Ethereum misplaced the vital $3,000 stage on Sunday, sliding towards $2,800 and triggering a brand new wave of concern throughout the market. The drop highlights a deepening corrective part that has pushed short-term buyers into heavy unrealized losses, prompting many to reassess their threat publicity.

Associated Studying

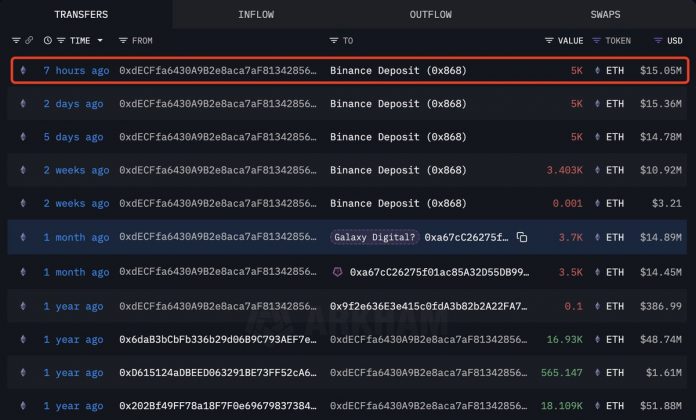

Including to the uncertainty, recent on-chain knowledge has revealed renewed distribution from main holders. Based on knowledge from Arkham, shared by Lookonchain, the well-known whale 0xdECF deposited one other 5,000 ETH—roughly $15.05 million—into Binance.

This transfer expands a sample of constant promoting strain from massive wallets, typically seen throughout heightened market stress. Whereas one whale doesn’t outline the broader pattern, these deposits often reinforce bearish sentiment amongst merchants who monitor trade inflows as a proxy for potential sell-side liquidity.

Whale Distribution Deepens Amid Broader Market Anxiousness

Since October 28, the identical whale pockets has accelerated its promoting exercise, unloading 25,603 ETH—roughly $85.44 million—throughout Binance and Galaxy Digital. Regardless of this aggressive distribution, the pockets nonetheless holds 10,000 ETH valued at roughly $30.34 million, leaving open the potential of continued promote strain if market circumstances weaken additional. Massive-scale actions like these typically sign a shift in sentiment from subtle holders who are likely to anticipate volatility sooner than the broader market.

This promoting spree comes at a second when confidence is already fragile. The latest Tether FUD, fueled by hypothesis round reserve transparency and potential regulatory scrutiny, has added stress to liquidity circumstances.

In the meantime, renewed headlines a couple of supposed China Bitcoin ban have resurfaced on social media, amplifying concern throughout each retail merchants and short-term buyers. Though neither narrative displays new basic dangers, emotional markets typically react sharply to sensational information throughout corrective phases.

Associated Studying

Collectively, these components create a backdrop the place whale distributions achieve outsized affect. If the remaining 10,000 ETH enters exchanges, it may deepen short-term draw back strain. Conversely, a pause in promoting could counsel that the whale views present ranges as near-capitulation territory, providing a possible ground for stabilization.

Ethereum Worth Checks Assist as Downtrend Stays Intact

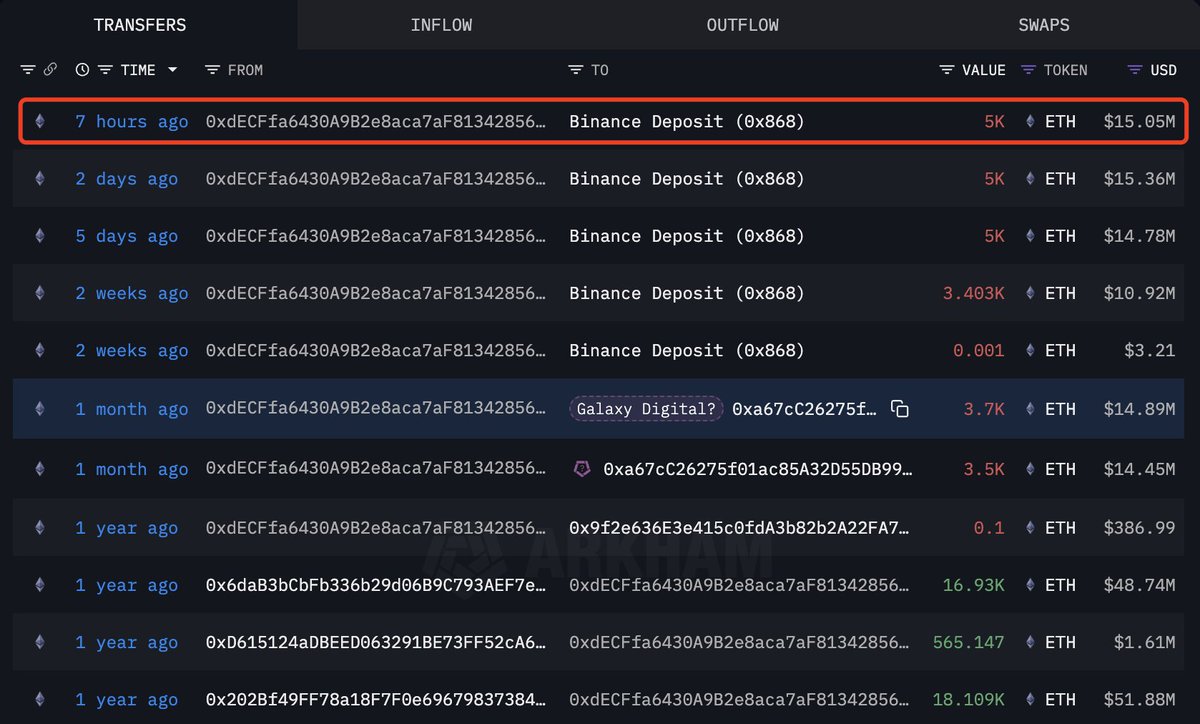

Ethereum’s 4-hour chart reveals a market nonetheless struggling to regain momentum after shedding the $3,000 deal with. The broader construction stays decisively bearish, with value buying and selling under the 50 SMA, 100 SMA, and 200 SMA—a transparent indication that sellers proceed to regulate the pattern. Every try and get well above the shifting averages has been rejected, reinforcing the downtrend that started in late October and has continued by means of November.

The latest bounce from the $2,750–$2,800 help zone reveals that consumers are defending this stage, however the response lacks conviction. Quantity stays muted, and the most recent try and reclaim $3,000 rapidly failed, forming one other decrease excessive. This indicators hesitation and means that bulls aren’t but robust sufficient to shift market construction.

Associated Studying

The compression seen towards the top of the chart fashioned a small symmetrical triangle, however the breakdown that adopted confirms that sellers nonetheless dominate short-term momentum. So long as ETH stays under the 200 EMA—now close to $3,350—the macro pattern favors continuation to the draw back.

If $2,800 breaks cleanly, the subsequent liquidity pockets sit round $2,600 and $2,450, ranges that might appeal to stronger purchaser curiosity. For now, Ethereum should reclaim $3,000 with sustained quantity to neutralize bearish strain.

Featured picture from ChatGPT, chart from TradingView.com