Financial institution of Canada (BoC) Governor Tiff Macklem addressed reporters’ questions, providing insights into the central financial institution’s financial coverage outlook. His remarks got here after the BoC lowered its rate of interest by 25 foundation factors to 2.50%, a transfer that markets had broadly anticipated.

BoC press convention key highlights

Wage development continued to ease.

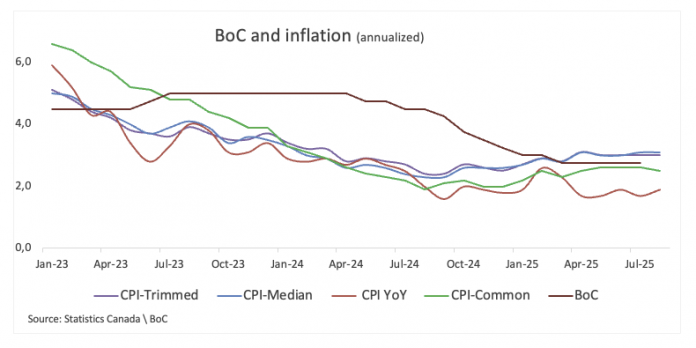

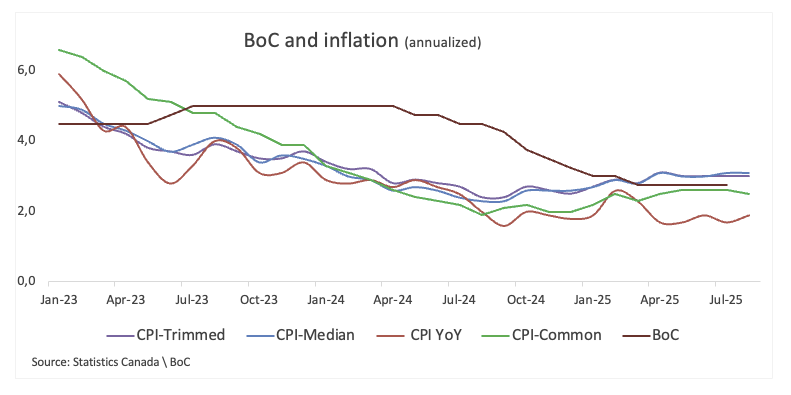

The popular core inflation measures have been round 3.0%.

Underlying inflation is working round 2.5%.

Consensus to chop charges was clear.

Consideration now shifts to how exports carry out.

There are nonetheless some blended alerts on inflation.

The Inflation image hasn’t modified a lot since January.

We’re not being as forward-looking as regular.

The Financial institution of Canada thought of holding the in a single day price regular.

I’ve extra consolation trying on the upward strain on CPI.

We shall be assessing the affect of presidency bulletins on focused assist and assist for giant tasks.

Inflationary pressures look considerably extra contained.

If dangers tilt additional we’re ready to take extra motion.

Will take it one assembly at a time.

This part under was printed at 13:45 GMT to cowl the Financial institution of Canada’s coverage bulletins and the preliminary market response.

In keeping with market analysts’ expectations, the Financial institution of Canada (BoC) trimmed its coverage price by 25 foundation factors, taking it to 2.50% on Wednesday. Buyers’ consideration will now shift to the standard press convention by Governor Tiff Macklem at 14:30 GMT.

BoC coverage assertion key highlights

Fee lower was applicable given the weaker economic system and fewer upside danger to inflation.

On a month-to-month foundation, upward momentum in core inflation seen earlier this yr has dissipated.

Disruption linked to commerce shifts will proceed so as to add prices whilst they weigh on financial uncertainties.

BoC says it would proceed to assist financial development whereas guaranteeing inflation stays effectively managed.

Ottawa’s determination to scrap tariffs on US imported items will imply much less upward strain on costs of these items.

Broader vary of indicators continues to recommend underlying inflation is working round 2.5%.

Within the months forward, sluggish inhabitants development and labour market weak point will doubtless weigh on family spending.

Market response

The Canadian Greenback (CAD) stays on the defensive on Wednesday within the context of renewed USD shopping for, with USD/CAD navigating the 1.3760 zone and reversing two consecutive day by day pullbacks.

Canadian Greenback Value At present

The desk under reveals the proportion change of Canadian Greenback (CAD) towards listed main currencies at this time. Canadian Greenback was the strongest towards the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.17% | -0.08% | -0.12% | 0.16% | -0.01% | -0.01% | 0.16% | |

| EUR | -0.17% | -0.25% | -0.29% | 0.02% | -0.04% | -0.05% | -0.00% | |

| GBP | 0.08% | 0.25% | -0.02% | 0.27% | 0.06% | 0.07% | 0.17% | |

| JPY | 0.12% | 0.29% | 0.02% | 0.27% | 0.21% | 0.11% | 0.14% | |

| CAD | -0.16% | -0.02% | -0.27% | -0.27% | -0.09% | -0.12% | -0.03% | |

| AUD | 0.00% | 0.04% | -0.06% | -0.21% | 0.09% | 0.01% | 0.04% | |

| NZD | 0.01% | 0.05% | -0.07% | -0.11% | 0.12% | -0.01% | 0.07% | |

| CHF | -0.16% | 0.00% | -0.17% | -0.14% | 0.03% | -0.04% | -0.07% |

The warmth map reveals share modifications of main currencies towards one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, for those who choose the Canadian Greenback from the left column and transfer alongside the horizontal line to the US Greenback, the proportion change displayed within the field will signify CAD (base)/USD (quote).

This part under was printed as a preview of the Financial institution of Canada’s (BoC) financial coverage bulletins at 09:00 GMT.

- The Financial institution of Canada is anticipated to scale back its key rate of interest to 2.50%.

- The Canadian Greenback maintains a constructive tone vs. the US Greenback this month.

- The BoC saved a gentle hand within the final three financial coverage conferences.

- The affect of US tariffs on the economic system ought to stay centre stage.

The Financial institution of Canada (BoC) is broadly anticipated to scale back its benchmark rate of interest by 1 / 4 share level on Wednesday, taking it to 2.50% after three consecutive ‘on maintain’ choices.

The probabilities of the BoC resuming its easing cycle have elevated as a result of weak development, a delicate labour market, and comparatively managed inflation.

Canada’s economic system contracted by 1.6% within the second quarter, a sharper decline than anticipated, whereas employment fell by greater than 100K in July and August, lifting the jobless price to 7.1%. Dovish forecasts had been bolstered by August inflation figures launched on Tuesday, which got here in higher than anticipated. The Shopper Value Index (CPI) rose by 1.9% YoY, under the two% forecast, whereas the core CPI remained regular at 2.6%.

“Inflation remained largely unthreatening in August, making the anticipated Financial institution of Canada rate of interest lower tomorrow a comparatively simple determination,” mentioned Andrew Grantham, senior economist at CIBC Capital Markets, per Reuters.

The central financial institution left curiosity charges unchanged at its gathering on July 30, a transfer that got here as little shock to markets. Nonetheless, the choice has raised a extra vital query: Has the cycle of price cuts already reached its peak?

Governor Tiff Macklem defined that the pause was pushed by inflation that simply received’t absolutely budge. The financial institution’s most popular measures, the trim imply and trim median, are nonetheless hovering round 3%, and a broader vary of indicators have additionally ticked increased. Macklem acknowledged that this persistence has drawn the eye of policymakers, who will carefully monitor it within the coming months.

Nonetheless, he shortly clarified that not all the present value pressures are everlasting. A stronger Canadian Greenback (CAD), softer wage development, and an economic system working under capability ought to all work to convey inflation decrease over time.

Previewing the BoC’s rate of interest determination, analyst Taylor Schleich on the Nationwide Financial institution of Canada (NBC) famous, “After holding regular for the final three conferences, the Financial institution of Canada’s Governing Council (GC) is about to decrease the in a single day goal by 25 bps to 2.5%. OIS markets decide a lower to be doubtless with ~90% implied easing odds. An inflation report simply over 24 hours earlier than the choice is a supply of uncertainty, however we don’t count on it to derail a lower.”

When will the BoC launch its financial coverage determination, and the way might it have an effect on USD/CAD?

The Financial institution of Canada will publish its coverage determination on Wednesday at 13:45 GMT. After that, Governor Tiff Macklem will attend a press convention at 14:30 GMT.

Market individuals have largely anticipated a price lower on Wednesday, whereas implied charges recommend practically 45 foundation factors of easing by year-end.

In accordance with FXStreet’s Senior Analyst, Pablo Piovano, the Canadian Greenback (CAD) has been appreciating at a agency tempo towards the US Greenback (USD) in the previous few days, with USD/CAD easing towards the 1.3750 area.

He notes that renewed promoting might see the pair drift again towards the August flooring within the 1.3730-1.3720 band. Additional assist sits on the weekly base at 1.3575 (July 23) and the June valley at 1.3556 (July 3), earlier than reaching the yr’s backside at 1.3538 (June 16).

On the topside, resistance is pegged on the August prime at 1.3924 (August 22), adopted by the 1.4000 spherical stage, with the Could ceiling at 1.4015 (Could 13) being bolstered by the proximity of the numerous 200-day Easy Shifting Common (SMA).

From a broader perspective, Piovano argues that the bearish bias stays intact so long as spot trades beneath its 200-day SMA.

That mentioned, momentum alerts stay blended: the Relative Power Index (RSI) has damaged under the 43 stage, hinting at strengthening draw back momentum, whereas the Common Directional Index (ADX) close to 16 means that the broader development nonetheless lacks juice.