- The USD/JPY weekly forecast signifies rising financial uncertainty in Japan.

- Trump imposed a tariff on metal and aluminum imports.

- Tariff fears overshadowed a downbeat US inflation report.

The USD/JPY weekly forecast turns optimistic as fears of the affect of Trump’s tariffs on Japan’s financial system rise.

Ups and downs of USD/JPY

The USD/JPY worth had a barely bullish week because the greenback recovered with Treasury yields. In the meantime, the yen gave up some positive aspects as market individuals anxious in regards to the affect of Trump’s tariffs on Japan.

-Are you interested by studying in regards to the foreign exchange indicators? Click on right here for details-

Trump imposed a tariff on metal and aluminum imports, igniting commerce wars with Canada and the Eurozone. This escalated fears of a world financial slowdown. In consequence, merchants sought security in US Treasuries. In the meantime, the tariff fears overshadowed a downbeat US inflation report.

Then again, the yen eased as market individuals centered on the weak export-reliant Japanese financial system. Trump’s tariffs may harm the financial system.

Subsequent week’s key occasions for USD/JPY

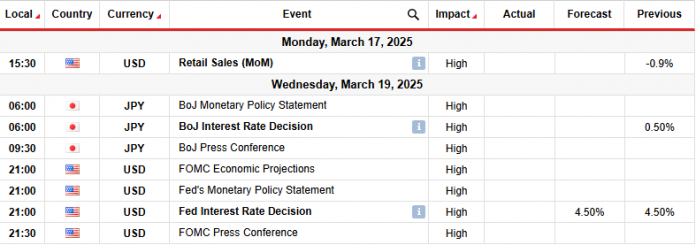

Subsequent week, market individuals will concentrate on financial coverage conferences by the Financial institution of Japan and the Fed. Furthermore, the US will launch its retail gross sales report, displaying the state of client spending.

Economists imagine each the Financial institution of Japan and the Fed will preserve rates of interest unchanged. Nevertheless, BoJ policymakers may keep a hawkish tone, signaling future hikes. In the meantime, the Fed may stay cautious as a result of uncertainty relating to Trump’s tariffs.

USD/JPY weekly technical forecast: Eying 149.00 key stage

On the technical aspect, the USD/JPY worth is climbing after assembly the 0.618 Fib retracement. Nevertheless, the value continues to be under the 22-SMA. On the similar time, the RSI trades under 50, supporting sturdy bearish momentum. For the reason that worth broke under the 22-SMA, it has maintained its place under this line, indicating a robust downtrend. Moreover, the value has persistently made decrease highs and lows.

-Are you interested by studying in regards to the finest AI buying and selling foreign exchange brokers? Click on right here for details-

The downtrend lately made a milestone transfer by breaking under the 149.00 help stage. After the break, the value has risen to retest this stage as resistance. If it holds agency, bears may resume the downtrend. Nevertheless, the value must break under the 0.618 Fib retracement. This is able to permit USD/JPY to focus on the 142.00 help stage.

Then again, if bears fail to interrupt under the 0.618 Fib, bulls may push the value again above 149.00. A break above the SMA would sign a probable reversal.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to take into account whether or not you may afford to take the excessive threat of dropping your cash.