After the Privateness Coin wave, the place would possibly traders flip subsequent? Knowledge from the primary week of November suggests the highlight might shift to Storage tokens.

Initially of November, merchants who missed the Privateness Coin rally look like accumulating decentralized storage initiatives — long-established tokens out there which have but to recuperate their worth. Which altcoins are drawing consideration?

3 Promising Storage Altcoins for November

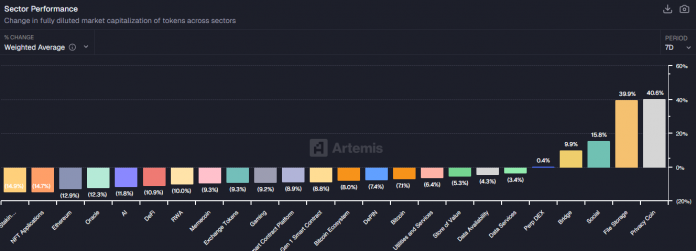

In line with Artemis knowledge, Storage tokens have practically caught up with Privateness Cash in the course of the first seven days of November, delivering a mean efficiency of virtually 40%.

Sponsored

Sponsored

These initiatives have real-world purposes and generate income from prospects, however their token costs have declined considerably.

“After Privateness tokens, File Storage tokens are additionally outpacing BTC,” investor iWantCoinNews predicted.

On this surroundings, potential altcoins are people who present indicators of accumulation or breakout from long-term consolidation zones. Beneath are a number of notable examples within the decentralized storage sector.

1. Filecoin (FIL)

Knowledge from CoinGecko reveals that Filecoin (FIL) is main the Storage Coin class in early November.

A latest BeInCrypto report famous that FIL’s buying and selling quantity exceeded $1.4 billion. In the meantime, Grayscale has been rising its FIL holdings this month, reflecting rising investor demand.

Sponsored

Sponsored

Moreover, Nansen knowledge reveals that high FIL whale wallets have amassed over 32% extra tokens prior to now month, whereas the out there FIL steadiness on exchanges has dropped by practically 15%.

These constructive indicators have led analysts to foretell additional worth will increase. CryptoBoss expects FIL to surpass $2.5 quickly and probably attain $5.

2. BitTorrent (BTT)

BitTorrent (BTT) is a decentralized data-sharing platform constructed on blockchain expertise and the BitTorrent protocol — one of many world’s oldest and hottest peer-to-peer (P2P) file-sharing programs.

BTT stands out on this checklist resulting from important adjustments in its holder knowledge in the course of the fourth quarter.

Sponsored

Sponsored

In October, the variety of BTT holders was round 91,000, however by November it had surged to 341,000.

Since June, the out there BTT steadiness on exchanges has fallen by greater than 6%, whereas the highest 100 wallets have elevated their holdings by 5.8%.

These figures point out that traders are actively accumulating BTT, regardless of the token’s 50% decline over the previous 12 months.

If this accumulation development continues and investor curiosity in Storage Cash stays excessive, BTT may have room for restoration.

Sponsored

Sponsored

3. Storj (STORJ)

Alongside Filecoin, Storj was one of many decentralized storage initiatives highlighted in NVIDIA’s report late final 12 months.

Santiment knowledge reveals that regardless of STORJ’s extended downtrend, the variety of holders continues to climb, reaching a file excessive of over 103,000 in November.

The token worth has additionally risen greater than 20% prior to now 24 hours, signaling renewed optimism amongst traders. Analysts have noticed a rotation of capital into Storage Cash, and STORJ could also be one of many subsequent beneficiaries.

“It’s evident that the storage narrative has began. First ICP > FIL > AR > Storj. Storj appears to be like like a high play amongst low caps with most ROI potential,” investor The BitWhale predicted.

The important thing query now could be how sturdy and the way lengthy the Storage Coin development will final. All of those initiatives share a typical threat — many holders are nonetheless caught at excessive entry costs from the earlier cycle. They might be prepared to maneuver tokens again to exchanges and exit if costs recuperate.