Shares in semiconductor design merchandise firm Synopsys (SNPS -1.82%) spiked increased by 5.5% in early buying and selling right now earlier than settling again later within the day. The transfer got here after the U.S. Federal Commerce Fee (FTC) gave conditional approval for its meant $35 billion acquisition of simulation and evaluation software program firm Ansys (ANSS -0.56%).

For reference, the European Fee has already accepted the acquisition. Synopsys is now awaiting approval from China earlier than doubtlessly closing the deal within the second half of 2026.

Why this acquisition issues

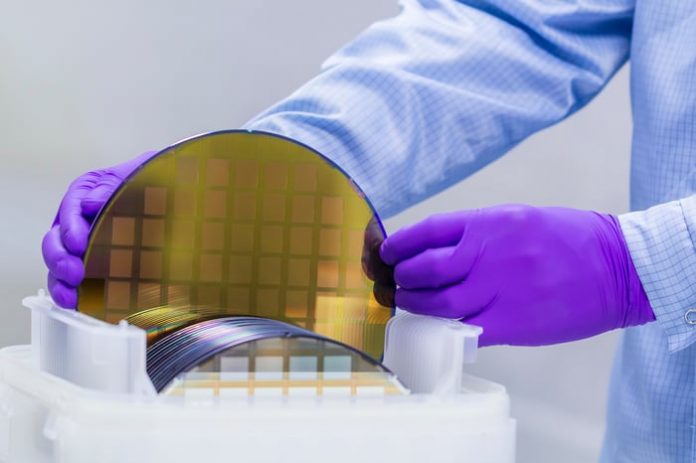

The Ansys acquisition is a daring transfer, designed to remain forward of the development in its finish markets. Synopsys manufactures digital design automation (EDA) tools utilized by semiconductor firms, in addition to by a rising checklist of firms designing chips to embed of their know-how. In the meantime, Ansys makes simulation and evaluation software program that measures how bodily merchandise (together with semiconductors) carry out.

Picture supply: Getty Pictures.

As such, the “new” Synopsys will assist firms design chips and merchandise, and likewise assist them analyze how they behave. It is an thrilling deal as a result of as semiconductors grow to be more and more embedded in a broader vary of merchandise with ever-increasing complexity, they are going to require extra simulation evaluation.

The place subsequent for Synopsys?

The deal has grow to be an integral a part of the funding case for purchasing Synopsys inventory, and the conditional FTC approval will seemingly please buyers who bought the inventory in anticipation of the long-term progress alternatives arising from the deal. It is also according to a bigger development within the trade — Siemens lately acquired industrial simulation and evaluation firm Altair.

Buyers might be hoping that Synopsys completes the Ansys deal in the end. Immediately’s information introduced that chance one massive step nearer.

Lee Samaha has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Synopsys. The Motley Idiot recommends Ansys. The Motley Idiot has a disclosure coverage.