Warren Buffett is likely one of the greatest buyers of all time. However he isn’t historically identified for investing in know-how companies. That is modified in recent times, nonetheless, and right now a few of his largest positions are know-how firms. In actual fact, he is at present betting billions of {dollars} on a selected synthetic intelligence inventory that appears like a screaming purchase for buyers bullish on synthetic intelligence (AI).

This iconic firm is a synthetic intelligence all-star

Most individuals do not consider Amazon (AMZN -1.65%) as an AI firm. However certainly one of its largest enterprise segments sits on the heart of the AI revolution.

In 2006, Amazon launched a brand new division: Amazon Net Companies, or AWS for brief. At first, this division was structured round serving to to make its inside e-commerce operation extra environment friendly at scaling. However over time, Amazon realized that different companies wanted the identical options, particularly when it got here to scaling cloud computing. As we speak, AWS controls greater than 31% of the cloud computing infrastructure market.

From distributed compute and storage to huge knowledge analytics, AWS helps make the web what it’s right now. However extra lately, cloud computing suppliers like Amazon cater to a massively rising market: AI and machine studying. Synthetic intelligence is essentially delivered by way of fashions. These are mathematically educated techniques fed with knowledge that enable AI platforms to do all of the issues have been depend on it for right now, issues like recognizing patterns, making predictions, and automating duties with out customized programming. Many AI firms run their very own fashions, although some use open-source fashions.

These fashions sometimes want big quantities of knowledge for coaching. To perform correctly upon launch, they should entry and course of much more knowledge. All of this requires big quantity of computing energy, a lot of which is supplied by cloud service suppliers like AWS. As the most important cloud service supplier on the earth, AWS advantages enormously from the AI business’s rising demand for extra cloud sources.

This progress in demand will not cease anytime quickly. Based on McKinsey & Co., knowledge heart capability might rise at an annual fee of between 19% and 22% from 2023 to 2030. This can require an enormous buildout of further cloud infrastructure. “To keep away from a deficit,” McKinsey & Co. concludes, “no less than twice the info heart capability constructed since 2000 must be in-built lower than 1 / 4 of the time.” As one of many largest, most skilled, and best-funded suppliers, Amazon has a front-row seat to each preserve and develop its dominant market share.

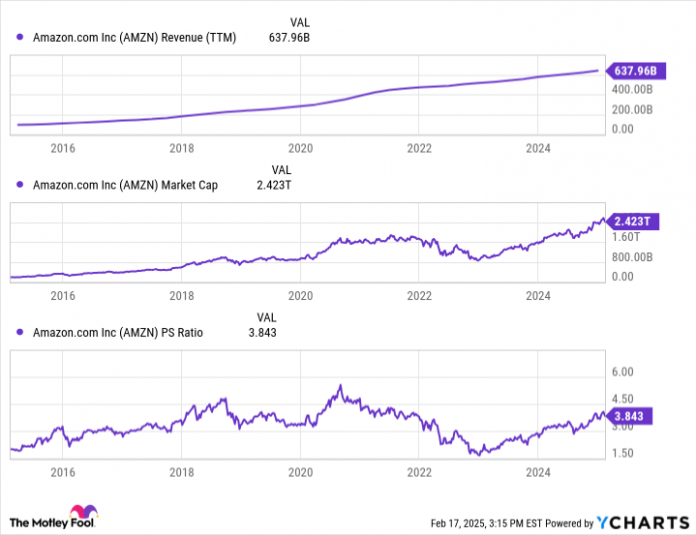

AMZN Income (TTM) knowledge by YCharts

Do you have to purchase Amazon inventory for its AI progress potential?

AWS continues to be a minority of Amazon’s whole total enterprise. However as a consequence of AI demand, this section is commanding extra consideration. In 2024, AWS generated practically $108 billion in income, comprising round 17% of Amazon’s whole gross sales. That is up from $91 billion in income in 2023, which represented simply 15.8% of Amazon’s income that 12 months.

Simply as essential is AWS’ contribution to Amazon’s profitability. This section is considerably extra worthwhile than others. Whereas it solely generated 17% of income in 2024, AWS was answerable for 58% of its whole working earnings that 12 months. So not solely is AWS a driving power behind Amazon’s top-line progress, but it surely’s additionally the vast majority of its working income right now.

AWS is a tantalizing motive for any investor like Buffett to have an interest. His holding firm owns round $2.1 billion shares, and owned a stake since 2019. To make sure, Amazon’s e-commerce enterprise will nonetheless doubtless be the main contributor of income for a number of years to return. However the explosion of AI demand might quickly flip Amazon into a good greater AI enterprise. If that occurs, there ought to be loads of upside versus the corporate’s present place as primarily an e-commerce supplier.

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Ryan Vanzo has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon. The Motley Idiot has a disclosure coverage.