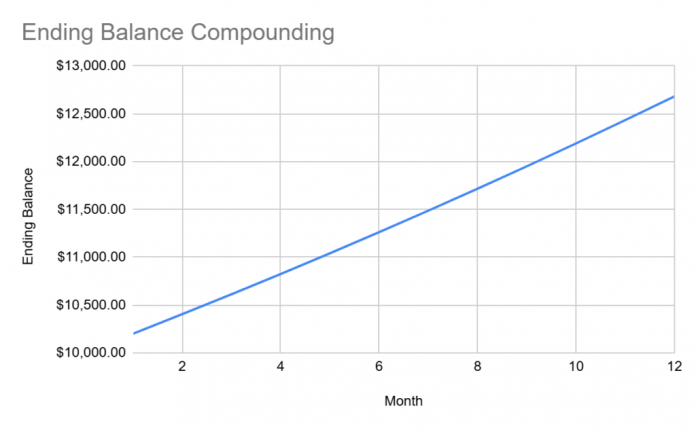

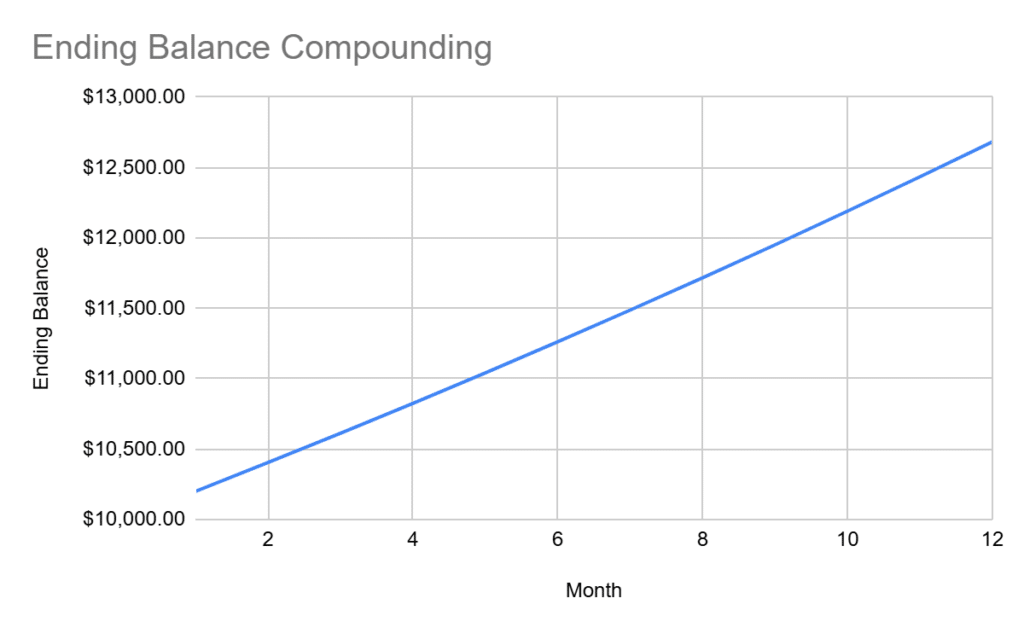

Suppose you begin with $10,000 (Principal), and also you persistently earn 2% monthly (Fee). You wish to calculate your account steadiness after 12 months (Time)…

Future Worth = $10,000 × (1 + 2/100)^12

Step-by-step:

Convert the speed: 2/100 = 0.02

Add 1 to the speed: 1 + 0.02 = 1.02

Elevate to the facility of time: 1.02^12 ≈ 1.2682

Multiply by the principal: $10,000 × 1.2682 = $12,682…

Comparability with out compounding your buying and selling returns

Now, let’s see how, with out reinvesting, the account grows in a straight line…

Calculate the overall revenue: 2% × $10,000 = $200 monthly

Multiply by 12 months: $200 × 12 = $2,400

Whole steadiness: $10,000 + $2,400 = $12,400

This reveals that compounding provides an additional $282, purely from reinvesting earnings…

That may not seem to be rather a lot, however there may be greater than a month’s price of earnings that you’re lacking out on!

You must also be aware that as time goes on, the distinction turns into an increasing number of excessive.

However earlier than I present you that, I wish to clarify why frequency is necessary, too.

Compounding Frequency

Unsurprisingly, the extra incessantly you reinvest, the sooner your account grows.

Month-to-month compounding (as within the instance) is way more practical than yearly compounding, particularly in unstable markets like foreign exchange.

Instruments like compound curiosity calculators can assist you perceive these eventualities…

To indicate you extra clearly, I wish to return to the snowball impact from earlier…

The Snowball Impact in Buying and selling

How Compounding Your Buying and selling Returns Accelerates as Your Account Grows

That is the place compounding will get actually thrilling.

The snowball impact is a wonderful visualization of how compounding positive factors momentum over time.

In buying and selling, each worthwhile commerce provides to your account steadiness, which means the next trades have extra capital to work with.

This step-by-step development means earnings can multiply exponentially, as returns are earned in your beginning capital PLUS any positive factors you will have, therefore, compounding your returns in buying and selling.

Take this instance:

You might have a beginning steadiness of $1,000.

With month-to-month returns of 2%.

Within the first month, you earn $20, growing your steadiness to $1,020.

Nonetheless, within the second month, your 2% return applies to $1,020, yielding $20.40

Stepping by way of additional, you’ll be able to see that by the tip of the yr, your account will develop considerably extra by reinvesting the additional earnings…

Let’s plug in some extra numbers to see it extra clearly.

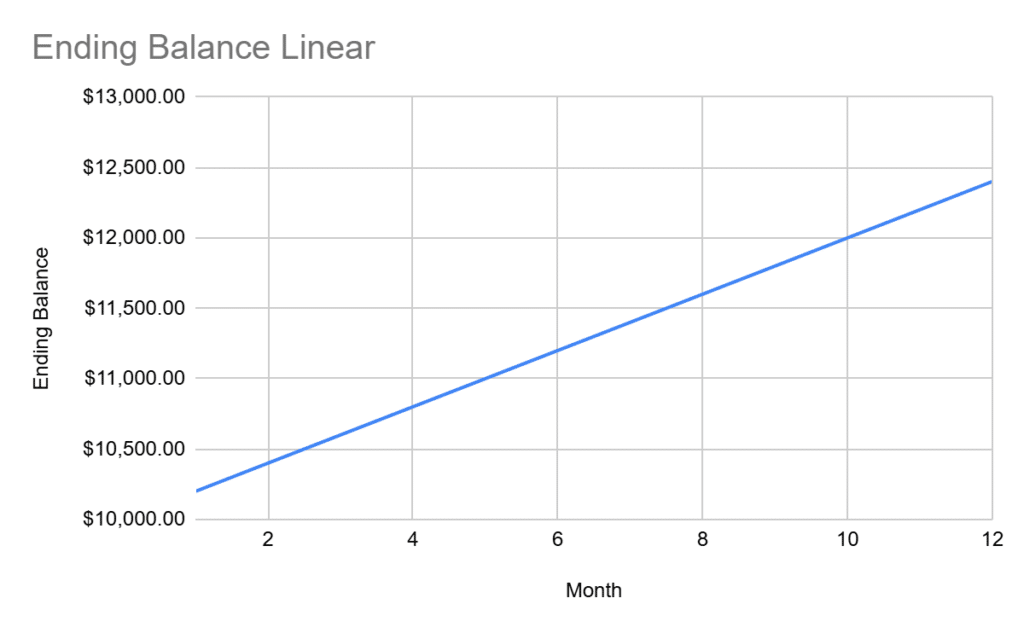

Beginning with $10,000…

You persistently obtain 2% monthly in your buying and selling account.

Let’s use the compound curiosity calculator offered by Thecalculatorsite.com

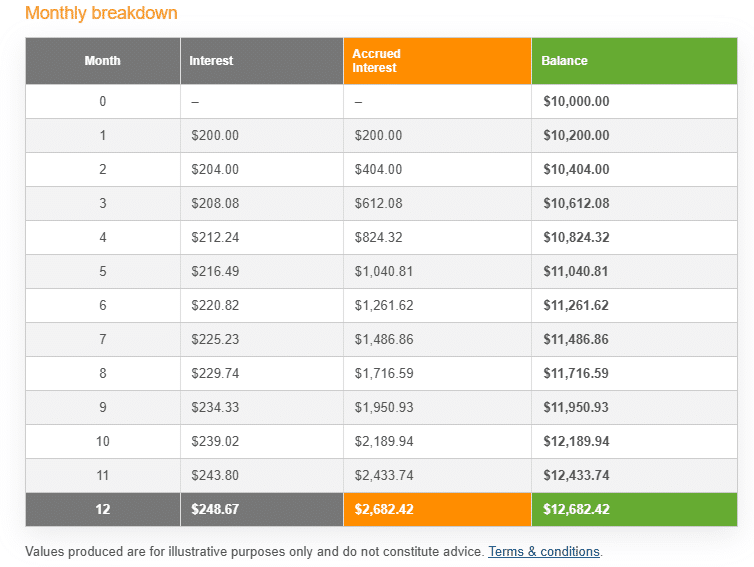

That is what your first buying and selling yr would appear to be utilizing compounding…

First-Yr Breakdown Foreign exchange Compounding Calculator:

Not unhealthy!

Contemplating all you might be doing is utilizing your earnings and funneling them again into your buying and selling account.

But it surely will get tremendous attention-grabbing as you attain the 5-10-year interval.

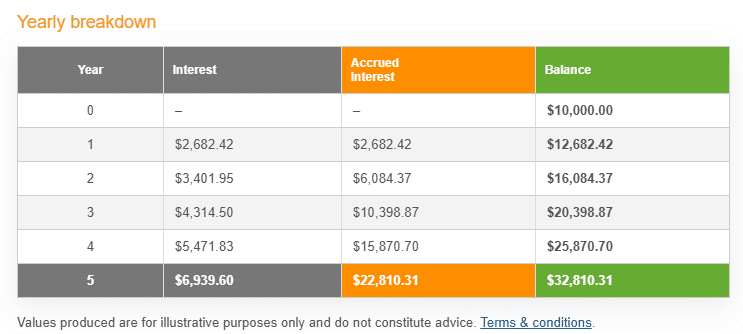

Have a look at the 5-year breakdown if you happen to had been to proceed these constant earnings…

5-Yr Breakdown Foreign exchange Compounding:

One thing ought to stand out right here.

Are you able to see how lengthy it takes time on your preliminary funding to double?

It wasn’t till the third yr, proper?

With out understanding higher, most individuals lose belief within the methodology earlier than seeing its true energy.

Nonetheless, in case you have the endurance to breach that barrier… the additional earnings actually start to shine!

Want extra convincing?

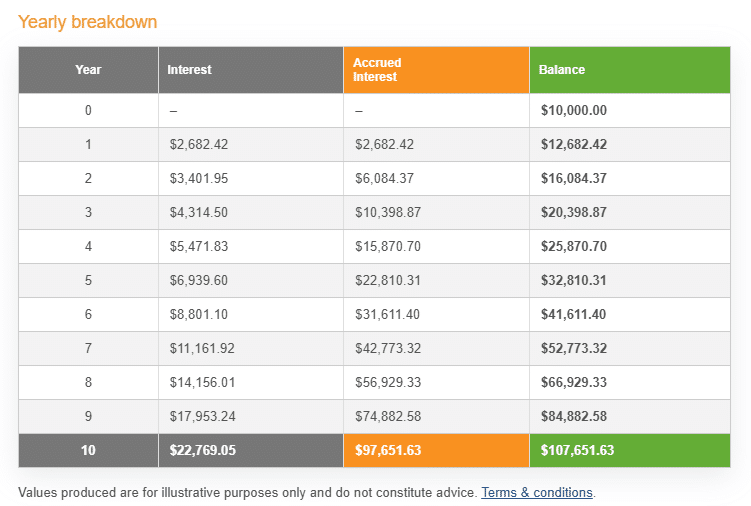

Let’s take a look at 10 years…

10-Yr Breakdown Foreign exchange Compounding Calculator:

…a whopping $107,651 from 10,000 {dollars} begin!

Now, you could be considering, “10 years is a very long time for that form of achieve…”

However it’s best to bear in mind this makes use of returns of two% monthly.

It’s undoubtedly achievable to compound your returns in buying and selling!

After all, numbers might range relying on profitability and consistency…

In precise buying and selling, there are ups and downs affecting how compounding works…

Nonetheless, the facility of compounding is obvious.

You possibly can see the snowball impact in play, as your account begins small however positive factors momentum, rising bigger.

Let’s transfer on to some methods to maximise these earnings even additional!

Methods to compound your buying and selling returns

1. Reinvesting Income

It’s the complete basis of what it means to compound a buying and selling account.

Nonetheless, it’s best to be aware that some merchants take the strategy of reinvesting some of their earnings – not all of their earnings.

I like to recommend making an attempt out compounding with smaller numbers at first.

And bear in mind – taking cash out right here and there’ll solely delay the method.

If you begin to make important positive factors and wish to take cash out of your account, withdraw solely what you want…

…minor sacrifices now result in a lot bigger rewards later!

As you noticed within the earlier instance of what 10 years of constant profitability seems like, years 4 onwards ship a big earnings.

Reinvesting calls for a disciplined mindset and a strong buying and selling technique to handle bigger place sizes successfully with out falling to undue dangers.

I’ve additionally seen very profitable merchants reinvest their earnings in different investments, such because the inventory market, mutual funds, or ETFs.

That’s what sensible wealth technology seems like.

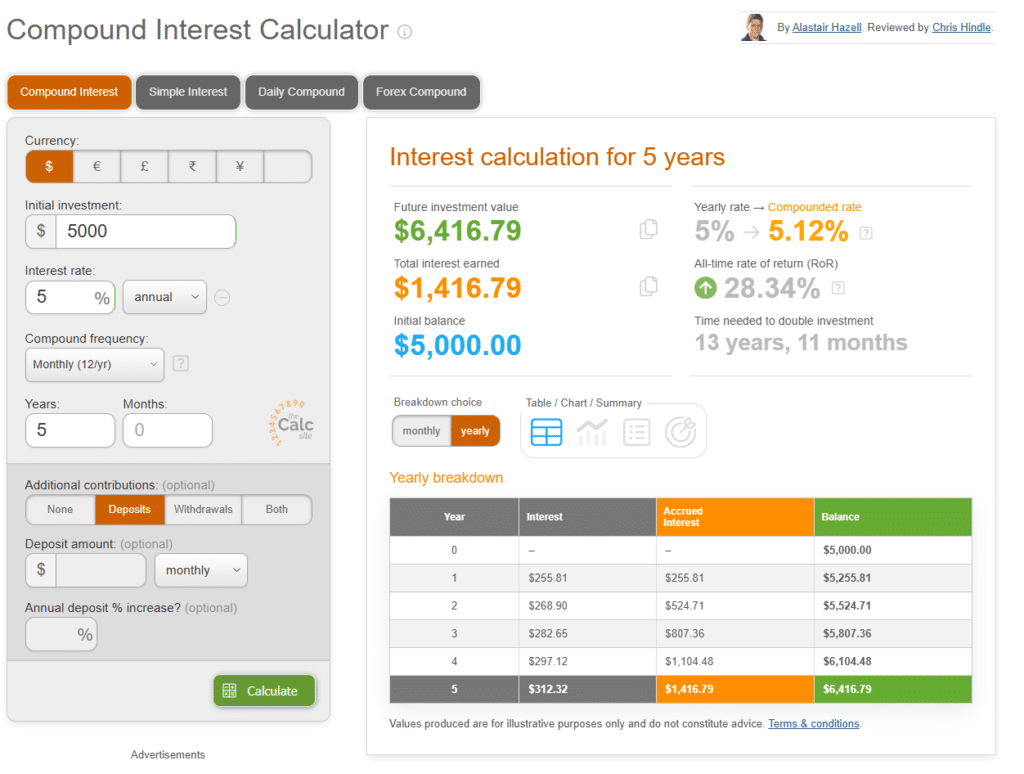

2. Reaching Constant Returns

Constant positive factors are method higher than sporadic positive factors in the case of compounding.

Common and slight profitability usually provides higher long-term outcomes than irregular, massive wins.

For instance, a dealer persistently incomes 2% monthly will outperform one who alternates between 5% positive factors one month and 4% losses the following.

To realize consistency, merchants ought to give attention to high-probability trades, disciplined execution, and avoiding pointless dangers.

Instruments like commerce journals and efficiency monitoring can assist keep focus and refine methods for regular returns, which in flip will compound your returns in buying and selling…

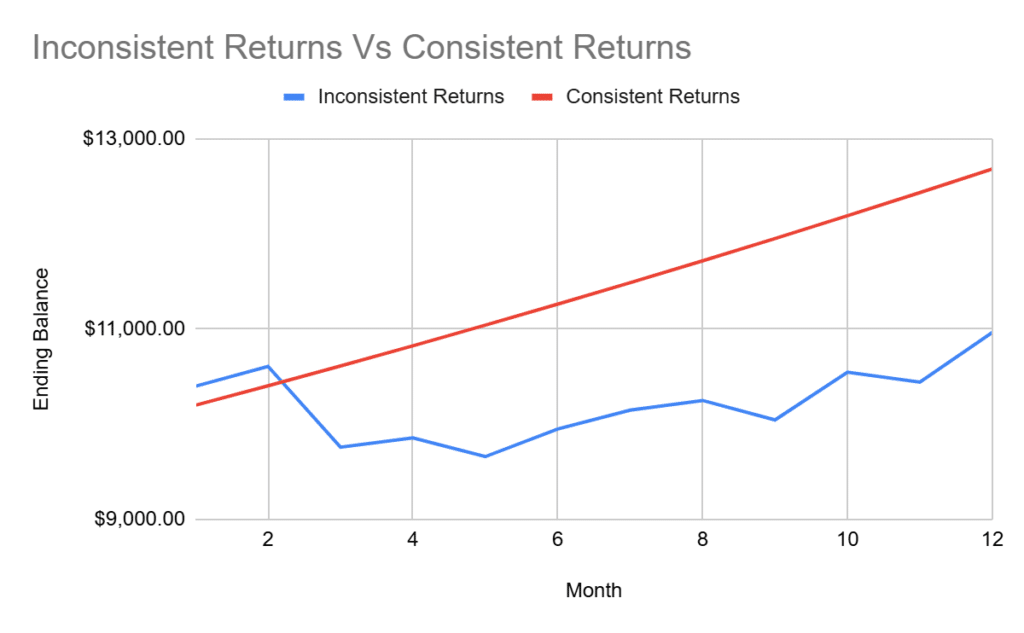

Inconsistent Returns Vs Constant Returns:

As you’ll be able to see from the graph above, inconsistent returns severely affect the speed of profitability.

This isn’t to say that compounding is a nasty concept for individuals who could also be barely inconsistent of their buying and selling returns, although.

In any case, shedding months will at all times happen in buying and selling, and that’s pure.

Nonetheless, it’s one thing to be aware of as you undergo your buying and selling journey.

3. Threat Administration

Threat administration is a no brainer in any buying and selling plan, however its affect on compounding is big.

With out efficient threat administration, compounding efforts can shortly come undone!

To guard capital and maintain development, I like to recommend at all times setting a most threat per commerce, reminiscent of 1-2% of the account steadiness.

You must also alter place sizes to match account development so your publicity doesn’t fluctuate.

This strategy minimizes the affect of losses, particularly throughout unstable market circumstances.

Say you will have a $1000 buying and selling account and incur a shedding streak of 5 trades to lose 5% of your account….

Your account is now $950.

On this case, you have to place your new trades as in case your buying and selling account is now 5% much less.

This implies your place sizing ought to match the 1-2% of $950, not the unique $1000.

This restricts additional losses from having a bigger affect in your remaining steadiness.

After all, this restricts your winners as effectively…

…however whenever you construct the account again up, it really works in your favor. (as proven within the tables)

Emotional self-discipline is equally necessary, as bigger account sizes amplify potential positive factors and dangers.

Sticking to your threat thresholds implies that development continues steadily with out exposing the account to devastating drawdowns.

Belief the compounding course of and proceed to focus on your proportion enhance somewhat than counting the cash misplaced and gained on every particular person commerce.

4. Common Contributions

I can’t stress sufficient how a lot common contributions, on prime of earnings, can affect your buying and selling account.

This isn’t about only a bodily win.

It’s a psychological win, particularly in case you have reached constant profitability.

Including exterior funds to a buying and selling account and reinvesting earnings can additional speed up development.

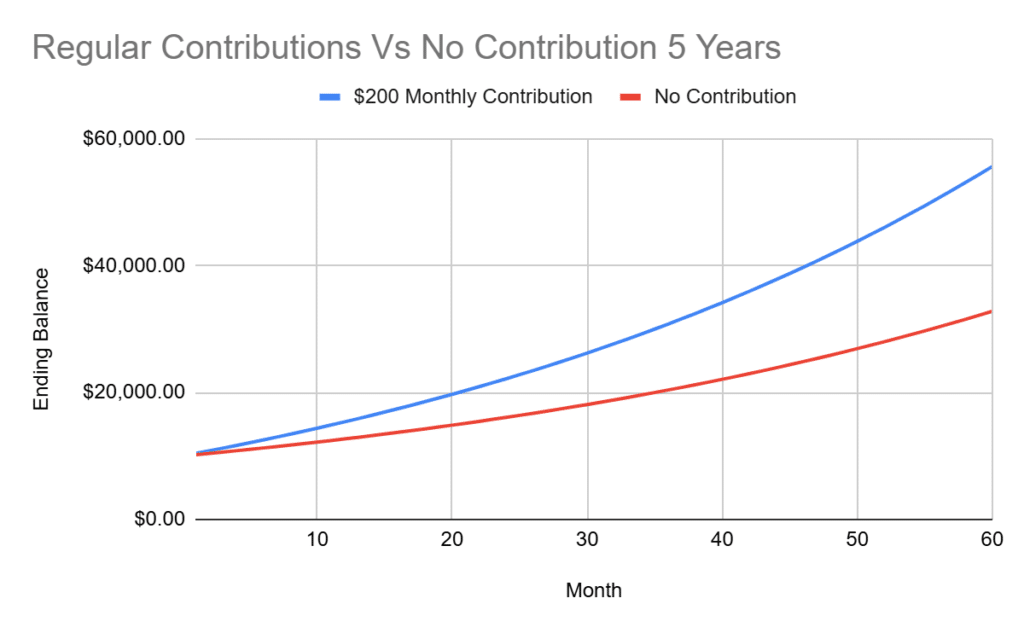

For instance, a dealer contributing $200 month-to-month to an account incomes 2% monthly will expertise considerably sooner development than relying simply on buying and selling positive factors.

This twin strategy positive factors from the mixed energy of financial savings and compounding your returns in buying and selling, making it particularly priceless for merchants with regular earnings sources outdoors of buying and selling.

Let’s take a look at an instance.

When you had been to contribute an additional $200 a month to your account over 12 months, your progress would look rather a lot higher…

After deducting the $2400 contributed over the yr, you’ll nonetheless find yourself near $300 {dollars} higher off.

It doesn’t sound like rather a lot, proper?

However what about over a 5-year interval?…

Over 5 years, the distinction is far more noticeable!

The common contributions ending worth is $55,620 vs. no contribution at $32,810, merely from including an additional $200 a month.

Once more, even if you happen to deduct the quantity contributed, you continue to find yourself round $11,000 higher off.

You possibly can think about that as you proceed your buying and selling journey and play with more cash, these variations start to get extra excessive, too.

So, now that you just see the true energy of compounding, let’s take a look at some errors to keep away from.

Errors to keep away from in compounding your buying and selling returns

Market Volatility

When contemplating on compounding your returns in buying and selling, volatility isn’t your pal.

Market volatility usually tempts you to make impulsive choices, chasing sudden value swings or exiting positions too early.

Whereas volatility is all a part of the market, failing to include it into your technique can result in important losses.

To mitigate the dangers of volatility, it’s best to keep away from excessive volatility market occasions reminiscent of information occasions or excessive unfold buying and selling occasions.

In case you are in a commerce, use a cease loss to forestall market volatility from having a big affect in your account steadiness.

Diversify your trades throughout totally different pairs or property to attenuate publicity to volatility.

Keep in mind, a disciplined strategy with a sound threat administration plan ensures you’ll be able to navigate unstable intervals with out derailing your progress.

Emotional Self-discipline

For my part, feelings are one of many largest obstacles to buying and selling success.

Worry, greed, and overconfidence, sometimes called the “buying and selling triad”, can result in expensive errors.

For instance, worry may stop you from taking well-calculated dangers.

Greed might drive overtrading or trigger you to carry onto trades for too lengthy and never take earnings on the applicable time.

Overconfidence can lead to careless trades with out correct evaluation.

To take care of emotional self-discipline:

- Observe a structured buying and selling plan.

- Take breaks when feeling careworn or overwhelmed.

- Preserve expectations sensible to keep away from emotional highs and lows.

Having management over your feelings is important for long-term success and maximizing the advantages of compounding.

Lack of Persistence

Everybody’s been there.

I wish to Get Wealthy Fast!

However do you bear in mind the story of the hare and the tortoise?

Impatience is a typical buying and selling pitfall.

Dashing into low-quality setups or revenge buying and selling when issues don’t go your method can hinder each profitability and the advantages of compounding.

True success in buying and selling requires a long-term perspective.

To follow endurance, it’s best to at all times look forward to high-probability setups somewhat than pressure trades.

Permitting trades to achieve their deliberate outcomes as a substitute of performing on impulse is one other nice solution to follow endurance.

The hot button is to give attention to the larger image, understanding that constant development takes time.

Keep in mind, this can be a marathon, not a dash!

Be the tortoise.

Inconsistent Technique

Incessantly altering technique isn’t simply unhealthy for compounding; it’s a poor buying and selling approach normally.

Always switching approaches usually results in erratic returns and missed alternatives, stopping merchants from realizing their potential development.

As talked about earlier than, inconsistency is an actual compound killer.

If you end up eager to swap methods, it’s best to as a substitute decide to a well-tested and confirmed technique that aligns with market circumstances.

This isn’t to say which you could’t alter your strategy, small changes are nice…

…however your core beliefs by which you might be buying and selling mustn’t transform from everyday or week to week.

I at all times suggest you repeatedly evaluation and refine your strategy based mostly on efficiency and evolving traits.

Conclusion

Compounding your returns in buying and selling is a strong instrument that has the potential to remodel a modest buying and selling account into substantial capital over time.

By utilizing the strategy of reinvesting earnings, sustaining constant returns, and practising stable threat administration, you’ll be able to unlock unimaginable development.

On this article, you lined the important methods and pitfalls of compounding in buying and selling:

- Exploring how compounding works and why it’s a game-changer for merchants.

- Reviewing the arithmetic behind compounding with real-world examples.

- Inspecting the snowball impact and its position in accelerating account development.

- Studying sensible methods to maximise compounding, together with reinvesting earnings and constant contributions.

- Observing frequent errors that may derail your compounding journey and easy methods to keep away from them.

By making use of these rules and avoiding the pitfalls, you’ll not solely enhance your buying and selling outcomes but additionally construct a disciplined, sturdy strategy for long-term success.

If you really perceive the facility of compounding, your buying and selling journey turns into much more thrilling.

Now it’s your flip!

Have you ever skilled the facility of compounding in your buying and selling?

What methods have labored finest for you?

Share your experiences and ideas beneath.

I’d love to listen to what steps you’re taking to compound your buying and selling returns!