- The USD/CAD weekly forecast signifies uncertainty forward of Trump’s tariffs.

- The US and Canada launched downbeat retail gross sales knowledge.

- The FOMC coverage assembly resulted in a pause, as anticipated.

The USD/CAD weekly forecast signifies some uncertainty as merchants speculate on the possible affect of Trump’s looming tariffs on Canada.

Ups and downs of USD/CAD

The USD/CAD value had a bearish shut however ended the week effectively above its lows. The worth fluctuated as market members digested financial knowledge and coverage bulletins. Furthermore, merchants have been gearing up for extra Trump tariffs that might ignite extra commerce wars.

–Are you interested by studying extra about crypto brokers? Test our detailed guide-

The US and Canada launched downbeat retail gross sales knowledge, indicating weaker-than-expected shopper spending in each international locations. In the meantime, the FOMC coverage assembly resulted in a pause, as anticipated. Nevertheless, Powell restated that there was no rush to decrease borrowing prices given the uncertainty surrounding Trump’s commerce insurance policies.

Subsequent week’s key occasions for USD/CAD

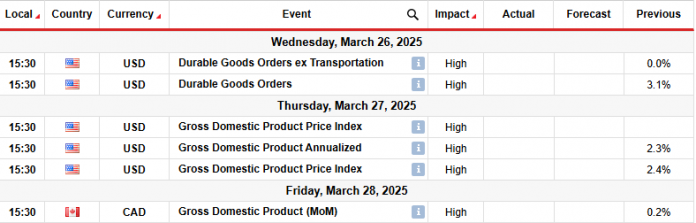

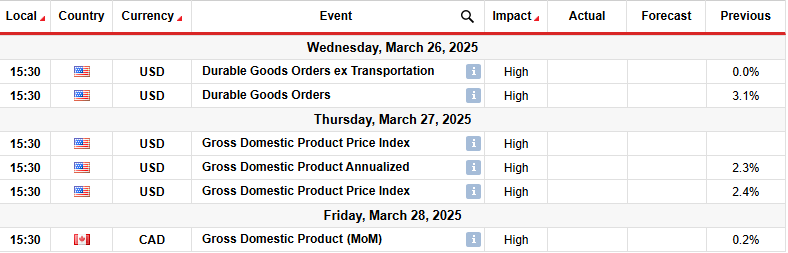

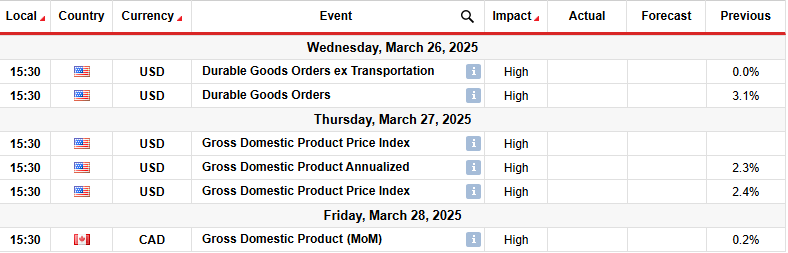

Subsequent week, merchants will monitor experiences from the US on sturdy items and gross home product. In the meantime, Canada will launch its GDP report.

The GDP experiences will include clues on the well being of the US and Canada’s economies. The US has skilled weak demand, with latest experiences exhibiting weaker employment, inflation, and gross sales. A weak GDP report will strain the Fed to decrease borrowing prices. Alternatively, Canada’s economic system faces the specter of punitive US tariffs. Due to this fact, the Financial institution of Canada is already beneath immense strain to protect development. A downbeat GDP report would improve rate-cut expectations.

USD/CAD weekly technical forecast: Bulls and bears battle round 22-SMA

On the technical facet, the USD/CAD value stays in a decent vary between the 1.4150 help and the 1.4501 resistance ranges. Inside this consolidation, the worth trades within the center, close to the 22-SMA, exhibiting neither bears nor bulls have the higher hand.

–Are you interested by studying extra about managed foreign exchange accounts? Test our detailed guide-

Subsequent week, the worth will detach from the SMA. If it trades above, bulls will retest the vary resistance, aiming for larger highs. Alternatively, if the worth trades beneath the SMA, it’ll revisit the vary help, concentrating on decrease lows.

Nevertheless, there’s a larger likelihood that bulls will win this battle as a result of the worth was in an uptrend earlier than it paused. Due to this fact, the vary may solely be a short cease for bulls as they regain momentum. A break above the vary resistance will permit USD/CAD to retest the 1.4804 resistance stage.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to take into account whether or not you may afford to take the excessive threat of dropping your cash.