Examine Level Software program Applied sciences (CHKP 1.65%) might not be a family identify within the cybersecurity trade, however the firm has registered spectacular beneficial properties of 15% already in 2025, and the nice half is that it appears to be in a stable place to maintain its spectacular momentum sooner or later as properly.

That is as a result of Examine Level is witnessing an enchancment in its income pipeline on account of the fast-growing adoption of synthetic intelligence (AI) instruments within the cybersecurity trade. Let’s take a more in-depth have a look at Examine Level’s latest outcomes to seek out out why this cybersecurity inventory is able to delivering extra upside.

Examine Level Software program’s progress fee is probably going to enhance

Examine Level ended 2024 with complete income of $2.66 billion, a 6% improve from the identical interval final yr. Its non-GAAP (adjusted) earnings elevated at a barely sooner tempo of 9% in 2024 to $9.16 per share. Traders might not discover this tempo of progress interesting, however they need to observe that Examine Level’s bettering income pipeline might assist it step on the fuel and develop at a sooner tempo sooner or later.

That is evident from the 12% year-over-year improve in its remaining efficiency obligations (RPO) in This autumn 2024, which was double the tempo of its income progress in the course of the quarter. The sooner progress in RPO is sweet information for Examine Level traders as this metric “represents the whole worth of non-cancellable contracted merchandise and/or providers which can be but to be acknowledged as income.”

So, Examine Level is bringing in additional enterprise than it’s fulfilling proper now. Because it begins fulfilling extra of its contracts, its progress fee ought to ideally enhance. A key cause why the corporate is signing extra contracts now’s due to its give attention to bringing AI instruments to prospects. Examine Level has unveiled a variety of AI cybersecurity instruments in latest instances, together with the Infinity AI Copilot, which is a generative AI-powered safety assistant meant to assist organizations enhance the effectivity of their safety analysts.

Provided that the adoption of generative AI throughout the cybersecurity area is anticipated to develop at an annual fee of 24% by way of the top of the last decade, Examine Level is doing the best factor by launching AI-focused instruments. The great half is that these product improvement strikes appear to be paying off for the corporate as its Infinity Platform witnessed double-digit progress within the fourth quarter of 2024.

Alternatively, the demand for the corporate’s AI-powered firewall product, Quantum Drive, can be selecting up. Gross sales of Examine Level’s merchandise and licenses elevated by 8% yr over yr within the earlier quarter on the again of rising Quantum Drive demand. Whereas that will not seem to be a lot, it’s price noting that its product and licenses enterprise grew at a a lot slower tempo within the first three quarters of the yr.

All this means that Examine Level’s tempo of progress might decide up sooner or later and it could even have the ability to outpace its personal expectations. Throw within the firm’s engaging valuation, and shopping for Examine Level proper now looks as if a wise transfer.

A pretty valuation and a possible enchancment in progress

Examine Level is anticipating its fiscal 2025 income to extend within the vary of 4% to eight%. In the meantime, the corporate has guided for barely stronger bottom-line progress to a variety of 5% to 11%. On the midpoint, Examine Level’s full-year earnings might land at $9.90 per share.

Once more, Examine Level’s steerage is not earth-shattering, however the potential of the corporate clocking sooner progress than what it has known as for can’t be dominated out. That is as a result of new contracts are flowing in at a sooner tempo than gross sales. And if Examine Level can certainly ship better-than-expected outcomes, the market might reward it with extra upside.

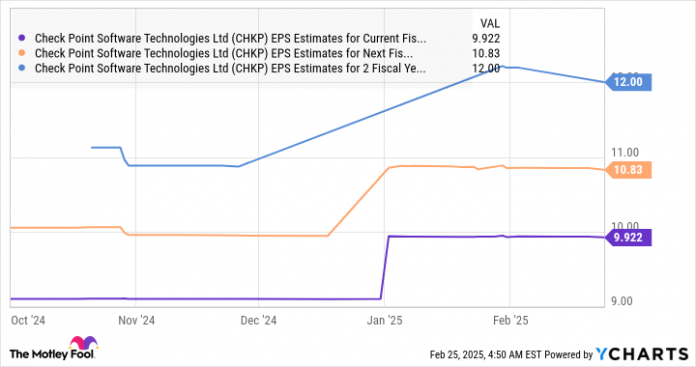

Furthermore, Examine Level is buying and selling at simply 22 instances ahead earnings, decrease than the Nasdaq-100 index’s ahead earnings a number of of 28 (utilizing the index as a proxy for tech shares). Analysts expect an uptick in Examine Level’s earnings progress over the following couple of years, which appears achievable contemplating the factors mentioned within the earlier part.

CHKP EPS Estimates for Present Fiscal Yr information by YCharts

Assuming Examine Level certainly delivers $12 per share in earnings in 2027 and trades consistent with the Nasdaq-100 index’s ahead earnings a number of of 28, its inventory value might hit $342. That may be a 59% leap from present ranges. So, traders seeking to purchase a cybersecurity inventory that is buying and selling at engaging ranges and has the flexibility to step on the fuel ought to take a more in-depth have a look at Examine Level Software program as it may maintain its bull run sooner or later.

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Examine Level Software program Applied sciences. The Motley Idiot has a disclosure coverage.