- The USD/JPY weekly forecast signifies additional weak point within the US labor market.

- The US economic system added solely 22,000 jobs in August.

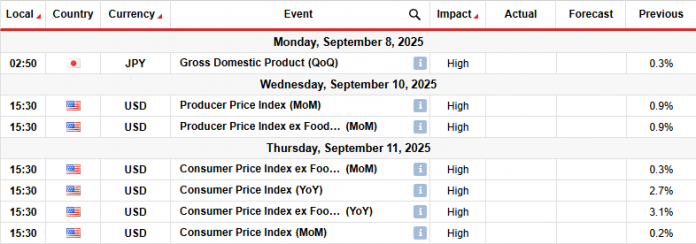

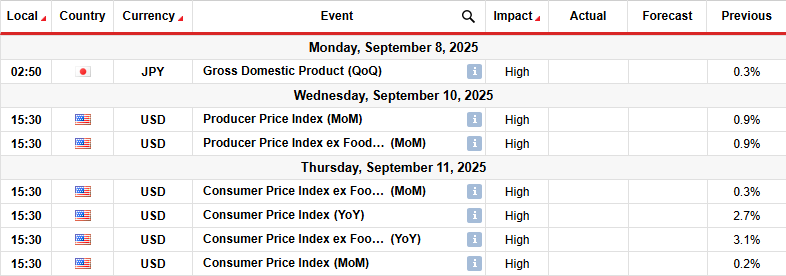

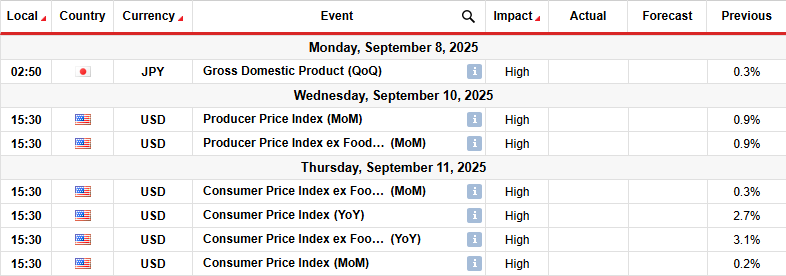

- Subsequent week, the US will launch its client and wholesale inflation stories.

The USD/JPY weekly forecast signifies additional weak point within the US labor market, which helps a extra dovish Fed.

Ups and downs of USD/JPY

USD/JPY ended the week bullish however closed nicely beneath its highs because the greenback dropped. In the beginning of the week, the greenback recovered briefly towards the yen as merchants awaited essential US employment figures. Nevertheless, as the info got here in, it grew to become clear that the labor market had softened greater than anticipated.

–Are you to study extra about MT5 brokers? Test our detailed guide-

Nonfarm payrolls revealed that the US economic system added solely 22,000 jobs in August, in comparison with the forecast of 75,000. In the meantime, the unemployment fee rose to 4.3% as anticipated. The poor figures elevated expectations for Fed fee cuts, weighing on the greenback.

Subsequent week’s key occasions for USD/JPY

Subsequent week, the US will launch its client and wholesale inflation stories, which is able to form the outlook for Fed fee cuts. Already, market individuals are totally pricing a fee reduce in September. Nevertheless, the outlook for future fee cuts remains to be altering. Furthermore, there’s a probability the Fed will decide to ship an enormous fee reduce this month.

If client inflation is available in beneath estimates, fee reduce expectations will enhance, and the greenback will prolong its decline. However, a constructive determine may ease fee reduce bets.

USD/JPY weekly technical forecast: Bears put together to problem the channel assist

On the technical aspect, the USD/JPY worth trades in a bullish channel with clear assist and resistance traces. Nevertheless, the value can also be chopping by means of the 22-SMA, an indication that bears are exhibiting energy. This additionally signifies that the transfer is corrective.

–Are you to study extra about Thailand foreign exchange brokers? Test our detailed guide-

Beforehand, the USD/JPY was buying and selling in a well-developed downtrend, principally staying beneath the 22-SMA. Nevertheless, the decline paused when it reached the 140.01 key assist stage. Right here, bulls took cost, making increased highs and lows. Nevertheless, the brand new pattern was shallow and corrective.

Throughout the bullish channel, the value has damaged beneath the SMA, and the RSI has dipped beneath 50. Subsequently, bears are at present stronger and will quickly problem the channel assist. Provided that the value is at present in a corrective transfer, a breakout would doubtless result in an impulsive transfer. If bears get away of the channel, the value will fall to retest the 140.01 assist stage.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to contemplate whether or not you’ll be able to afford to take the excessive danger of shedding your cash.