Breakout Buying and selling: What Is It And How Does It Work?

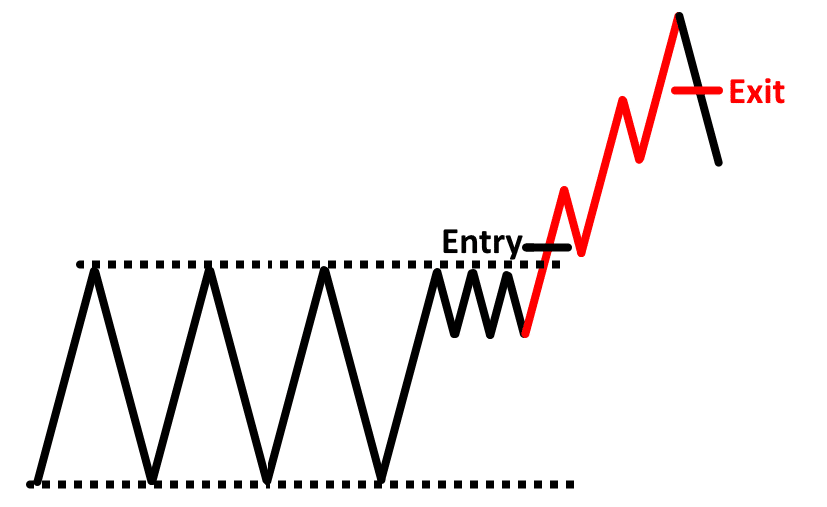

Merely put, breakout buying and selling is attempting to enter a inventory because it “breaks out” of its sample or key stage.

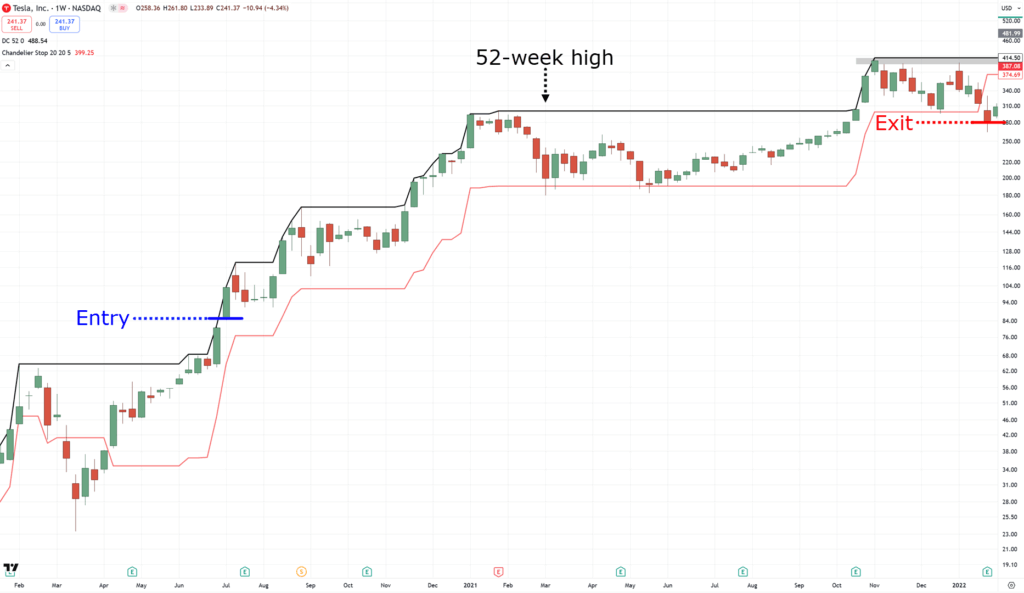

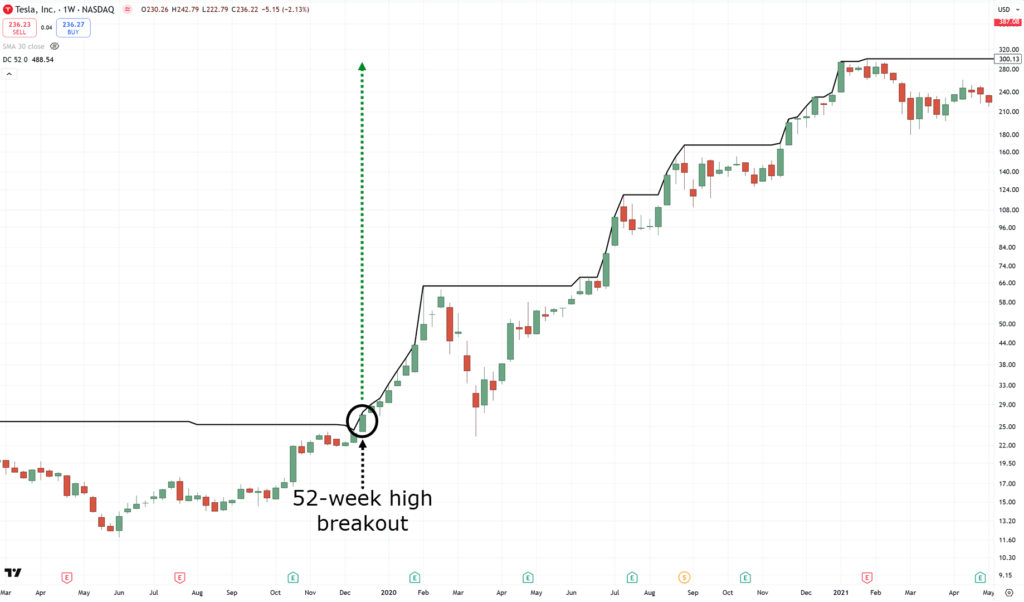

It may be coming into a inventory at any time when it makes a 52-week excessive…

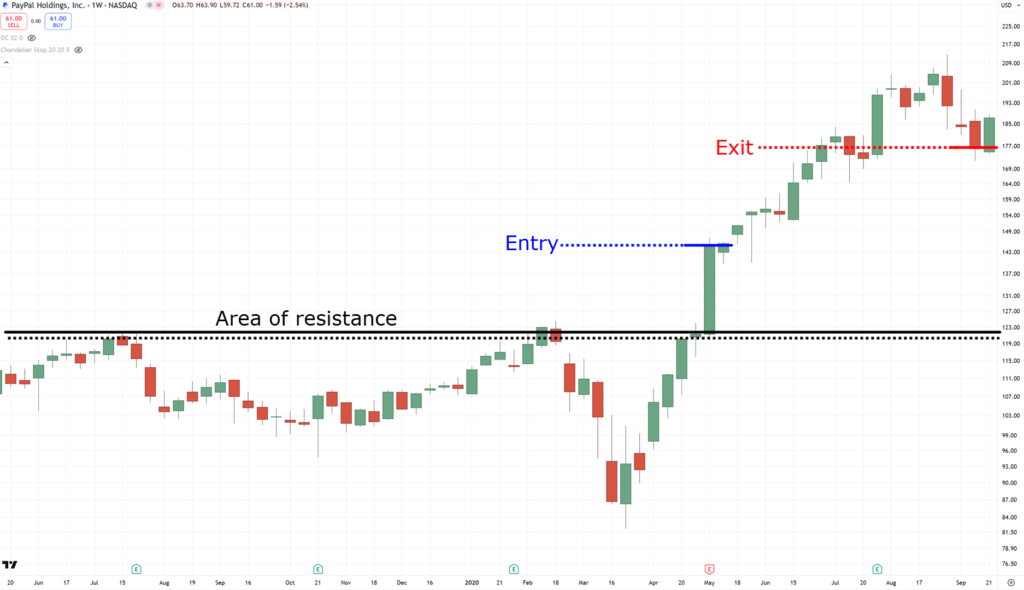

Or coming into at any time when it breaks out of its main space of resistance…

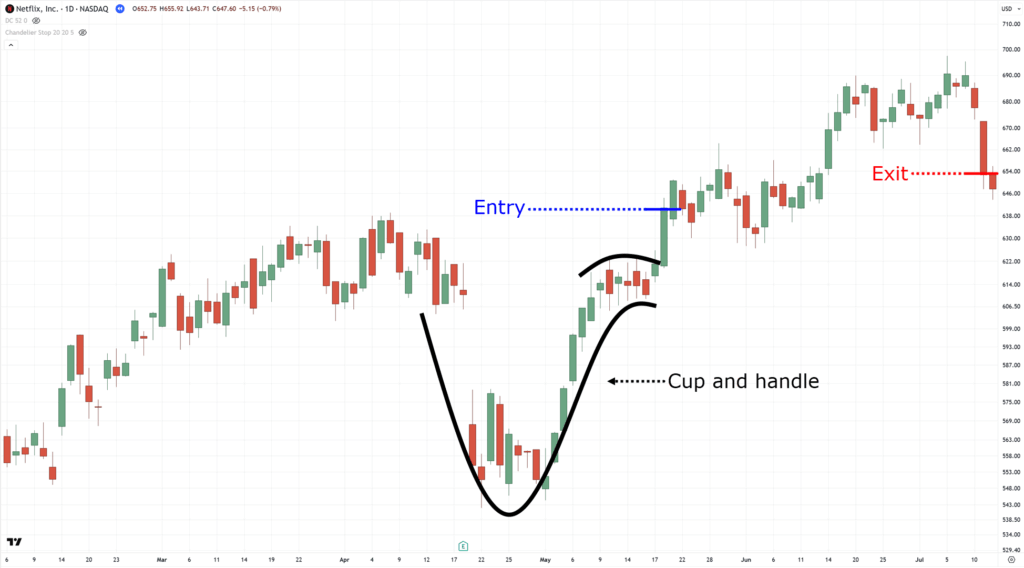

Or maybe even because it breaks out of its cup and deal with sample…

However whereas I’ve shared three ideas of how breakout buying and selling works with you…

…they at all times have one recurring sample:

Shopping for excessive and promoting larger

I’m positive you’ve heard numerous occasions from different merchants.

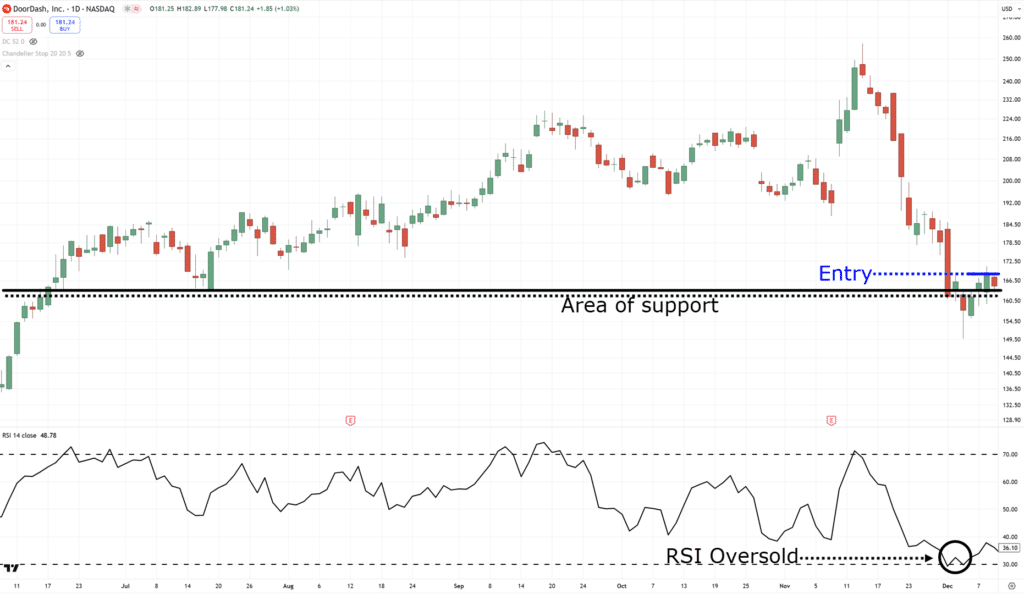

“Be certain to purchase when a inventory is oversold!”

“Purchase low and promote excessive!”

“Purchase when others are fearful, and promote when others are grasping!”

Whereas these statements have their deserves, in addition they carry the danger of shopping for in opposition to the present momentum!…

It’s like catching a falling knife or getting your intestine punched into the bottom like an anime character….

In hindsight, certainly, the market can probably provide nice rewards when shopping for low and promoting excessive.

However even when shopping for low on a inventory, it could actually typically go even decrease…

Can your intestine take that type of punch!?

That is the place breakout buying and selling has its benefits.

Why breakout buying and selling?

For one, you’re not going in opposition to the market’s momentum.

You’re attempting to “journey” a development getting in a sure path.

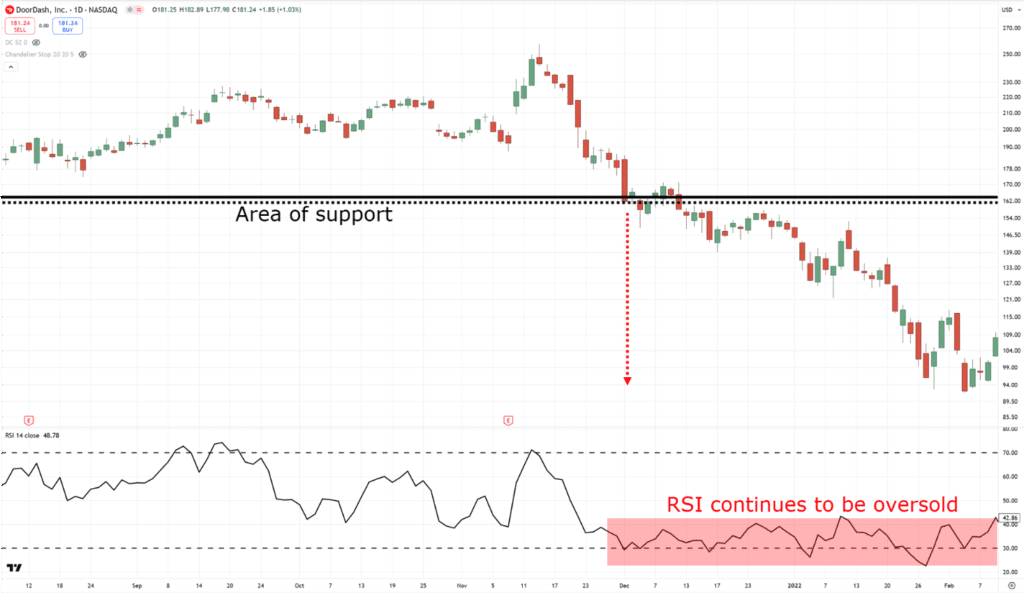

In truth, these developments can typically final for months and even years…

This will can help you seize monster strikes available in the market

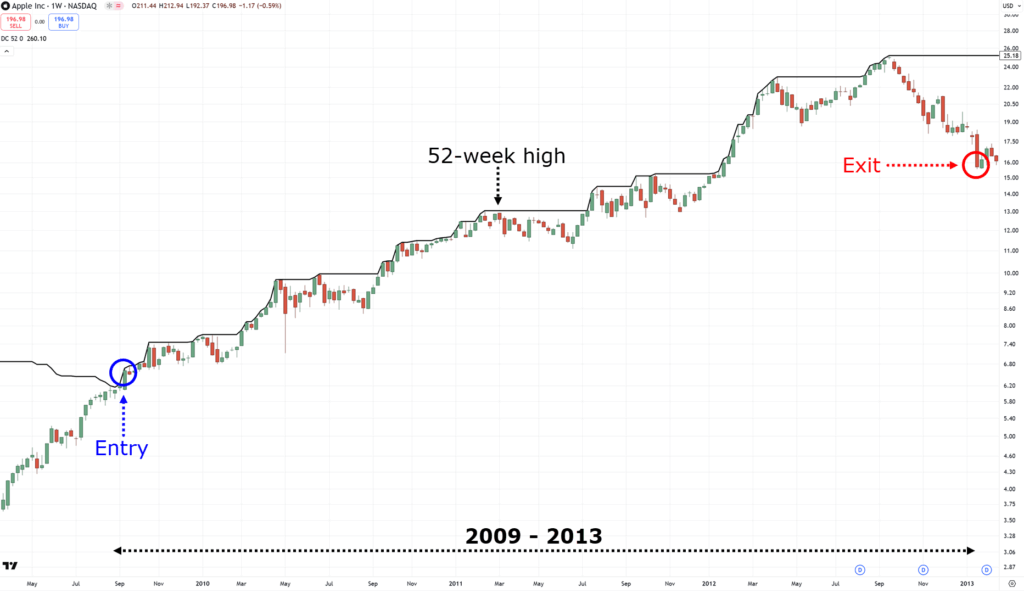

However in fact, breakout buying and selling has its downsides, as any system does

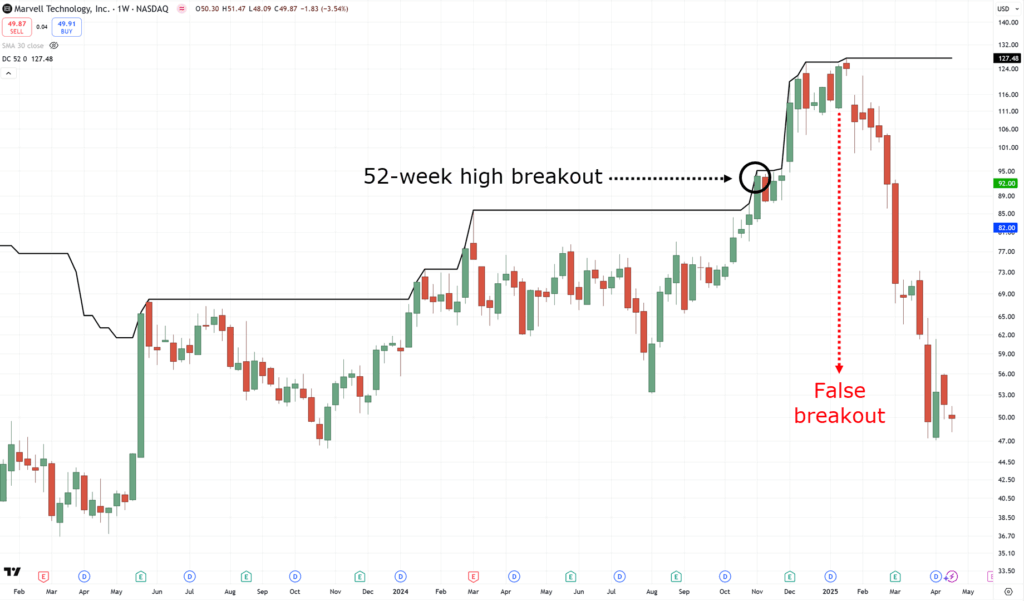

For instance, there are occasions when a breakout can flip into “false breakouts.”…

So, nothing is flawless!

At this level, you is likely to be considering:

“Which is the perfect Rayner?”

“Shopping for excessive and promoting larger or shopping for low and promoting larger?”

Nicely…

All ideas have their execs and cons, however the hot button is figuring out the right way to capitalize on the PROs and the right way to treatment the CONs.

That is precisely what I’ll educate you within the subsequent part.

The Secret To Making Income With Breakout Buying and selling

Earlier than I share some superior suggestions with you on what to do subsequent.

There’s one very last thing to cowl earlier than transferring ahead.

Why breakout buying and selling on the inventory markets?

The first motive is that it gives extra alternatives.

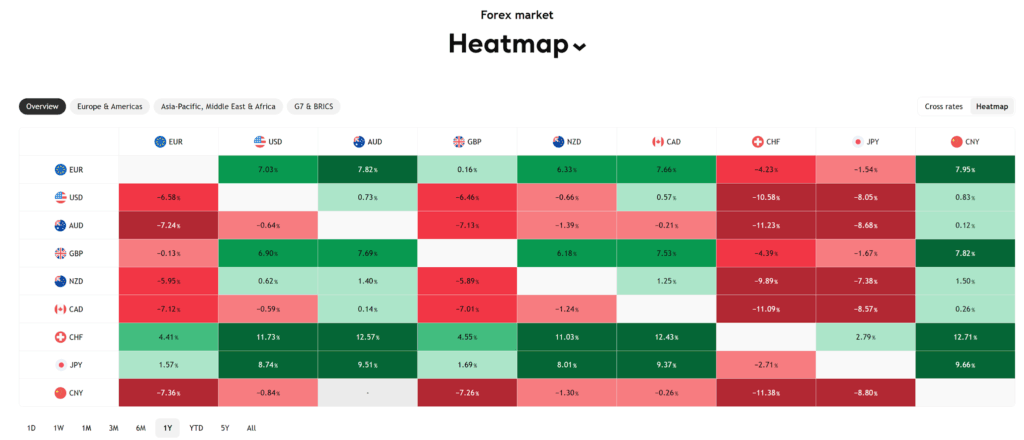

Take the foreign exchange market’s 1-year heatmap for instance…

Are you able to see how the efficiency is inconsistent?

You’d must pinpoint which pairs have been performing effectively to search out trades for breakout buying and selling.

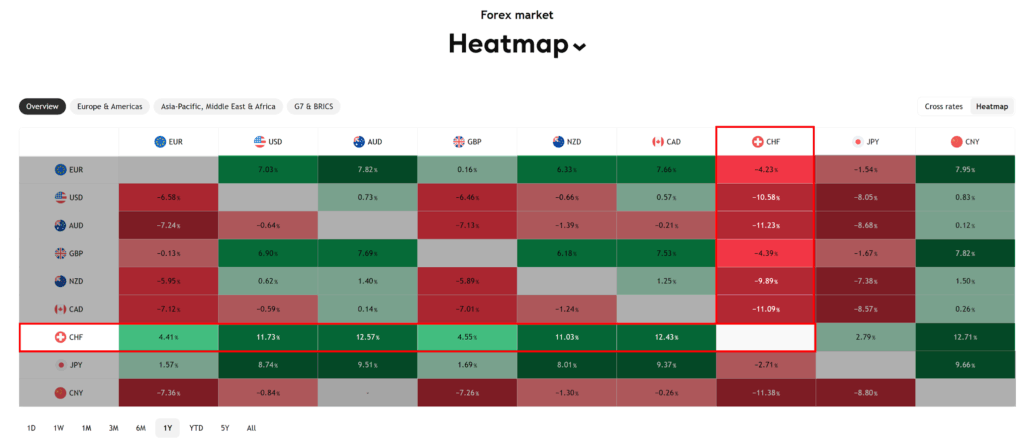

And even whenever you do, the alternatives are restricted, for instance, by specializing in the CHF pairs for longs and JPY pairs for shorts…

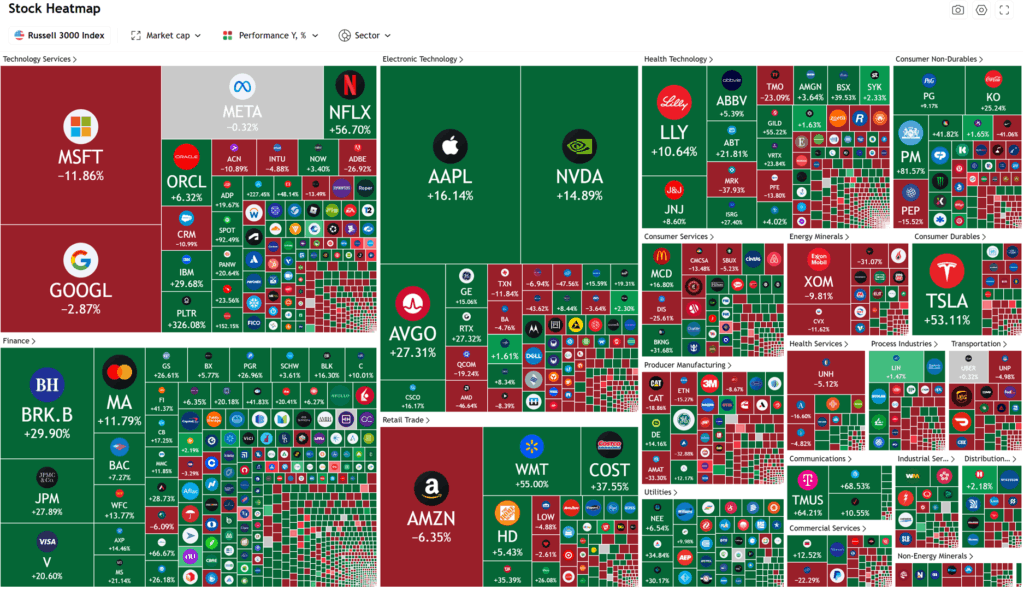

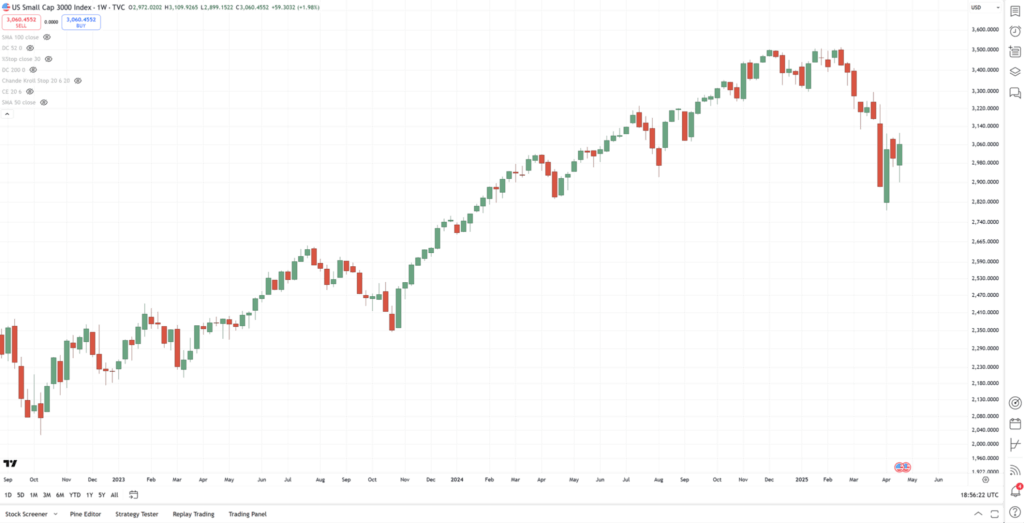

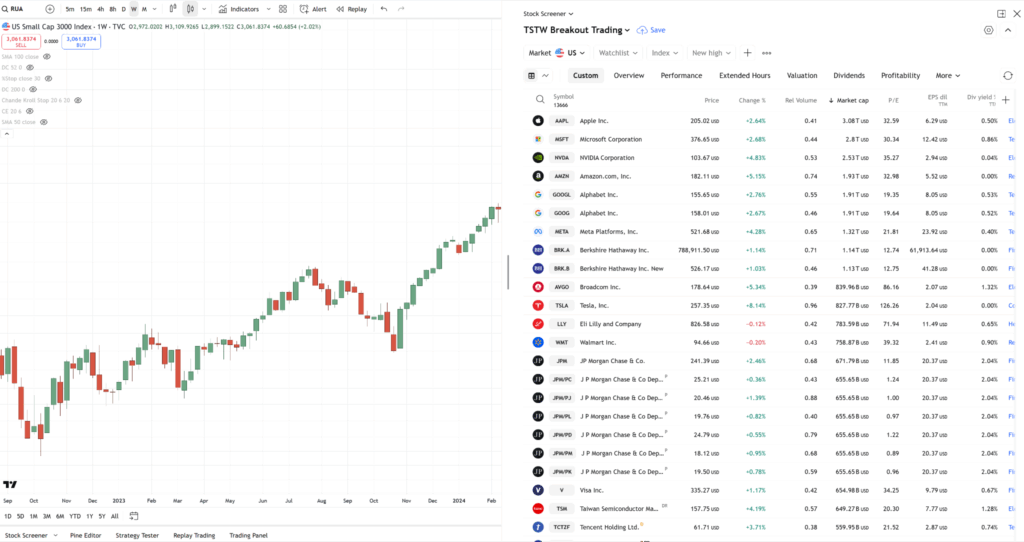

However what in regards to the 1-year heatmap of US inventory markets such because the Russell 3000?…

Woah… That’s a whole lot of shares!

However this time, you may extra simply spot which shares are doing effectively and which aren’t.

Are you able to see AAPL and NVDA bulging out of the heatmap with out squinting your eyes?

You get the purpose.

That is how buying and selling the inventory market enhances the strengths of breakout buying and selling.

Extra alternatives, higher developments, and probably greater earnings.

So now the following query is:

How precisely do you reap the benefits of this large market?

Nicely, the three superior suggestions I’ve been ready to share with you’re:

- Align with the broader market

- Use a trailing cease loss

- Apply threat administration and place sizing

Let me clarify…

Superior Tip #1: Align With The Broader Market

Let’s face it.

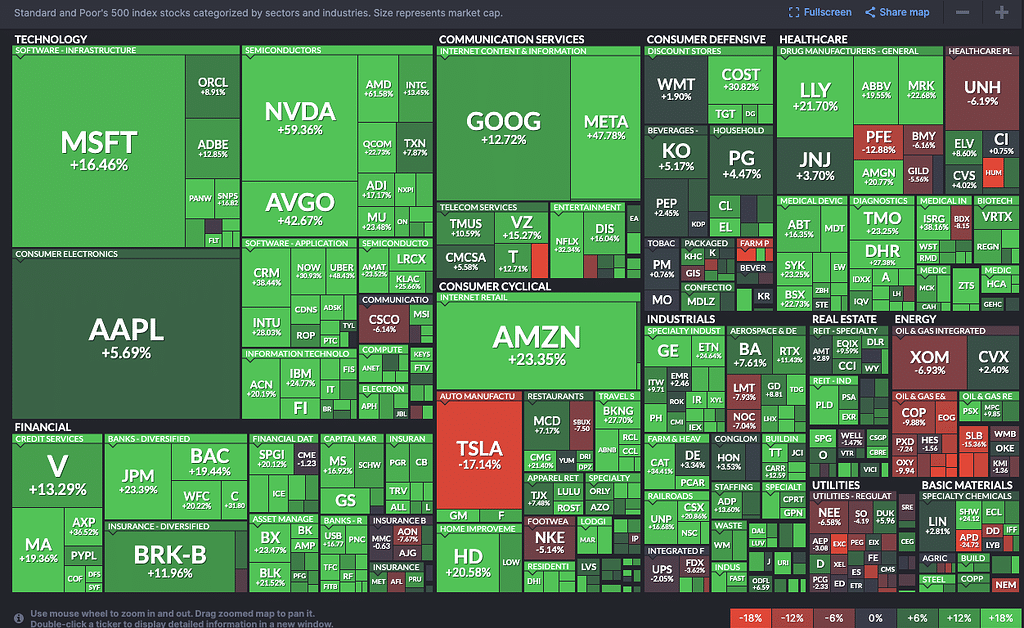

It’s all sunshine and rainbows when the market pulls off a pleasant efficiency…

As you may see, it’s like an ocean on the market – nearly all inventory on the heatmap is within the inexperienced!

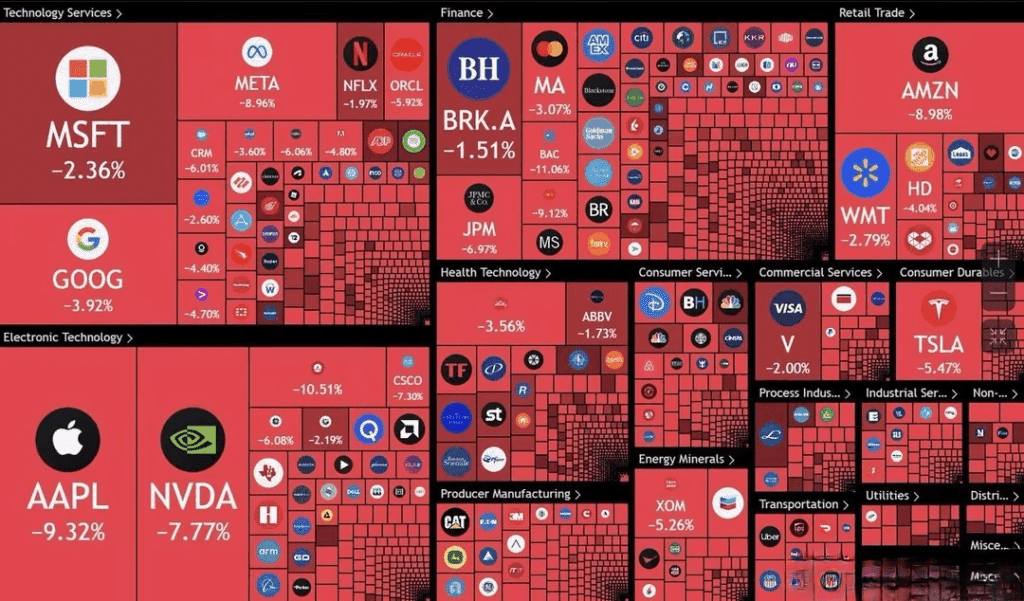

However on the similar time, when there’s concern available in the market, there’s a whole lot of blood within the water…

Now, each heatmaps I lately shared with you’re cherry-picked to indicate extremes.

Nevertheless it’s to focus on how developments are a typical conduct within the inventory markets.

So, what must you do?

Easy, keep on the fitting facet of the market!

When there’s a bull market => Go lengthy

When there’s a bear market => Keep money

Is smart, proper?

However it’s possible you’ll ask:

When precisely must you go lengthy and keep money?

What’s the on/off change right here that you should use as a reference?

On this case, you should use a long-proven and examined idea…

An index filter

As a substitute of sifting by tons of of monetary stories and articles simply to know whether or not or not you need to keep money, undertake an index filter.

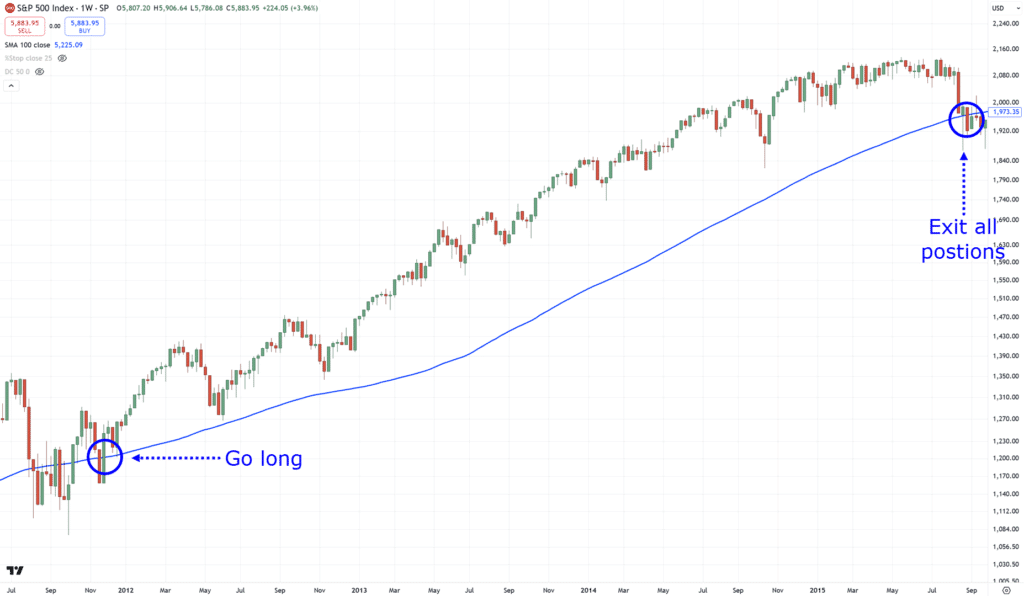

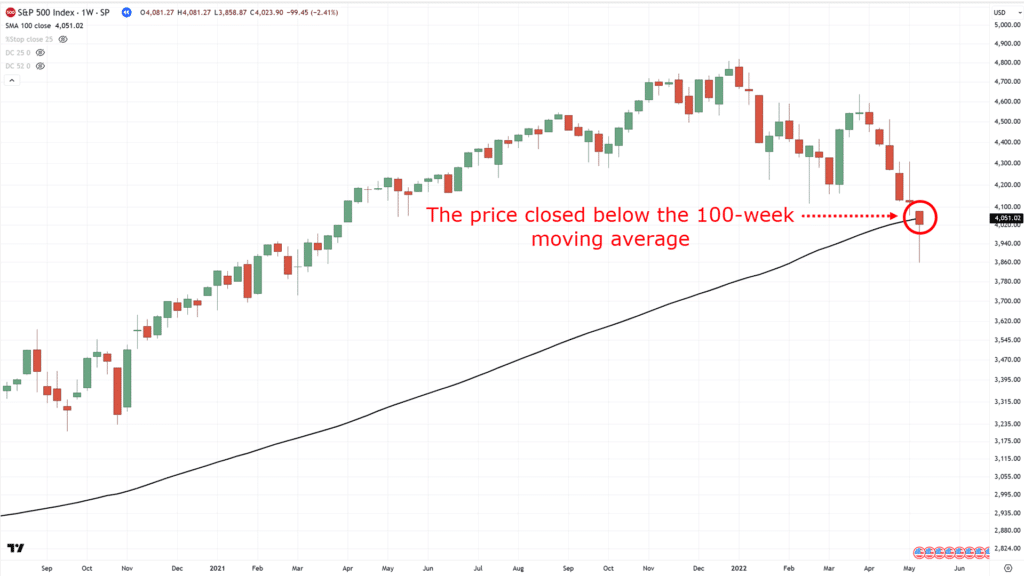

For instance, if buying and selling the S&P 500 index, pull a 100-week transferring common in your chart.

If the worth closes above the 100-week transferring common, you begin searching for buying and selling alternatives…

If the worth closes under it?

You exit each single inventory you personal and keep in money…

Positive, the alerts could be blended at occasions.

However this gives you with a scientific manner of figuring out when to be on the fitting facet of the tide.

This improves your outcomes and in addition reduces your losses.

Don’t imagine me?

Then let me do a statistical take a look at for you.

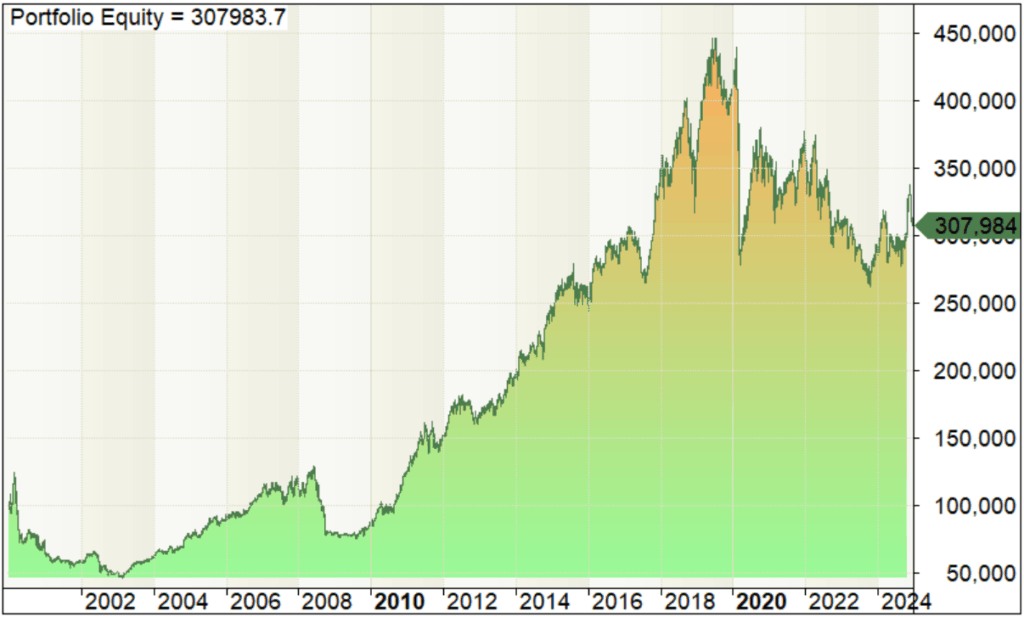

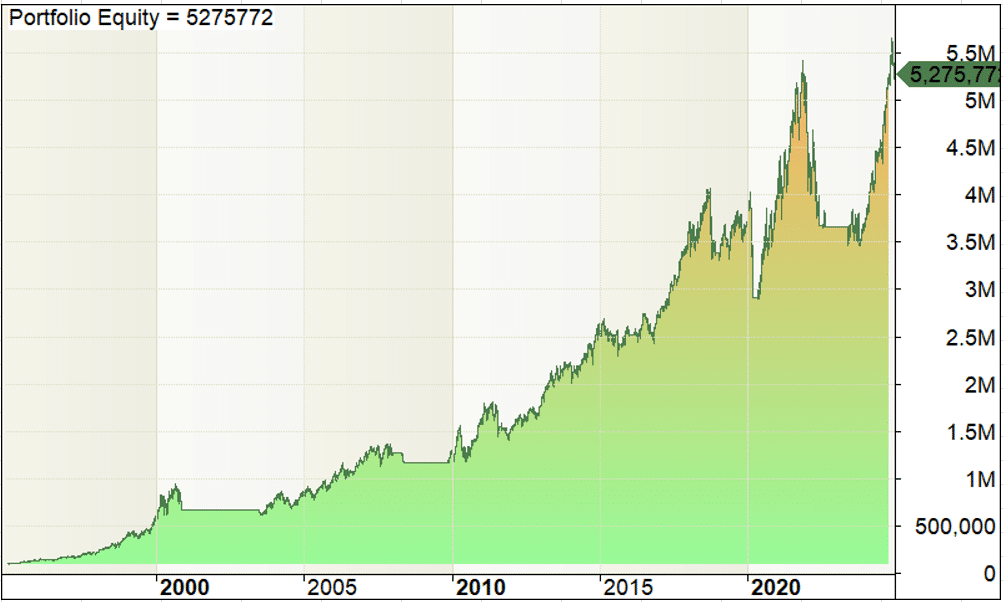

Right here’s a efficiency of a inventory trend-following system that trades within the S&P 500 with out utilizing an index filter…

Positive, it makes cash within the markets, however the outcomes?

Not so good!

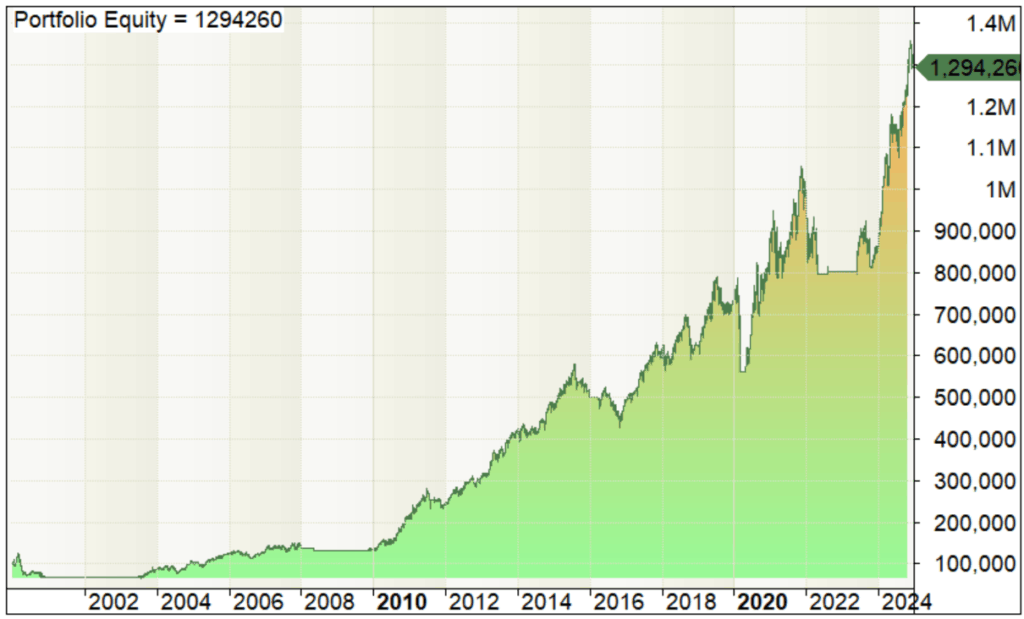

However how does it examine now whenever you put an index filter on it with the identical guidelines and all?…

Growth, large distinction.

And all it took was simply including a single index-filter rule!

So, now that when to and when to not commerce.

How have you learnt when to exit your commerce?

Let me share it with you subsequent…

Superior Tip #2: Use A Trailing Cease Loss

By now, you perceive that the objective is to purchase excessive with the tide and promote larger as that tide ends.

Positive, there can be occasions the place breakouts could be short-lived as you make a little bit of a revenue, after which the market reverses in opposition to you…

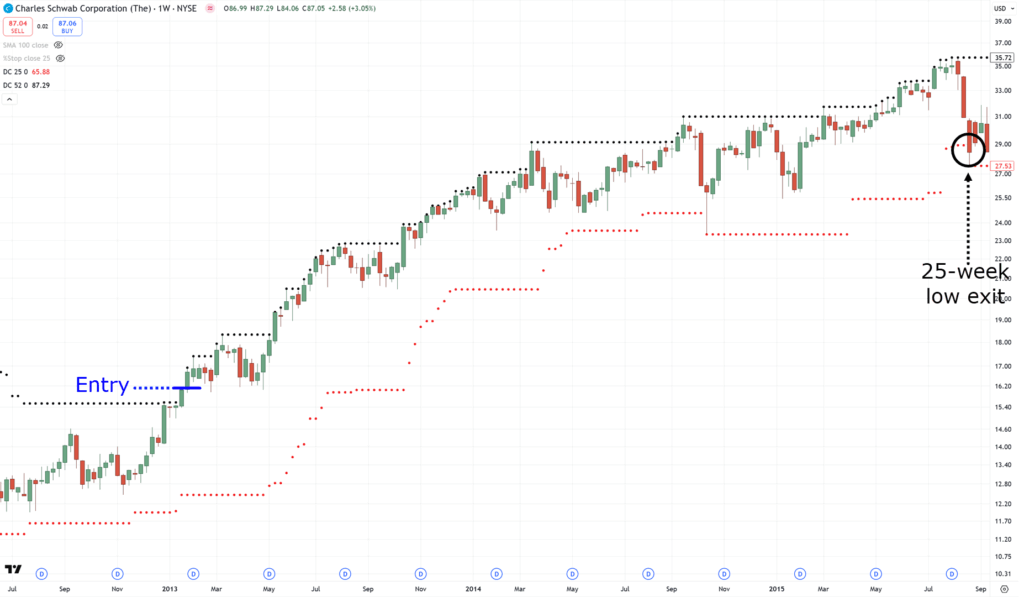

However on the similar time, monster strikes resembling this could occur, the place it looks like the sky is the restrict…

General, with regards to breakout buying and selling, what issues is that you just by no means understand how excessive the inventory can go.

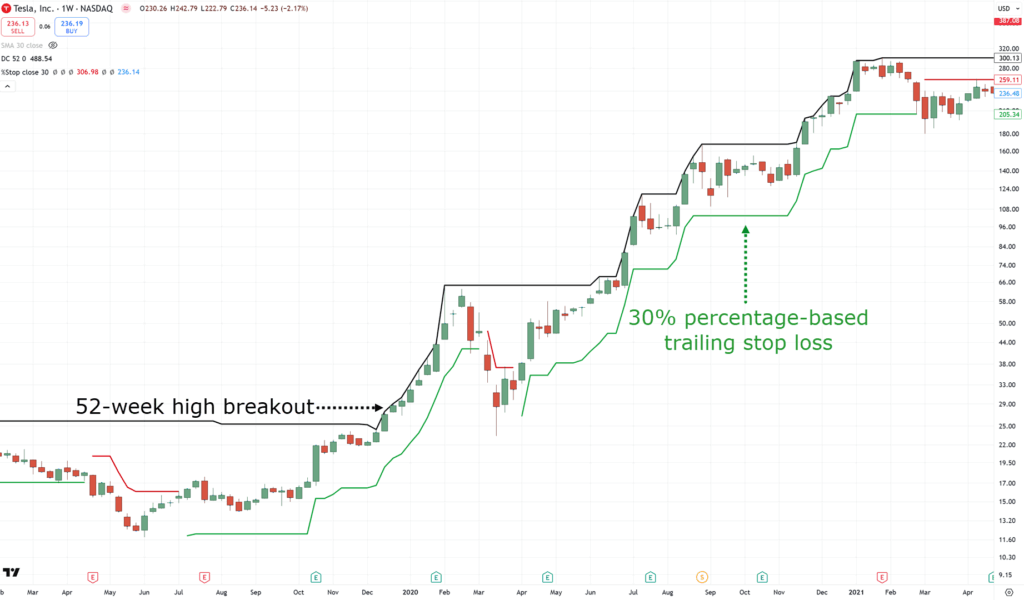

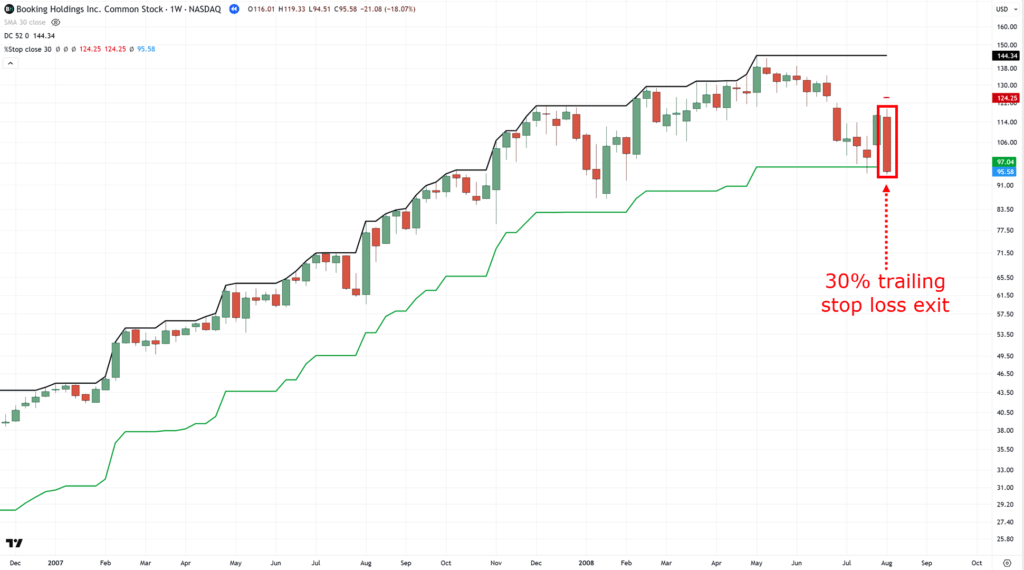

There are numerous alternative ways to path your cease loss, resembling with indicators just like the transferring common, Donchian channel, or common true vary…

Nonetheless, I’ll share with you a trailing cease so easy that it truly works – a percentage-based trailing cease loss!…

Utilizing this methodology signifies that you’ll maintain the inventory till it declines 30% from its peak, for instance…

It’s so darn easy, proper?

There’s no must memorize fancy formulation, simply primary math!

Now, if you wish to seize short-term developments, then you may undertake a ten% to twenty% percentage-based trailing cease loss.

However if you happen to go by the precept of attempting to journey “large” long-term developments, then you definitely’d wish to think about using 30% or larger.

Acquired it?

Now, I do know it’s simple to cherry-pick these attractive shares that went to the moon.

However as …

That’s not how actuality goes, proper?

Oftentimes, the market both reverses in opposition to you the second you hit that purchase button, or smells your take revenue stage after which crashes again right down to the bottom!

So, how do you treatment this?

How do you “enhance” your luck in breakout buying and selling within the inventory markets?

Let me share the following and ultimate superior tip on this part with you.

Superior Tip #3: Apply Danger Administration and Place Sizing

You possibly can by no means get rid of the truth that sooner or later, the inventory that you’ve got entered will go in opposition to you.

…otherwise you get a breakout setup that all of a sudden fails.

However at this level, you need to think about them “enterprise prices.”

The excellent news is that you would be able to cut back these prices by selection:

Diversification by portfolio allocation

Now that is only a fancy manner of holding a number of shares on the similar time.

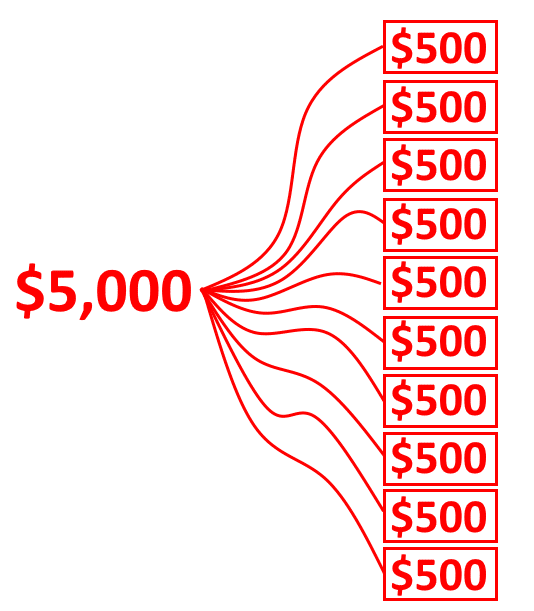

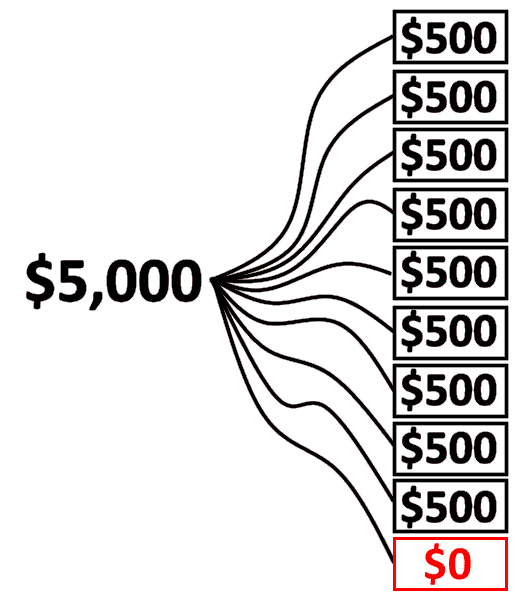

So, in case you have a $5,000 account, for instance, and you’ve got a 10% portfolio allocation rule…

Which means you received’t purchase a inventory value greater than $500.

And sure, you guessed it: This provides you a most open commerce of 10…

The explanation why you need to do that is that you would be able to by no means know exactly which inventory will do effectively or badly.

By adopting a portfolio allocation, even when one in every of your shares goes to zero, you’d nonetheless have sufficient funds to push on buying and selling…

However…

By holding a number of shares in your portfolio, you have got a very good likelihood of catching long-term breakouts available in the market.

Even when it’s only one or two shares, it could simply be sufficient to push your portfolio again to the inexperienced or extra.

So, now that the ins and outs, in addition to “why” behind breakout buying and selling.

You may as effectively name your self the grasp of breakout buying and selling!

However to consolidate every little thing you’ve realized thus far, I’m going to share with you a confirmed and backtested breakout buying and selling system that works.

You prepared?

Then let’s get began!

A Breakout Buying and selling System That Works

Here’s what makes this information additional particular.

A whole breakout buying and selling technique with its full backtesting outcomes, to indicate you the way it has carried out within the inventory market.

In fact, previous outcomes are by no means indicative of future outcomes.

However let me ask you:

Would you commerce a system if it carried out poorly up to now?

No manner, proper?

And that’s what I need you to grasp right here.

This breakout technique has generated 5,175.77% over the past 30 years.

To start, although, listed here are a few vital particulars about this breakout buying and selling system it is advisable know:

- This method trades off the weekly timeframe solely

- This method has been examined to commerce on the S&P 500 whereas utilizing the index itself as a development filter

- This method makes use of a ten% portfolio allocation, which supplies you a most of 10 shares in your portfolio (bear in mind what I taught you earlier?)

Now, let’s undergo the principles of this method collectively.

The S&P 500 is above the 100-week transferring common

Bear in mind this idea I taught you some time again?

That is the exact same spine of this method.

However as a refresher, all you need to do is pull out a 100-period easy transferring common and go to the weekly timeframe…

So long as the worth is above it, you maintain your trades or carry on opening trades in line with the principles.

Fundamental stuff, proper?

So, what’s the following factor to search for?

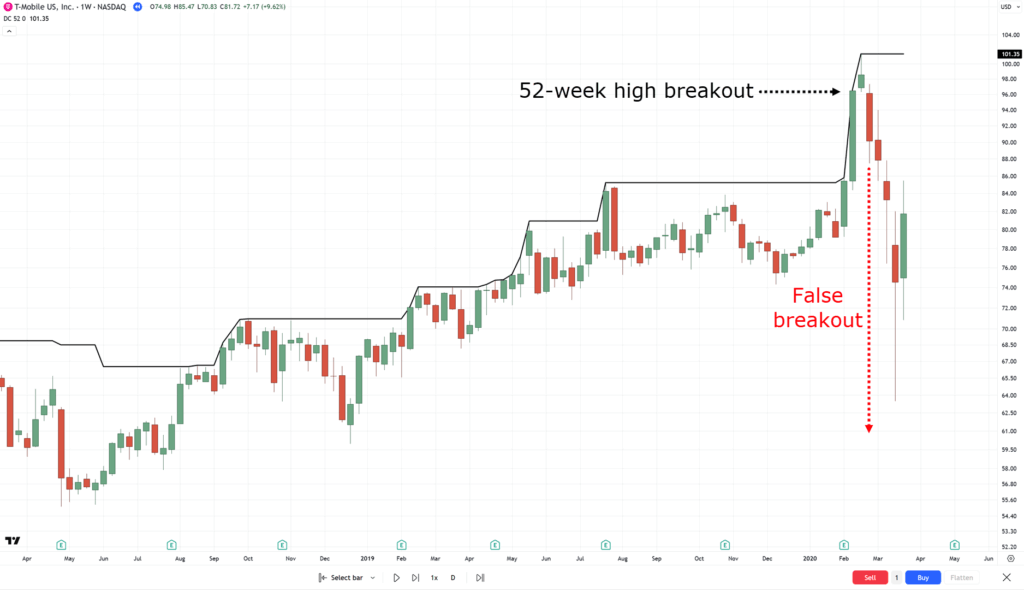

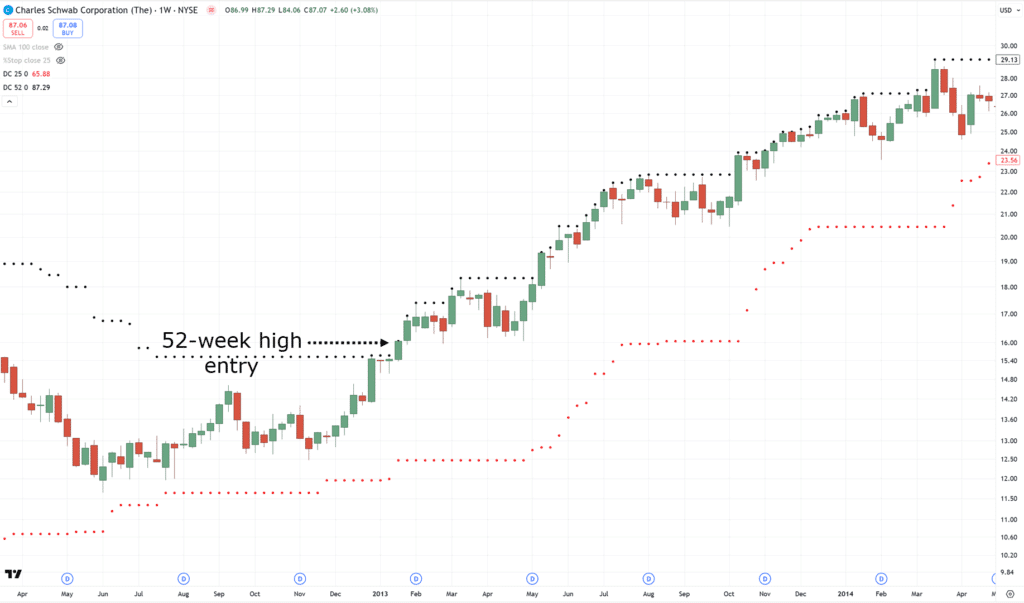

If the inventory makes a brand new 52-week excessive, then purchase the inventory on the subsequent week’s open.

The rule is just about self-explanatory, proper?

Nonetheless, the wrestle right here is discovering all-time highs constantly.

There are about 500 shares within the index we’re buying and selling at.

It might be insanity to look over all of these shares manually each weekend!

So, what’s the answer?

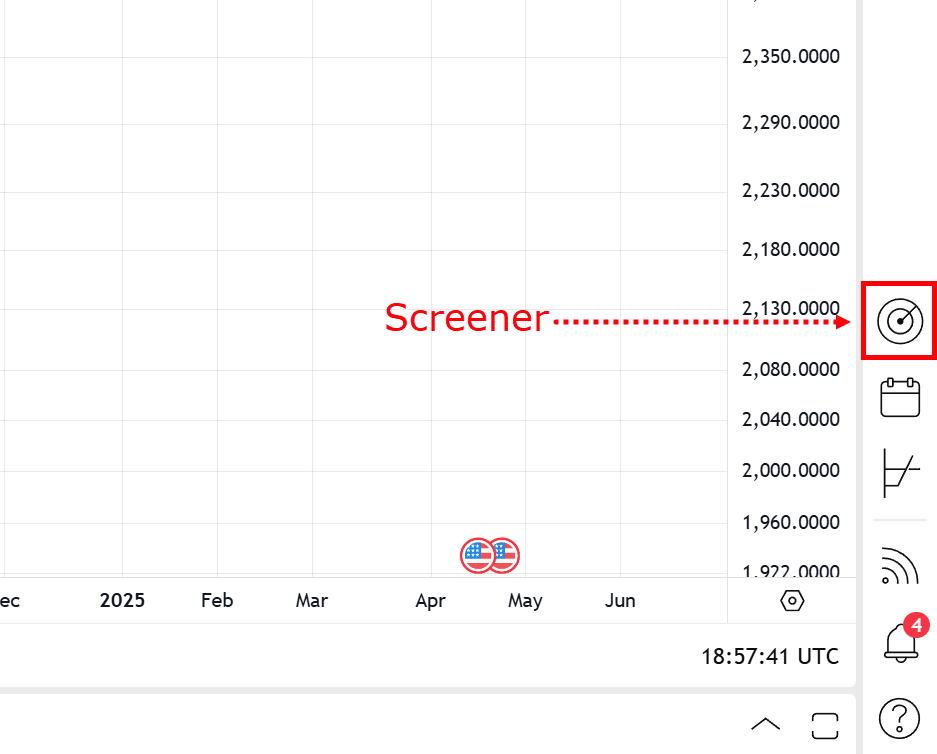

You guessed it, a inventory screener.

Fortunately, the rule is easy sufficient that you should use a few free screeners and make this work.

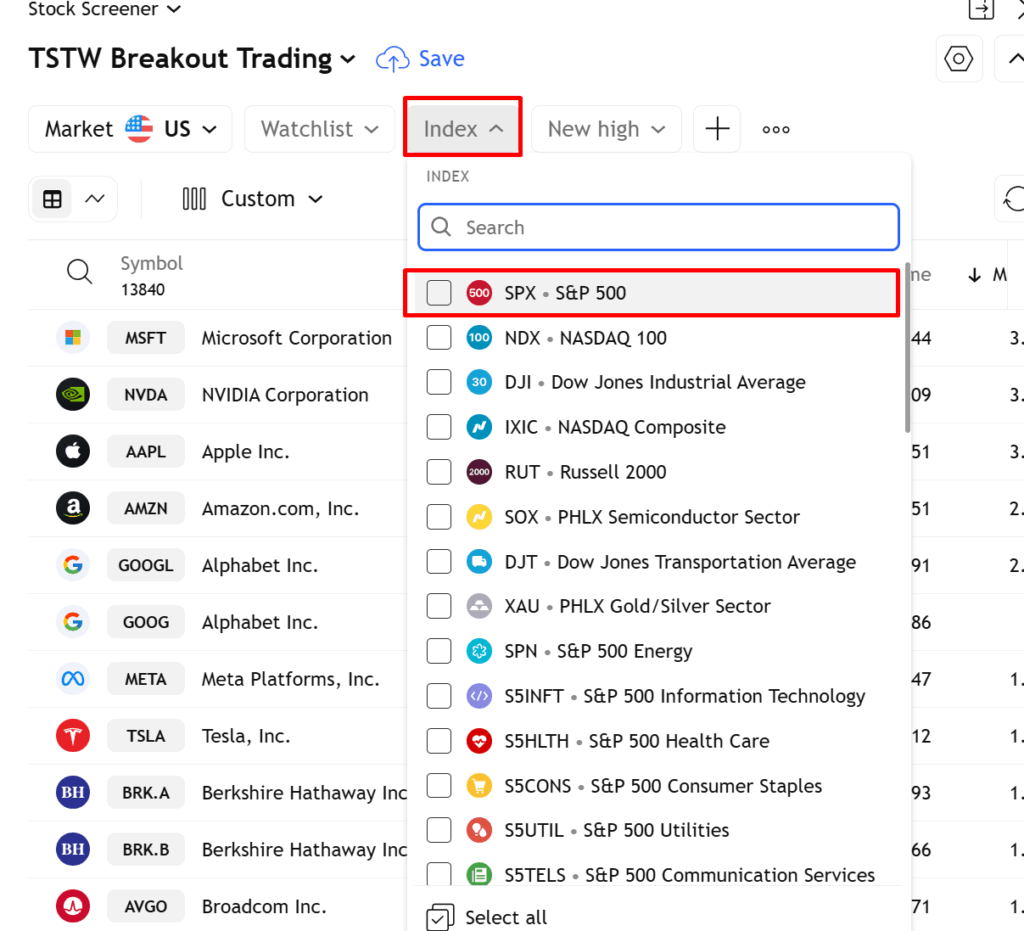

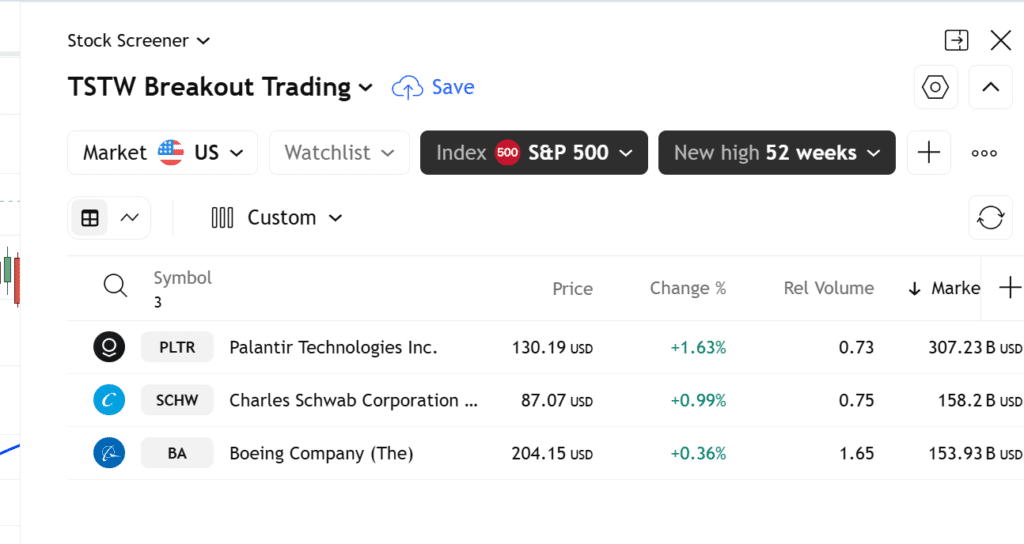

One such screener is thru TradingView!

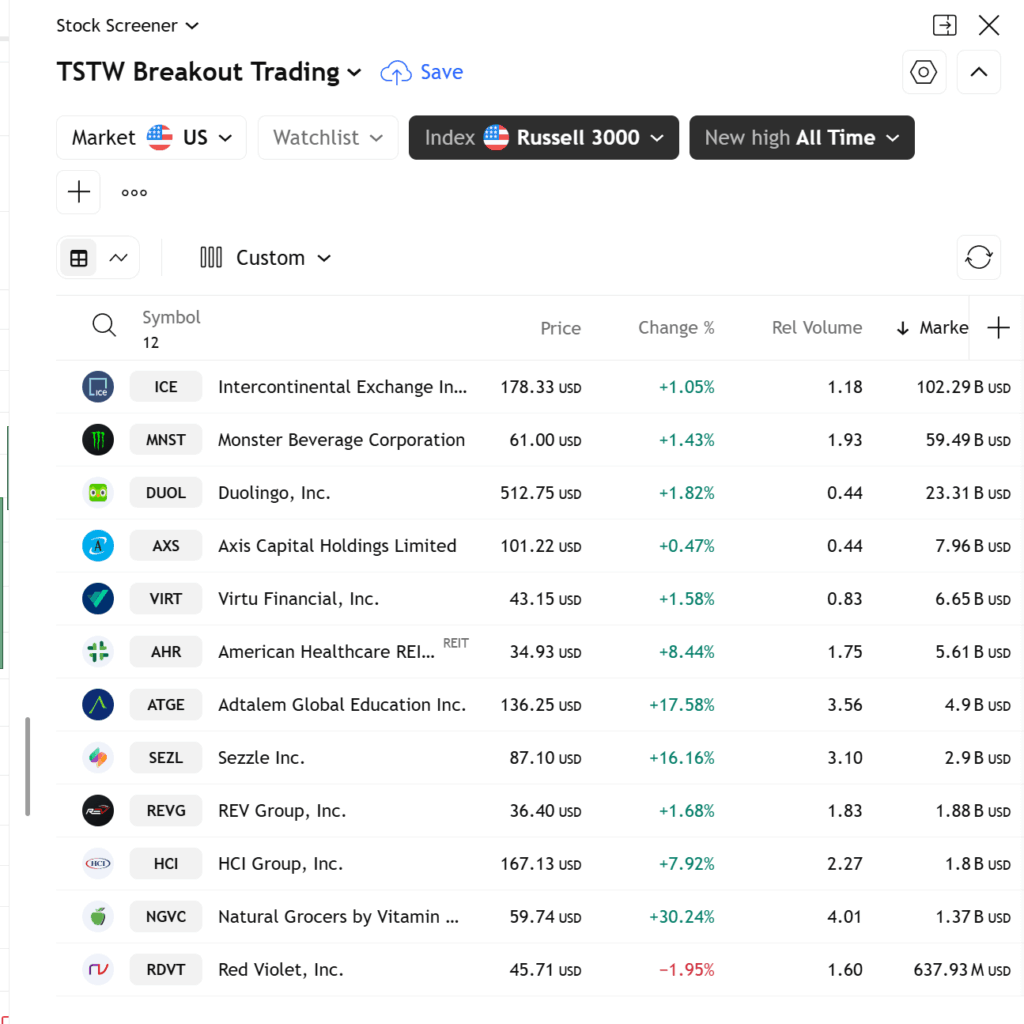

Now, if you happen to go to TradingView’s charts, we’d in all probability see the identical factor right here…

However what you wish to concentrate on is that this button right here…

And now it ought to present one thing like this…

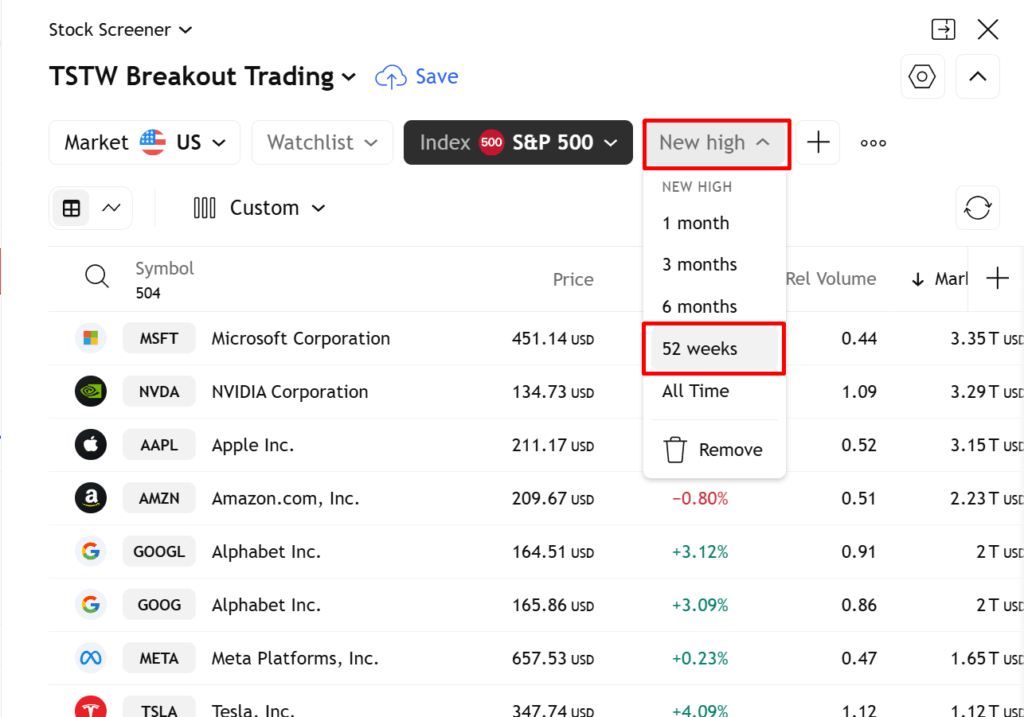

Recall, we’re buying and selling the S&P 500, and we’re searching for all-time highs right here.

So, all that issues is setting your index to S&P 500…

…and ensuring that you just allow the “new excessive” filter and set it to 52 weeks…

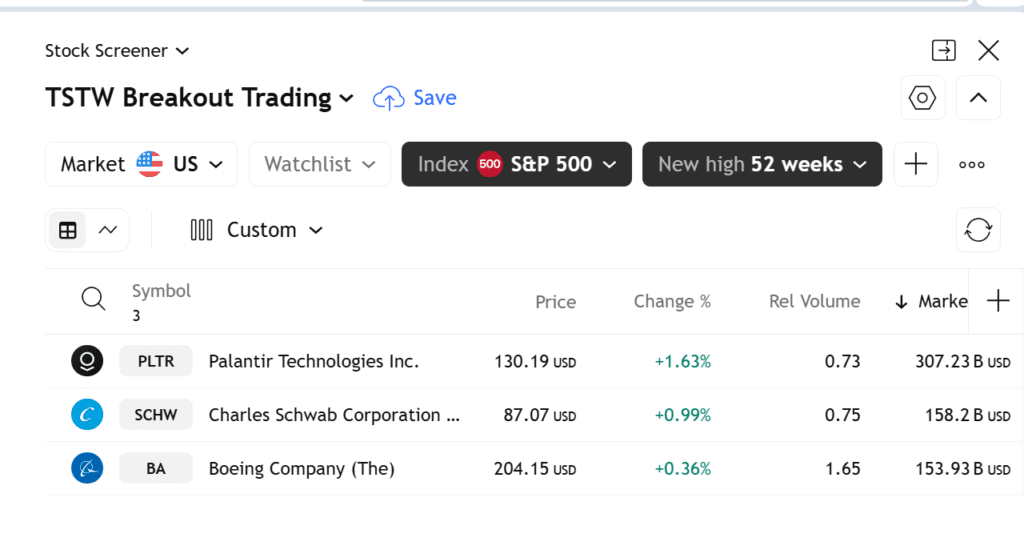

As of scanning right this moment, listed here are the shares that got here up on my checklist…

Bear in mind, you solely do that scan as soon as every week, each weekend, ideally when the earlier week’s market is closed.

So, with these shares on the checklist, what’s subsequent?

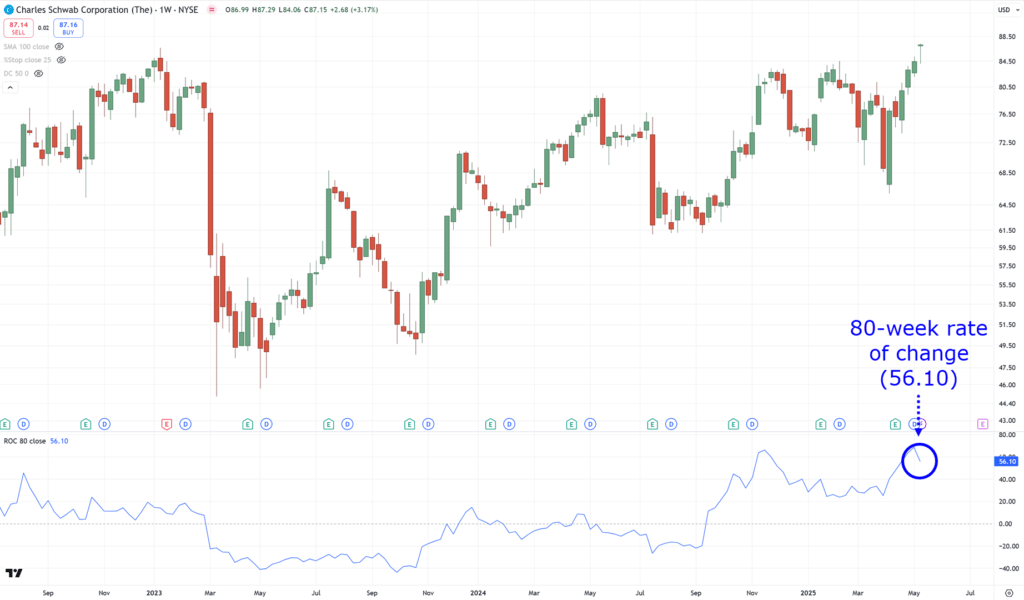

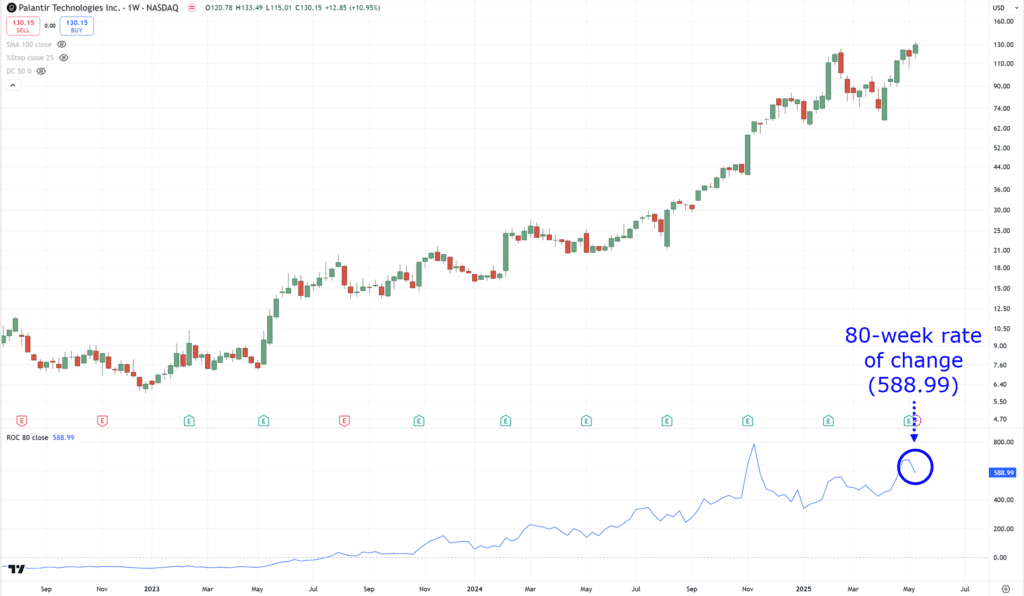

Rank shares based mostly on the 80-week charge of change, and prioritize buying and selling shares on the high of the rating

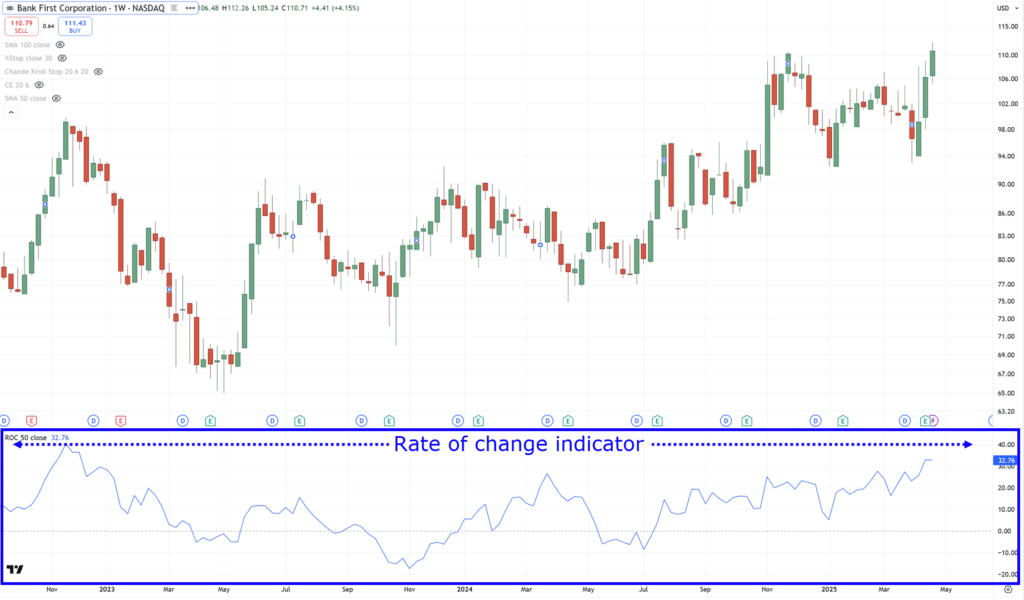

This step might sound new, however we’re incorporating a rating device known as the Price of Change (ROC).

The speed of change indicator seems one thing like this…

What it does is just measure the power of the inventory.

It doesn’t present oversold or overbought circumstances. Merely put, the upper the ROC worth, the stronger the inventory, which is simply what we’re searching for!

So, based mostly on the shares which have made their 52-week excessive closes based mostly on the screener I shared with you some time in the past…

You now individually take a look at these shares on the checklist and get their 80-week charge of change values.

Listed below are their values…

So, based mostly on the ROC rankings, you’d wish to enter a commerce with PLTR first, then SCHW, then lastly BA.

Fortuitously, there aren’t a whole lot of shares on the checklist.

Nonetheless…

There can be occasions when your scans may appear like this…

And also you is likely to be questioning…

“Wow, ought to I enter all of these shares?”

Nope!

Bear in mind, you have got 10 max open trades.

The rule is to solely allocate a most of 10% of your portfolio per inventory!

And this is the reason you rank shares based mostly on ROC, in order that which of them to commerce first.

So, now that you just’ve entered the inventory.

How must you handle it, or exit it?

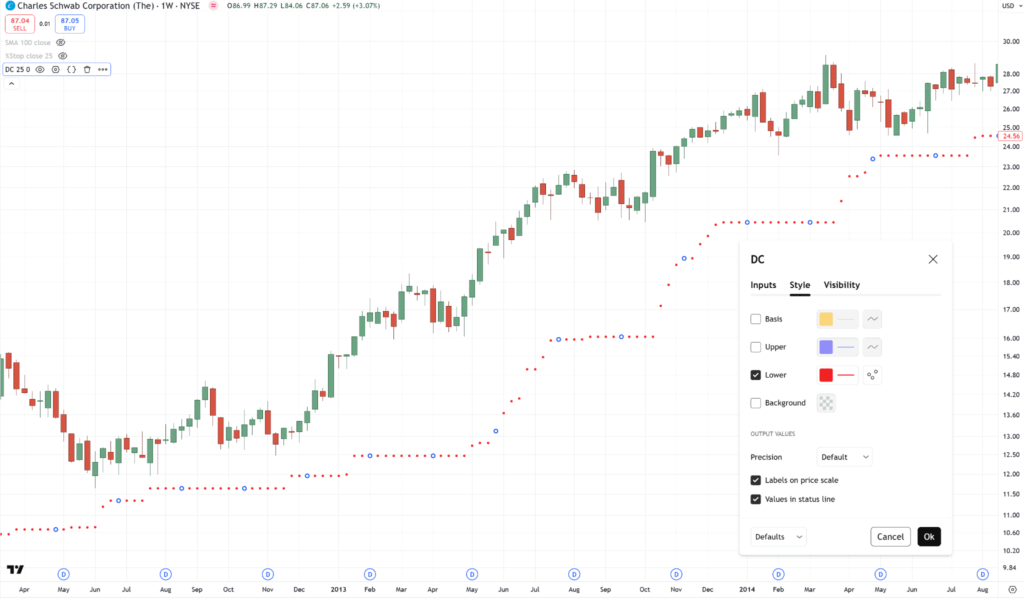

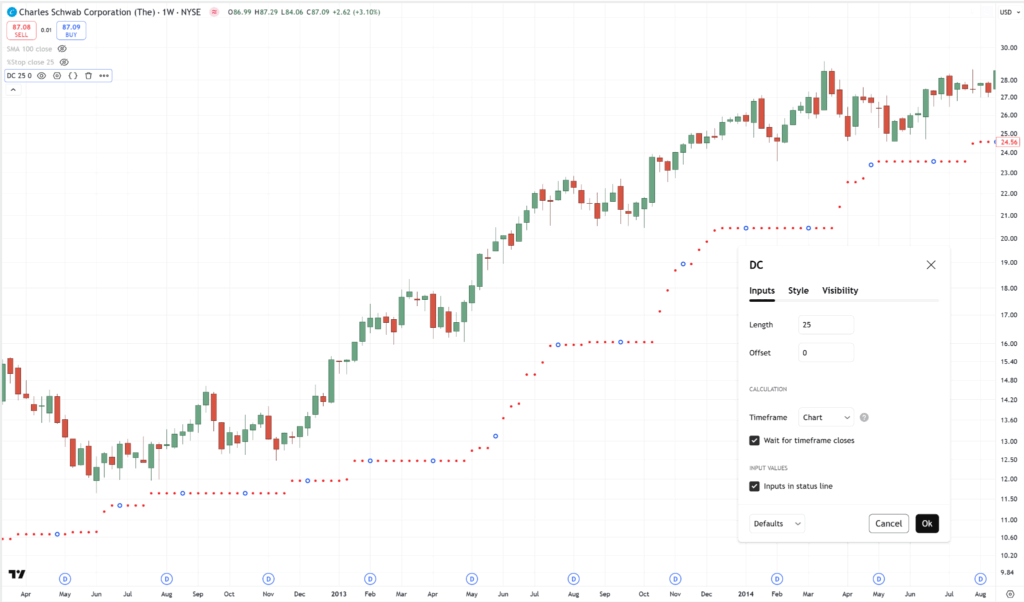

If the inventory closes under the 25-week low, then promote the inventory at subsequent week’s open.

For this rule, you may merely use the Donchian Channel, the place the decrease channel is the one one being proven…

And on the similar time, the interval is about to 25…

Once more, we’re buying and selling the weekly timeframe – be sure that your chart is about to it.

So now, for instance, you’re in a commerce and a inventory has gone manner in your favor…

You’d solely wish to exit this commerce if the inventory closes under its 25-week low…

Fairly easy, proper?

How about exits, although?

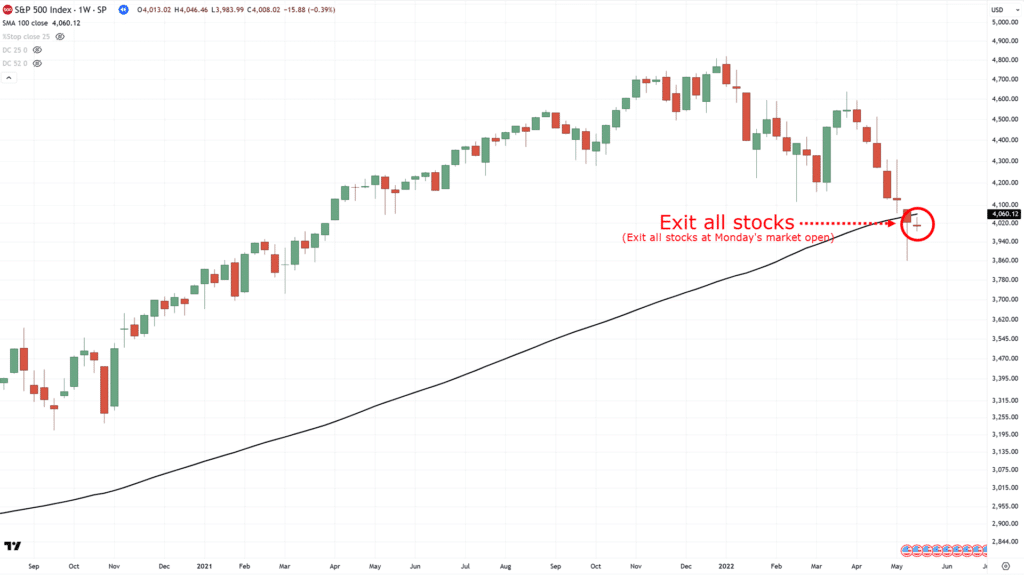

If the S&P 500 is under the 100-week transferring common (based mostly on weekly shut), then exit all positions at subsequent week’s open.

When issues are nice, hold holding on to your trades.

However what must you do when it crosses under the 100-week transferring common?

Simple, if the worth closes under the transferring common on Friday, for instance…

Then on Monday, the second the market opens, you exit all positions and keep in money…

Acquired it?

So now that the principles, does this method actually work within the inventory markets?

How a lot does it make per 12 months?

Nicely, keep tuned as I’m about to indicate you what an “edge” seems like within the markets.

Breakout Buying and selling System Outcomes

As , that is an goal buying and selling system with clearly outlined guidelines.

This implies you may backtest this buying and selling system and see the way it fares.

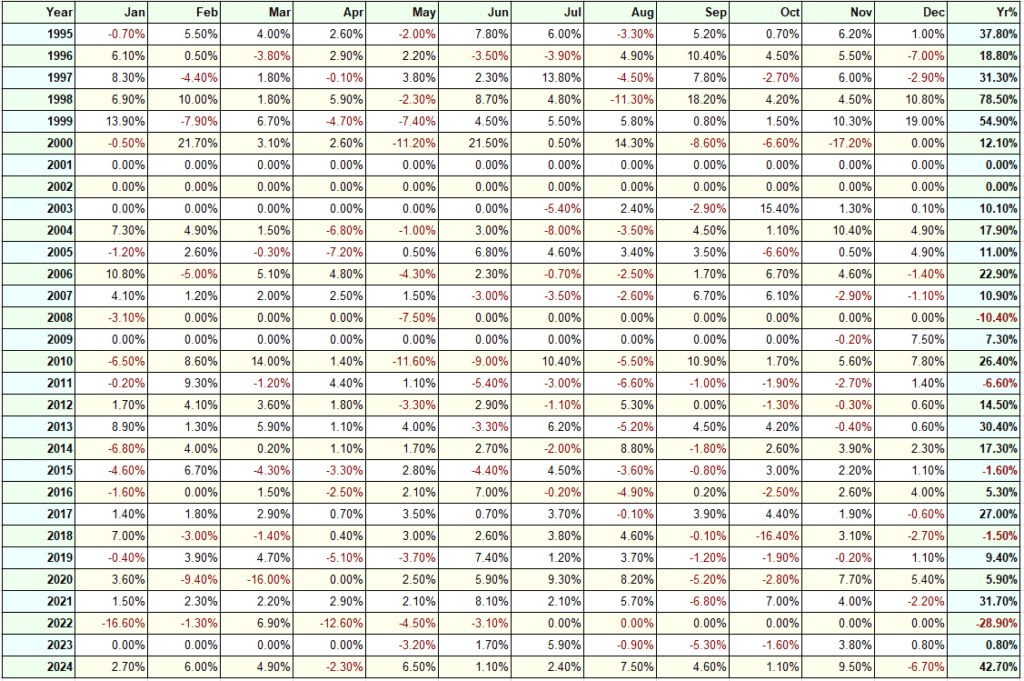

The backtest length is from 1995 to 2024.

That’s a whole lot of knowledge!

Nonetheless, it has gone by a few crises such because the 1997 Aian monetary disaster, the 2008 monetary disaster, the 2020 Covid disaster, and even the Russia-Ukraine battle.

This method has survived all of them and continues to be making earnings.

So, listed here are the outcomes…

- Variety of trades: 320

- Common Annual return:13%

- Most drawdown: –12%

- Successful charge:50%

- Payoff ratio:38

As you may see, the breakout buying and selling system has had 5 dropping years over the past 30 years.

Nonetheless fairly spectacular, proper?

Now, whereas this method makes a median of 14.13% a 12 months, these numbers are usually not assured.

Generally, you’ll make large features like in 2024.

However typically, a 12 months could find yourself as painful as 2022.

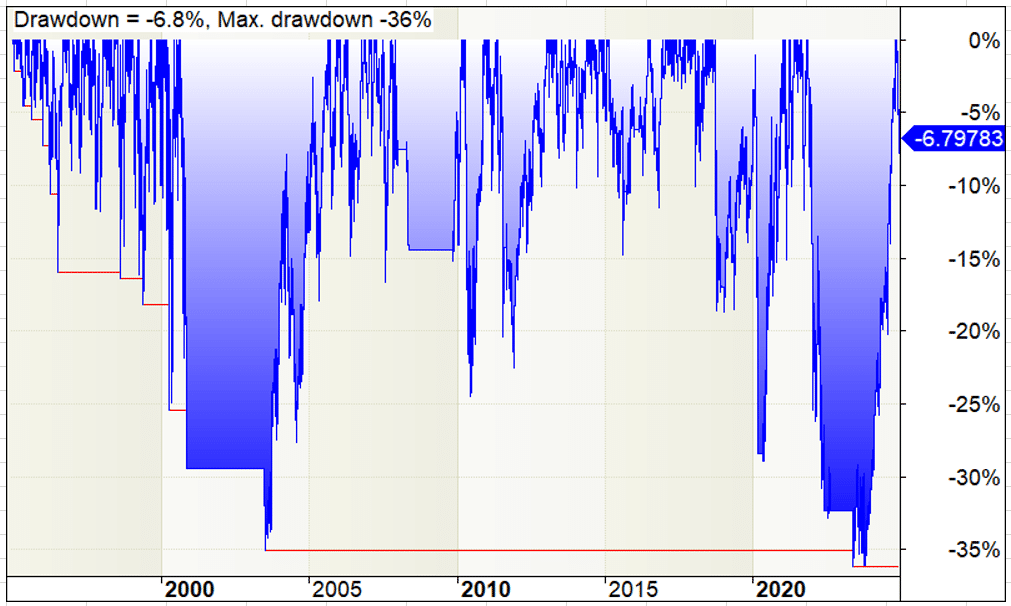

So, simply so as to add how the system performs throughout unhealthy occasions, right here’s an underwater fairness curve as a bonus:

It reveals how typically the system goes right into a dropping streak, and the way steep they’re.

So be ready!

And there you go – an entire breakout buying and selling system that has a quantifiable edge within the markets!

However in fact…

Studying a method is one factor, however executing it constantly is the onerous half.

As losses go, you’ll begin asking the deeper questions…

“Why this indicator?”

“I’m wondering if I ought to modify the settings?”

“Why not use this idea?”

And this is the reason I created an FAQ…

Incessantly Requested Questions

Lastly, listed here are some generally requested questions on breakout buying and selling.

What kind of order do I take advantage of to enter the commerce?

On this case, you’d wish to enter with a market order.

If the 25-week low is hit throughout the week (between Tuesday and Friday), do I exit the commerce instantly or watch for the weekly candle to shut?

You watch for the weekly candle to shut.

As soon as the weekly candle closes, and on Saturday, if the closing value is above the 25-week low, you maintain the commerce.

If it’s under it, then you definitely exit the commerce on Monday.

If the S&P 500 strikes again above the 100-week transferring common throughout the week, do I purchase shares that meet my standards instantly or watch for the weekly candle to shut?

On this case, you watch for the weekly candle to shut.

If the S&P 500 closing value is above the 100-week transferring common, then you definitely purchase shares in line with the buying and selling guidelines.

If not, stay in money.

Why do you employ the S&P 500 as an alternative of the Russell 3000?

There’s no explicit motive.

You should utilize the Russell 3000, and the buying and selling system will nonetheless work!

In relation to the 100-week transferring common, do I take advantage of a easy or exponential transferring common?

Whereas I take advantage of a easy transferring common, it doesn’t matter which you employ.

The idea behind it’s what issues, not the parameters.

I’d be nervous if a buying and selling system broke down as a consequence of a minor parameter change, as this could inform you it’s possible curve-fitted.

Does the breakout buying and selling system work for brief promoting utilizing an reverse set of buying and selling guidelines, which means you quick shares at an all-time low?

I’ve backtested this, and sadly, it doesn’t work.

You’ve now taken a deep dive into the mechanics and inside workings of this breakout buying and selling system, studying the way it has survived and profited over a long time.

That’s proper… A long time!

Now, right here’s one final secret that I wish to inform you:

That is simply one of my working programs.

What’s been mentioned right here is breakout buying and selling, however I even have trend-following programs and mean-reversion programs – every with their very own edges within the markets.

Think about if you happen to may commerce a number of (uncorrelated) buying and selling programs that work…

…it’d be like having a number of streams of long-term earnings, proper?

So, if you wish to be taught extra about them, a brand new ebook is being launched known as Buying and selling Techniques That Work.

On this ebook, you’ll get the total bundle – the system I shared with you right this moment, however far more improved, together with three different programs.

You’re welcome to test it out right here.

With that stated… I wish to know what you assume!

Do you assume that programs buying and selling is the “best” technique to discover an edge available in the market?

If that’s the case, do you propose to develop your system sometime?

Or attempt to commerce one which already works after which work from there?

Let me know your ideas within the feedback under!