Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Tron (TRX) has captured investor consideration as soon as once more with main developments surrounding its future. On Monday, Nasdaq-listed SRM Leisure (SRM.O) confirmed a strategic settlement with Tron founder Justin Solar. The deal will see SRM purchase Tron tokens, rebrand itself as “Tron Inc.,” and onboard Solar as an adviser, successfully bringing Tron nearer to turning into a publicly traded entity. This marks a historic shift for the blockchain business and positions Tron in a singular house amongst crypto initiatives.

Associated Studying

Nevertheless, the market backdrop is something however calm. Rising geopolitical tensions within the Center East have sparked sharp volatility throughout threat property, together with Tron. Whereas the token’s value has fluctuated considerably, long-term metrics counsel underlying power within the community.

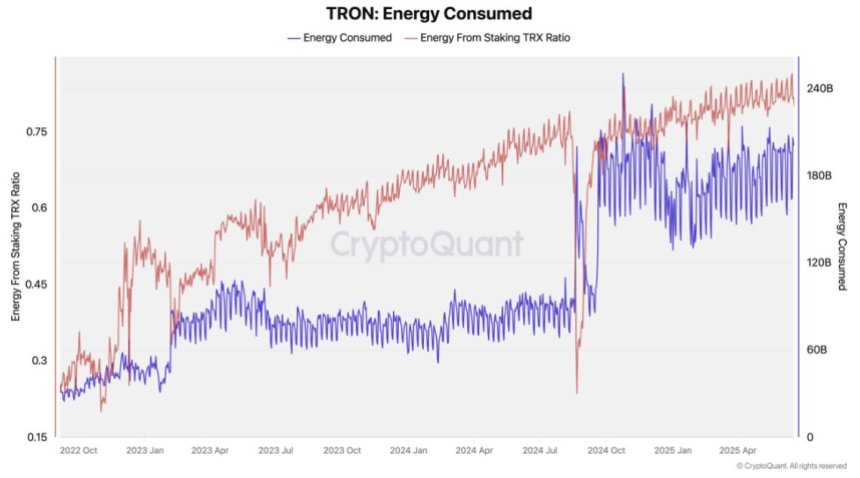

In accordance with new CryptoQuant knowledge, TRON’s whole every day vitality consumption—an essential measure of good contract execution and consumer exercise—has surged 108% year-over-year. It now sits at 200 billion vitality models per day, in comparison with simply 77 billion a yr in the past. Notably, 80% of this demand originates from staked TRX, indicating sturdy participation within the protocol and a big improve in good contract interactions. Collectively, these elements underscore Tron’s rising relevance as each a technical platform and a public-facing blockchain enterprise.

Tron Trades Close to Key Demand Amid Broader Market Pullback

Tron is at present testing key demand ranges after a 9% correction from its latest excessive close to $0.295. The value had briefly surged on Monday after the announcement of Tron’s plans to go public via a take care of Nasdaq-listed SRM Leisure. Nevertheless, the joy was short-lived. As macroeconomic uncertainty deepens and Center East conflicts escalate, your complete crypto market has entered a retracement part, dragging TRX under the degrees it traded at previous to the information.

Regardless of the difficult situations, on-chain fundamentals paint a way more resilient image. CryptoQuant knowledge exhibits that Tron’s community exercise stays sturdy, with vitality consumption—used to execute good contracts—up 108% year-over-year. Complete every day vitality utilization now exceeds 200 billion models, in comparison with simply 77 billion on the identical time final yr.

This surge in vitality use alerts rising demand for on-chain operations and good contract execution. Importantly, about 80% of this vitality demand comes from staked TRX, pointing to robust consumer dedication to the community and elevated participation in decentralized purposes.

The divergence between TRX’s on-chain power and its present value efficiency means that the latest pullback could also be extra about broader market stress than any deterioration in Tron’s fundamentals. If volatility stabilizes, these sturdy exercise metrics might assist place Tron for a powerful restoration.

Associated Studying

TRX Value Holds Trendline Assist Regardless of Unstable Reversal

Tron is at present buying and selling at $0.2730, exhibiting a modest 9% pullback from the $0.295 excessive reached earlier this week following the announcement of a deal involving SRM Leisure. Value motion within the chart displays this unstable response—after spiking, TRX retraced sharply and is now consolidating simply above the 50-day transferring common (blue line), which has acted as dynamic assist over the previous two months.

Regardless of this pullback, the construction stays bullish. TRX continues to respect the long-term ascending trendline fashioned since early March, with larger lows being maintained. Quantity surged throughout the preliminary rally on the announcement however has since returned to pre-news ranges, indicating fading short-term hype and a return to fundamentals.

Wanting on the broader setup, the 100-day and 200-day transferring averages (inexperienced and pink traces) stay sloped upward, reflecting sustained long-term momentum. The $0.269–$0.253 assist band, outlined by these MAs, will likely be key if additional draw back stress materializes.

Associated Studying

A break above $0.295 would invalidate this short-term pullback and probably ignite a transfer towards $0.32. Conversely, failure to carry the trendline might set off a deeper retracement. For now, TRX holds construction—but warning stays warranted given broader market uncertainty.

Featured picture from Dall-E, chart from TradingView