The corporate been unable to benefit from the fast-growing demand for AI software program to this point.

BigBear.ai (BBAI 1.48%) inventory was in roaring kind on the inventory marketplace for a lot of the previous yr, rising by a whopping 337% as of this writing, regardless of even wilder swings in its share value. The previous month, nonetheless, has been one which the corporate’s traders may need they may overlook — the inventory misplaced 31% of its worth in the course of the interval.

Its second-quarter outcomes, which it launched on Aug. 11, made issues worse. BigBear.ai did not simply miss Wall Road’s expectations — it additionally trimmed its 2025 steerage, and the inventory was hammered. Buyers, nonetheless, ought to do not forget that BigBear.ai is working within the synthetic intelligence (AI) software program market, which is on the right track to develop quickly within the coming years.

So, ought to savvy traders deal with this inventory’s latest drop as a shopping for alternative in anticipation of wholesome beneficial properties over the following three years?

Picture supply: Getty Pictures.

BigBear.ai’s finish market is rising at an unbelievable tempo

BigBear.ai’s AI-powered options allow its shoppers to research their information in order that they’ll enhance their decision-making means, which may finally result in improved operational effectivity and productiveness. The corporate’s AI options are already being deployed in such assorted areas as cybersecurity, digital identification administration, pc imaginative and prescient, and predictive intelligence.

BigBear.ai factors out that these AI instruments are being utilized in industries equivalent to border safety, protection, journey and commerce, provide chain, healthcare, and lecturers. The great half is that demand for the kind of AI software program platform that BigBear.ai offers is rising at an amazing tempo. Market analysis agency IDC expects this market to generate $153 billion in annual income in 2028, up from simply $28 billion in 2023.

The unhealthy information, nonetheless, is that BigBear.ai is not doing sufficient to benefit from this profitable alternative. Its income barely elevated final yr, and its up to date 2025 steerage for income within the $125 million to $140 million vary means that its high line will drop by between 12% and 21%. In the meantime, competitor Palantir Applied sciences (PLTR 2.97%) has been making vital strides within the AI software program platform market.

Within the first half of 2025, Palantir’s income jumped by 44%. Its backlog grew at a quicker tempo than BigBear.ai’s. Palantir additionally ended the second quarter with a 65% spike in its remaining deal worth (the overall worth of its unfulfilled contracts) to $7.1 billion. In the meantime, BigBear.ai’s $380 million backlog on the finish of Q2 represented a 43% improve from the year-ago interval.

Briefly, Palantir is rising at a a lot quicker tempo than BigBear.ai, although it’s the larger firm. A serious motive why that is the case is that Palantir is efficiently focusing on industrial prospects. The corporate began providing its Synthetic Intelligence Platform (AIP) to industrial prospects in April 2023, and it has been reaping the rewards ever since.

Palantir’s industrial income elevated by a formidable 47% yr over yr within the second quarter, pushed by an nearly an identical improve within the industrial buyer rely. BigBear.ai, then again, depends on federal authorities contracts for almost all of its income. The unpredictability related to authorities spending is the rationale why BigBear.ai’s newest quarterly efficiency wasn’t on top of things.

Decrease-than-expected revenues from its Military contracts led to an 18% year-over-year income decline in Q2 and in addition pressured administration to decrease its steerage.

It is clear that BigBear.ai must take a leaf out of Palantir’s playbook and extra aggressively pursue industrial alternatives. CEO Kevin McAleenan realizes this. On the corporate’s newest convention name, he stated:

Coming into the function as CEO earlier this yr, it was clear to me that our pipeline was slim and relied on just a few giant contracts. Now we have taken steps this yr to deepen and broaden that pipeline with further prospects, extra prime contract targets, bigger alternatives, and growth into new markets, together with internationally.

Nonetheless, McAleenan added that these adjustments will take time to materialize.

The subsequent three years could possibly be troublesome for this AI software program specialist

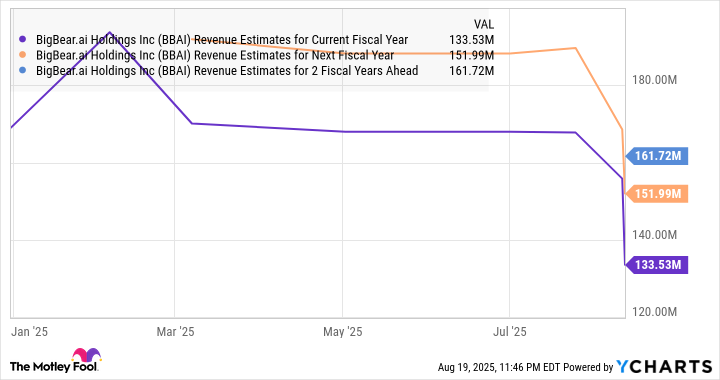

Analysts considerably lowered their 2025 income expectations for BigBear.ai following its newest quarterly report. Their consensus income estimate for 2026 has additionally dipped considerably.

BBAI Income Estimates for Present Fiscal Yr information by YCharts.

The corporate was beforehand anticipated to ship wholesome income development subsequent yr. Although it’s nonetheless anticipated to provide a double-digit share leap in its high line, the forecast for 2027 factors towards one other sluggish yr. As such, BigBear.ai inventory might stay underneath strain. Nonetheless, traders would do nicely to maintain this inventory on their watch lists.

That is as a result of BigBear.ai’s technique of widening its buyer base and accessing new markets might repay, permitting it to doubtlessly outpace Wall Road’s expectations over the following three years. The inventory is presently buying and selling at 10 instances gross sales, and it could develop into cheaper following its latest outcomes. So if there are indicators of a turnaround in BigBear.ai’s enterprise, savvy traders might take into account shopping for this AI inventory at an affordable valuation earlier than the corporate steps on the fuel.