The WLFI buyback and burn proposal has simply gone dwell. It guarantees to show treasury charges into direct shopping for stress and completely cut back provide throughout the community.

Might WLFI quickly witness a 50% value surge because the treasury formally “pours cash” into shopping for and completely burning tokens?

Sponsored

Sponsored

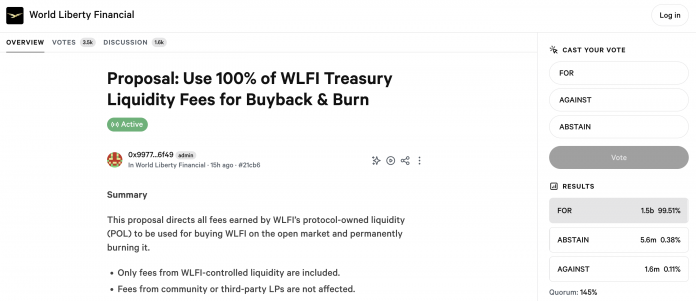

Catalyst: ‘Buyback & Burn’ on WLFI

World Liberty Monetary (WLFI) has simply launched a key proposal: redirect 100% of treasury liquidity charges to market-buy WLFI tokens and completely burn them throughout a number of chains. In truth, this route charges – market-buy – everlasting burn strategy is a well known catalyst utilized by tasks like HYPE, PUMP, and TON.

From an financial perspective, buyback & burn is an efficient deflationary mechanism. The “computerized” demand generated by protocol exercise (liquidity charges) will buy tokens on the spot market, and burning will completely cut back the full provide. Because of this, assuming demand stays secure or will increase, costs may re-rate upward.

Nevertheless, its full impression is dependent upon two key elements: the quantity of charges collected by the treasury and the frequency/timeline of the buybacks. The buyback impression shall be restricted if day by day/weekly charges are nonetheless small relative to market liquidity. Conversely, the mechanism can ship a major impact if the treasury generates giant and constant payment flows.

If authorized and executed transparently, this buyback-and-burn mechanism may assist revive WLFI’s value, which has been severely depressed following governance dangers and centralization issues. Since launch, the controversy surrounding Justin Solar has sharply lowered WLFI’s value. On the time of writing, WLFI is buying and selling at $0.1996, down 40% from its earlier ATH.

Nevertheless, implementing a buyback mechanism won’t assist enhance token costs. Some analysts argue that crypto buybacks are seen as value-destroying quite than value-creating. They burn income that might have fueled development by means of product improvement and person acquisition.

With rising regulatory dynamics and a maturing business, the main target needs to be on constructing clear, environment friendly tokens for long-term traders. These tokens ought to act as on-chain fairness, driving sustainable worth over time.

Sponsored

Sponsored

“The market doesn’t want extra buybacks. It wants productive tokens and persistence.” The Moonrock’s founder commented.

Technical View

From a technical evaluation perspective, a number of analysts on X notice that WLFI is at the moment in a falling wedge sample and could also be nearing its backside. Value motion suggests a pointy reversal could also be imminent, with upside potential of as much as 50%, focusing on $0.26.

In one other evaluation, a person on X noticed that WLFI is testing the Level of Management (PoC) worth zone after breaking out of a descending bearish channel on decrease timeframes.

“A robust breakout above this PoC may spark a 30–40% short-term rally, with rising quantity confirming momentum — one to observe intently!” CryptoBull said.

These observations all counsel {that a} reversal could also be very shut. Nevertheless, WLFI should nonetheless safe a confirmed shut above key resistance and sustained buying and selling quantity to validate this transfer.

Furthermore, whereas the burn mechanism is enticing, market confidence in governance (who controls the treasury, who indicators buyback transactions, and the way transparently burn reviews are printed) will largely decide its long-term effectiveness.