How do some merchants appear to acknowledge legit value actions versus fakeouts?

Can they actually see into the longer term?

Is a few sort of blood sacrifice required?

Don’t fear—no black magic needed!

Skilled merchants typically use methods like quantity evaluation to assist make knowledgeable selections.

It’s no secret, then, that studying about it might probably enormously increase your buying and selling success!

At first, Quantity might look like a pointless addition to the chart…

Nonetheless!

…if used accurately, it might probably assist provide the further affirmation you have to take trades with confidence.

I wrote this information to clarify precisely what quantity evaluation is as merely as doable.

With a little bit of focus, I’m certain you’ll see how it may be extraordinarily useful on your buying and selling!

On this article, you’ll dive into key elements akin to:

- What’s Quantity Evaluation?

- How one can add Quantity to your Tradingview chart

- The distinction between inexperienced and purple bars

- Some variations for quantity in Foreign exchange vs. Shares

- How quantity is usually used with some sensible examples

- The restrictions of quantity evaluation

Prepared to boost your buying and selling technique?

Let’s start!

What’s Quantity Evaluation?

So, what’s Quantity evaluation?

Mainly, quantity evaluation is a buying and selling technique that appears on the variety of shares traded over a sure time.

The information you get from it might probably help you in figuring out the power of value actions.

By how a lot of an asset is being traded, merchants can study market sentiment.

Quantity evaluation helps affirm traits, determine potential reversals, and validate breakouts by revealing shopping for or promoting strain.

As an example, a value rise on excessive quantity signifies sturdy shopping for curiosity, which suggests the pattern is more likely to proceed.

Alternatively, a value improve on low quantity… is probably not as dependable!

Quantity can be utilized on all belongings; nonetheless, there are some variations, which I’ll spotlight afterward on this article.

The place to Discover It

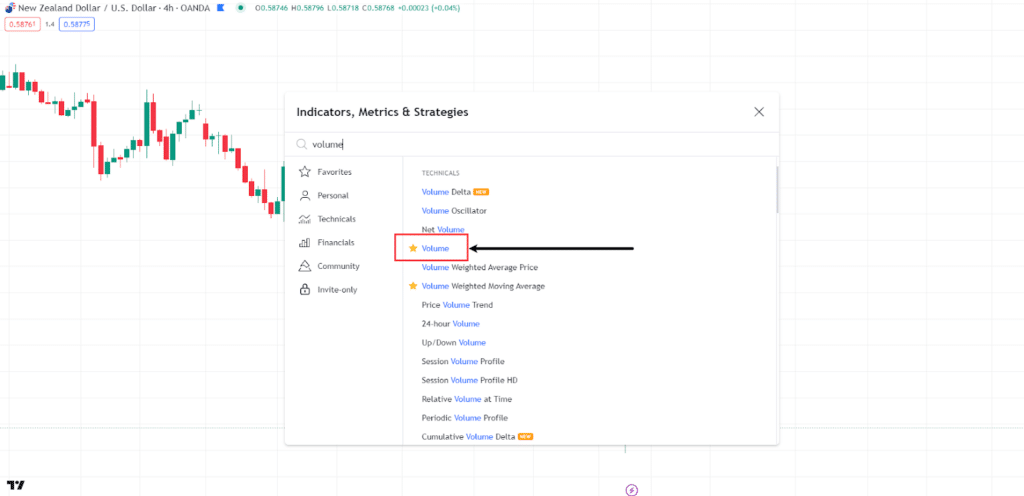

Let’s take a look at the place yow will discover the commonest Quantity indicator on Buying and selling View.

- Navigate to your Buying and selling View display and choose any chart.

- On the high of the chart, you will notice the Indicators tab…

Click on on the Indicators tab and it’ll deliver you to a window the place you may seek for totally different indicators.

3. Seek for Quantity Indicator…

Within the search window, sort “Quantity” and choose the Quantity Indicator as proven within the instance.

4. View the Quantity information in your chart

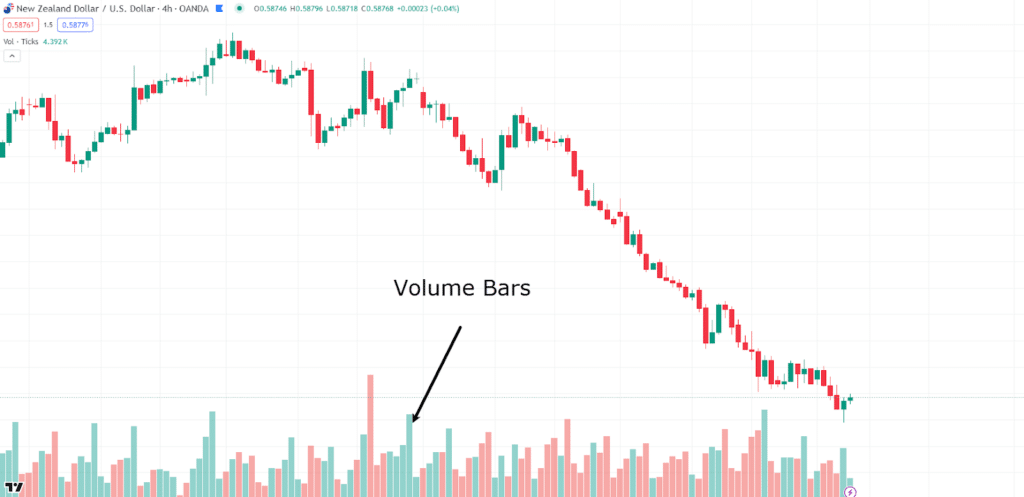

As soon as chosen, the window will shut, and your chart will show the Quantity Indicator on the backside, much like the instance beneath…

Quantity information could be discovered on nearly all buying and selling platforms and monetary web sites, the placement simply relies on what you’re utilizing.

So, quantity is displayed in lengthy bars on the backside of the chart – see the purple and inexperienced bars?

The peak of every bar represents the amount traded throughout that interval.

For this instance, it represents the amount traded for every 4-hour candle interval on the NZD/USD 4-hour chart.

Now that you realize the place to search out it, let’s take a look at what it’s making an attempt to inform you!

What Quantity Represents

Quantity reveals the variety of shares or contracts traded throughout a sure time-frame.

Excessive quantity means elevated buying and selling exercise and curiosity within the asset, typically with main value actions.

Low quantity suggests an absence of curiosity and might sign weak value actions or consolidation durations.

The primary objective of quantity evaluation is to point out the power or weak spot of value actions and make it easier to make higher selections.

It’s typically used as affirmation moderately than the entry set off itself.

Do not forget that many components can have an effect on quantity, and I’ll clarify extra about this later on this article.

So, you may be asking, why are among the bars purple and a few inexperienced?

Let’s have a look.

Inexperienced Bars vs. Pink Bars

Usually, merchants mistake the purple and inexperienced colours as indicators of the amount itself.

Nonetheless, they merely present whether or not the worth moved up or down throughout that interval.

If the worth will increase from the earlier candlestick, the amount bar shall be inexperienced.

If the worth decreases from the earlier candlestick, it is going to be purple.

These colours typically have an excessive amount of affect on merchants’ selections when, truly, it’s the peak and distinction in quantity bars which might be extra necessary!

Earlier than trying on the particulars on find out how to use quantity for charting, there’s one main piece of data you have to know.

It’s necessary to recollect that there’s a distinction between quantity for Foreign exchange vs. Shares

And actually, quantity has at all times been thought of rather more worthwhile for shares…

Right here is why.

Distinction in Quantity for Foreign exchange vs. Shares

Quantity evaluation differs between the foreign exchange and inventory markets due to the best way they’re structured.

Shares commerce on centralized exchanges just like the NYSE or NASDAQ, the place quantity information is clear and simply accessible.

In distinction, the foreign exchange market is decentralized, with quantity information being broker-dependent.

It means the amount information in foreign exchange markets won’t be fully dependable when fascinated about the market as an entire.

Regardless of this, quantity evaluation stays worthwhile in foreign currency trading, as most giant foreign exchange brokers report comparable quantity information, reflecting general market sentiment.

One level, although, is that analyzing quantity on decrease timeframes in foreign exchange can current new challenges.

Whereas it can provide insights into intraday buying and selling exercise and assist determine potential buying and selling alternatives, it’s necessary to notice the affect of buying and selling periods in overlapping time zones.

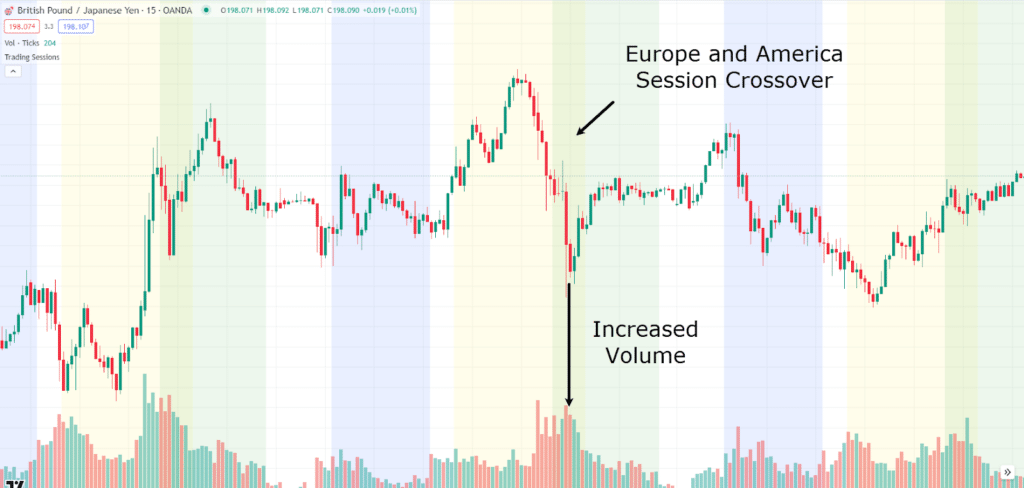

Check out this chart beneath…

GBP/JPY 15 Minute Chart Buying and selling Periods:

The blue zone signifies the Asia session, whereas yellow represents Europe, and inexperienced signifies America.

You possibly can see the place the Europe and America periods overlap, leading to elevated quantity, which isn’t essentially worthwhile throughout evaluation.

So with the fundamentals in place, let’s put quantity evaluation into follow, serving to you employ it for buying and selling affirmation and selections!

How is Quantity Usually Used?

You now know why quantity is used and the place to search out it in Tradingview.

However how are you going to use it when a chart?

By no means Utilized in Isolation – Use with a Technique as Affirmation

It’s best to make use of quantity evaluation together with different technical indicators and chart patterns moderately than by itself.

It ought to function a affirmation device on your buying and selling indicators and techniques.

As an example, when a technical indicator suggests a possible commerce, quantity evaluation can affirm the power of that sign by exhibiting the extent of market participation.

A excessive quantity mixed with a sign may imply sturdy market curiosity, making a profitable commerce extra seemingly.

The Common Quantity Throughout an Space of Curiosity

A mistake I typically see merchants make is trying on the quantity of every session individually moderately than taking a holistic strategy.

I favor to have a look at the common quantity over a particular interval to know the standard buying and selling exercise for a safety.

A sudden spike in quantity above the common can sign an upcoming vital transfer.

For instance, if a inventory’s common quantity is pretty flat however then, for some cause, a couple of quantity bars start to point out elevated quantity at an space of worth, you would possibly begin paying nearer consideration and construct up a case for coming into the inventory.

Pattern Continuation Affirmation

Quantity evaluation can affirm pattern continuation.

In an uptrend, rising quantity as the worth rises signifies sturdy shopping for curiosity, suggesting the pattern is more likely to proceed.

As you might even see on value charts, too, when value is in an uptrend, it typically has small, minor pullbacks.

If the strikes upward have sturdy quantity, whereas the small retracements have decrease quantity, it might imply that the pullbacks are weak and the uptrend is robust sufficient to proceed.

Candlestick Quantity Affirmation

So should you’ve adopted me for a while, you realize I really like my candlestick patterns!

Effectively, quantity can add an additional layer to them.

For instance, a bullish engulfing sample that happens on excessive quantity suggests a powerful reversal sign, because it signifies vital shopping for curiosity.

Quantity affirmation of candlestick patterns would add further power to your evaluation, serving to you make extra correct predictions about future value actions.

Breakout Affirmation

Breakouts are not any exception when quantity, both.

Breakouts are important factors the place the worth strikes above or beneath resistance or help ranges.

Excessive quantity throughout a breakout can affirm the breakout is actual, because it reveals sturdy market participation and will increase the probability of a sustained value motion.

Nonetheless, if the worth breaks out of a spread on low quantity, it suggests weak market curiosity and the next danger of it turning into a false breakout.

By analyzing quantity throughout breakouts, merchants can work out which breakouts are real or false, which improves the effectiveness of their buying and selling methods.

Now that you know the way to make use of Quantity, let’s take a look at some real-life examples!

Buying and selling Examples

Let’s check out some precise buying and selling examples to offer you a greater understanding of how you need to use quantity to make higher buying and selling selections.

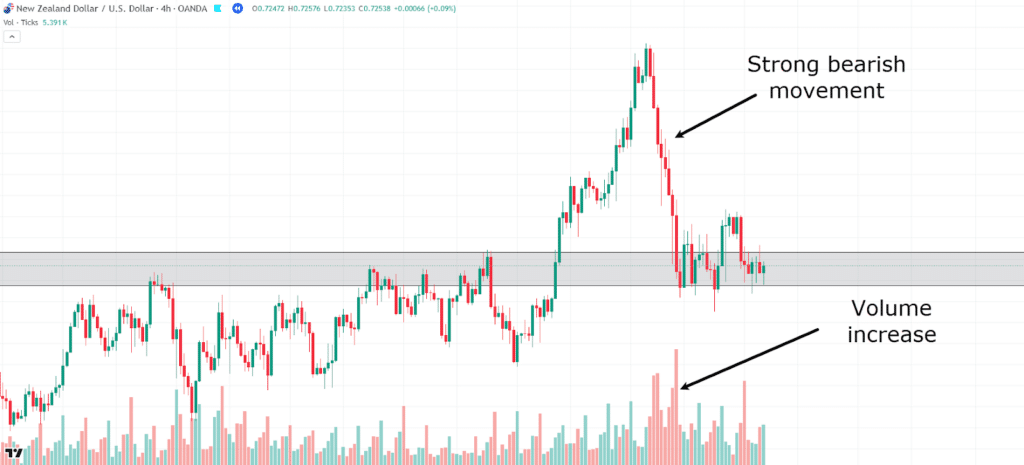

Try this chart…

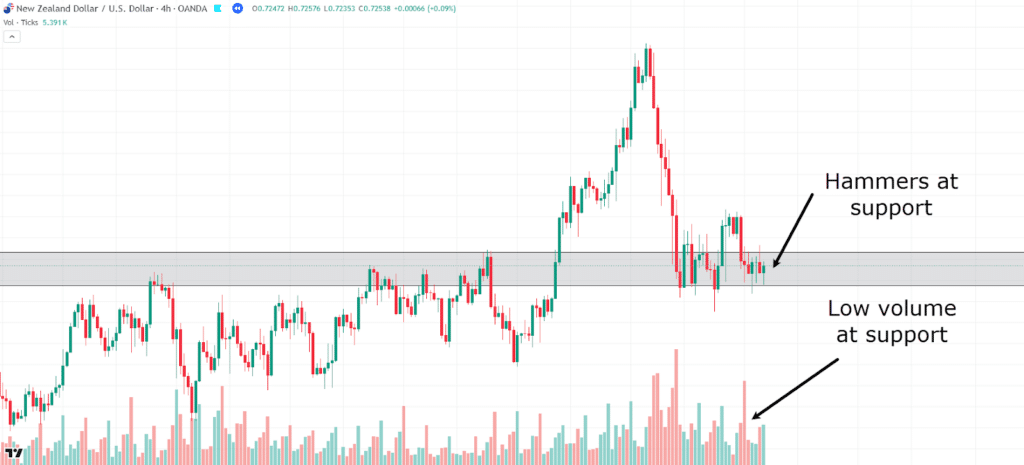

NZD/USD 4-Hour Chart:

Right here, you may see an space of worth the place value beforehand acted as resistance and is now help.

Worth broke by the resistance stage, forming a a lot greater excessive, finally peaking and reversing again right down to the resistance stage, which now appears to be like to be performing as help.

Discover the amount improve on the transfer down…

NZD/USD 4-Hour Chart Low Quantity:

You may be pondering, “Nice! Worth is at a help stage, let’s take the purchase!”

Nonetheless, are you able to see one thing attention-grabbing occurring on the space of worth?

Worth is rejecting the zone, nevertheless it’s at low quantity…

…and the one quantity improve throughout this era was from the massive bearish candle after the small bounce.

This would possibly imply that there’s not a variety of quantity with the bulls making an attempt to carry this help stage…

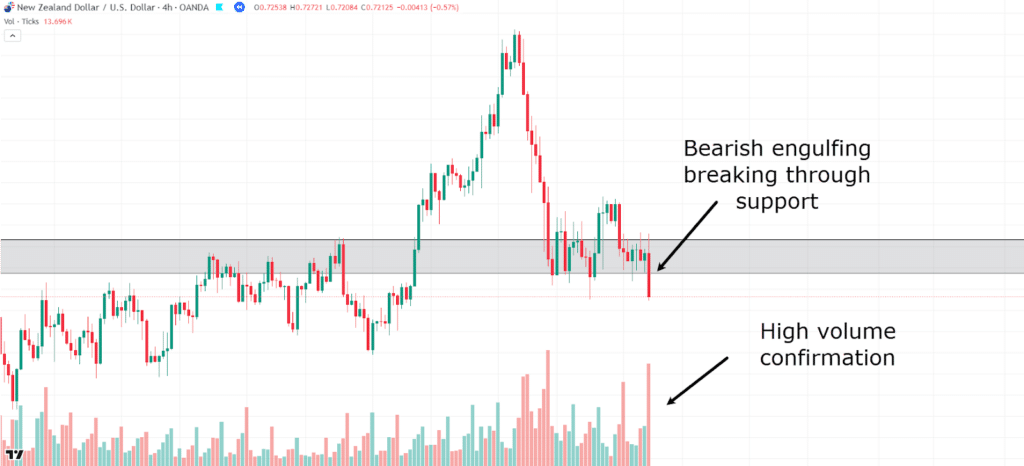

NZD/USD 4-Hour Chart Improve Quantity:

The value finally breaks the help stage as anticipated, and take a look at what occurred with the amount in the course of the break!

Quantity elevated as help fell!

This reveals how quantity will increase can reveal which strikes have some actual momentum behind them, in comparison with the remainder of the candlesticks.

Let’s check out what occurs subsequent…

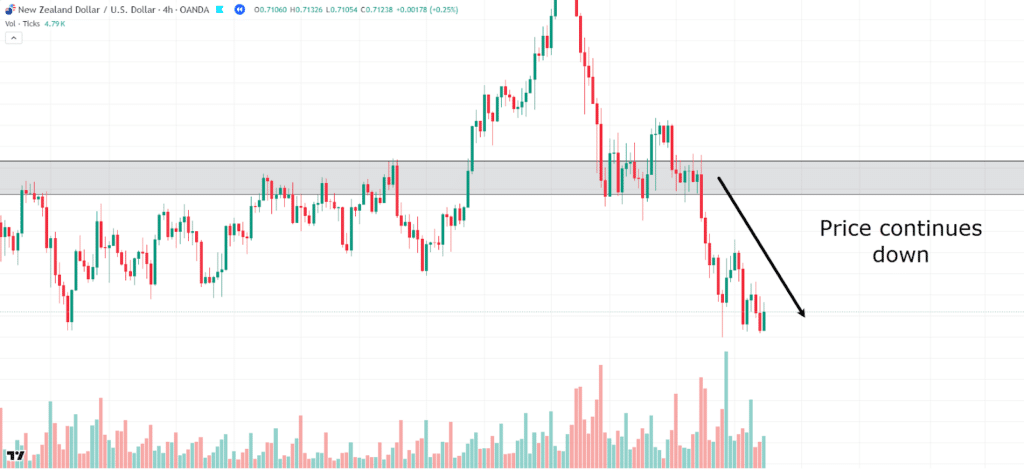

NZD/USD 4-Hour Chart Worth Continuation:

Worth continues its sturdy momentum to the draw back, giving a good alternative to take a brief commerce.

Earlier than occurring, the necessary factor to notice right here is find out how to determine whether or not the help is more likely to maintain or not, because it may forestall you from taking an extended commerce at help.

Let’s take a look at one other instance – this time with a inventory…

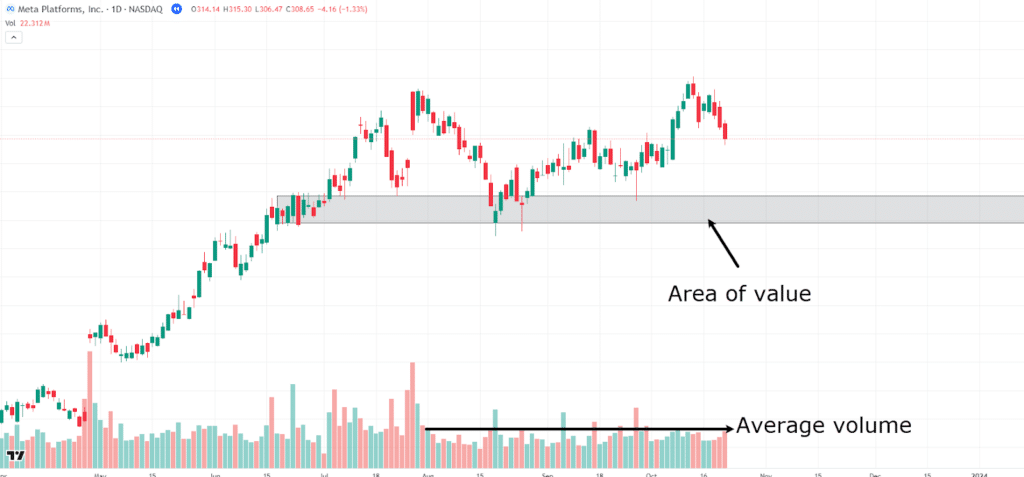

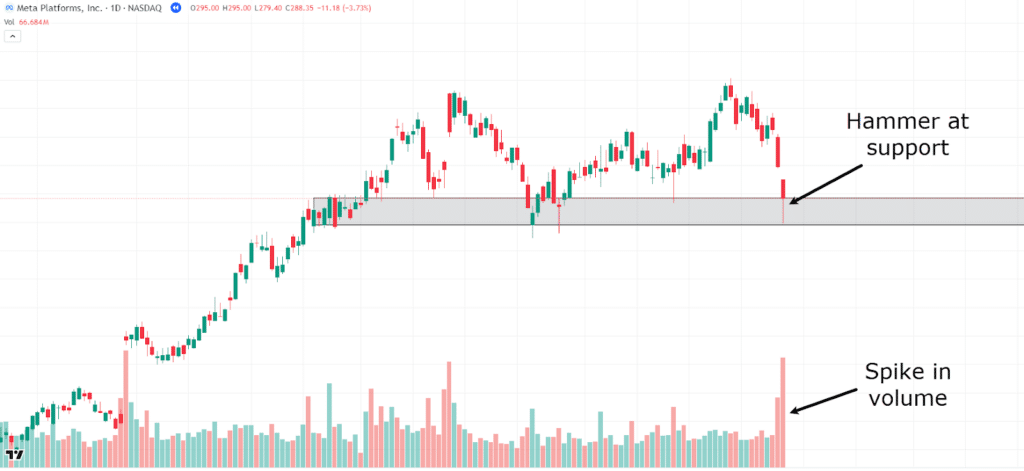

META Day by day Chart:

Right here you may see the inventory Meta has been in an uptrend.

Whereas the worth has now shaped a little bit of consolidation, quantity has additionally evened out and is remaining comparatively low.

An space of worth has shaped with a help stage…

META Day by day Chart Help Stage:

Worth comes again to the help stage once more, and a few key notes to determine are the candlestick sample and the amount…

See how the hammer has shaped at help, which is a bullish candlestick sample?

Despite the fact that it’s a purple quantity bar and a purple candlestick, as mentioned earlier, the colour of the amount shouldn’t be so necessary.

What this setup is telling you, is that bears tried to deliver the worth below the help stage however failed to take action, and this time on excessive quantity.

This implies there’s sufficient quantity on the shopping for facet to carry this help stage.

Are you able to see how this differs from the earlier instance, the place help quantity was weak?…

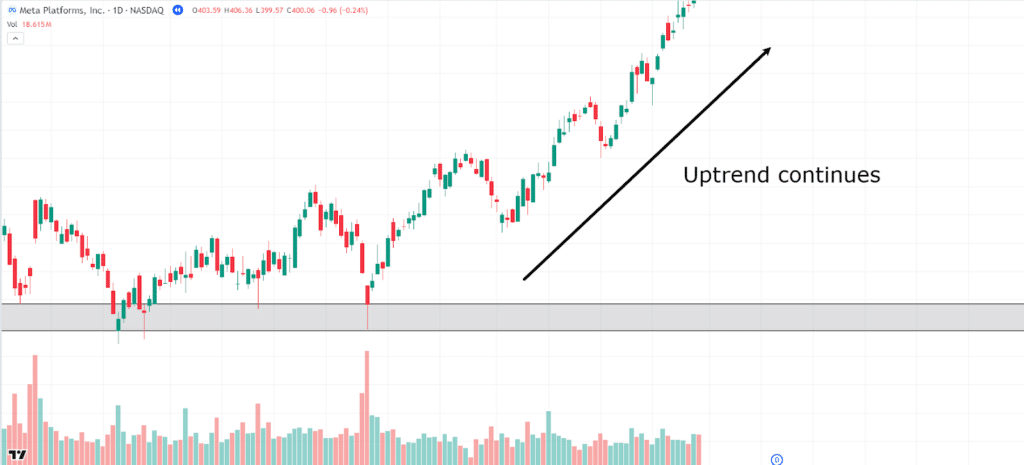

META Day by day Chart Uptrend Continuation:

From that time on, the worth strikes again into its uptrend.

On this means, the amount and candlestick sample gave you the data you wanted to CONFIRM the purchase entry, moderately than making it the only cause to purchase.

The value got here to an space of worth, and there was a bullish candlestick on excessive quantity.

If you happen to already owned Meta inventory, this may very well be an effective way of understanding whether or not or not it was value holding it or exiting your place.

Or, should you have been trying to enter a brand new place, you’d have an amazing consolidation interval, with sturdy entry indicators utilizing the technical evaluation of help and candlestick patterns, mixed with the affirmation from quantity.

So with all that stated, let’s take an important take a look at how quantity can typically be deceptive…

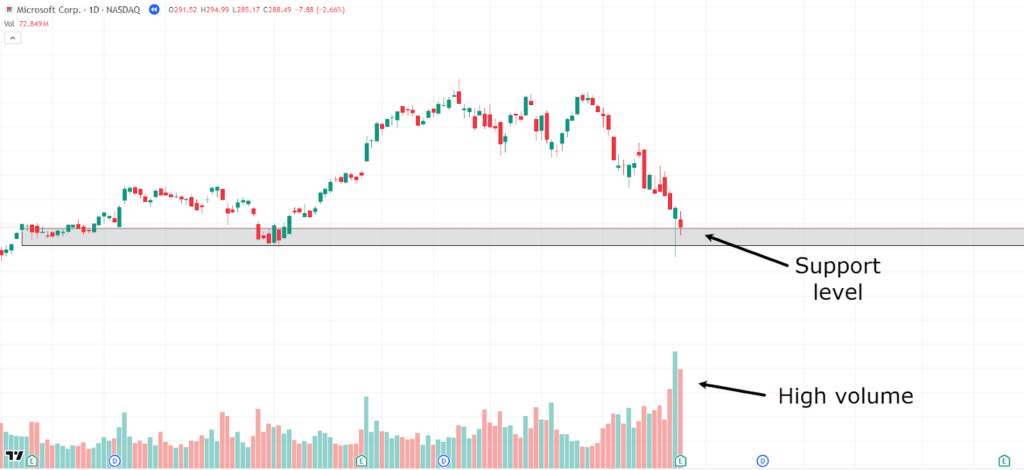

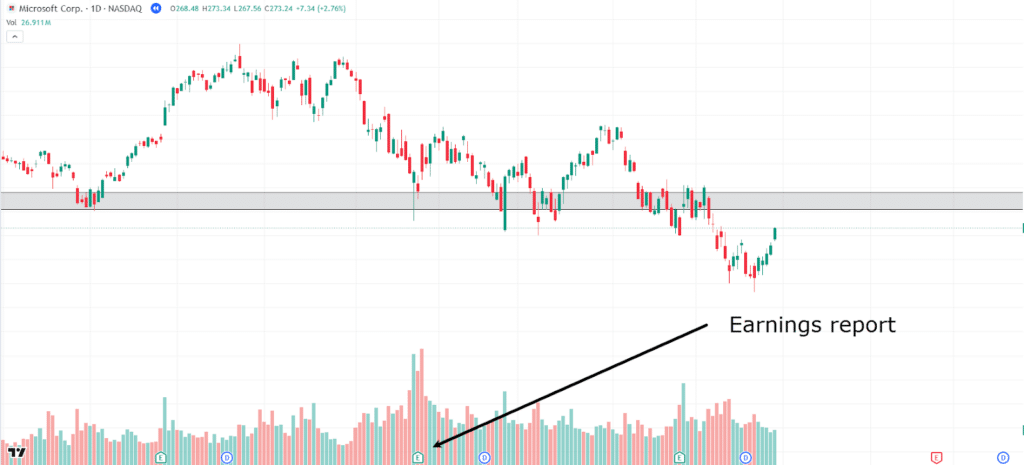

Microsoft Day by day Chart:

Here’s a comparable instance to the earlier one, the place the inventory Microsoft has shaped a help stage after a good uptrend.

The value has come again to the help stage, and one thing attention-grabbing is happening.

A hammer candlestick has shaped at help, together with a rise in quantity…

Equally to the final time, there’s cause to consider this stage will maintain!

Let’s check out what occurs…

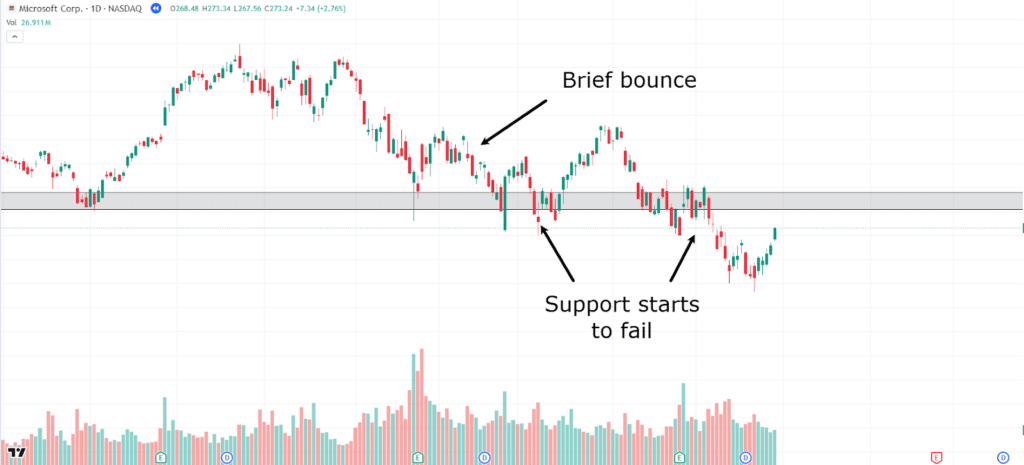

Microsoft Day by day Chart Help Breaks:

Though the worth initially bounced, which remains to be useful info, it in the end grinded its means beneath the extent.

On the chart, I’ve highlighted the areas the place help begins to fail.

So that you may be asking:

“OK, why did this occur, Rayner?”

It’s query, and the sincere reply is…

…typically quantity doesn’t give the entire image!

This help tried to carry, and you’ll see a number of bounces from it after the amount spike, however finally, as the worth got here again to the help stage time and time once more, the consumers have been exhausted.

Keep in mind, the advantage of this evaluation is that it nonetheless provides you loads of time to exit your place.

Finally, the worth didn’t proceed in an uptrend, nevertheless it held the help lengthy sufficient so that you can reevaluate whether or not or not the extent would maintain the second, third, and even fourth time.

There may be one different factor you would possibly want to contemplate when shares.

Check out the next chart…

Microsoft Day by day Chart Earnings Report:

Clearly, dividends and earnings are key components in value actions for shares…

…however additionally they affect quantity!

Simply by trying on the chart, it’s laborious to say whether or not or not this earnings report was adverse or constructive, nevertheless it may have performed a job in whether or not or not the worth continued in an uptrend.

It’s an amazing instance of quantity evaluation limitations, however let’s check out some extra.

Limitations

Solely Helpful as Affirmation – Not a Sign in Itself

Quantity information can actually assist affirm traits, breakouts, and different indicators generated by different technical evaluation.

Nonetheless, relying solely on quantity could be deceptive, because it won’t present clear entry or exit factors with out the context of different indicators like shifting averages, pattern traces or help and resistance.

For instance, a value transfer with excessive quantity suggests power, whereas the identical transfer with low quantity may be a false sign.

Can Turn into Complicated

Quantity evaluation could be complicated, particularly in markets with excessive volatility or low liquidity.

Sudden spikes or drops in quantity could be misinterpreted, resulting in flawed conclusions about market path.

Moreover, algorithmic and high-frequency buying and selling (HFT) has modified conventional quantity patterns, making it more durable to know quantity information precisely.

HFT could cause giant quantity spikes that don’t essentially mirror significant market sentiment, complicating the evaluation additional, so maintain a watch out.

Lack of a Complete Market View

When contemplating Foreign currency trading, for instance, quantity information typically represents solely a portion of the overall market exercise.

This could make quantity accuracy inconsistent and laborious to depend on.

Moreover, information occasions can enormously have an effect on quantity.

Excessive-impact information could cause quantity spikes which might be extra of a knee-jerk response than a real market affirmation.

Whereas quantity is beneficial for confirming breakouts and pattern continuations, it’s necessary to be cautious throughout information occasions, as these can disrupt regular quantity patterns.

Conclusion

Clearly, quantity evaluation generally is a worthwhile device to higher perceive market dynamics and make sure your buying and selling indicators.

By together with quantity information along with your buying and selling technique, you may achieve essential insights into the power of value actions and market sentiment.

When used alongside different instruments, quantity evaluation can provide you an edge in predicting market traits and validating breakouts or reversals.

To summarize, on this article, you’ve:

- Discovered what quantity evaluation is and the place to search out quantity information

- Mentioned what quantity represents

- Explored the variations in quantity for Foreign exchange vs. Shares

- Understood the three main methods quantity is utilized in markets

- Reviewed chart examples of quantity affirmation for pattern continuation and breakouts.

- Recognized the restrictions of quantity evaluation, together with its dependency on context and potential for confusion.

By mastering quantity evaluation and integrating it along with your different technical evaluation instruments, you might be nicely in your technique to turning into a extra knowledgeable and efficient dealer.

Now, I’m very keen to listen to your ideas on quantity evaluation!

Do you at the moment use quantity evaluation in your buying and selling?

Are you able to see why it’s a important part of technical evaluation?

How a lot success have you ever had with it?

Share your ideas and experiences within the feedback beneath!