Optical and photonics element vendor Lumentum Holdings (LITE -0.58%) delivered an excellent efficiency on the inventory market final yr, registering wholesome positive aspects of 61% as traders took notice of the rising affect of synthetic intelligence (AI) on the corporate’s enterprise, and it seems just like the inventory’s red-hot run is right here to remain in 2025.

Lumentum launched fiscal 2025 second-quarter outcomes (for the three months ended Dec. 28, 2024) on Feb. 6. The corporate’s development trajectory continued bettering throughout the quarter due to the sturdy efficiency of its cloud and networking enterprise. It’s value noting that Lumentum completed fiscal 2024 on a bitter notice, because the weak demand for its optical elements within the industrial section and from telecom suppliers led to a pointy decline in its income and earnings.

Nonetheless, fiscal 2025 is popping out to be a a lot better yr for the corporate because the demand for its optical elements deployed in AI servers for high-speed knowledge transmission is rising quickly. Let’s study Lumentum’s newest outcomes and test why this firm has room for extra upside.

Lumentum’s AI-driven development is simply getting began

Lumentum reported a ten% year-over-year improve in its fiscal Q2 income to $402 million, pushed primarily by the AI-powered demand for its elements within the cloud and networking enterprise. Extra particularly, the cloud and networking section’s income elevated 18% from the year-ago interval, offsetting the 21% drop within the industrial enterprise.

The cloud and networking enterprise now accounts for 84% of Lumentum’s high line, and the rising affect of this section on Lumentum’s high line ought to pave the way in which for stronger development going ahead. This explains why the midpoint of Lumentum’s fiscal Q3 steering of $417.5 million would translate right into a 14% leap from the year-ago interval.

Lumentum administration factors out that it’s witnessing wholesome demand from hyperscale cloud clients. Extra particularly, the demand from its largest hyperscale buyer elevated throughout the quarter, and it began quantity shipments to a brand new buyer. Even higher, Lumentum’s elements are within the qualification part at one other buyer. Administration estimates that it’s going to start quantity shipments to this new buyer in fiscal This autumn.

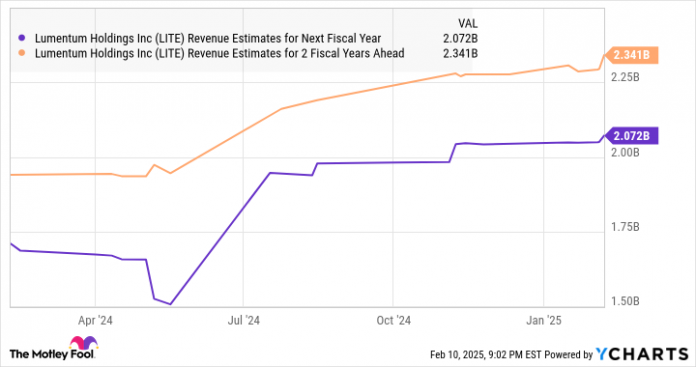

The great half is that the demand for Lumentum’s elements utilized in knowledge facilities is so robust that the corporate is growing its manufacturing capability. So, it will not be shocking to see Lumentum’s development certainly choosing up because the yr progresses. Analysts are forecasting the corporate to finish the yr with an 18% improve in income to $1.6 billion, adopted by wholesome development over the following couple of years as nicely.

LITE Income Estimates for Subsequent Fiscal Yr knowledge by YCharts

Lumentum administration factors out that its “engagement with cloud clients and AI infrastructure suppliers on their long-term expertise and product roadmap has reached an all-time excessive.” The shipments of its externally modulated lasers (EMLs), which allow high-speed knowledge transmission with the assistance of fiber-optic cables, hit a report final quarter due to AI-related demand.

Trying forward, Lumentum’s EML shipments are prone to head larger because it expects to achieve extra market share on account of latest design wins for AI purposes. What’s extra, the info heart interconnect (DCI) market that Lumentum is concentrating on is predicted to develop by 71% over the following 4 years, based on one estimate, with AI set to play a central function on this market’s wholesome development. So, Lumentum might be originally of a terrific long-term development alternative.

Robust earnings development might result in spectacular inventory value upside

One other factor value noting is that Lumentum’s margins are getting higher on account of upper manufacturing utilization and its deal with maintaining prices underneath test. In consequence, Lumentum’s non-GAAP (adjusted) working margin jumped by six proportion factors yr over yr within the earlier quarter. This led to stronger development of 75% within the firm’s backside line final quarter to $0.42 per share.

Consensus estimates are projecting a 73% improve within the firm’s backside line this yr to $1.75 per share, adopted by excellent development over the following two years as nicely.

LITE EPS Estimates for Subsequent Fiscal Yr knowledge by YCharts

Assuming Lumentum might hit $4.74 per share in earnings in fiscal 2027 and trades at 27.6 instances earnings at the moment (in keeping with the tech-laden Nasdaq-100 index’s ahead earnings a number of), its inventory value might hit $131 in simply over two years. That will be a 60% leap from present ranges, suggesting that this AI inventory has the potential to fly larger even after clocking spectacular positive aspects final yr.