The arduous, chilly actuality of buying and selling is that each commerce has an unsure final result.

– Mark Douglas

I would like you to re-read the above quote by the (sadly) just lately handed Mark Douglas, who was one of many best buying and selling psychology educators ever, if not the most effective ever. The unsure final result of any given commerce, or the random final result, is the explanation why it appears so tough to find out when to take earnings on a commerce.

I would like you to re-read the above quote by the (sadly) just lately handed Mark Douglas, who was one of many best buying and selling psychology educators ever, if not the most effective ever. The unsure final result of any given commerce, or the random final result, is the explanation why it appears so tough to find out when to take earnings on a commerce.

The reality is, us people have an innate need to regulate issues, conditions, and even different folks generally. So, when that innate need meets the uncontrollable market, there’s sure to be some, shall we embrace, cognitive dissonance concerned. When conditions don’t unfold how we wish or anticipate them to, it makes us pissed off, offended or unhappy. Relating to buying and selling, that is precisely why you can not anticipate any explicit final result on any explicit commerce, as a result of in case you do, you’re going to jump-start an emotional storm of destructive emotions that trigger you to commit account destroying buying and selling errors if the result you anticipated on a commerce isn’t the result you bought.

To keep away from making these errors, it’s vital that you just perceive the psychology of revenue targets…

Each commerce has a random final result

If you obtain full acceptance of the uncertainty of every edge and the individuality of every second, your frustration with buying and selling will finish.

– Mark Douglas

As Mark Douglas discusses in his e book Buying and selling in The Zone, each commerce you’re taking is completely unconnected and unbiased of the final commerce you took or the following one you’ll take. This reality is the inspiration of understanding revenue targets and why they provide merchants a lot bother. The rationale it’s the inspiration is that most individuals will imagine very strongly that if the final commerce they took had a sure final result, and their present commerce setup regarded the identical (as that final one) upon entry, the identical or very related outcome ought to happen. Nevertheless, this pondering is strictly the place the difficulty begins as a result of as Mr. Douglas factors out again and again in his e book, every commerce’s outome is unsure and basically a random occasion.

It may be obscure how you might earn cash out there if each commerce has an basically random final result as a result of that truth appears to be in battle with the truth that merchants do earn cash constantly over time and it’s potential. The problem lies in the truth that it’s worthwhile to maintain two completely different understandings of buying and selling in your thoughts concurrently that appear to be in battle with one another. The primary understanding is that you just can earn cash constantly if you execute your buying and selling technique constantly over time. The second perception is that you can not management the market and each commerce has a random and unbiased final result of every other commerce you’re taking.

Now, right here’s the important thing to creating these two beliefs join; the best way you earn cash from a seemingly random final result on every commerce is by executing your buying and selling technique or edge constantly over a big sufficient pattern measurement or sequence of trades.

The above sentence is how casinos make a lot cash annually off of seemingly random video games. Casinos know that even when their ‘edge’ is say 5%, then meaning over a big sufficient pattern measurement, they’ll make 5% on each greenback risked of their on line casino, together with any huge winners folks could take from them. The bottom line is to execute the technique or edge constantly over a big sufficient pattern measurement to see it repay.

It’s the power to imagine within the unpredictability of the sport on the micro degree and concurrently imagine within the predictability of the sport on the macro degree that makes the on line casino and the skilled gambler efficient and profitable at what they do.

– Mark Douglas

Expectation is the enemy of buying and selling success

Now, let’s dig into the psychology behind why folks battle with revenue targets and with commerce exits basically, earnings or losses.

As I alluded to within the opening, expectations are what give folks bother within the markets. A dealer who doesn’t imagine or possibly isn’t conscious that each commerce has a random final result that’s unbiased of every other commerce, isn’t going to be mentally ready to cope with a commerce outcome that doesn’t align together with his or her expectations. That is why the inspiration of profitable buying and selling is constructed on an understanding of the randomness of each commerce. When you actually perceive and settle for that each commerce has a random final result, no matter what occurred in your final commerce, you shouldn’t be dissatisfied and even enthusiastic about the results of your present commerce; as a result of you shouldn’t have any expectations.

After I placed on a commerce, all I anticipate is that one thing will occur.

– Mark Douglas

The one expectation you need to have is that IF you observe your buying and selling technique / buying and selling edge over a big sufficient pattern measurement, you need to come out worthwhile on the finish of that pattern measurement, assuming you’re utilizing an efficient buying and selling technique in fact.

To additional make clear this level of random expectations out there, take into consideration a automobile salesman. That automobile salesman doesn’t know which automobile an individual will purchase or even when they may purchase one; he has a random expectation for each individual he offers with. Serving to a buyer could be seen because the automobile salesman taking over ‘threat’ as a result of he’s spending his time on them and it could yield nothing, or it could yield a big fee.

One of the best ways to method revenue targets and commerce exits

Why do casinos make constant cash on an occasion that has a random final result? As a result of they know that over a sequence of occasions, the chances are of their favor. In addition they know that to comprehend the advantages of the favorable odds, they should take part in each occasion.

– Mark Douglas

You might have learn my article on set and overlook buying and selling and minimalistic buying and selling, when you’ve got learn them, then right now’s lesson concerning the psychology behind exiting a commerce will assist you perceive why I take that set and overlook / minimalist method to my buying and selling and why I train different merchants to do the identical. Because of the lack of management we’ve over the market, the one ‘commerce administration’ approach that really provides your buying and selling edge / technique the most effective probability to play out and work in your favour over a sequence of trades, is just letting the market play out with out your interference.

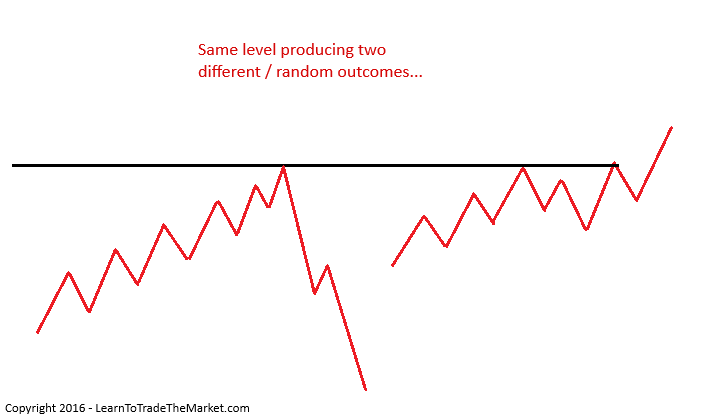

After we enter a selected commerce we can not know the way far it would transfer for or towards us, so we want to concentrate on this truth and handle trades accordingly. Check out the next diagram for a visible illustration of random outcomes utilizing the identical edge (on this case promoting a key resistance degree) can produce two very completely different / random outcomes…

Now, if we have a look at the above diagram and we think about a dealer who merely trades key assist and resistance ranges by fading them as worth hits them (sells power and buys weak point), we will get a real-world understanding of the randomness concerned in any given commerce…

The dealer doesn’t know the way far the market will transfer away from the extent or whether or not it would rotate (reverse) or begin to development from there. All he is aware of is that fading key chart ranges is his edge and he should execute it again and again to see a revenue over time.

This dealer is taking over market threat however she or he can also be taking a possibility to earn cash, that is precisely how a on line casino or “the home” operates. Knowledgeable dealer thinks like the home in a on line casino and even like a bookmaker when it comes to odds / chances; risking a small quantity on a commerce can yield large rewards, however then once more, when these large rewards happen is a random expectation.

There’s a random expectation on any given commerce which implies there’s additionally a random distribution of winners and losers for any given buying and selling edge. You can not know beforehand whether or not THIS commerce will likely be worthwhile or not, all you recognize is that IF you observe your buying and selling technique you need to be worthwhile over a sequence of trades. It’s important to mentally settle for that even in case you intention for 200 pips on a commerce, it could solely go 175 pips, that’s one thing you need to cope with and it’s additionally the place the talent of a dealer is available in. A talented dealer will use their intestine buying and selling really feel at occasions to exit a commerce, and there’s nothing flawed with doing so, however it does take coaching, time and expertise to develop.

For those who take a look at my article on the market wizards and even in case you learn the Market Wizards books, you’ll notice most of these well-known merchants weren’t utilizing mechanical entry / exit guidelines, they used discretion and intestine really feel usually.

In closing, buying and selling just isn’t about ‘getting it proper’ on a regular basis. As Mark Douglas emphasised, it’s about chances, particularly, studying to suppose in chances. If you mix a high-probability buying and selling edge like my worth motion buying and selling methods, with an understanding and acceptance of the random final result of each commerce you’re taking, you place your self ready to revenue constantly in case you commerce with self-discipline over a big sufficient pattern measurement.

PLEASE LEAVE A COMMENT BELOW – I WOULD LIKE TO HEAR YOUR FEEDBACK 🙂

QUESTIONS ? – CONTACT ME HERE