The second week of September noticed the Altcoin Season Index attain its highest stage in 5 years. Optimistic sentiment pushed a number of altcoins to all-time highs and attracted huge open curiosity. Nonetheless, this additionally got here with the chance of large-scale liquidations.

The next altcoins present indicators of maximum FOMO and face potential liquidation dangers within the third week of September.

1. Ethereum (ETH)

By mid-September, Ethereum reserves reached a brand new peak of 4.9 million ETH price $22.2 billion. This determine excludes the 6.7 million ETH held in Ethereum ETFs, valued at $46.3 billion.

Sponsored

Sponsored

A latest BeInCrypto report highlighted on-chain knowledge suggesting Ethereum’s worth may attain $5,000 or greater. Derivatives merchants seem to share that perception, growing leverage and lengthy positions. This implies their losses can be better if ETH strikes in opposition to expectations.

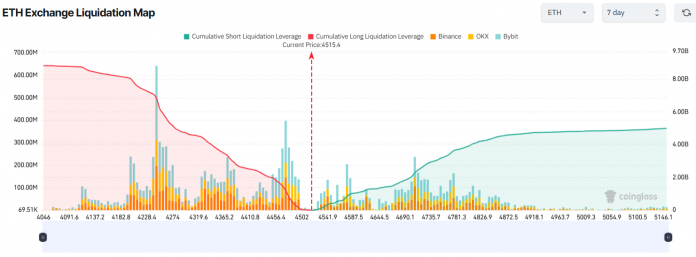

The liquidation map reveals that if ETH drops to $4,046 this week, greater than $8.8 billion in lengthy positions can be liquidated. Conversely, if ETH rises to $5,000 as many analysts predict, about $4.8 billion briefly positions can be liquidated.

Are there causes to anticipate ETH to say no? BeInCrypto’s newest evaluation famous that Ethereum’s worthwhile provide just lately hit 99.68%, an indication of potential profit-taking.

As well as, over 2.6 million ETH are actually queued for unstaking. The preliminary set off got here from Kiln Finance, which unstaked to handle dangers after points tied to SwissBorg.

Nonetheless, the unstaking queue has continued to develop as ETH’s worth climbed, reflecting stronger demand for profit-taking.

Sponsored

Sponsored

2. Binance Coin (BNB)

Binance Coin (BNB) reached an all-time excessive of $944 in September.

The rally adopted information that Binance and Franklin Templeton introduced a brand new partnership to develop blockchain and crypto options for institutional adoption.

Like ETH, BNB’s 7-day liquidation map reveals an imbalance between lengthy and quick positions. Lengthy liquidations dominate, signaling that many merchants are betting on continued good points.

If BNB falls to $818 this week, greater than $189 million in lengthy positions can be liquidated. Alternatively, if BNB climbs to $1,031, about $103 million briefly positions can be worn out.

What dangers ought to merchants take into account for BNB longs? One warning signal comes from whole open curiosity (OI).

Sponsored

Sponsored

Knowledge from Coinglass reveals that as of September 14, BNB’s whole OI hit $1.72 billion. Within the present quarter, OI crossed $1.5 billion thrice. Each the earlier two situations triggered corrections of seven% to fifteen%.

If historical past repeats, the third surge may result in losses for merchants holding BNB longs.

3. MYX Finance (MYX)

MYX Finance (MYX) delivered probably the most controversial rallies of September. BeInCrypto’s knowledge reveals the token surged 450% previously month.

Nonetheless, MYX has confronted skepticism, together with accusations of Sybil assaults in its airdrops and fears of a collapse much like Mantra (OM).

Sponsored

Sponsored

The token has already dropped from its ATH of $18.9 to $10.9, a greater than 40% decline. This pullback means that FOMO-driven sentiment has cooled.

Consequently, derivatives merchants are leaning towards quick positions. The 7-day liquidation map reveals shorts will face heavier losses if they’re incorrect.

If MYX recovers to $12.35, greater than $19 million briefly positions can be liquidated. If MYX falls to $8.79, over $12 million in lengthy positions can be liquidated.

Some technical analysts anticipate a rebound, arguing that the $10–$11 vary is a robust help zone the place traders are possible to purchase.

“Lovely breakout by $MYX & sturdy bounce from essential help space. Excessive probability of a pleasant bounce. Targets 12, 13, 14, 15, 16,” dealer BitcoinHabebe predicted.

BeInCrypto’s newest evaluation additionally instructed that the present pullback is just not a pattern reversal however a short lived correction.