Over the previous 5 years, shares have solely gained as soon as in September.

It doesn’t matter what the market is doing, it is a terrific concept to regulate the strikes of Warren Buffett. He is proved his understanding of shares over time and his potential to translate that into investing success. The highest investor has sat on the helm of Berkshire Hathaway for practically 60 years, and over that point interval has helped drive a compounded annual return of about 20%. That far outshines the S&P 500 (^GSPC -0.32%), which delivered a ten% such return.

And through occasions of market uncertainty, it is significantly fascinating to look to Buffett for steerage. Now could also be a type of occasions — with the S&P 500 lingering close to document highs and as we begin off a month that is traditionally been the worst for traders. What has Buffett been doing in latest occasions? Properly, the investing large has been a internet vendor of shares quarter after quarter for nearly three years.

Actually, his strikes have resulted in a $344 billion money pile at Berkshire Hathaway, and this can be seen as a warning to Wall Avenue that is ringing out loud and clear. Does this imply you can purchase or keep away from shares through the probably troublesome month of September? Let’s discover out.

Picture supply: The Motley Idiot.

Shares in September

So, first, let’s speak concerning the month of September. It has been the worst for traders over time, and this development is confirmed if we have a look at latest knowledge. Over the previous 5 years, the S&P 500 solely superior as soon as in September — by 2% final 12 months. The opposite Septembers resulted in losses of about 3% to 9%. If historical past is right, we could also be heading for one more robust month that would decrease the worth of your portfolio, at the least quickly.

Now, let’s transfer on to Buffett’s warning. The billionaire by no means joins in massive market actions. For instance, if everyone seems to be shopping for synthetic intelligence (AI) shares, Buffett will not be a part of this crowd. He would not do that simply to be opposite. As a substitute, Buffett prefers specializing in worth shares — high quality firms that could be neglected by the final market right now however have what it takes to ship development over the long term.

So, in latest quarters, as traders flocked to know-how and development shares and the S&P 500 soared, Buffett purchased selectively and grew his pile of money, readying himself for future funding alternatives. Buffett’s warning is basically this: Shares have change into costly, and in consequence, the market might pull again at any second.

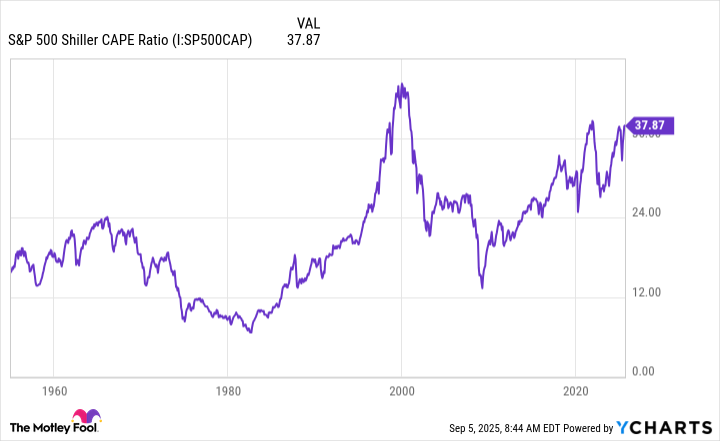

We will see this by way of the S&P 500 Shiller CAPE ratio, right now at ranges it is solely reached twice earlier than for the reason that S&P 500 launched as a 500-company index.

S&P 500 Shiller CAPE Ratio knowledge by YCharts

What Buffett does on this investing atmosphere

The Shiller CAPE ratio is a very sound metric as a result of it measures an organization’s earnings per share, adjusted for inflation, over a 10-year interval. And the present stage reveals that shares, general, are costly, making this the form of atmosphere that Buffett approaches with warning.

Contemplating all of this, do you have to purchase or keep away from shares throughout what usually is the worst month for the inventory market? Like Buffett, all of us ought to pay shut consideration to valuation and keep away from shopping for shares that look overvalued — however this is a crucial rule to speculate by at any time, whether or not the general market is rising or falling. (In fact, there could also be some exceptions. Aggressive traders may, for instance, think about shares of a high-growth tech firm that is buying and selling for a steep valuation if the complete long-term image appears vivid.)

Alternatives on the horizon?

Nonetheless, this doesn’t suggest we must always keep away from shares altogether, and Buffett is not telling us to cease investing both. As a substitute, his big money pile implies alternatives could also be restricted for the time being, in lots of instances attributable to excessive valuations. However this is the excellent news. If shares truly observe the historic development and decline in September, this will likely create alternatives — so September could also be a incredible time for the bargain-hunting long-term investor to go purchasing for shares.

Buffett backs up this concept as we will see in a remark he as soon as made: “One of the best likelihood to deploy capital is when issues are happening.”

In any case, the general market and high quality shares have proven over time that they do not stay within the doldrums without end. So, whenever you purchase at a low level and maintain on for a interval of years, you may set your self up for an enormous win.

All of because of this, sure, it’s best to think about shopping for shares through the worst month of the 12 months — so long as, like Buffett, you be sure that the value is true.