Some individuals hate engaged on the weekends however I adore it, actually, I sit up for it, right here’s why…

Some individuals hate engaged on the weekends however I adore it, actually, I sit up for it, right here’s why…

As a dealer, I do know it’s critically necessary that I’m as ready as doable for the upcoming buying and selling week, and I’ve discovered over my 15+ years available in the market that one of the best time to do my market evaluation and make buying and selling selections, is when the markets are closed.

In fact, what I simply described is the alternative of what most merchants do; frantically checking the charts all through the day through the week, hoping or praying and in the end making horrible decisions about when to enter and exit the market. Whereas, if they’d simply discover ways to do their market evaluation on the weekends and take the remainder of the week off, they’d not must hope or pray as a result of they’d be strategically preempting their selections and actions available in the market with logic and objectivity.

Now, I could also be exaggerating barely with “take the remainder of the week off”, however what I imply is, most of your time spent in entrance of the charts needs to be on the weekend. Throughout the week, I’ll monitor the market evenly every day, perhaps 10 to fifteen minutes initially and finish of the day. If there’s something to do this meshes with my weekend-analysis, I’ll place the orders and stroll the hell away from the charts till tomorrow. I DO NOT need to be consumed by the market or always looking at charts, as an alternative, I need to be out having fun with the fruits of my craft (as a result of being a dealer rocks). By the best way, being out and having fun with your life can have the unintended advantage of serving to you enhance your buying and selling outcomes, as a result of as I’ve mentioned in-depth in an article on why you shouldn’t watch your trades, the much less concerned you might be together with your trades, the higher your buying and selling efficiency is prone to be.

What’s weekend market evaluation?

So, what does my weekend evaluation appear to be? What do I ACTUALLY do, you could be questioning. I’m going to elucidate it to you then present you on the charts in a while…

First off, 95% of my market evaluation is finished on the weekend and takes place on the weekly and every day chart timeframe (I’ll clarify extra on this later). It’s no massive secret, what I’m doing is mainly on the lookout for key chart ranges of help and resistance, swing highs and lows, occasion areas and every day chart value motion alerts (See linked phrases in case you are uncertain what any of these items are).

Primarily, what I’m doing is studying the story on the chart and mapping the market from left to proper. I’m studying what has occurred, what is occurring and making a remaining determination of what I believe would possibly occur subsequent (the upcoming week). I need to have all my key ranges drawn in, my bias (bullish or bearish) written out together with the chart situation (uptrend, downtrend, massive sideways vary or tight / uneven consolidation) in addition to paying attention to any imminent commerce setups that I’m taking a look at.

WHY it’s best to do your buying and selling evaluation on the weekends:

Earlier than I get into the step-by-step breakdown of how I analyze the markets on the weekend, I need to ensure you know why this idea is so highly effective so that you that you simply begin placing it into follow and reaping the advantages of it as quickly as doable:

First off, finish of week and finish of day evaluation clearly saves lots of time in comparison with day buying and selling, permitting us to actually benefit from the fruits of our craft, however this isn’t the principle cause I do my evaluation this fashion, not by a long-shot…

You see, the tip of the week means one thing available in the market. Actually, it’s essential as a result of it reveals a complete 5 days or 1 week of buying and selling available in the market, exhibiting who gained the battle between bulls and bears that week. The market can have proven a part of its hand at week’s shut and there’s way more weight behind the place the market closes on a Friday in comparison with another day of the week.

Word: This doesn’t imply “weekly chart buying and selling”, it means END OF THE WEEK evaluation; figuring out the important thing ranges and pattern and if any commerce alerts fashioned over the earlier week. In different phrases, utilizing the weekly and every day chart to get the entire image after which develop your strategy from that.

One other massive cause why this end-of-week evaluation strategy works so nicely is that it contributes to a low frequency buying and selling strategy, one thing I’ve written about fairly extensively in varied classes over time.

While you commerce much less, it improves your buying and selling efficiency over the long-run, and there are various research that present this. That is partially why the info reveals that ladies make higher merchants than males; as a result of they commerce much less ceaselessly than males do as I defined in my current article What’s the weakest hyperlink in your buying and selling?

The market is slower than we predict, that means good trades take time to play out, and over time you’ll agree. You look again at trades you have been in and suppose, “I ought to have held that longer”. This hindsight remorse ought to educate you to carry trades longer and have some religion in your evaluation. The tip of week evaluation will aid you, and the finish of day entries will additional enhance your efficiency and readability, right here is how I do my evaluation….

Here’s a abstract model of my buying and selling routine

My weekly and every day buying and selling routine is rather a lot easier than you most likely suppose. First off, as I’ve written about in a current article on the energy of buying and selling routines, an important factor to recollect right here is that each one of this has turn out to be a HABIT for me. The routine of writing my weekly market commentary, which I began again in 2008, nonetheless helps me in any case these years.

It’s essential to develop the correct buying and selling habits if you wish to turn out to be a profitable dealer, as in another occupation.

The dialogue that follows is mainly a step-by-step rationalization of how I create my weekly members market outlook, which, coincidentally, was one thing I used to be doing BEFORE I ever had any college students. It ought to go with out saying that that is one thing you ought to be doing too; creating your personal weekly market outlook will offer you a ‘street map’ to the market every week that can assist information you in making commerce selections within the ‘warmth of the second’. Simply as a normal in conflict preempts his technique, so you will need to preempt your buying and selling technique so that you’re not making impulsive selections in the midst of a heated market transfer. Subsequently, you usually see me write in my market commentaries one thing like, “We’ll do that if this occurs this week, or bullish above this degree, look forward to this to do this and to observe XYZ degree, and many others”…I’m laying out a street map so as to preempt your buying and selling week fairly than making selections within the ‘warmth of battle’…

Step 1.

The very very first thing it’s best to know is that I don’t have a look at each Foreign exchange pair, not even shut. I’ve a choose variety of my favourite Foreign exchange foreign money pairs that I observe and these are those I’ve open on my MetaTrader 4 buying and selling platform and I actually don’t have a look at another ones. I do, after all, commerce different markets, like Gold, Oil and a number of other Inventory Indices, however I’m not making an attempt to research and observe 30 totally different markets every week as many merchants do, so preserve that in thoughts.

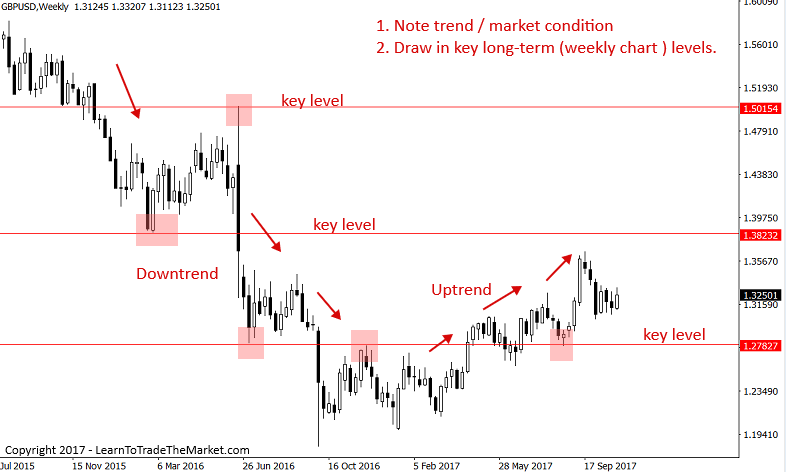

The very first thing I do is open my charts and have a look at the weekly timeframe to plot the important thing ranges and to get a great hen’s eye view of the long-term market pattern. Within the chart instance under, I’ve drawn within the key help and resistance ranges and I’ve marked on the chart the plain total pattern of the market, so you’ll be able to see what I’m considering after I have a look at it. It’s necessary to know what the present long-term market situation is (trending up or down, sideways and many others.), on this case the long-term pattern is up, as we will see under. This truth, together with the important thing ranges you plotted, will work to information your buying and selling selections all through the upcoming week, as we’ll see later…

Right here’s one other instance…

Step 2.

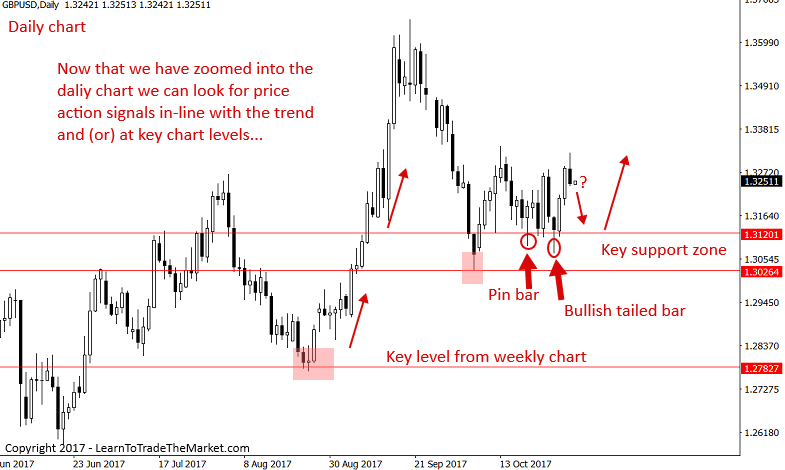

The following factor I do after having analyzed the weekly chart as mentioned in Step 1, is to drill-down to the every day chart timeframe, the place we’ll do a couple of various things…

- We’re drawing in any apparent help or resistance ranges that maybe weren’t apparent on the weekly chart.

- We’re figuring out the near-term every day chart pattern, so we will resolve which course we’ll look to commerce for the upcoming week (this may be totally different than the weekly pattern).

- Scan for any apparent value motion alerts for potential commerce entries.

Right here’s the way it seems on the every day chart of the identical EURUSD weekly chart within the first picture above…

Word: If the every day chart is sideways, at all times refer as much as the weekly chart for which course it’s best to look to commerce in. So, if the every day chart is sideways or range-bound, however the weekly chart is in a long-term uptrend, then look to commerce lengthy. Within the chart above, the pattern was not too long ago sideways however now could be exhibiting indicators of switching to a downtrend following the current shut underneath help close to 1.1660 – 1.1620.

Right here is the GBPUSD every day chart that follows the GBPUSD weekly chart view from Step 1. Discover, we’ve got drawn in a near-term help zone that wasn’t seen on the weekly and we’ve got marked a possible pin bar sign commerce which we mentioned in our current weekly commerce outlook.

Word: If there are every day / weekly alerts there from the Friday’s shut, then we plan a commerce for the Monday of the following week, and if there isn’t simply but then we WAIT for the every day chart to point out us one thing that following week. Additionally, the entries are all triggered by finish of day on the every day chart, we aren’t taking weekly chart alerts. However, if a weekly chart value motion sign did kind the earlier week, that WOULD CERTAINLY affect our strategy and selections on the every day and even 4 hour or 1 hour chart for that subsequent week.

Conclusion

This text has given you a glimpse into how I do my weekly market evaluation on the weekends. I hope now you’ll be able to see that market evaluation is definitely not all that troublesome, you actually simply have to make it right into a routine in order that routine develops right into a behavior.

As I discussed above, my weekly market commentary has turn out to be a behavior for me, even when I had no college students I might nonetheless be marking up the charts and making my weekly evaluation on the weekend, as a result of I understand how necessary it’s to my buying and selling efficiency. Staying in-tune and in-touch with the market is important to your buying and selling success. It’s essential to perceive the ‘story’ the chart is telling you and one of the simplest ways to do this is to do what I’ve outlined on this lesson.

Subsequently, my members commerce setups commentary is a superb software so that you can be taught from. You might be basically ‘within the trenches’ with me as I stroll via the charts and do my weekly evaluation. My weekend market overview, in addition to my members every day commerce setups evaluation will help you ‘look over my shoulders’ and see what I’m seeing as the value motion unfolds all through the week. More often than not I gained’t do something, as a result of I favor to not commerce simply any sign since I’m ready for the finest setups. So, get used to being affected person and make persistence your finest pal if you wish to be taught my buying and selling strategy.

You see, I need to enhance my chance of profitable and that’s the reason persistence is one thing anyone that learns my model of buying and selling should grasp. The act of buying and selling solely takes a small period of time, so there’s lots of down-time that we will use to additional our information by studying, learning, and dealing to grasp our craft. I can’t spoon-feed you, however I can present you ways I’m seeing issues available in the market by way of my buying and selling course and members commerce setups commentary. My hope is that by profiting from these instruments to ‘look over my shoulder’ as I perform my chart evaluation and plan trades, you’ll be taught one thing and begin placing all of the items collectively in order that in the future it is possible for you to to copy the identical or comparable buying and selling routine and obtain constant buying and selling success.

LEAVE A COMMENT BELOW & TELL ME WHAT YOU THINK …

Any questions or suggestions? Contact me right here.