This innovation-first inventory is priced for good long-term progress.

Over the previous couple of years, there is a robust case that no corporations have gotten as a lot consideration as these coping with synthetic intelligence (AI). In some circumstances, these are comparatively new corporations, whereas in different circumstances, they’re established massive tech shares.

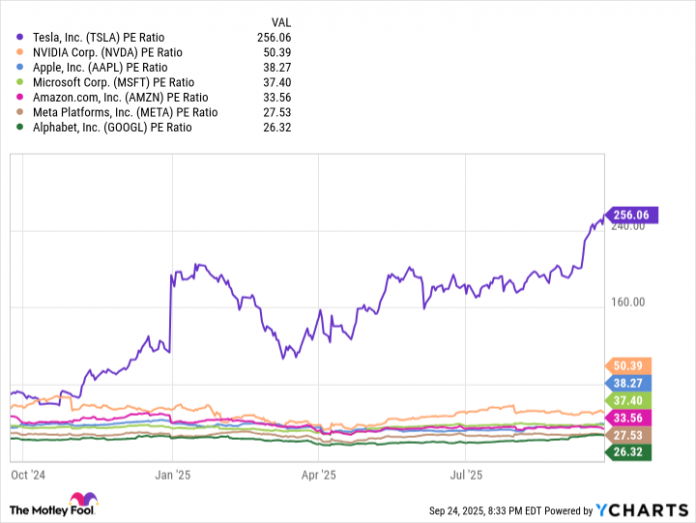

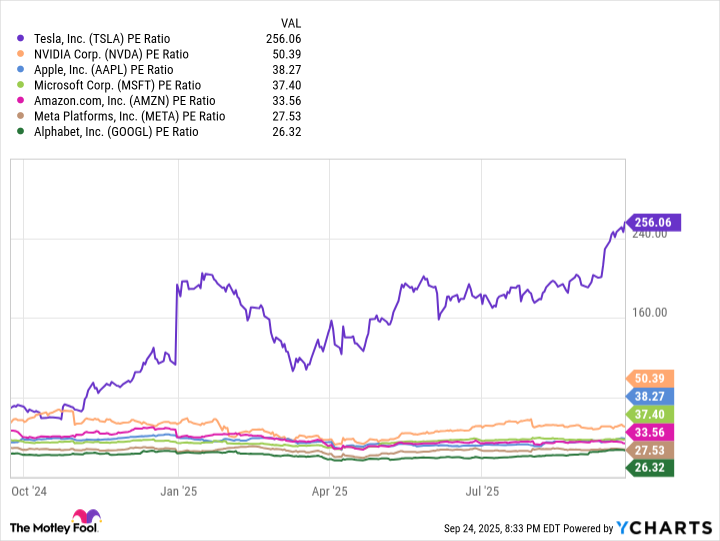

Specializing in the large tech shares (as a result of they’re higher positioned for longevity generally), there’s one inventory that stands proud as the most effective AI bargains available on the market: Alphabet (GOOG 0.21%) (GOOGL 0.28%). On the time of writing, Alphabet is buying and selling at 26.3 instances its projected earnings over the subsequent 12 months — which is the most affordable of all of the “Magnificent Seven” shares.

TSLA PE Ratio knowledge by YCharts. PE = price-to-earnings.

Valuation alone does not make a inventory a purchase, but it surely does give it extra upside than draw back. There is not as a lot progress and expectation priced into the inventory, which might assist guard towards sharp pullbacks if these expectations aren’t met.

Picture supply: Getty Photos.

Except for simply its valuation, Alphabet stands out as a result of it operates in lots of essential elements of the AI pipeline. Its subsidiary, DeepMind, handles AI analysis. It owns and operates dozens of information facilities (that are wanted to coach and scale AI), and it has client AI functions, equivalent to its generative AI device, Gemini, and Movement, its filmmaking device.

Being concerned within the numerous elements of the AI pipeline is helpful for Alphabet, as a result of it has extra management over innovation and integration and is much less reliant on others.

Stefon Walters has positions in Apple and Microsoft. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.