25 Sep What’s Plasma (XPL)?

Plasma is a layer-1 blockchain developed with a deal with stablecoin funds, aiming to deal with the rising position of digital {dollars} within the international economic system. Whereas stablecoins have already change into one of many dominant purposes in crypto, present networks weren’t constructed particularly to satisfy their calls for. Plasma’s design incorporates options reminiscent of zero-fee transfers for USDt, the flexibility to make use of customized tokens for fuel, and confidential transactions. These traits are supposed to make stablecoin transfers quicker, less expensive, and extra personal, whereas supporting a variety of payment-oriented purposes.

On the infrastructure stage, Plasma is secured by PlasmaBFT, a variant of the HotStuff consensus algorithm that provides Byzantine fault tolerance with low-latency finality. Its execution layer is powered by Reth, an Ethereum-compatible consumer written in Rust, which permits builders to deploy purposes utilizing acquainted EVM instruments. Collectively, these parts present deterministic ensures on settlement velocity and throughput, making Plasma technically able to dealing with the high-volume atmosphere related to international funds.

A distinguishing characteristic of Plasma is its integration of stablecoin-specific mechanisms instantly on the protocol stage. For instance, its paymaster system sponsors fuel prices for USDt transfers, permitting customers to ship funds with out holding the native XPL token. On the similar time, different transactions incur regular charges to maintain validator incentives and preserve the community’s financial safety. Over time, the community additionally plans to introduce extra options reminiscent of a trust-minimised Bitcoin bridge, confidential funds, and deeper integration of stablecoin-native contracts, with options rolled out in phases moderately than .

The community’s financial mannequin revolves round its native token, XPL, which is used for validator rewards, staking, and payment funds past the gasless USDt transfers. Distribution of XPL spans public sale members, the staff, traders, and ecosystem initiatives, with a gradual unlocking schedule. Validators safe the community underneath a proof-of-stake mannequin, incomes rewards by way of managed inflation that decreases over time to stability long-term provide. By combining consensus design, stablecoin-first options, and EVM compatibility, Plasma represents an effort to create an infrastructure layer tailor-made to the calls for of digital cash and high-volume, international fee exercise.

What’s the XPL Token?

The XPL token is the native asset of the Plasma blockchain, serving as the muse of the community’s financial and safety mannequin. Just like how ETH features on Ethereum or BTC on Bitcoin, XPL is used to pay transaction charges, safe the community by way of staking, and incentivise validators who preserve consensus. Whereas Plasma helps gasless USDt transfers by way of a protocol-managed paymaster, XPL underpins all different exercise on the chain, guaranteeing that validators are rewarded and the system stays sustainable. On this means, XPL balances the aim of enabling frictionless stablecoin funds with the necessity to preserve sturdy community economics.

XPL additionally performs a important position in Plasma’s proof-of-stake consensus. Validators stake XPL to earn the fitting to take part in block manufacturing and transaction verification, receiving rewards in return for his or her service. To align incentives, Plasma implements a system the place misbehaving validators lose rewards moderately than their staked capital, lowering the chance of catastrophic losses whereas nonetheless penalising misconduct. Because the community decentralises over time, staked delegation will permit common token holders to contribute to safety by assigning their XPL to validators, broadening participation in consensus with out requiring all customers to run infrastructure.

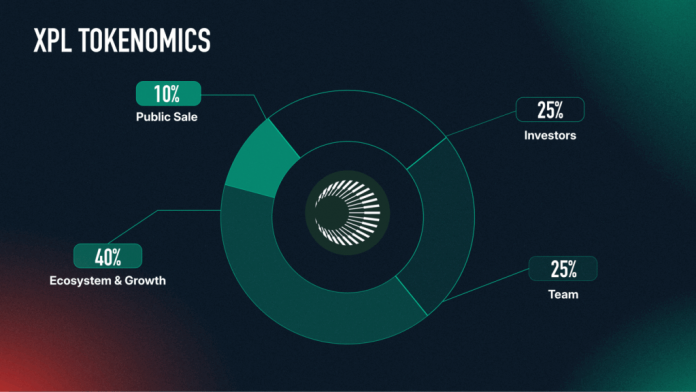

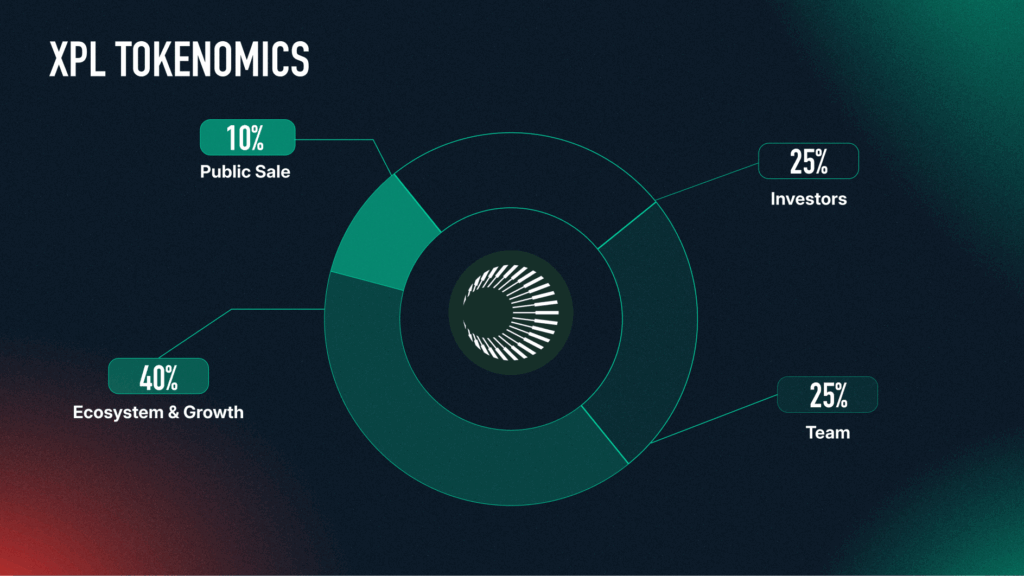

The token’s distribution displays its twin position as each a utility and governance asset. Out of a complete provide of 10 billion XPL, allocations are unfold throughout ecosystem progress initiatives, the staff, early traders, and a public sale. These tokens are topic to lockups and vesting schedules designed to assist long-term alignment and stop extreme early promote strain. Inflation begins at 5% yearly for validator rewards, regularly tapering to three%, with EIP-1559-style payment burning serving to offset provide progress as transaction quantity will increase. This mixture of emission controls and fee-burning is supposed to maintain validator participation whereas managing dilution for long-term holders.

Inside the broader Plasma ecosystem, XPL features as the important thing enabler of options past easy stablecoin transfers. Builders constructing purposes on Plasma will use XPL for fuel until they decide into customized fuel token preparations, whereas cross-asset programmability, staking, and future governance mechanisms are additionally tied to XPL. Briefly, the token acts as each the safety spine and the worth anchor of the community, guaranteeing that Plasma’s stablecoin-focused design stays economically viable whereas supporting its ambition to scale into a world funds infrastructure.

XPL Tokenomics

Find out how to purchase XPL with crypto

1. Log in to your Bitfinex account or join to create one.

2. Go to the Deposit web page.

3. Within the Cryptocurrencies part, select the crypto you propose to purchase XPL with and generate a deposit handle on the Trade pockets.

4. Ship the crypto to the generated deposit handle.

5. As soon as the funds arrive in your pockets, you’ll be able to commerce them for XPL. Learn to commerce on Bitfinex right here.

Find out how to purchase XPL with fiat

1. Log in to your Bitfinex account or join to create one.

2. You must get full verification to have the ability to deposit fiat to your Bitfinex account. Find out about totally different verification ranges right here.

3. On the Deposit web page, underneath the Financial institution Wire menu, select the fiat forex of your deposit. There’s a minimal quantity for fiat deposits on Bitfinex; be taught extra right here.

4. Verify your Bitfinex registered electronic mail for the wire particulars.

5. Ship the funds.

6. As soon as the funds arrive in your pockets, you should utilize them to purchase XPL.

Additionally, we now have Bitfinex on cellular, so you’ll be able to simply purchase XPL forex whereas on-the-go.

[AppStore] [Google Play]

XPL Group Channels

Web site | X (Twitter) | Discord