Shutdowns occur, however markets maintain up. This ETF will enable you journey it out.

Although we have been by this earlier than, the U.S. authorities shutdown might be an unsettling time. Swaths of federal staff are off the job — or nonetheless working however not being paid — and it is unclear how lengthy the impasse will final.

On the similar time, it is scary for non-government staff, too. We depend on the federal government for Social Safety checks, Medicare, Medicaid, veterans’ advantages, and for much-needed providers corresponding to air visitors management.

Individuals will nonetheless get their checks and veterans’ advantages, however some providers will likely be delayed. And vacationers are already reporting delays and cancelled flights at airports.

Thankfully, the inventory market has a historical past of holding its personal throughout a authorities shutdown. Protecting your cash available in the market has historically been a wise transfer. And in case you’re fearful about ensuring you may have a gradual move of revenue, a dividend exchange-traded fund (ETF) just like the Vanguard Dividend Appreciation ETF (VIG -1.96%) generally is a good choice.

Picture supply: Getty Photos.

Concerning the Vanguard ETF

First, it is vital to grasp why the Vanguard Dividend Appreciation ETF consists of the shares it does. And to do this, it’s important to perceive the rules of the underlying index, which is the Nasdaq US Dividend Achievers Choose Index.

This index consists of firms which might be on the Nasdaq US Broad Dividend Achievers Index, with some vital exceptions. First, it excludes the highest 25% of firms within the index by dividend yield. That is to verify the Nasdaq US Dividend Achievers Choose Index does not have unstable firms with dividends which might be artificially excessive as a result of their companies are unstable.

And second, the fund excludes all grasp restricted partnerships and actual property funding trusts. Lastly, it solely consists of firms which have elevated their dividend yearly for at the least 10 consecutive years.

The shares left make up the Nasdaq US Dividend Achievers Choose Index, and people names are skewed towards the expertise, industrial, and monetary sectors, which account for a collective 64% of the fund.

That is the index that the Vanguard ETF strives to duplicate, so you could find the identical breakdown by inventory and sector in it. The highest 10 holdings are all blue chip names, with no inventory having greater than a 6% weighting.

|

Holding |

Portfolio Weight |

1-12 months Return |

Dividend Yield |

|---|---|---|---|

|

Broadcom |

5.95% |

91.2% |

0.70% |

|

Microsoft |

4.8% |

27.8% |

0.69% |

|

JPMorgan Chase |

4% |

49% |

1.95% |

|

Apple |

3.7% |

13.6% |

0.41% |

|

Eli Lilly |

2.8% |

-4.1% |

0.71% |

|

Visa |

2.7% |

26.5% |

0.67% |

|

ExxonMobil |

2.4% |

-5.3% |

3.47% |

|

Mastercard |

2.3% |

16.9% |

0.52% |

|

Johnson & Johnson |

2.1% |

20.5% |

2.75% |

|

Walmart |

2% |

28% |

0.91% |

Supply: Morningstar

Solely two of those firms within the Vanguard Dividend Appreciation ETF’s high 10 are within the pink after 12 months. That is the great thing about an ETF: Quite than making an attempt to guess the one or two greatest shares to purchase, you get a complete bushel of them with the Vanguard ETF.

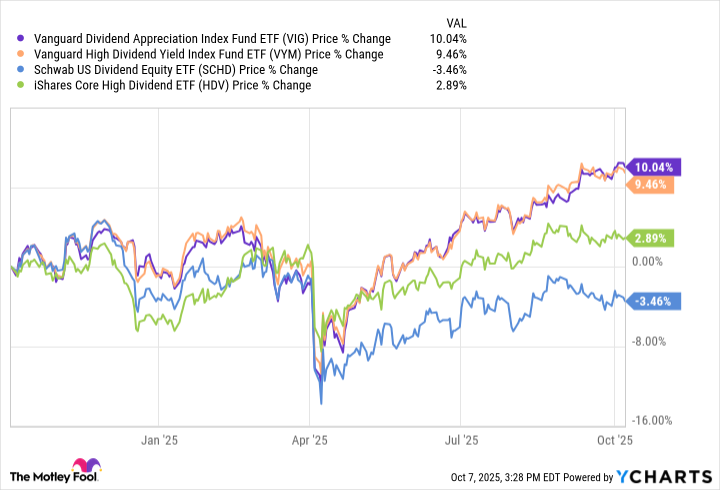

The opposite factor I actually like about this ETF is that it offers you an excellent mixture of efficiency and yield. In comparison with another fashionable dividend ETFs, it gives the most effective one-year efficiency, with a achieve of 10%. Mix that with a dividend yield of 1.6%, and also you get a pleasant whole return from Vanguard Dividend Appreciation.

The underside line

Sure, this may be an unsettling time, and it is solely pure to just be sure you’re investing in a fund that may offer you some assured quarterly revenue, particularly in case you’re fearful that you will should cowl a shortfall by one other supply.

The Vanguard Divided Appreciation ETF gives the most effective mixture of dividend payout and one-year efficiency. And once you additionally take into account that it has a low expense ratio of solely 0.05%, or $5 yearly per $10,000 invested, then I am snug parking funds right here whereas ready for the federal government to restart.

JPMorgan Chase is an promoting associate of Motley Idiot Cash. Patrick Sanders has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, JPMorgan Chase, Mastercard, Microsoft, Vanguard Dividend Appreciation ETF, Vanguard Whitehall Funds-Vanguard Excessive Dividend Yield ETF, Visa, and Walmart. The Motley Idiot recommends Broadcom and Johnson & Johnson and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.