Product Obtainable right here:

https://www.mql5.com/en/market/product/145087/

Options

- Three Hull MA Variations: Traditional HMA, Exponential HMA (EHMA), and Triangular HMA (THMA)

- Multi-Timeframe Help: View greater timeframe Hull MA on any chart

- Dynamic Shade Coding: Automated trend-based shade switching for straightforward visualization

- Candle Physique Coloring: Shade candle our bodies based mostly on Hull pattern or value place

- Actual-Time Alerts: Get notified on pattern modifications and candle shade switches

- Customizable Visuals: Adjustable colours, line thickness, and transparency

- Band Show Choice: Present shifted Hull line for enhanced visible evaluation

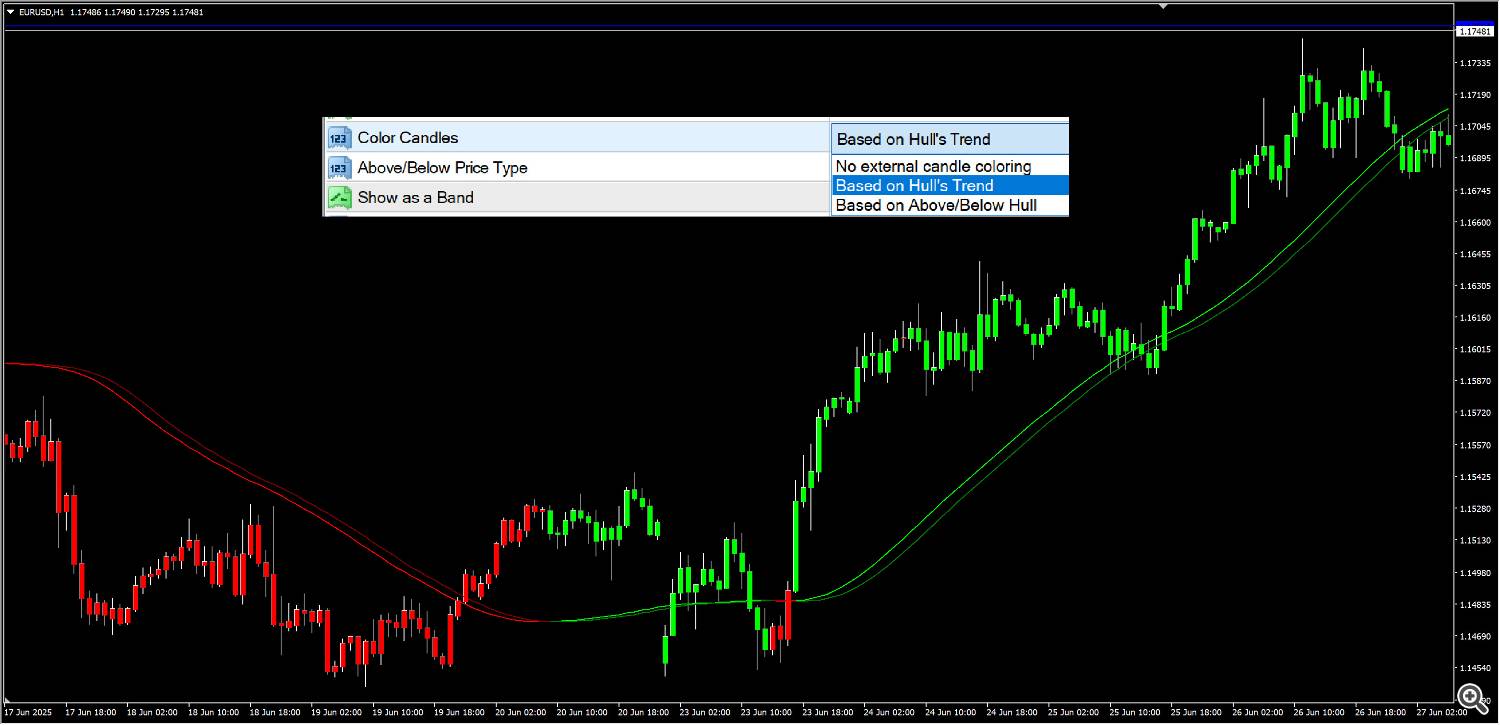

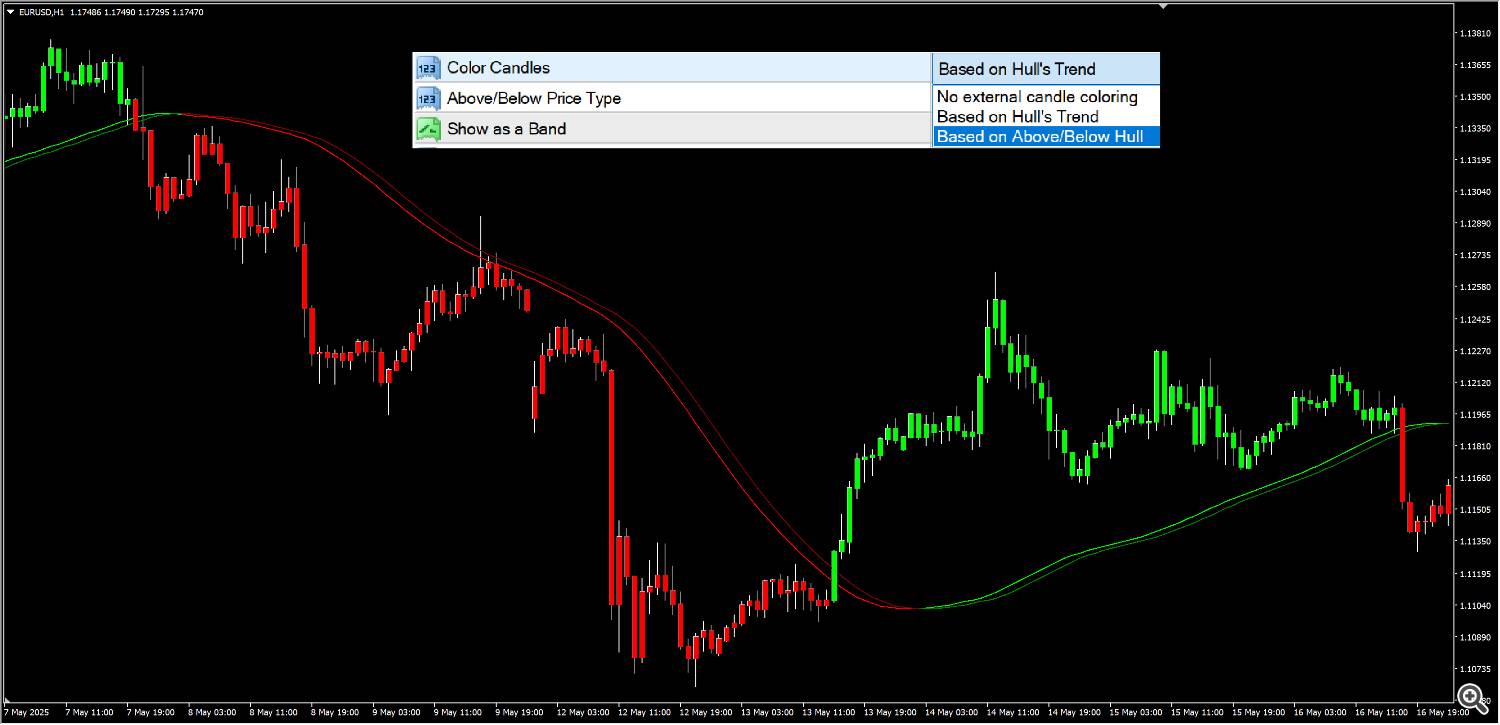

Worth Coloring:

HMA Types:

Hull Transferring Common (HMA) The unique Hull MA system that reduces lag whereas sustaining smoothness. Excellent for pattern following and swing buying and selling setups.

Exponential Hull Transferring Common (EHMA) Makes use of exponential smoothing as an alternative of weighted averages, offering sooner response to cost modifications whereas preserving the Hull system advantages.

Triangular Hull Transferring Common (THMA) A novel variation that makes use of triangular weighting, providing the smoothest indicators with minimal false breakouts.

How one can Use

Development Identification: When the Hull line is inexperienced/lime, the pattern is bullish. When crimson, the pattern is bearish.

Entry Alerts: Search for shade modifications from crimson to inexperienced for lengthy entries, and inexperienced to crimson for brief entries.

Use SR areas like from Pivots or Quarter Areas for entry and exit.

Multi-Timeframe Evaluation: Set the next timeframe (like H4 on M15 chart) to see the larger image pattern whereas buying and selling on decrease timeframes.

Candle Coloring: Allow candle physique coloring to immediately see if value is above or under the Hull line, or following the Hull pattern course.

Settings:

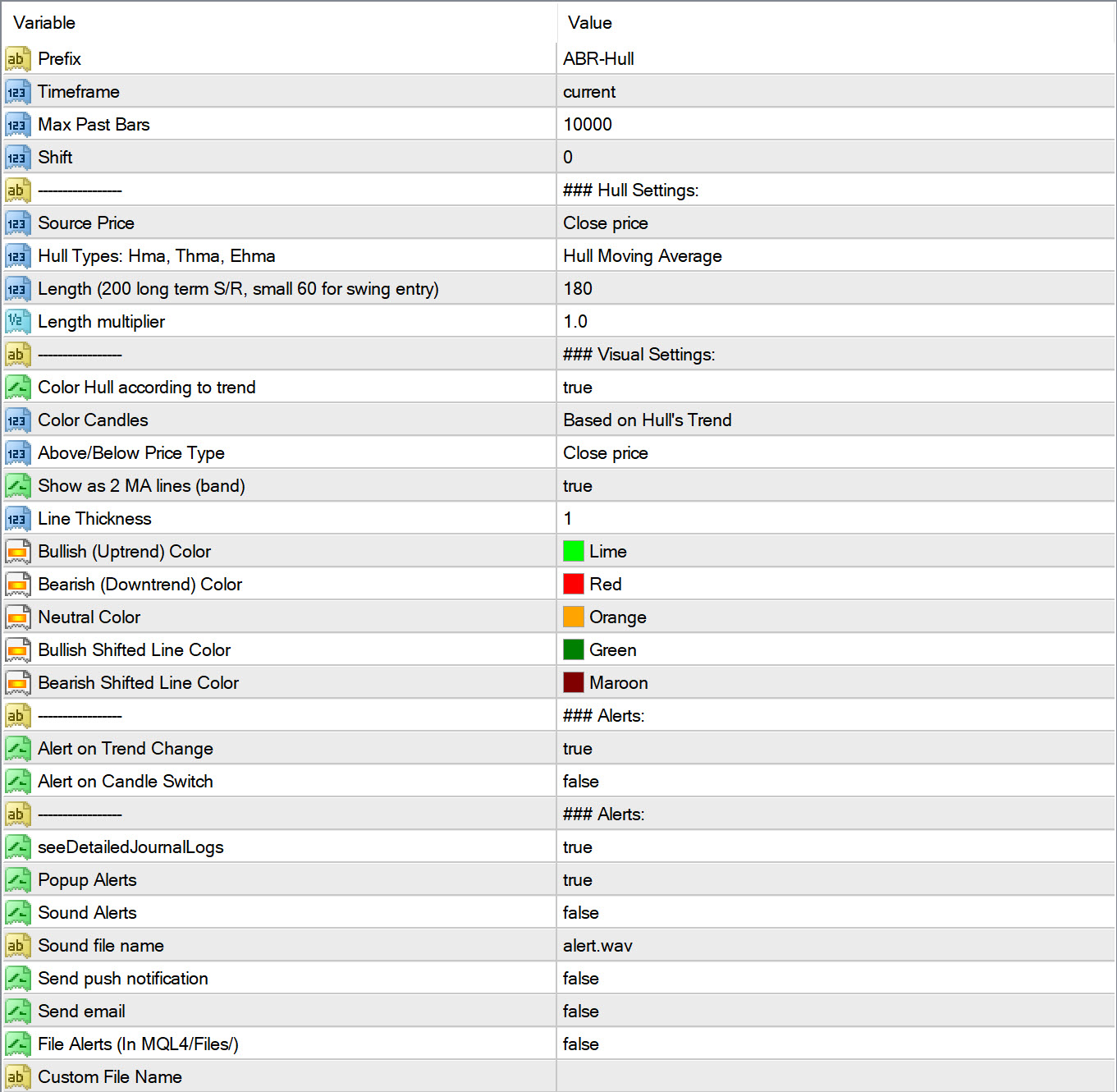

Hull Settings

- Supply Worth: Select which value (Shut, Excessive, Low, and many others.) to calculate Hull MA from

- Hull Variation: Choose between HMA, THMA, or EHMA

- Size: Interval for Hull calculation (smaller like 55 for swing buying and selling, 180-200 for assist/resistance)

- Size Multiplier: Multiply the bottom size for longer-term evaluation

Visible Settings

- Shade Hull: Allow/disable automated shade switching based mostly on pattern

- Shade Candles: Select candle coloring mode (None, Development-based, Above/Under Hull)

- Present as Band: Show each principal and shifted Hull strains for band evaluation

- Line Width: Regulate thickness of Hull strains

- Colours: Customise bullish, bearish, and impartial colours

Alert Settings

- Alert on Development Change: Get notified when Hull pattern switches

- Alert on Candle Swap: Get alerted when candle colours change

Instance Buying and selling Methods

Technique 1: Long run H1

Add Wyatt’s Pivots for Weekly if utilizing H1. Or Pivots-H4 if TF is M1. Pivot-Every day if TF is M5-M15.

Look forward to a excessive quantity candle from VolumeCandles to cross a Pivot stage.

Use default HMA 60 interval and three multiplier. And solely commerce if in course of Hull MA pattern.

Technique 2: M5 for fast scalping

Hull MA: Settings are Size is 60, and Size Multiplier is 3.

QQE Blue for Purchase and Crimson for SELL.

Quantity Oscillator: Above 0%

Waddah Attar Explosion above explosion line

Easy RSI: Not above Overbought(70) for Purchase. And Not under oversold (30) for SELL.