- The USD/CAD weekly forecast signifies a dim outlook for Canada’s economic system.

- US tariffs on Canadian items will come into impact in March.

- The greenback surged as merchants sought security amid financial uncertainty.

The USD/CAD weekly forecast signifies a dim outlook for Canada’s economic system as Trump plans to implement a 25% tariff in March.

Ups and downs of USD/CAD

The USD/CAD pair had a bullish week because the greenback rebounded amid safe-haven inflows. This week, the greenback was on the entrance foot as Trump maintained his aggressive push for tariffs in Canada and Mexico.

–Are you interested by studying extra about getting cash with foreign exchange? Examine our detailed guide-

The US president shocked markets by saying the tariffs would come into impact in March. Analysts had anticipated one other delay to April. Because of this, fears of a weaker economic system in Canada amid decrease demand damage the loonie. However, the greenback surged as merchants sought security amid financial uncertainty.

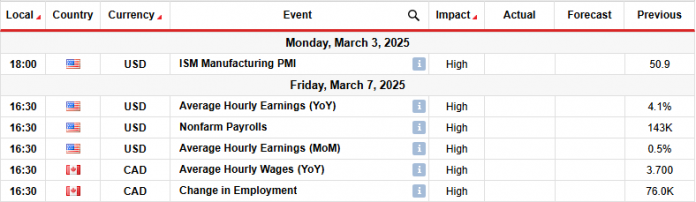

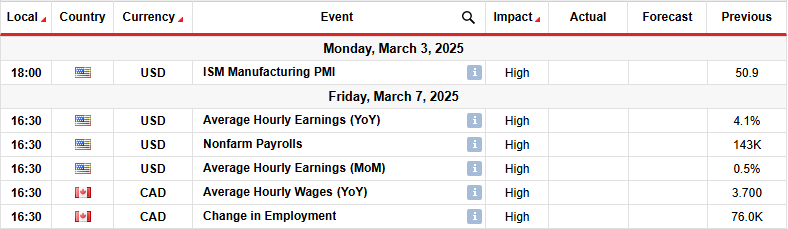

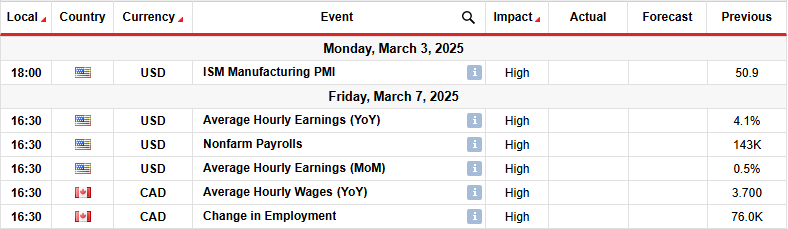

Subsequent week’s key occasions for USD/CAD

Market individuals are trying ahead to key stories from the US, together with manufacturing PMI and employment. In the meantime, Canada will solely launch its month-to-month employment figures.

Merchants will keenly monitor employment numbers from the US and Canada to find out what the Fed and the Financial institution of Canada will do within the close to future. Upbeat stories will decrease bets for fee cuts. In the meantime, a downbeat report will strain each central banks to chop borrowing prices.

USD/CAD weekly technical forecast: Bulls resurface, concentrating on 1.4804

On the technical aspect, the USD/CAD value has bounced again after an try by bears to reverse the development. The worth has damaged above the 30-SMA, indicating a bullish shift in sentiment. On the identical time, the RSI now trades above 50, suggesting strong bullish momentum.

–Are you interested by studying extra about MT5 brokers? Examine our detailed guide-

The earlier bullish development paused just under the 1.4804 resistance degree. The worth had made a robust bullish hole to this degree. Nevertheless, bears emerged with stronger momentum, closing the hole and forming a bearish engulfing candle. This sudden energy pushed the worth under the SMA, difficult the uptrend.

Nevertheless, bears couldn’t push the worth past the 1.4150 assist degree, permitting bulls to return to the market. This return may solely be temporary to retest the 1.4804 resistance. Nevertheless, it may also enable USD/CAD to proceed its earlier bullish development. If bulls keep their place above the 1.4400 key degree, the worth will revisit the 1.4804 resistance.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to think about whether or not you’ll be able to afford to take the excessive danger of shedding your cash.