In mild of the present market situations which include some very robust ‘one-way’ developments within the U.S. greenback pairs, I wished to jot down a lesson not nearly the benefits of trend-trading, but in addition about how buying and selling in opposition to the pattern can and can destroy your buying and selling account, when you let it.

In mild of the present market situations which include some very robust ‘one-way’ developments within the U.S. greenback pairs, I wished to jot down a lesson not nearly the benefits of trend-trading, but in addition about how buying and selling in opposition to the pattern can and can destroy your buying and selling account, when you let it.

Merely put, the best method to become profitable as a dealer or investor, is buying and selling with the dominant each day chart pattern. Nevertheless, throughout my time instructing folks the way to commerce, I’ve discovered that it nearly appears to be human nature to need to commerce in opposition to the pattern, at the very least within the early-stages of 1’s buying and selling journey. So, I hope in the present day’s lesson will provide help to keep away from making this gigantic mistake that so many starting merchants make, by exhibiting you tangible proof of why the pattern is certainly your good friend and why you shouldn’t commerce in opposition to it more often than not.

Don’t combat the trail of least resistance…

When markets are trending, they need to transfer within the path of the pattern as a result of that’s the trail of least resistance. As I train extra in-depth in my course and members space, when a market is trending it should make a robust transfer within the path of the pattern after which it should usually pullback or ‘revert to the imply’. That mainly simply means worth will rotate again to its latest ‘common’ worth, additionally typically referred to as the ‘worth worth’.

Understanding this, we will look to commerce from worth in trending markets, as a result of on the level of worth in a market, the pattern has the largest likelihood of resuming. By on the lookout for worth motion entry alternatives which have the confluence of the pattern and the ‘worth space’ behind them, we will considerably enhance our possibilities of buying and selling success. Let’s check out some examples of latest trades the place we may have traded from worth inside a pattern and the way we might have misplaced cash buying and selling in opposition to the pattern:

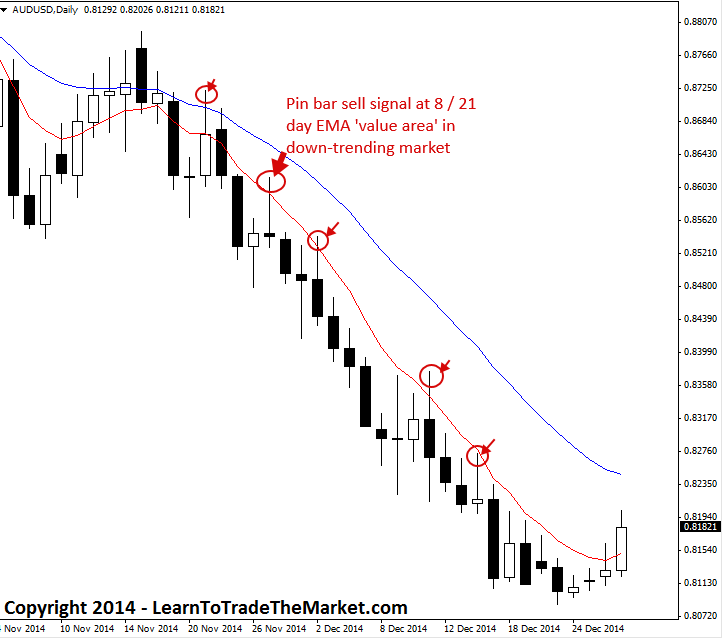

Within the AUDUSD each day chart beneath, we will see that the trail of least resistance was clearly down. Be aware, the crimson and blue strains are the 8 and 21 day exponential transferring averages (EMAs), keep in mind above once I mentioned the ‘common worth’? These transferring averages present the latest common costs going again 8 and 21 intervals respectively, this supplies us with a ‘worth space’ to search for worth motion promoting alternatives to re-join the downtrend:

Discover there was one good pin bar promote sign within the chart above in addition to a number of different alternatives to promote on the transferring averages as worth rotated increased. Worth gained’t all the time respect the transferring averages this properly, however in strong-trends like the present AUDUSD chart above, we do typically see it doing simply that.

The purpose of the above instance is that this: in robust developments, you should solely look to commerce with the trail of least resistance, i.e., WITH the dominant each day chart pattern. Let’s have a look at the identical chart above from the perspective of a dealer making an attempt to commerce in opposition to it…

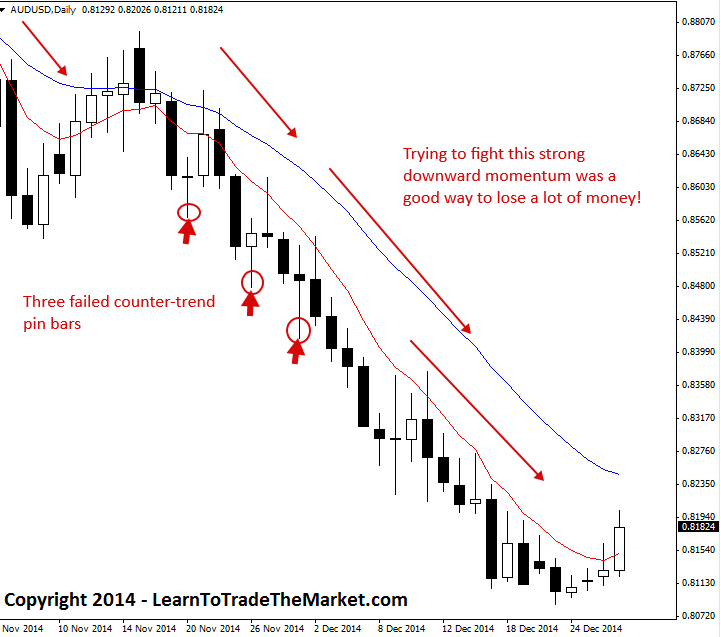

In the identical AUDUSD chart that we checked out above, we will see what the expertise may need been like for the ‘backside picker’ making an attempt to commerce in opposition to the robust downtrend. Clearly, she or he would have misplaced cash on any one of many three pin bars proven beneath. Some folks get so obsessive about making an attempt to select the underside (or high) in a market like this that they might have taken all three of those counter-trend purchase alerts. You may simply see now why counter-trend buying and selling will destroy your buying and selling account!

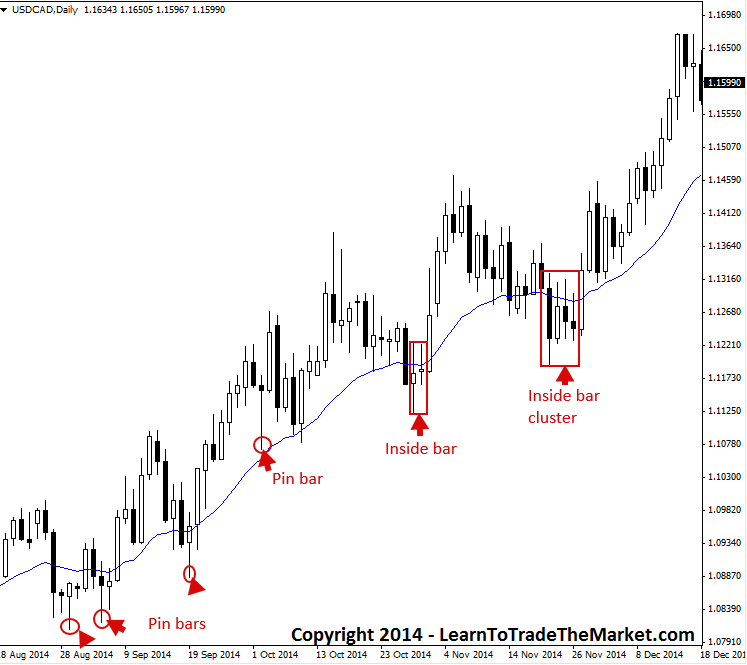

Within the USDCAD chart beneath, we see a transparent uptrend has been in place on this market since concerning the starting of August 2014. The blue line is the 21 day EMA and it exhibits us the pattern path in addition to a price space that we will look to purchase from so as to commerce in-line with the uptrend from worth.

Be aware, there have been a number of worth motion shopping for alternatives from worth close to the 21 day EMA within the type of pin bars and inside bars over the course of this uptrend. We are able to clearly see that the trail of least resistance has been to the upside on this market and so on the lookout for purchase alerts was the plain selection during the last 5 months…

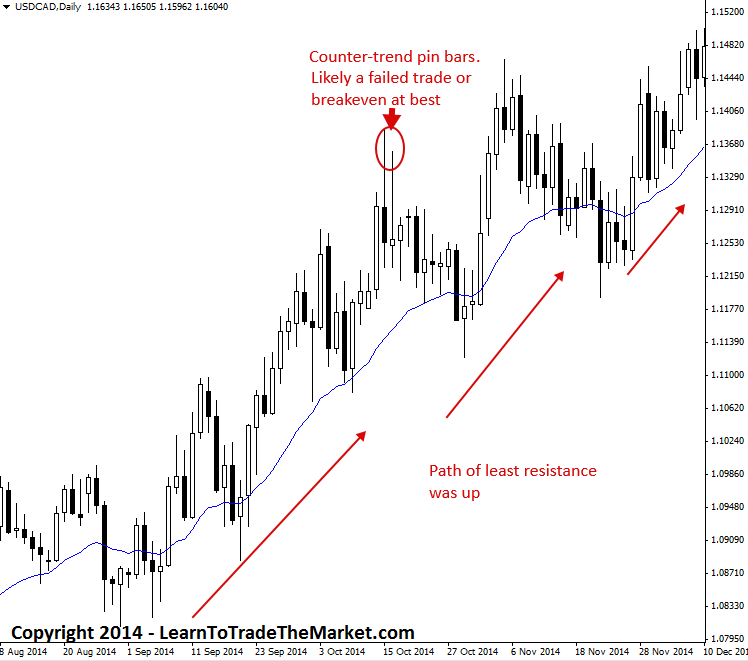

In the identical USDCAD chart we checked out above, we will see that the expertise would have been completely totally different when you had been making an attempt to ‘choose the highest’ of this market by on the lookout for a counter-trend promote sign. Even a long-tailed bearish double pin bar setup like we see beneath most likely would have been a loss or breakeven at finest, as we will see within the chart beneath. When there’s a transparent path of least resistance in a market, don’t combat it!

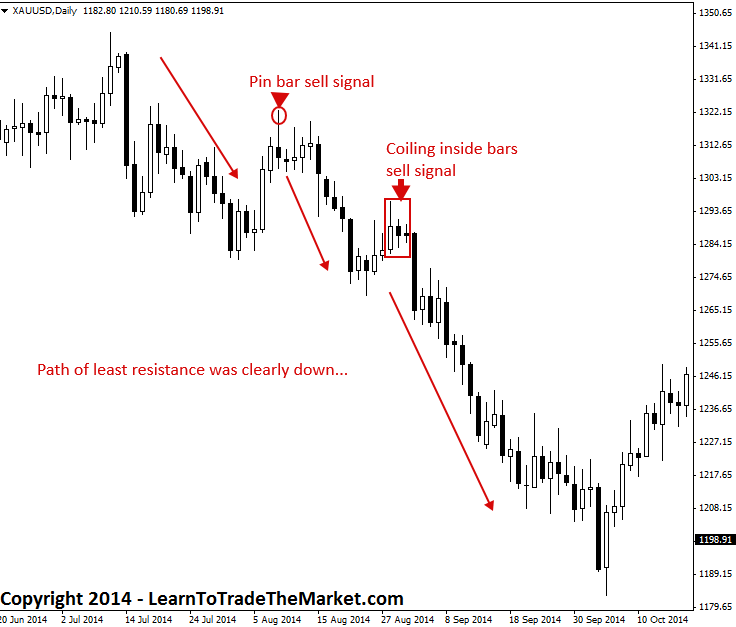

Within the subsequent chart beneath, we will see the each day spot Gold market earlier this yr. There was a pleasant downtrend in place and so the trail of least resistance was clearly down. Due to this fact, we had been on the lookout for worth motion promote alerts on retraces again to worth / resistance so as to commerce in-line with the downtrend. We are able to see a pleasant pin bar promote sign a coiling inside bar technique that fashioned following retraces increased inside this falling market, each setups led to the resumption of the downtrend and massive down strikes…

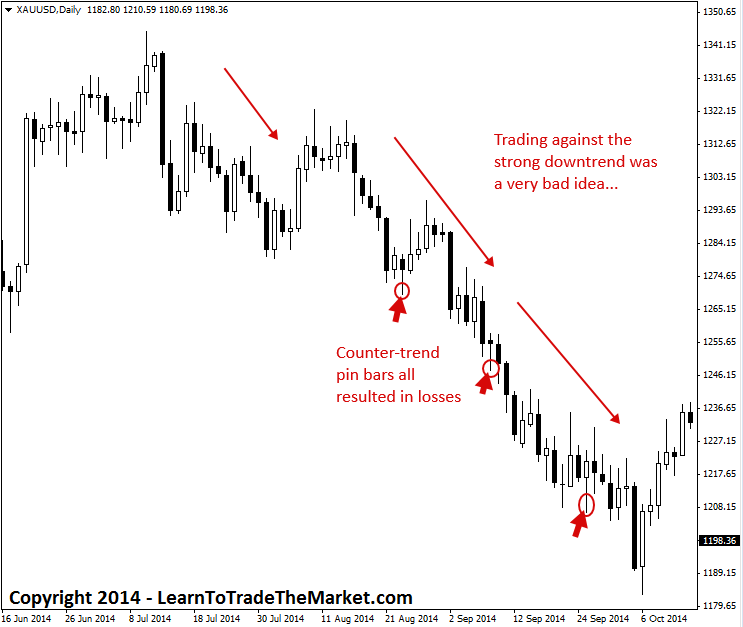

Lastly, we’re trying on the identical spot Gold chart as above, besides this time we’re taking a look at it from the perspective of an sadly misplaced dealer who’s making an attempt to commerce in opposition to the pattern. Be aware, within the chart beneath we will see a number of failed counter-trend pin bars that may have resulted in losses if a dealer took them in opposition to the pattern.

Conclusion

I hope it’s changing into extra apparent to you simply how harmful buying and selling in opposition to the pattern is. Merchants additionally are likely to try to commerce each side of a pattern, each with it and in opposition to it, and in doing so that they usually give again most or all the earnings they made on the trades with the pattern. This is without doubt one of the largest errors I see merchants make that stops them from reaching actual success available in the market. Throughout your profession, you must make it one in all your largest buying and selling targets to stay with the dominant market developments and keep away from buying and selling in opposition to them in any respect prices. Your buying and selling account will thanks later. To study extra about buying and selling with the pattern, checkout my all new up to date worth motion buying and selling mastery course and members space.

PLEASE LEAVE A COMMENT BELOW – I WOULD LIKE TO HEAR YOUR FEEDBACK 🙂

QUESTIONS ? – CONTACT ME HERE