uTrade has introduced the launch of a unified monetary buying and selling ecosystem designed to combine synthetic intelligence (AI), copy buying and selling, non-fungible tokens (NFTs), staking, and decentralized finance (DeFi) right into a single platform. The initiative seeks to supply each new and skilled buyers with instruments that mix institutional-level buying and selling methods and community-driven wealth sharing.

In contrast to many narrowly targeted tasks within the cryptocurrency sector, uTrade is structured as a multi-layered ecosystem. It combines automated buying and selling bots, profit-sharing NFTs, a deflationary token mannequin, and community-first mechanisms, aiming to create a clear and sustainable monetary framework.

uTrade’s Imaginative and prescient: Bridging Conventional Buying and selling and Decentralized Finance

uTrade positions itself as extra than simply one other crypto platform. In its whitepaper, the corporate describes its mission as creating “a gateway to the monetary buying and selling revolution.” This imaginative and prescient displays an effort to merge the precision of conventional finance instruments with the open, accessible ethos of decentralized techniques.

The place conventional buying and selling usually depends on advanced software program and closed ecosystems, uTrade seeks to make superior buying and selling methods obtainable to a wider viewers. On the similar time, DeFi rules comparable to revenue sharing, token burns, and treasury reinvestment are embedded into the platform’s construction, making certain that progress is shared with the group fairly than concentrated on the prime.

AI Buying and selling Bots and Superior Automation for On a regular basis Traders

On the core of the uTrade ecosystem are AI-powered buying and selling bots, designed to adapt dynamically to altering market situations. The Futures Grid Bot, for instance, runs on the Pionex change and executes purchase and promote orders inside user-defined value grids. The sort of technique is especially efficient in sideways markets, the place value fluctuations create a number of alternatives for small, repeated positive aspects.

Past static grid parameters, uTrade’s AI bots are designed to course of a broad vary of indicators and information sources. These embody Relative Power Index (RSI), Transferring Common Convergence Divergence (MACD), supply-demand imbalances, macroeconomic tendencies, and institutional exercise. The purpose is to create bots that may reply with human-like adaptability, much like the best way hedge funds and quantitative merchants strategy markets.

For retail buyers, because of this methods as soon as reserved for establishments can now be deployed with out technical experience or coding data. Working 24/7, the bots cut back the necessity for fixed monitoring, providing a level of automation that may assist each lively merchants and people with restricted time to have interaction immediately with markets.

Copy Buying and selling: Verified Consultants and Accessible Buying and selling for All

One other main characteristic of the platform is its copy buying and selling system, which permits customers to mechanically mirror the trades of skilled professionals. Accessible by exchanges like MEXC and BingX, copy buying and selling gives an accessible entry level for many who could not have the experience or time to construct their very own methods.

The platform presents completely different replication modes — comparable to Sensible Ratio, Fastened Quantity, and Fastened Ratio — enabling customers to regulate threat publicity in ways in which match their very own buying and selling preferences.

For customers searching for a extra tailor-made expertise, uTrade additionally gives paid indicators by way of Telegram, protecting not simply cryptocurrencies but additionally foreign exchange, commodities, shares, and indices. These indicators embody detailed entry, exit, and stop-loss ranges ready by analysts.

Moreover, the ecosystem integrates with Skilled Advisors (EAs) for MetaTrader 4 and 5. Customers can join their accounts to subscribe to automated buying and selling robots at a month-to-month subscription price, extending the attain of uTrade’s methods past its personal platform.

NFTs With Actual Utility: Revenue Sharing By means of uShark NFTs

In distinction to speculative NFT tasks that depend on hype-driven valuations, uTrade’s uShark NFTs are designed as profit-sharing devices tied to actual buying and selling efficiency.

The monetary construction is clearly outlined:

- 75% of NFT sale proceeds are allotted to buying and selling capital.

- 15% goes into the treasury to make sure platform stability.

- 10% is directed to operational bills.

Earnings generated from buying and selling are then distributed on a quarterly foundation:

- 50% of earnings are shared immediately with NFT holders.

- 10% is used for buybacks and burns of uTrade and uShark tokens, decreasing provide.

- 20% is allotted to the group.

- 20% helps the startup treasury for future innovation.

NFTs are provided in Gold, Silver, and Bronze tiers, every akin to a special share of the revenue pool. In keeping with the whitepaper, if the platform had been to generate $100,000 in month-to-month revenue, Gold NFTs would yield $25 per NFT, Silver NFTs $12.50, and Bronze NFTs $6.25 (Based mostly then all NFTs the place bought).

Observe: The NFTs have a max provide of Bronze 3000, Silver 1500, Gold 500

This mannequin transforms NFTs from speculative belongings into utility-based devices that generate recurring revenue, aligning them extra intently with monetary participation than digital artwork.

The uTrade Token (UTT): Deflationary Provide With Constructed-In Utility

The uTrade Token (UTT) underpins a lot of the platform’s ecosystem. Constructed with a deflationary mechanism, the token provide is capped at 50 million. Importantly, 10% of platform earnings are dedicated to buybacks and burns, regularly decreasing circulation and making use of upward stress on worth.

Distribution is structured to encourage stability:

- 45% of tokens are locked in treasury for twenty-four months.

- 15% are reserved for change liquidity.

- 10% for staking swimming pools.

- 15% for advertising initiatives.

- The rest is allotted throughout presales, whitelist allocations, group compensation, and NFT airdrops.

Holding UTT gives entry to unique providers inside the ecosystem, reductions on subscriptions, and eligibility for affiliate rewards. Token holders might also profit from airdrops, notably if additionally they take part within the NFT program.

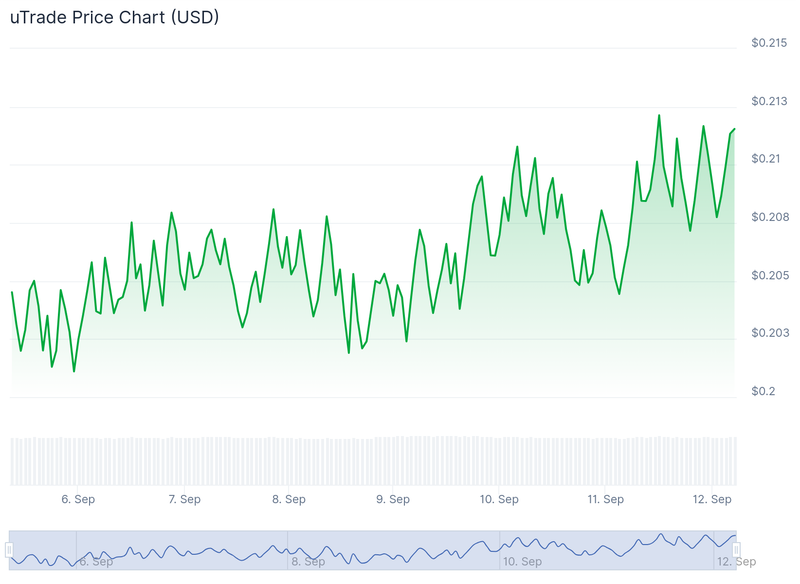

Preliminary pricing tiers had been set at $0.05 through the whitelist section, rising by $0.10 and $0.15 in presales, with a public launch value of $0.20.

Staking Program: Fastened APR Rewards for Lengthy-Time period Holders

To incentivize long-term participation, uTrade presents a staking program with fastened APR swimming pools:

- 12-month lock-up: 10% APR.

- 18-month lock-up: 15% APR.

- 24-month lock-up: 20% APR.

Rewards are distributed mechanically, offering predictable returns for customers who decide to longer holding durations. Importantly, staked tokens don’t depend towards entry necessities for bots or group teams — liquid UTT tokens should stay in wallets for that objective. This design maintains each circulation and participation whereas rewarding those that assist the platform’s stability.

Market Making Service: Self-Managed Options for Initiatives

Along with serving particular person merchants, uTrade has developed a Market Maker SaaS resolution aimed toward crypto tasks. Market making is usually crucial within the months following a token itemizing, the place tasks face dangers from arbitrage and insider exercise.

uTrade’s MM service allows tasks to conduct market making in-house, fairly than outsourcing to third-party suppliers. Bots join by way of buying and selling APIs, making certain that mission funds stay below their direct management. The platform’s built-in anti-arbitrage protections are designed to stabilize liquidity and cut back dangers throughout weak durations.

For rising tasks, this service can cut back prices, enhance safety, and foster higher independence.

Sustainable Progress Mannequin and Revenue Allocation

uTrade’s financial framework emphasizes sustainability and group profit.

Ecosystem revenue allocation consists of:

- 50% distributed to NFT holders.

- 10% directed to token burns.

- 20% reinvested in improvement and uShark startup funding.

- 20% allotted to group and operations.

Income from gross sales is structured as:

- 75% to buying and selling capital and bots.

- 15% to uShark’s treasury for long-term progress.

- 10% for operational prices comparable to IT and market making.

This stability displays an effort to mix group incentives with operational resilience, making certain that the platform can scale whereas sustaining belief.

International Market Context: AI, DeFi, and NFT Progress

uTrade’s launch comes at a time when a number of monetary expertise sectors are increasing quickly.

- The AI in finance market was valued at $40.7 billion in 2023 and is projected to develop to $181.8 billion by 2030, at a compound annual progress fee (CAGR) of 24.6% (MarketsandMarkets).

- The decentralized finance (DeFi) market is forecasted to achieve $231 billion by 2030, with progress pushed by growing adoption of decentralized exchanges, lending protocols, and yield providers (Allied Market Analysis).

- The NFT sector is evolving past artwork hypothesis towards utility-driven fashions, comparable to income participation and asset-backed possession. This aligns immediately with uTrade’s profit-sharing NFT design, which positions NFTs as income-generating devices.

By working on the intersection of those three tendencies — AI buying and selling, DeFi, and utility NFTs — uTrade is getting into a market with important long-term potential.

Conclusion: Transparency, Neighborhood, and the Way forward for Wealth Creation

From its whitepaper to its web site disclaimers, uTrade underscores that buying and selling entails dangers and that members should make their very own monetary choices. The corporate disclaims duty for particular person outcomes, noting that foreign exchange and crypto markets may end up in losses past preliminary capital.

On the similar time, the platform has taken steps towards compliance and transparency, together with public Audit and KYC references, detailed revenue allocation fashions, and common token burn mechanisms.

In presenting itself as a community-first ecosystem, uTrade emphasizes sustainability, transparency, and entry to instruments that had been as soon as the protect of institutional finance.

For extra data, go to www.utrade.vip or join with the group on X (Twitter), Telegram, Discord, and YouTube.

Disclaimer: The knowledge supplied on this press launch is just not a solicitation for funding, neither is it meant as funding recommendation, monetary recommendation, or buying and selling recommendation. It’s strongly advisable you apply due diligence, together with session with knowledgeable monetary advisor, earlier than investing in or buying and selling cryptocurrency and securities.