Injective (INJ), a Layer 1 blockchain purpose-built for tokenized shares, property, and real-world property (RWA), has seen a dramatic spike in day by day energetic addresses (DAAs) in July.

Regardless of the INJ token dropping 80% from its all-time excessive (ATH), the community’s resurgence reignites optimism. What’s driving this sudden development? This text explores the important thing elements behind the surge.

Injective Community Rebounds in 2025, DAAs Hit Highest Since December 2023

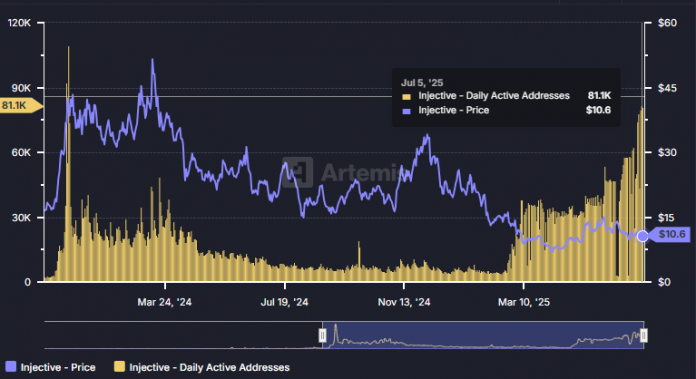

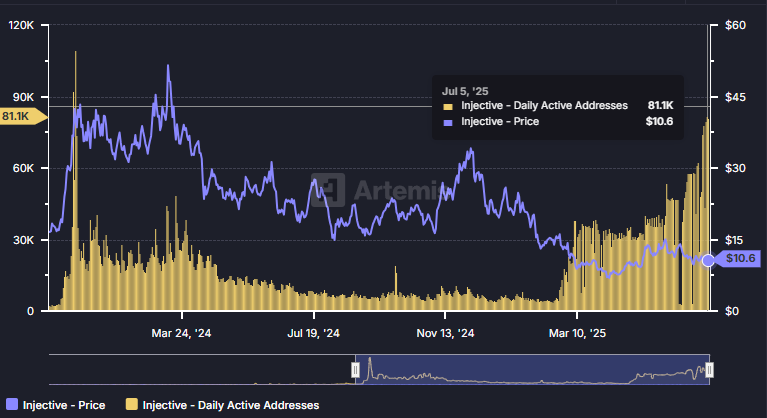

Information from Artemis Analytics exhibits INJ’s day by day energetic addresses have skyrocketed from 4,500 initially of 2025 to over 81,000 in July, a surge of greater than 1,700%.

This marks the best degree since December 2023, when the INJ worth climbed from $1.25 to over $50.

In consequence, many buyers speculate that the community’s renewed exercise might sign a contemporary worth rally for INJ in 2025.

“INJ day by day energetic addresses pumped +1,500% to 82,500 in 6 months. Injective is rising exponentially and that is only the start,” analyst Lennaert Snyder commented.

The rise in DAAs seems to have began after February 17. Injective rolled out a serious protocol improve often known as the Nivara Improve on that date. The group authorised it with excessive participation, and it was anticipated to enhance community efficiency, attracting extra customers and builders.

By July, DAAs doubled in comparison with Q2 averages. One main driver behind this development was Injective’s launch of its Ethereum Digital Machine (EVM) Public Testnet.

On July 3, 2025, Injective introduced the testnet rollout. It permits builders to construct and run Ethereum-compatible decentralized purposes (dApps) straight on Injective’s Layer 1 blockchain.

Is Injective (INJ) Undervalued?

In 2025, Injective accelerated its token burn fee by 5x following the launch of INJ 3.0. The weekly protocol income burn mechanism has lowered token provide and launched deflationary strain. Nonetheless, it hasn’t but translated right into a worth restoration amid the continuing altcoin winter.

Regardless of undertaking improvement and powerful on-chain metrics surpassing 2024 ranges, INJ continues to be 80% under its ATH of $52. In accordance with knowledge from BeInCrypto, INJ is hovering round $10.5, down 60% year-to-date.

Some buyers now consider INJ is severely undervalued.

“Injective INJ is massively underrated. For those who’ve been paying consideration: Main devs, companions, and launches are lining up behind the scenes, making ready for a wave of product rollouts that would make every thing up to now look small,” investor CryptoBusy stated.

Amid rising trade curiosity in tokenized shares and property, Injective might re-emerge as a number one Layer 1 community for real-world asset tokenization — an area gaining rising institutional and retail traction.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.