The Nasdaq Composite (^IXIC 2.49%) is formally in a bear market. Whereas it had been floating round in correction territory for just a few weeks, it fell greater than 20% beneath its all-time excessive after President Donald Trump introduced his new tariff plan on April 2. Trump introduced new tariffs on greater than 180 nations, with the quantities various from 10% to 99%.

A few of the extra noteworthy tariffs have been placed on imports from nations like China, Taiwan, and Vietnam, which many tech corporations depend on. That is why traders have grown additional cautious of the tariffs’ results, and the tech-heavy Nasdaq Composite has skilled harsher drops than different main indexes just like the S&P 500 (^GSPC 2.11%) and Dow Jones (^DJI 2.10%).

Though inventory market crashes are nerve-wracking, the silver lining is that historical past exhibits that traders should not go into full-blown panic mode. Let’s check out why.

The Nasdaq has been right here earlier than

For higher or worse, the Nasdaq is not new to bear markets. Together with the present bear market, the Nasdaq Composite has skilled 5 bear markets since 2000. Beneath are the bear markets and roughly how a lot the index dropped throughout that point:

| Bear Market Length | Nasdaq Share Decline |

|---|---|

| Dec. 2024 to April 2025 (Present) | (23%) |

| Nov. 2021 to Dec. 2022 | (33%) |

| Feb. 2020 to March 2020 | (30%) |

| Oct. 2007 to March 2009 | (54%) |

| March 2000 to Oct. 2002 | (78%) |

Supply: YCharts. Present bear market share decline as of April 4, the latest low level.

A part of being a sound investor is knowing that bear markets are a pure a part of the inventory market cycle. Because the Nasdaq Composite was launched in February 1971, it has skilled 9 bear markets. Regardless of that, the index has been an awesome long-term funding.

Utilizing 15,600 because the Nasdaq Composite’s level degree (the quantity on the time of this writing), here is roughly how a lot the index has elevated for the reason that finish of every of the above bear markets (excluding the present one):

- December 2022: 45%

- March 2020: 127%

- March 2009: 1,085%

- October 2002: 1,280%

A great way to spend money on the Nasdaq Composite throughout this time

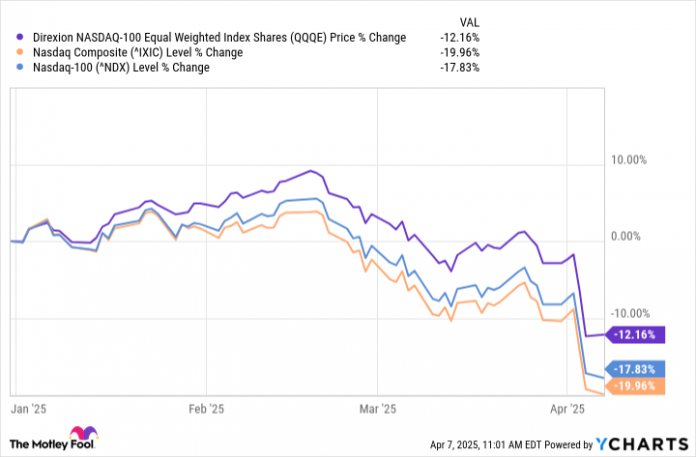

When you’re all in favour of investing within the Nasdaq proper now, I would think about going with an exchange-traded fund (ETF) just like the Direxion NASDAQ-100 Equal Weighted Index Shares (QQQE 2.09%). This ETF mirrors the Nasdaq-100, a subset of the Nasdaq Composite that solely tracks the 100 largest non-financial shares on the Nasdaq inventory trade.

Though this ETF comprises the identical shares within the Nasdaq-100, it is equal-weighted, which means your funding might be unfold equally amongst all the businesses as a substitute of unfold based mostly on corporations’ market caps, as is the case with the usual Nasdaq-100.

Since the usual Nasdaq-100 is market-cap-weighted, mega-cap tech shares account for an enormous portion of the index, and that has taken a toll on it since these have been among the most affected by the response to Trump’s tariff plans. Apple, Nvidia, and Microsoft make up over 1 / 4 of the index by themselves.

It is at all times dangerous to maintain the majority of your investments in a handful of corporations, so the equal-weight Nasdaq-100 ETF supplies a technique to spend money on the Nasdaq with out relying an excessive amount of on large tech and the “Magnificent Seven” shares.

You do not have to take a position a big lump sum proper now

With all of the uncertainty surrounding the economic system and inventory market proper now, I would not advise you to take a position a lump sum, even when you’re all in favour of investing within the equal-weight Nasdaq-100 ETF. As an alternative, I’d use dollar-cost averaging.

Whenever you dollar-cost common, you determine on an quantity you may make investments after which put your self on an investing schedule to take a position that quantity at common intervals. For instance, when you determine you wish to make investments $1,000 whole within the ETF, you would divide your investments into 10 $100 investments, 4 $250 investments, two $500 investments, or no matter makes essentially the most sense for you.

By dollar-cost averaging throughout occasions of excessive volatility, you cut back the danger of investing a lump sum earlier than a market drop and assist offset among the damaging results of a extremely risky market.

Keep in mind: Your focus needs to be on the long run. Do not let bear markets or down durations discourage you from investing. Simply strategy it with a sluggish and regular mindset and belief that in the long term, you may be glad you took benefit of present falling costs.

Stefon Walters has positions in Apple and Microsoft. The Motley Idiot has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.