Have you ever ever positioned a commerce, solely to search out the market went nowhere?

Or jumped into what seemed like a robust development… simply to see it reverse?

Understanding whether or not a market is ranging or trending could make or break your buying and selling technique.

These two situations behave fully otherwise, and in case you’re taking the incorrect strategy within the incorrect setting, even setup can rapidly crumble.

Some merchants excel in fast-moving developments.

Others thrive in sideways worth motion.

However what separates profitable merchants from the remainder is appropriately understanding the market kind and adapting accordingly!

On this article, I’ll break down precisely find out how to spot the distinction between range-bound and trending markets, present you find out how to commerce each successfully and information you thru actual chart examples that carry these ideas to life.

Right here’s what you’ll cowl:

- What defines a range-bound market, and find out how to commerce inside key ranges

- What makes a trending market, and find out how to commerce with momentum

- Widespread errors merchants make in each situations and find out how to keep away from them

- Key indicators and instruments to assist establish market kind with confidence

- Learn how to shift gears when the market transitions from vary to development (or vice versa)

- A mixed strategy: utilizing each methods in real-world buying and selling

By the top, you’ll have a clearer understanding of find out how to work with any market situation and the instruments to take your trades with extra confidence and consistency.

Let’s dive in!

Vary vs Trending Market: What Is A Vary-Certain Market?

Definition

So that you could be asking, what precisely is a range-bound market, and the way can I establish it?

Let’s check out the definition first:

A spread-bound market happens when an asset’s worth strikes inside an outlined horizontal vary, bouncing between established excessive and low factors with out forming a transparent upward or downward development.

So, not like trending markets, the place costs persistently rise or fall, range-bound situations create a repetitive cycle of shopping for and promoting inside the set boundaries.

Now, you in all probability know these boundaries as help and resistance ranges, proper?

Help is the worth degree the place demand stops additional worth decline, and resistance is the place promoting strain caps any upward motion.

Traits

One of many key facets of a range-bound market is that there isn’t any dominant development.

Costs could transfer inside a fairly slender vary for longer durations, making a sideways worth sample on charts.

The sort of market habits sometimes means traders are unsure (as a gaggle), with neither patrons nor sellers having sufficient management to push the worth in a sure path for lengthy.

Throughout these phases, volatility is commonly decrease in comparison with trending markets, and worth actions are usually extra predictable inside the outlined vary.

Why do they happen?

Let’s dig a bit deeper.

I like to consider vary markets occurring in three eventualities.

On the finish of an uptrend, on the finish of a downtrend, or when the worth is taking a quick pause throughout a development.

These ranges can happen in all timeframes.

However why do they occur in any respect?

Effectively, traders could also be ready for brand spanking new financial information, earnings experiences, or political developments earlier than they decide to a brand new development.

Different instances, uncertainty within the broader market can result in worth stagnation, as merchants keep cautious and reluctant to take important positions.

There may even be exterior elements like central financial institution insurance policies, industry-specific information, or adjustments in market sentiment that may additionally contribute to longer durations of sideways motion.

Keep in mind to consider the vary as a time of indecision – a bit like a tug-of-war between bulls and bears the place the steadiness is evenly matched.

Let’s check out a ranging market instance on a chart, so you may see what it could seem like…

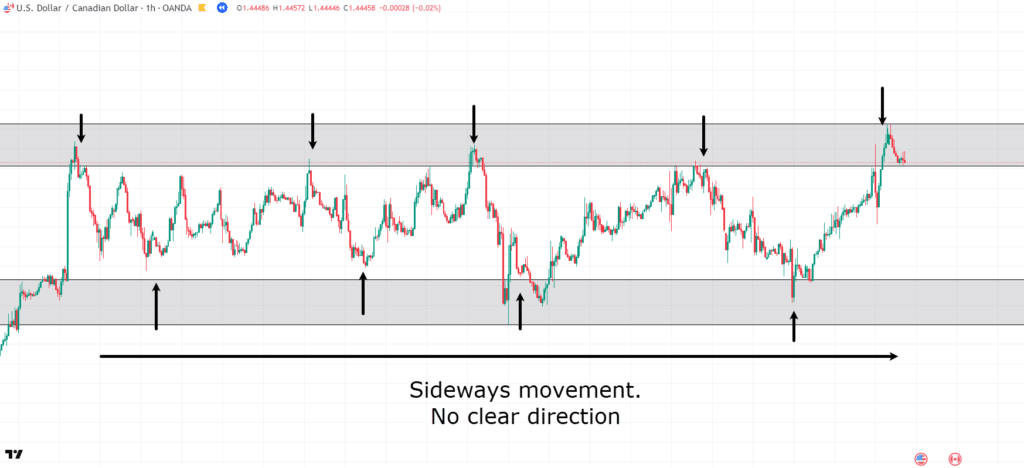

USD/CAD 1-hour Chart Vary Instance:

See how there isn’t any clear path throughout this era on the chart?

Each time it reaches the intense, there’s a quick pause after which… reversal.

I’ll go into extra element on find out how to truly commerce these markets afterward – maintain tight.

For now, let’s contact on some widespread errors I see merchants make.

Vary vs Trending Market: Widespread Errors in Vary-Certain Markets

Buying and selling inside a spread could appear easy on the floor, however there are many methods it will probably go incorrect in case you’re not cautious.

Vary Boundaries

Some of the widespread errors I see merchants make is misjudging the boundaries of a spread.

Markets may appear to be ranging, just for the worth to rapidly plough via what seemed like a help or resistance degree.

Performing too quickly earlier than ranges have been actually confirmed can lead to poorly timed trades and repeated stop-outs.

To keep away from this, I wish to all the time have a look at the intense edges of the vary.

That’s to not say it’s a must to place an entry on the intense, however not less than remember that the worth may use that excessive boundary as the sting of its vary.

Context Issues

One other widespread pitfall is ignoring the context.

Simply because the worth has been transferring sideways for some time doesn’t imply it should proceed to take action!

I see merchants usually get caught off guard by breakouts that happen after prolonged consolidation, particularly in the event that they haven’t accounted for indicators of rising quantity or shifts in volatility.

What was as soon as a dependable vary can immediately change into the launchpad for a brand new development, and merchants nonetheless treating it like a spread can discover themselves on the incorrect aspect of the transfer.

Take note of quantity shifts – what I wish to name a build-up close to help – or resistance the place worth tends to linger close to the extremes of the vary.

These are good indicators that worth could quickly get away.

Overtrading

Lastly, there’s the problem of overtrading.

Ranges can encourage a way of rhythm of shopping for low, promoting excessive, however this may lure merchants into forcing trades that aren’t excessive likelihood setups.

Not each contact of help or resistance is price buying and selling, particularly if momentum or quantity doesn’t help the transfer.

Though ranges do present these setups, just be sure you are buying and selling the vary sensibly, with cease losses that make sense, moderately than speeding right into a commerce that forces you to neglect your cease loss placement.

Nice. Now that you already know the widespread errors, let’s have a look at some indicators that may help you in your buying and selling!

Vary vs Trending Market: Indicators That Assist With a Vary-Certain Market

Efficiently navigating range-bound markets usually comes right down to readability and everybody’s favourite… endurance!

Clearly, that is simpler stated than completed, so the suitable indicators will help with each.

Relative Energy Index (RSI)

An excellent place to begin is horizontal help and resistance ranges.

Manually plotting these zones the place costs have repeatedly reversed provides you the framework for the place patrons and sellers will possible step in once more.

From there, the Relative Energy Index (RSI) may be particularly helpful.

In a trending market, RSI tends to remain in overbought or oversold territory for prolonged durations.

However in a ranging market, it behaves otherwise, transferring extra predictably between the extremes.

When RSI approaches 70 or 30 inside a spread, it will probably sign potential reversal factors, particularly if these ranges align with horizontal help or resistance.

Quantity

As talked about earlier than, quantity can be crucial.

Ranges usually type during times of low quantity or consolidation after a robust transfer.

So, watching how quantity behaves close to the perimeters of the vary will help you perceive whether or not a breakout is probably going.

For example, a rise in quantity at a resistance degree may trace that patrons are getting ready to push worth increased, moderately than simply respecting the vary once more.

Bollinger Bands

Some merchants additionally use Bollinger Bands in a sideways market, as they contract throughout low-volatility phases, which may spotlight consolidation.

Value bouncing between the higher and decrease bands in a good vary can create clear commerce setups when mixed with different alerts like RSI or worth motion.

One thing to all the time bear in mind is that no single indicator will let you know every part…

However combining a couple of key instruments like RSI, quantity, and help/resistance zones can provide a clearer image of what’s occurring contained in the vary and show you how to keep away from these widespread traps.

So, now you could have a greater understanding of ranging markets, let’s dive into trending markets!

Vary vs Trending Market: What’s a Trending Market?

Definition

To me, a trending market is one the place worth strikes persistently in a single path.

This may be both up or down over a sustained interval.

Keep in mind how costs bounced between fastened ranges within the ranging market?

In trending markets, the market exhibits a transparent bias, constructing momentum as patrons or sellers take management.

Attempt to consider an uptrend as a sequence of upper highs and better lows, whereas a downtrend varieties via decrease highs and decrease lows.

The important thing distinction is that the market isn’t transferring sideways; it’s progressing in a path with some degree of persistence.

How do you acknowledge a trending market?

Effectively, this could be up for debate, however I all the time say…

…if it isn’t apparent, then it in all probability isn’t what you’re on the lookout for!

That can assist you visualize it higher, although, let’s take a deeper have a look at the trending market traits.

Traits

Trending markets are inclined to have a way of rhythm, even when they’re not all the time clean.

In an uptrend, you’ll usually see impulsive bullish strikes adopted by quick pullbacks earlier than the worth pushes increased once more.

These retracements are pure and an essential a part of the development.

They permit the market to “breathe” earlier than persevering with.

Downtrends observe an identical construction, however in reverse: sharp downward strikes adopted by smaller rallies.

Trending markets can final for days, weeks, and even months, relying on the timeframe and context.

You’ll usually discover them after durations of consolidation, however they are often influenced by a spread of things, from financial information and rate of interest adjustments to earnings experiences and market sentiment.

However is there any explicit purpose a development may type as an alternative of a ranging market?

Let’s have a look!

Why Developments Type

Developments type when there’s a continuous imbalance between provide and demand.

In an uptrend, demand outweighs provide, which suggests extra persons are shopping for than promoting, driving costs increased.

The other is true in a downtrend: sellers are in management, and patrons aren’t prepared to step in at increased costs.

This imbalance may be triggered by every kind of issues, corresponding to adjustments within the financial outlook, shifts in rates of interest, geopolitical occasions, and even robust earnings experiences.

Nonetheless, developments can be sustained by market psychology.

As soon as merchants acknowledge {that a} market is trending, extra contributors are inclined to observe the momentum, reinforcing the transfer and pushing costs additional in the identical path.

This self-reinforcing nature of developments is why they will persist for thus lengthy even with out new basic developments.

Let’s have a look at an instance of a transparent development…

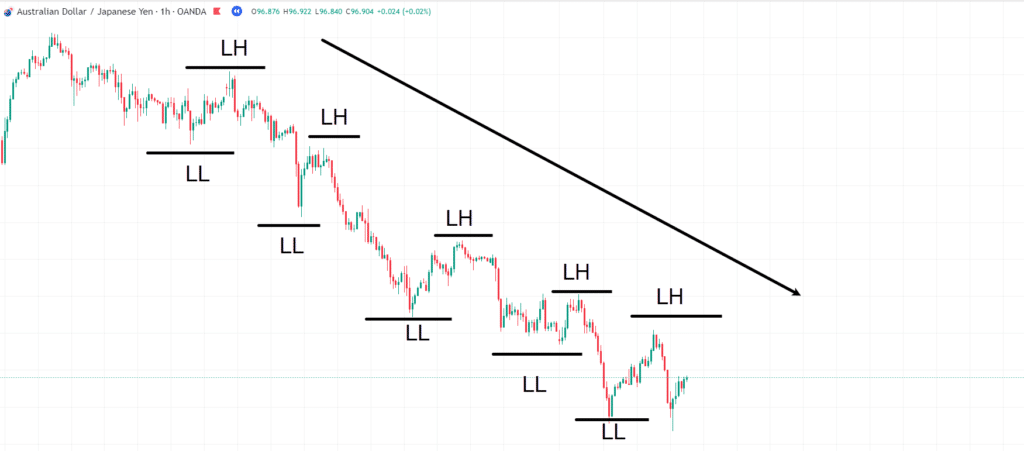

AUD/JPY 1-Hour Chart Downtrend:

As you may see, the worth varieties decrease highs and decrease lows, forming a transparent downtrend.

Appears easy sufficient, proper?

However let’s check out some widespread errors I see merchants make with these…

Vary vs Trending Market: Widespread Errors in Development Buying and selling

Chasing Value

One of many greatest errors I see merchants make in trending markets is what I name chasing worth.

Seeing a robust transfer, it’s simple to get FOMO and bounce in too late, that’s, proper earlier than a pullback or perhaps a reversal.

Getting into impulsively, with no plan or affirmation, can simply go away you shopping for the highest or promoting the underside.

This can be a troublesome factor to grasp, however when you perceive the move of developments, you’ll be significantly better at timing your entries and sustaining a wise danger construction.

Brief Time period Development

One other difficulty is failing to differentiate between a development and a short-term fluctuation.

Simply because the worth is transferring up or down for a day doesn’t imply a development has shaped.

Some merchants misinterpret non permanent volatility or news-driven spikes as development alerts and get caught out when the worth snaps again.

The apparent option to keep away from that is by being very conscious of stories occasions or any earnings experiences which may be having an impact on market situations.

Taking Earnings

One final main mistake I see merchants make is that they usually exit too early out of worry of dropping income.

Sarcastically, one of many greatest benefits of a development is the flexibility to let winners run, however provided that you handle danger and belief the construction.

Exiting too early or continually second-guessing your place can result in missed alternatives, particularly in case you had some dropping trades making an attempt to catch the beginning of the development.

I like to consider this as ensuring you’re getting paid for being proper a few development.

In that regard, let’s have a look at some useful indicators.

Vary vs Trending Market: Figuring out Developments – Development Indicators

As talked about earlier than, there are a number of methods to establish developments, and probably the most dependable is thru worth construction itself:

– increased highs and better lows in an uptrend or

– decrease highs and decrease lows in a downtrend.

However indicators will help help what the worth is already telling you.

Transferring Averages

Transferring averages are broadly used for this function.

A rising 50-day or 200-day transferring common can point out a longtime uptrend, whereas a falling one suggests a downtrend.

When the worth stays above a transferring common, it’s usually an indication that patrons are in management.

However, when it stays beneath, sellers are possible dominating.

Crossovers, like when the 50-day crosses above the 200-day (a “golden cross”), may sign development shifts.

Common Path Index

Much less widespread however simply as useful, I current the Common Directional Index (ADX).

This instrument doesn’t let you know the path of the development, however moderately how robust it’s.

A rising ADX above 20 or 25 can verify {that a} development has momentum behind it, whether or not it’s bullish or bearish.

Trendlines

Different merchants watch trendlines, drawing them throughout the swing lows in an uptrend or swing highs in a downtrend.

So long as these strains are revered and quantity helps the transfer, the development is commonly thought of wholesome.

In the end, profitable development buying and selling comes right down to affirmation, endurance, and never making an attempt to power trades in unsure situations.

When used collectively, worth motion and indicators can provide you a strong framework for recognizing and staying with the development with out getting shaken out too early.

Okay, so now all of the groundwork is put in, let’s talk about find out how to truly use these in your buying and selling methods!

Vary vs Trending Market: Learn how to Commerce Ranging Markets

Let’s begin with the vary markets.

As talked about beforehand, buying and selling ranging markets must be approached fully otherwise from trending markets.

Step one? Establish a spread.

This simply means discovering a chart the place worth is transferring between two factors and reversing with out breaking in any type of clear path.

Keep in mind, the extra apparent it’s, the higher likelihood you’ll have at success.

If it isn’t clear, simply transfer on to a different chart or alter your technique relying on what you could have in entrance of you…

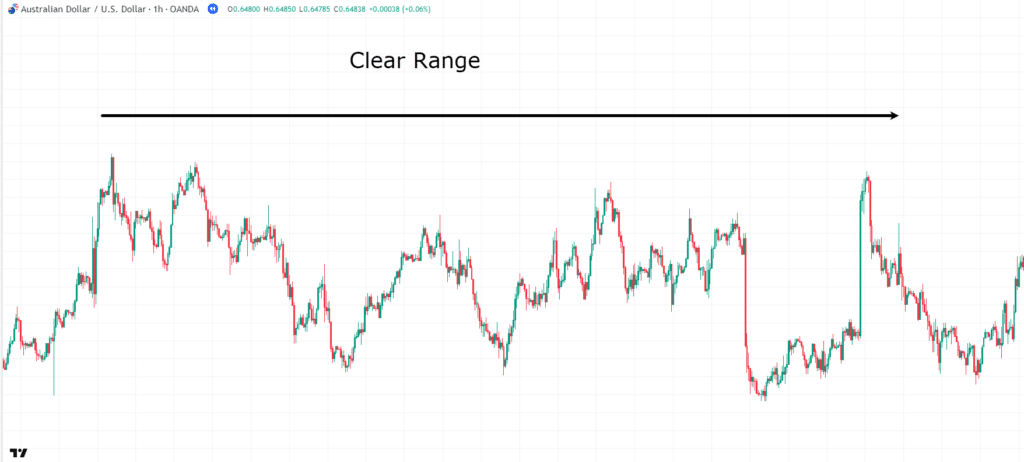

AUD/USD 1-Hour Chart Vary:

There is no such thing as a doubt that worth is transferring inside the boundaries of the highs and lows right here.

So, how would you commerce this vary, and wouldn’t it be so apparent early on?

Effectively, let’s return a bit…

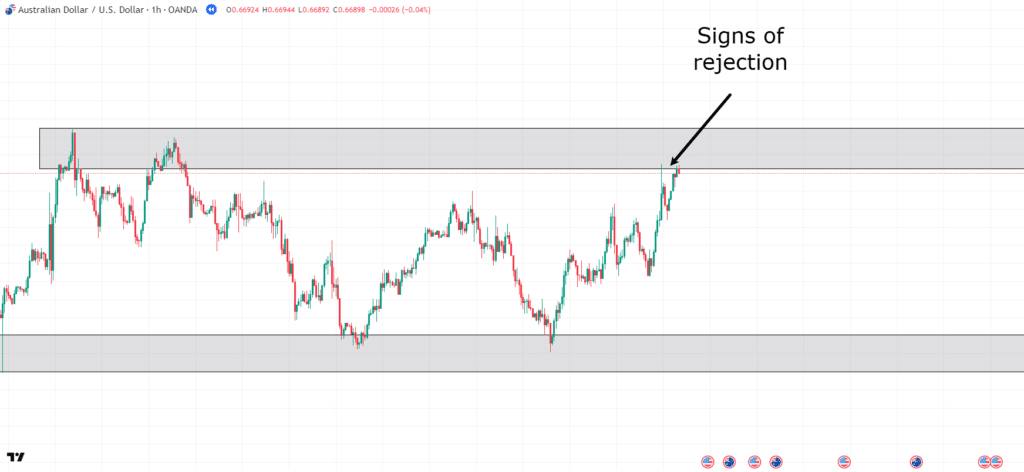

AUD/USD 1-Hour Chart Vary Forming:

So you may see that worth has began doing one thing fascinating.

Each time it’s within the gray zones ( Help and Resistance), there tends to be some degree of reversal.

Begin paying consideration when the worth comes again in and even close to these zones.

Let’s roll it ahead…

AUD/USD 1-Hour Chart Vary Rejection:

Okay, so worth has come again into the zone and is starting to reject the zone.

There’s each likelihood that worth pushes barely increased than the zone, however for the evaluation to be right, the place needs to be a brief commerce on this zone with the cease above the zone.

Our goal for take revenue may be both the vary low or a set TP based mostly on risk-reward.

Let’s see how two totally different trades could possibly be arrange…

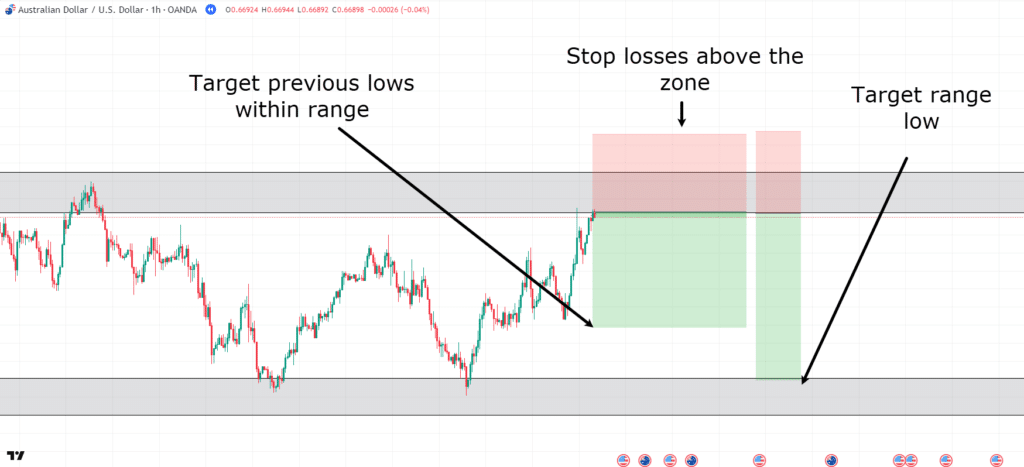

AUD/USD 1-Hour Chart Vary Commerce Setup:

Each these setups are fully cheap.

The primary is extra conservative, focusing on earlier lows, avoiding the danger that worth may type a brand new degree and get away to the upside.

Whereas the second is utilizing the idea that in ranges, worth will proceed to hit the outer boundaries of the help and resistance ranges.

Let’s see what occurs…

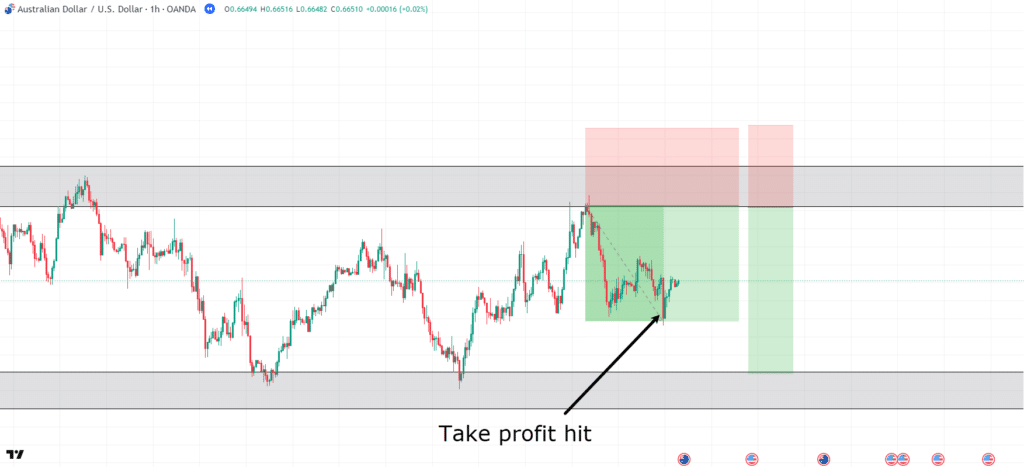

AUD/USD 1-Hour Chart Vary Take Revenue 1:

Take a look at that! Value moved in a short time to the take-profit space after a robust rejection of the zone.

What’s fascinating is that worth does certainly appear to be stalling on the earlier lows.

This may imply the second setup won’t play out.

Nonetheless, endurance is required.

Let’s have a look…

AUD/USD 1-Hour Chart Vary Take Revenue 2:

Effectively, ultimately the worth fell to the help zone and you possibly can take a revenue.

Nonetheless, it wasn’t with out some hesitation!

Value nearly reversed again to your entry-level a number of instances.

A key distinction is that worth by no means actually shaped a better excessive above entry, so the commerce was nonetheless legitimate all over until the take revenue.

Neither possibility was proper or incorrect; each serve their function, and in some eventualities, the primary possibility would be the safer possibility.

Job properly completed…. Proper?

Effectively, aren’t you continue to in vary, although?

Let me ask you, the place is the worth proper now?

On the vary low!

Does this current one other buying and selling alternative?

Technically, it does!

Nonetheless, the worth motion on the backside of this zone presents a troublesome query…

Has the promoting strain change into too heavy for this help to carry?

If unsure… merely wait and see if the worth rejects the zone…

AUD/USD 1-Hour Chart Vary Help:

After ready a couple of extra hours it’s clear that worth desires to not less than try to carry this zone because the vary low.

Similar to with the resistance, let’s place the cease beneath the zone and this time goal the highest of the massive sell-off, aka the bearish engulfing candle…

AUD/USD 1-Hour Chart Vary Help Entry:

Good tight cease however nonetheless beneath the help zone while focusing on the excessive of the bearish engulfing…

AUD/USD 1-Hour Chart Vary Help TP:

Take a look at that, worth continued to take a seat within the zone for a while, however ultimately broke again up in the direction of the vary excessive.

I do know what you’re pondering…

“You need to’ve set the take revenue on the vary excessive.”

However fact be instructed, the longer a spread goes on, the much less clear these boundaries change into.

There’s nothing incorrect with taking income when they’re made accessible to you.

Take cash off the desk and reassess the chart to make your subsequent choice.

Simply bear in mind, ultimately the vary highs and lows will break!

It’s about capitalising available on the market when it’s performing inside the vary and making more cash on these trades till you finally get stopped out.

Now that you simply totally perceive vary buying and selling let’s check out find out how to commerce trending markets.

Vary vs Trending Market: Learn how to Commerce Trending Markets

Step one in buying and selling trending markets is to establish the change of character.

What do I imply by this?

Merely have a look at the chart and ask your self whether or not or not the earlier market construction is continuous in that very same sample or if one thing has shifted.

Let me present you…

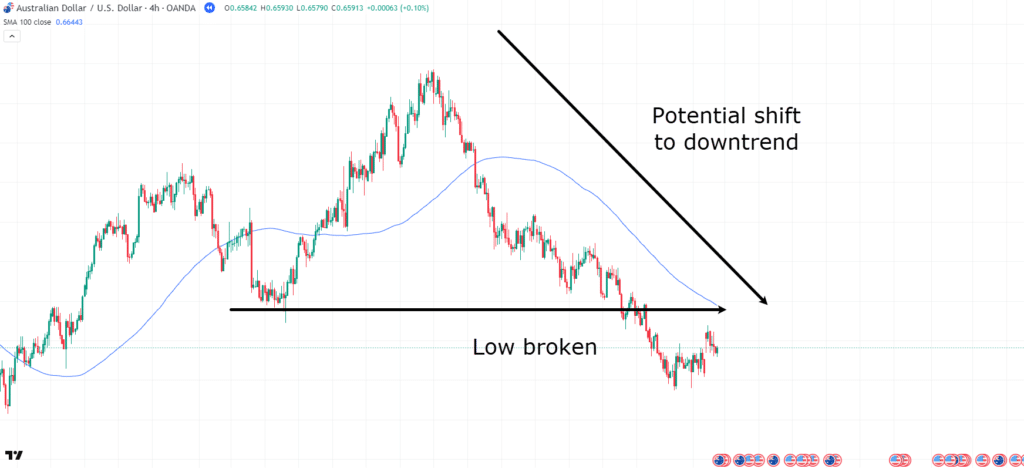

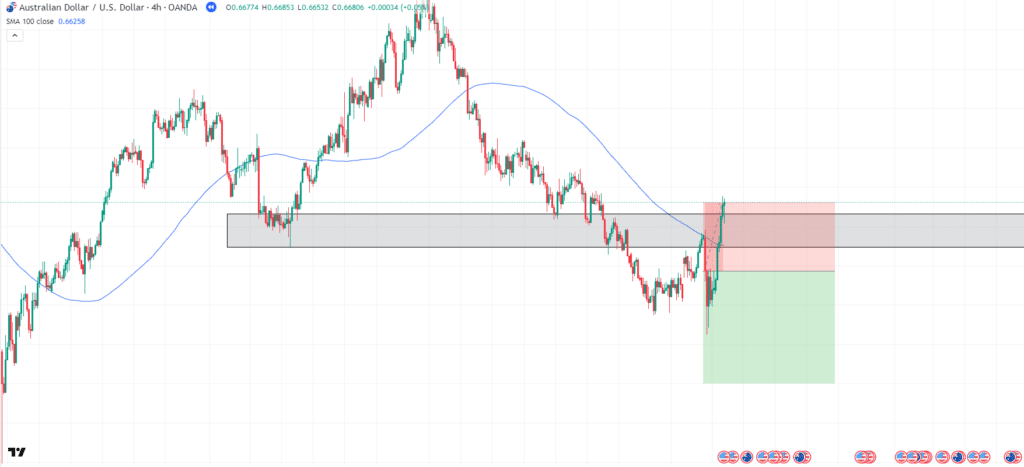

AUD/USD 4-Hour Chart Shift To Downtrend:

Because the earlier low is damaged, a shift in character has occurred.

Value appears to now not be forming increased lows and better highs, does it?

Now, this doesn’t imply it’s a must to act right away, nevertheless it ought to get you enthusiastic about a possible market shift.

Let’s proceed ahead…

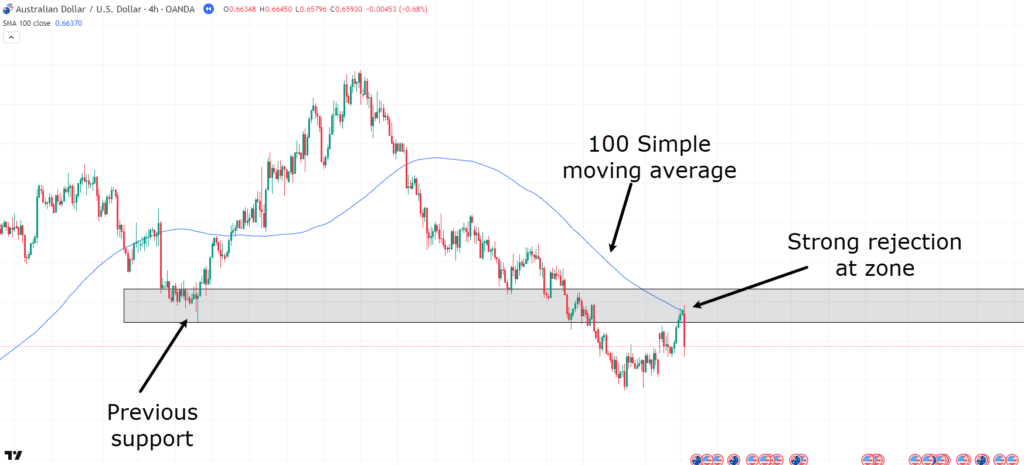

AUD/USD 4-Hour Chart Rejection:

A number of issues are occurring right here…

See how worth has modified its construction by forming a decrease low?

After that, it tried to reclaim the help degree however failed, with a robust sell-off at help now performing as resistance.

On prime of all of that, it coincides with the 100 easy transferring common.

All the things factors in the direction of a continuation downwards!

This now presents a possibility to take a commerce…

AUD/USD 4-Hour Chart Entry #1:

You can enter this commerce by merely inserting the cease loss above the transferring common and the help zone.

Our goal is just not going to be a set goal, however moderately every time the worth crosses again above the transferring common utilizing a extra dynamic trailing take revenue…

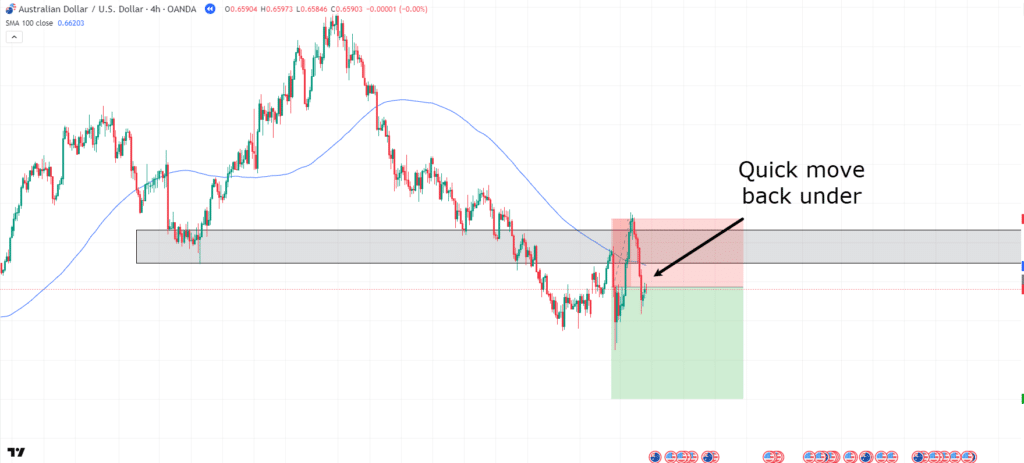

AUD/USD 4-Hour Chart Cease Loss:

Hold on a minute!

What simply occurred?

Value shot via the zone and the transferring common and stopped out!?

Don’t panic.

These items occur in buying and selling.

Nonetheless, I’m not fully satisfied that this implies the downtrend was short-lived…

From right here, typically it’s greatest to attend and see what happens.

Let’s proceed ahead…

AUD/USD 4-Hour Chart Development Continuation:

As you may see, proper the place the cease loss was, worth rejected after which fell again beneath the zone…

“Dammit.”

However hey, that’s buying and selling! And, it doesn’t imply the commerce evaluation was fully incorrect.

Typically markets simply act barely otherwise from the way you anticipate.

So, as an alternative of being aggravated, let’s see if a brand new alternative has introduced itself…

In fact, it’s fully as much as you at this level whether or not you select to re-enter!

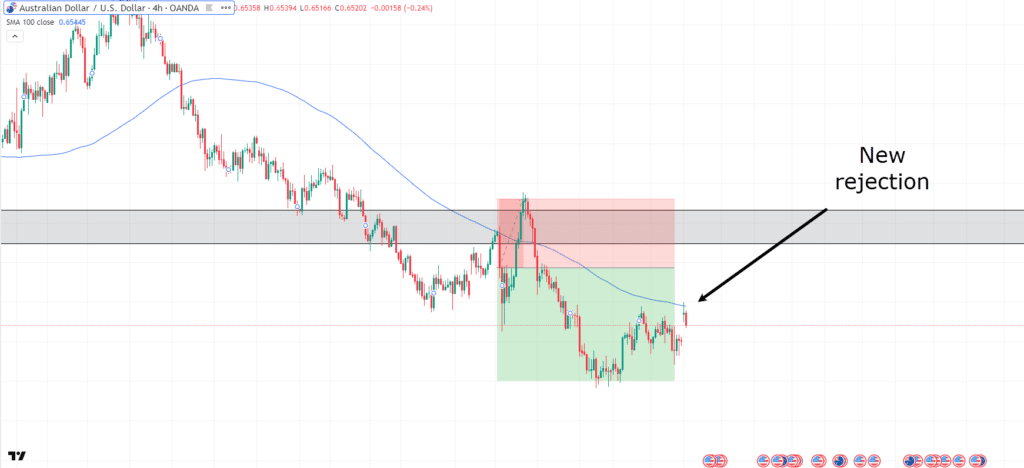

However for argument’s sake, let’s say you wished to see the worth reject the transferring common once more…

AUD/USD 4-Hour Chart New Rejection:

Okay.

So the unique commerce, if re-entered, would have been profitable, however there’s nothing incorrect with being cautious both.

At any price, a brand new commerce alternative has introduced itself…

AUD/USD 4-Hour Chart Commerce Setup:

Similar to final time, the cease loss will sit above the transferring common with a little bit of respiratory room, and take revenue received’t be a set take revenue, however moderately a take revenue when the transferring common breaks.

Let’s see what occurs…

AUD/USD 4-Hour Chart Take Revenue:

Take a look at that!

Value continued in your path for a big period of time earlier than breaking above the transferring common and stopping out in revenue.

If you happen to re-entered after the unique commerce on the re-entry beneath the transferring common, this commerce can be price round 5rr, and in case you waited patiently for a retest of the transferring common, relying in your cease loss placement, you’ll have yielded 3+rr.

See how the preliminary loss actually was simply the price of extra info earlier than the winner?

That’s why it’s essential to by no means doubt your self, even when the worth doesn’t act precisely the way you anticipated.

Watch the chart and examine if it was only a liquidation seize or a information occasion that brought on a quick disruption to your buying and selling plan earlier than a brand new alternative introduced itself.

It received’t all the time be good, however in case you can catch a development commerce, the income will usually outweigh the losses taken making an attempt to get in on the proper time.

Vary vs Trending Market: How do these work collectively?

Markets usually have sure traits as mentioned earlier.

They are often going up, down, and sideways, which means that you must use the suitable instrument for the suitable job…

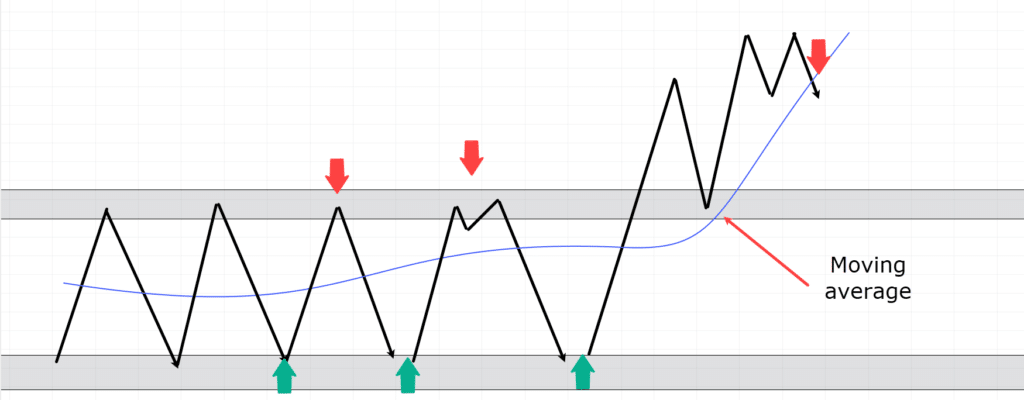

Diagram Of Dynamic Buying and selling:

Because the diagram exhibits, as worth goes via the vary, the transferring common is of no use.

Nonetheless, the vary highs and lows present good alternatives to take lengthy and quick entries.

However when the worth busts via the vary excessive with none resistance and retests the excessive of the vary, your buying and selling technique has to shift and the transferring common does come into play in a extra development buying and selling type.

Staying dynamic and conscious of what market situations you’re in is important to buying and selling success!

Conclusion

By now, it is best to have a transparent understanding of the variations between range-bound and trending markets and why adapting your strategy to every is so essential.

On this article, you’ve realized:

- What defines a range-bound market, and find out how to acknowledge help and resistance zones

- How trending markets type and find out how to establish their construction

- Widespread errors that merchants make in each environments

- Which indicators will help verify ranging or trending situations

- Actual examples of find out how to commerce each markets

- How self-discipline and context assist keep away from false entries in each market varieties

Mastering these two situations is much less about predicting the long run and extra about recognising the current.

When you may confidently establish whether or not the market is ranging or trending, you give your self a transparent edge and a method that matches with actuality.

So the following time you sit right down to commerce, ask your self one easy query:

Is the market ranging, or is it trending?

When you’ve received that, the remainder turns into a lot simpler to handle!

So, do you could have a market situation you like buying and selling?

Have you ever traded each situations already?

Let me know within the feedback beneath!