You’d be forgiven for considering that technological growth was following a predetermined trajectory. Previously few many years, we’ve seen the rise of private computer systems, the web, cellular gadgets, and now, the arrival of Bitcoin.

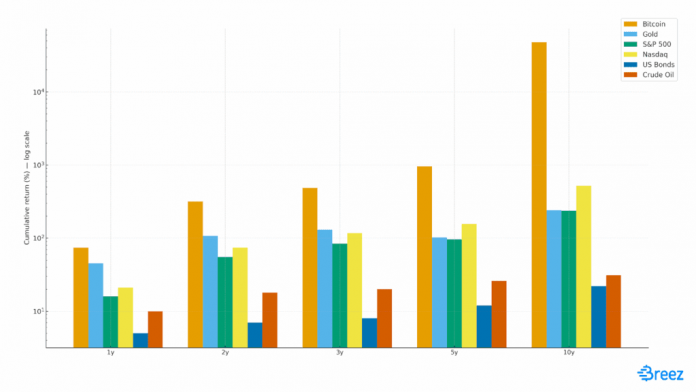

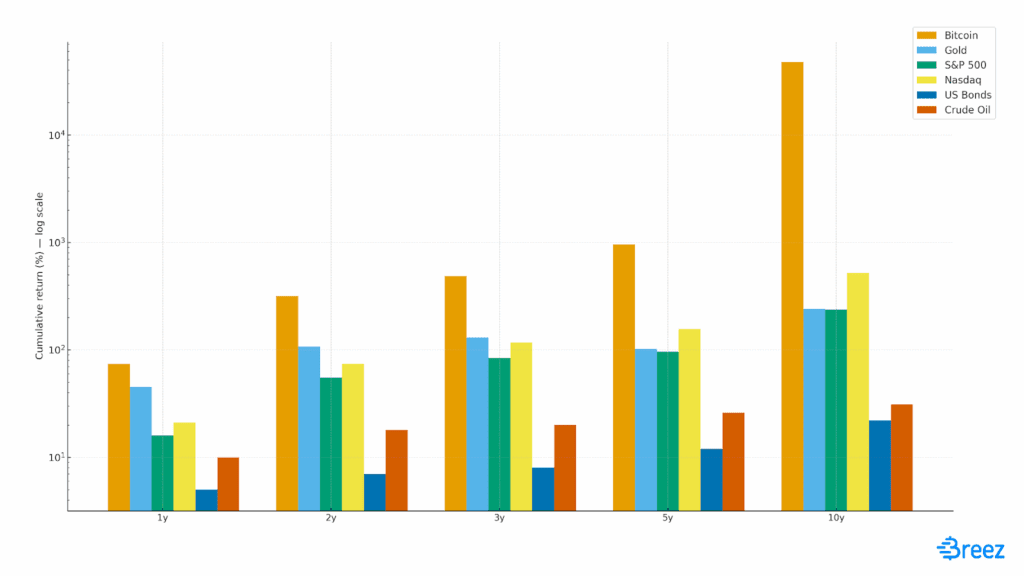

It’s already well-established that bitcoin is one of the best asset. That’s only a matter of primary monetary literacy. In the event you can learn a graph, the proof is clear.

Supply: CaseBitcoin & Market Information (2025)

What’s much less apparent is Bitcoin’s utility, and the way that’s going to recast our financial lives within the coming many years. Past its properties as an asset, that are getting many of the consideration and recognition, Bitcoin is a technique to transfer worth. That’s its core utility. And it’s not about shopping for espresso or underwear (no less than not but). Because it’s a foreign money designed on and for the web, retail adoption will possible come after it goes mainstream on-line. And the way it will go mainstream on-line is by commoditizing worth switch — letting anybody transfer worth anyplace for any function with out intermediaries.

Shifting worth is such a giant a part of our lives that increasing that realm of prospects means altering our conduct and the form of our societies. On the subject of shifting worth, borders will evaporate, colossal establishments like banks will shrivel, and new connections will sprout like blossoms in spring. The size of the transformation will rival that of the web itself.

Bodily books had been laborious to acquire and straightforward to ban (and generally burn). The web liberated info, giving way more folks entry to way more concepts than we had ever had earlier than. Standard cash is locked within the walled gardens and most popular pathways of market incumbents. Bitcoin represents the tip of this method and the start of one other.

The web unlocked info; bitcoin is unlocking worth.

To know the potential of the present transformation and to distinguish it from boilerplate pro-Bitcoin rhetoric, consider it as a shift from the fiat-based fee paradigm to the Bitcoin-based value-transfer paradigm. This sounds extra summary than it truly is.

First, let’s recall the acquainted: funds. Standard funds are directions to clear a debt, a definition echoed by skilled economists. If somebody sells you a espresso or cuts your hair, you owe them, and you agree that debt by paying them. Notice that, in observe, paying them requires instructing intermediaries — banks, apps, playing cards, center males — to really transfer the worth.

Distinction that with worth switch. There are two key variations. First, as we conceptualize it, worth switch is direct. It’s not an instruction to an middleman to carry out an motion; it’s the act itself. Second, worth switch needn’t settle a debt. Fee is a quid professional quo. Worth switch is simply quid. You may ship worth at a whim; it doesn’t essentially suggest a commerce, although it may well.

Money makes the variations between funds and worth switch readily obvious. Once you pay somebody in money, you’re not asking permission. You’re bodily transferring worth from one hand to a different. And money can do greater than settle money owed, i.e. greater than funds. Dropping some change right into a busker’s hat or giving your child an allowance are easy transfers of worth with out prior debt. You may “push” worth with money reasonably than simply commerce it.

Nevertheless, money is being marginalized by the authorities and it’s poorly suited to our digital world, so we’re dropping our capacity to switch worth. We belief these third-party intermediaries, like banks, bank card firms, and fintech suppliers, to honor our fee directions and fulfill our requests, however fee directions are sometimes denied or delayed.

Extra importantly, these fee directions are restricted to predefined patterns dictated by the intermediaries’ siloed buildings (e.g. from buyer to service provider, from employer to worker, from one checking account to a different if the banks share a wire-transfer protocol). This may sound like an exaggeration, however take into account platforms like Uber, OnlyFans, AirBnB, and Spotify. On the floor, all of them appear to be decentralization: the platforms simply join service suppliers with customers. However the funds all run alongside the platforms’ predefined paths, which embody lengthy chains of grasping intermediaries — banks, fintech apps, bank card firms. and so forth. Every of those intermediaries provides price, a possible level of failure, and a supply of permissioned friction, regulatory and in any other case.

The distinction to worth switch is stark. Merely put, worth switch distills the permissionlessness, instantaneousness, and adaptability of money funds with out the constraints of getting to carry and transfer bodily objects.

However how will we reimagine money in a digital world? How will we transfer from the constraints of funds to the empowerment of worth switch? If solely we had a technique to ship and obtain peer-to-peer digital money…

Bitcoin is extra programmable, extra versatile, extra adaptable than digital funds will be. Bitcoin lets us retailer and transfer worth simply as easily and simply as our telephones retailer and share a snapshot. By treating worth as simply one other type of info, Bitcoin will allow new patterns of financial exercise constructed on total ecosystems of specific use instances.

And sure, it have to be Bitcoin.

Worth switch — shifting worth at will immediately between sender and recipient — represents a momentous shift from the traditional fee paradigm. So why isn’t fintech making it occur? Isn’t this what stablecoins are for? Why is bitcoin the required basis for an financial system based mostly on worth switch?

The brief reply is that funds are deeply embedded within the structure of the fiat system, together with fintech.

A fintech fee includes an indefinite chain of intermediaries. For every middleman to earn income from the transaction, they want a billing mannequin. And so they go for discrete funds as a result of that’s what regulated cash transmitters are allowed to do. Because of the KYC, AML, and threat evaluation concerned, it’s an costly enterprise, so their charges are commensurately excessive.

Past price, intermediation essentially introduces friction. Every middleman is topic to regulatory constraints that change throughout borders and jurisdictions, which limits their markets and their attain. They need to additionally take into account extraneous enterprise issues, like the danger of enormous purchasers in a single sector revoking their enterprise due to unrelated transactions in one other sector. Furthermore, these funds aren’t any extra programmable than the intermediaries enable, and they’re neither closing nor instantaneous. The intermediaries can course of them at their leisure, and the payer can usually rescind the fee after the very fact.

Stablecoins, usually touted as an answer, merely substitute one fiat-based promise for one more. As MiCA and the GENIUS Act present, stablecoins are deeply susceptible to foreign money controls. A given stablecoin may work for cross-border funds at this time, however not subsequent quarter. USDT and 9 different tokens had been delisted from European exchanges in the beginning of 2025 in response to the brand new laws. Stablecoins’ issuers are topic to the identical extraneous issues as fintech suppliers, and they’re solely as programmable as these central entities enable them to be. Stablecoins are simply fiat beheld via blockchain-colored glasses. Certainly, stablecoins and fintech are digital lipstick on a legacy-payments pig.

Bitcoin succeeds the place fintech and stablecoins fail. The place their pricey intermediation requires funds, bitcoin permits worth switch. The place their operational constraints restrict entry and use instances, Bitcoin is an open, decentralized, impartial financial community that works for anybody, anyplace, anytime. The place they appeal to regulatory scrutiny and change into geopolitical pawns, Bitcoin gives a minimal regulatory footprint with out a native jurisdiction. The place they restrict programmability to guard established patterns and privileges, Bitcoin fosters innovation and the programmability that it requires.

If we may return to the daybreak of the web and design a foreign money optimized for the digital age, it might appear to be bitcoin. It is bitcoin.

Apps are the autos of change. They’re the nodes of our fixed information streams, and they’re the instruments that alter how we work, how we transfer, how we love, and the way we predict. Apps outline the digital surroundings to which we people are adapting, and we construct apps to adapt the environment to us. Worth switch is eclipsing funds, and apps are its conduits.

To know how apps will combine and foster worth switch, take into account the evolution of the digital digicam. The primary “filmless” cameras hit the market within the mid-Nineteen Seventies, however for the primary 20 years, they had been single-purpose gadgets. Even the cameras connected to early cell telephones had been “simply” cameras. They took photos, nothing extra.

The revolution in what digital cameras can do and in our relation to them got here in 2007 with the discharge of the primary iPhone. It wasn’t simply the digicam itself however the mixture of the digicam with apps that modified every little thing. Builders rapidly built-in the digicam into their apps, enabling customers to take, modify, and share pictures.

The synergy of digital cameras and apps modified our actuality and our conduct. Apps like TikTok, Instagram, and Pokemon GO make behaviors that will have appeared deranged 20 years in the past (e.g. photographing hamburgers, chasing invisible monsters via parks, choking oneself to the purpose of blacking out, and so forth.) mainstream, perhaps even aspirational. We’re continuously capturing our lives and consuming others’ lives via the photographs we see in our apps, on our telephones. Even Meta’s AI glasses are principally only a digicam connected to an everything-app.

What bitcoin does is commoditize worth switch, making it as versatile and freely adaptable because the digital digicam on a telephone. Any developer engaged on any type of app can combine worth switch. Messaging apps can let customers connect worth to their messages. Social apps can let customers elevate funds and break up payments with the convenience of liking a submit. Constructing a market — like Uber, Spotify, AirBnB, OnlyFans — not requires tens of millions of {dollars} and navigating a labyrinth of walled fee gardens; any dev can do it.

Funds require bankers and attorneys. Commoditized worth switch simply wants Bitcoin and builders.

Bitcoin is maturing out of its adolescence. Particularly, Bitcoin wanted Lightning to extend throughput and improve interoperability. For its half, Lightning wanted to search out its place because the frequent language for bitcoin-based worth switch.

However we’re there. A biome of distinct bitcoin subnetworks, together with Spark, Ark, Liquid, Fedimint, Botanix, and Cashu has arisen, every with distinctive benefits. SDKs at the moment are accessible that permit any developer add worth switch to their apps. By way of the digital digicam analogy, it’s 2007, the iPhone has simply hit the market, and builders are beginning to play with the digicam API.

It’s an opportune second. The expertise is ripe, however the market has but to cost the transformation in. Worth is about to begin shifting like info. It’s late sufficient for strong projections of what’s about to occur and early sufficient to make the most of the disruption. The convergence of bitcoin-based worth switch and apps is as inevitable because it was so as to add a digicam to a smartphone.

Funds are the camcorders of our age, the following expertise whose time has handed. The brand new age that’s simply starting will really feel qualitatively totally different, just like the second Dorothy steps out of her black-and-white world into the colourful colours of Oz. When worth flows as freely as info, the financial system adjustments, and society adjustments with it. Borders matter much less. Wealth and worth move just like the breeze (pun meant). World interactions throughout political and sophistication boundaries shift from distinctive to bizarre.

The parts are all in place. Bitcoin is flourishing, outstripping each different asset. Lightning permits any bitcoin endpoint to speak with some other. Protocols now exist to serve a wide range of makes use of and preferences. Builders are discovering SDKs that simplify the combination of bitcoin-based worth switch into their apps, and so they’re studying from one another about new methods to use and leverage worth switch, methods that can make their apps as indispensable as utilities like ChatGPT and Google Maps.

We’re residing on the finish of an age that our descendants will regard as primitive, just like the age earlier than electrical energy and operating water. We’re additionally residing in the beginning of an age that they’ll take into account transformative, just like the Renaissance or the beginning of the web. Let’s make them pleased with all we’ve achieved for them and astounded at how we ever received by with out the instruments we constructed.

It is a visitor submit by Roy Sheinfeld from Breez. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.