Trump Accounts, just lately launched as a part of the One Massive Stunning Invoice Act (OBBBA), are producing a vigorous debate amongst financial savings and retirement consultants.

Introduced as a brand new type of birthright funding account, may these accounts actually rival, and even surpass, Particular person Retirement Accounts (IRAs)? A more in-depth look is so as.

A monetary increase from beginning

The precept behind Trump Accounts is straightforward: for every little one born between 2025 and 2028, the US Authorities mechanically pays an preliminary deposit of $1,000, supplied the kid has a Social Safety quantity.

Thereafter, mother and father, employers or different entities can contribute as much as $5,000 per yr to this account, with inflation indexation scheduled to start in 2027.

Funds should be invested in Index funds monitoring the US market, with charges restricted to 0.1% to ensure most returns.

Not like conventional retirement financial savings accounts, Trump Accounts don’t require earned revenue to contribute.

Which means even a new child child can begin saving in its first yr, an method paying homage to the “child bonds” championed by a number of politicians for over a decade.

An IRA-like construction, however with nuances

Tax-wise, Trump Accounts resemble a hybrid between a Roth IRA and a Conventional IRA.

Contributions, as in a Roth IRA, are made on an after-tax foundation and are usually not deductible.

Funds develop tax-free, however not like a Roth, withdrawals are typically taxed like a Conventional IRA, with sure exceptions (greater training, actual property purchases, and so on.).

From age 18, the account holder could make withdrawals, which then observe the standard IRA tax guidelines.

Earlier than the age of 59 and a half, penalties of 10% apply on earnings within the occasion of non-qualified withdrawals, besides within the case of use for bills supplied for within the IRA early withdrawal code.

A sensible retirement instrument or simply one other bureaucratic monster?

The principle benefit of those accounts lies of their long-term nature. Positioned from beginning in low-cost index funds, investments can develop considerably due to the energy of compound curiosity.

In response to CNBC projections, an preliminary account of $1,000 with common contributions of $200 a month may develop to over $250,000 in 30 years, with a median annual return of seven%.

However this promise is nuanced. On the one hand, Trump Accounts allow households to construct capital for training, residence buy and even their youngsters’s retirement.

Then again, they add a layer of complexity to the already cluttered panorama of American retirement financial savings.

At this time, the US tax system has greater than ten totally different financial savings autos, all with distinct guidelines: IRA, Roth IRA, 401(okay), 529, HSA… and now Trump Accounts.

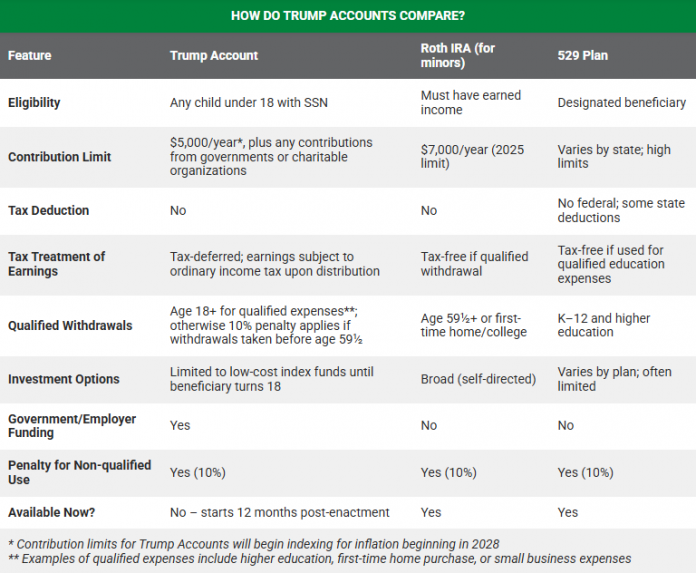

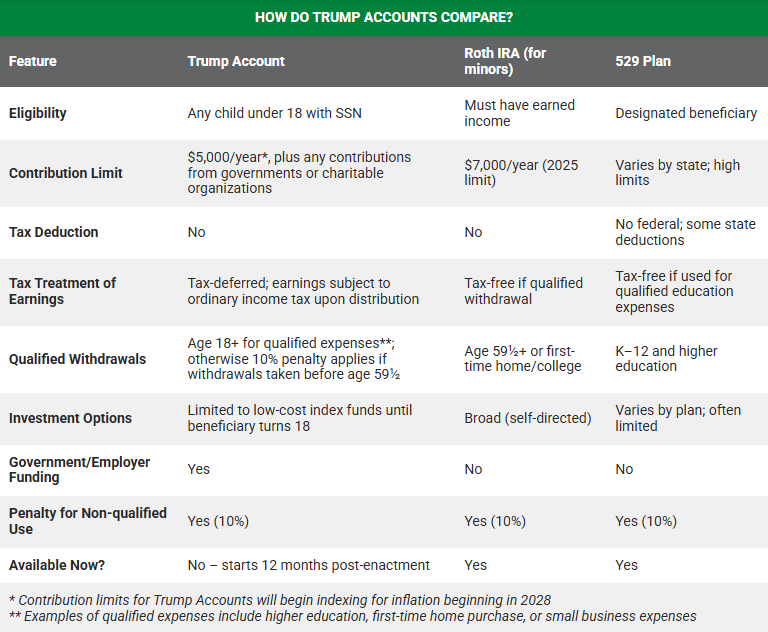

Trump Accounts vs IRAs: Key variations to pay attention to

Supply: BRAGG Monetary

Trump Accounts are distinguished by their early accessibility. Not like Conventional IRAs and Roth IRAs, which require earned revenue to contribute, Trump Accounts are open from beginning.

When it comes to contribution limits, Trump Accounts permit annual funds of as much as $5,000, whereas Conventional and Roth IRAs supply a barely greater restrict, with set contribution limits at $7,000 in 2025 for individuals below 50.

Taxation is one other main level of divergence. Deposits right into a Trump Account are usually not tax-deductible, simply as in a Roth IRA.

Then again, contributions to a Conventional IRA can, below sure situations, be tax-deductible, making it an enticing instrument for taxpayers wishing to cut back their taxable revenue within the quick time period.

About withdrawals, Trump Accounts function in keeping with guidelines just like Conventional IRAs: Features are taxed on the time of withdrawal, with sure exceptions (training, first actual property buy, and so on.).

Conversely, the Roth IRA is distinguished by a complete tax exemption on certified withdrawals after age 59 1/2, making it essentially the most tax-efficient possibility for long-term retirement planning.

Lastly, the flexibility of use varies considerably. Trump Accounts permit withdrawals as early as age 18, however with restrictions. Conventional IRAs, then again, impose an age restrict of 59 and a half, on ache of penalty.

The Roth IRA is extra versatile, permitting contributions (however not earnings) to be withdrawn tax- and penalty-free at any time, offering helpful leeway in case of unexpected want.

Briefly, whereas Particular person Retirement Accounts (IRAs), and significantly the Roth IRA, retain a transparent tax benefit for retirement planning, Trump Accounts are enticing for his or her early accessibility and obvious simplicity.

Nonetheless, the taxation of exit good points stays a possible brake, limiting their competitiveness with current retirement financial savings merchandise.

A chance, however not a miracle resolution

It might be tempting to see Trump Accounts as a common, miraculous resolution. In any case, who would flip down a free $1,000 cost for his or her little one?

But past this “present”, consultants level out that different retirement accounts could also be simpler, relying on the target pursued.

To finance training, for instance, 529 plans stay unbeatable, with their focused tax benefits. For retirement planning, Roth IRAs dominate with their whole exemption on exit.

Nonetheless, the administration of those new accounts, their nonetheless unclear tax standing, and their restricted funding framework (Index funds solely) make them a instrument for use with discernment, as a complement to, not a alternative for, current retirement financial savings devices.

IRAs FAQs

An IRA (Particular person Retirement Account) means that you can make tax-deferred investments to save cash and supply monetary safety if you retire. There are several types of IRAs, the most typical being a conventional one – during which contributions could also be tax-deductible – and a Roth IRA, a private financial savings plan the place contributions are usually not tax deductible however earnings and withdrawals could also be tax-free. Once you add cash to your IRA, this may be invested in a variety of monetary merchandise, often a portfolio primarily based on bonds, shares and mutual funds.

Sure. For typical IRAs, one can get publicity to Gold by investing in Gold-focused securities, equivalent to ETFs. Within the case of a self-directed IRA (SDIRA), which affords the opportunity of investing in various property, Gold and treasured metals can be found. In such instances, the funding relies on holding bodily Gold (or another treasured metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t maintain the bodily metallic, however a custodian entity does.

They’re totally different merchandise, each designed to assist people save for retirement. The 401(okay) is sponsored by employers and is constructed by deducting contributions instantly from the paycheck, that are often matched by the employer. Selections on funding are very restricted. An IRA, in the meantime, is a plan that a person opens with a monetary establishment and affords extra funding choices. Each techniques are fairly related by way of taxation as contributions are both made pre-tax or are tax-deductible. You don’t have to decide on one or the opposite: even in case you have a 401(okay) plan, you could possibly put more money apart in an IRA

The US Inside Income Service (IRS) doesn’t particularly give any necessities concerning minimal contributions to start out and deposit in an IRA (it does, nevertheless, for conversions and withdrawals). Nonetheless, some brokers might require a minimal quantity relying on the funds you wish to spend money on. Then again, the IRS establishes a most quantity that a person can contribute to their IRA every year.

Funding volatility is an inherent threat to any portfolio, together with an IRA. The extra conventional IRAs – primarily based on a portfolio made from shares, bonds, or mutual funds – is topic to market fluctuations and might result in potential losses over time. Having mentioned that, IRAs are long-term investments (even over a long time), and markets are inclined to rise past short-term corrections. Nonetheless, each investor ought to think about their threat tolerance and select a portfolio that fits it. Shares are typically extra risky than bonds, and property obtainable in sure self-directed IRAs, equivalent to treasured metals or cryptocurrencies, can face extraordinarily excessive volatility. Diversifying your IRA investments throughout asset courses, sectors and geographic areas is one option to defend it in opposition to market fluctuations that would threaten its well being.